I oftentimes am asked by people how much you can make from stocks in a month? Truthfully, it’s a question that scares me a lot because I instantly think that the type of people that ask that sort of question might be looking at investing in stocks as some sort of “get rich quick” scheme and trust me, investing won’t get you rich quick, but you can use investing to get rich, quickly.

The short answer to the question of, “how much can you make from stocks in a month?” is there is no max. You could make an infinite amount, theoretically. But you also could lose 100% of your investment as well, so it really is a risk reward situation. Let me give you some data.

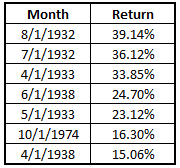

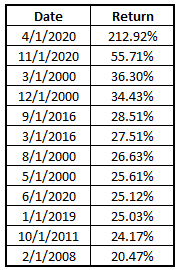

If you had invested in the S&P 500, which you can do with an ETF like SPY, then you could’ve made some pretty major monthly returns, such as in August of 1932 when you made 39.14%!

In fact, there actually have been 3 months since 1928 where you made over 30% in a month and 7 months where you made over 15%!

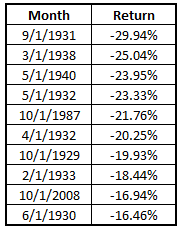

Now, the flip side to that is that you can also lose a ton of money when you’re investing. Using the same example as above where you’re just investing in the S&P 500, you would have 0 months where you lost 30%, so that’s a major win!

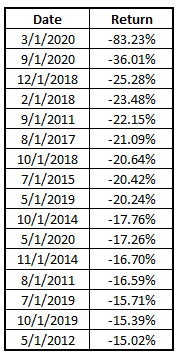

However, you would have had 10 months where you lost 15% or more:

What this tells me is that by only investing in the S&P 500, you might get lucky and hit the lottery but you can just as easily lose – it’s nothing more than a coin flip.

One thing I noticed is that all of these monster months, except for one, occurred in the 1930’s. Spoiler – it’s nearly 100 years later so I am not expecting those returns to necessarily be replicated.

Now, a lot of the really bad months are also in the 1930’s because it was a super volatile time, but it adds to the fact that investing for only a 1-month outlook can be very dangerous.

In fact, of the 1,114 months of data that I was able to pull from Yahoo Finance, 663 months had a positive return while 451 months had a negative return. Over those 1,114 months, the average monthly return was .63% while the median was .91%, meaning that you still could expect a modest return over the history of the S&P 500.

“Andy, that data is great, but I ain’t investing in the boring ol’ S&P 500 – show me TESLA!”

Ok, fine.

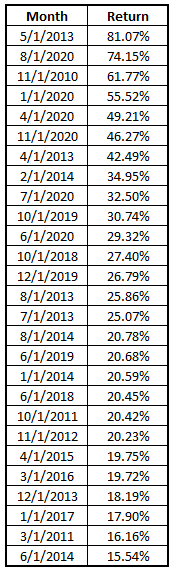

Tesla has had 10 months where they returned over 30% and 27 where the return was over 15%!

WOW! That is absolutely stunning. Especially look at those top months where you see 4 different times there was a return over 50% in a single month. That is seriously stunning.

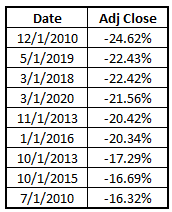

Something almost equally as stunning for me is that they’ve had 0 months with 30% losses, and even 0 at the 25% level, as well as only 7 months with a 15% loss or greater:

Now, of course, those are still monster losses, but considering the upside of some of the big months, I think the downside is a major win if you’re an investor.

Over the 126 months that Tesla has been traded, 68 of those months have a positive return while 58 have a negative return. The average return over that timeframe has been 5.34% while the median has been 1.48%.

The large variance between the average and the median shows that there have been some major highs during Tesla’s 126 months that are drastically increasing the average. That’s great if you’ve been a long-term investor but if you’re just jumping in for a 1-month gamble, you’re going to be looking at the median, which is 1.48%.

Personally, I’m actually surprised it’s not higher. Tesla has been one of the dandy’s of the younger generation (my generation but they’re not my dandy) for quite some time, so I really thought we might see some larger returns.

The issue with people is that they get caught up in the hype and FOMO (fear of missing out) when investing. What I am saying is that they will watch CNBC, listen to some hot stock picks, and then go buy those companies blindly and hope for the best.

But when do companies get the most press and attention? When they’re having great success, of course! Companies that are getting tons of attention are likely going to get overbought, including when you buy in, and then have a correction to the downside.

Then you’ll panic sell and lose your money.

If it sounds like I am speaking from experience, it’s because I am. Don’t be like old Andy – be like new Andy. New Andy understands that you can make money off of people doing what Old Andy did, and it’s called Momentum investing.

But what about Apache Corporation (APA)? They’re a company that used to be a fan favorite back in the late 2000’s but have hit some turbulence lately. You can see from the Yahoo Finance Chart just how volatile their stock has been, really starting in 2000:

If you had invested in Apache from their origination in 1979 then you would’ve experienced 6 months that were 30% or better and 52 months that returned you at least 15% in that month. On the flip side, you would’ve experienced 4 months that lost you more than 30% and 40 months that lost you at least 15%.

At a high-level, at least you’re outperforming the bad months simply on a count basis, right? I suppose that’s a good first step. Ironically enough, the average and the median were the exact same for Apache at 1.38%. This is super unlikely, especially in a company that has as much volatility as Apache.

Do you remember how I mentioned previously that people tend to get wrapped up in companies when they’re getting a ton of attention in the news? Well, I feel like these Oil & Gas companies especially are those that get wrapped up into that hype.

And honestly, the Oil & Gas hype is extremely cyclical. Right now, we’re in a downtrend where nobody trusts the Oil & Gas industry as oil prices are low, a Democratic president elect is coming in that has said they will ban fracking, and the COVID impacts are drastically hurting the industry, even causing dividend meccas like XOM to really consider cutting their dividend.

But let’s pretend that you got caught up in this hype and bought in on 1/1/2010. You didn’t buy at the top, but definitely not at the bottom. How much would you have made on average those months?

Well, you would’ve had 4 months return over 30%, including a 213% month which is the most insane thing I have ever seen. You also would’ve had a total of 12 months that returned over 15%, which seems pretty good to me, truthfully.

Now let’s look at the bad – you would’ve had only 2 months return worse than 30% but one of those was 83% worse. Now remember, you can’t have a 213% loss like you had a 213% up month. You only have 100% of your money (unless you’re using margin), so a 100% loss is your max.

In total, you would’ve had 16 months net you a loss of at least 15%. Brutal!

The average return form 1/1/2010 is .89%, which honestly is way better than I expected but the median is -.59%. So, if you were to just randomly pick a month to invest, you should expect a -.59% return while if you had been invested the entire time, you realistically could have returns of .89%. That is a monstrous difference.

I really have two takeaways that I want to hammer home from this post:

1 – You have to be invested for the long-term

Being invested for the long-term is going to let you capitalize on those big gains. I talked a lot about the mean, or average, vs. the median and it’s important to understand the difference. If you’re investing for the long-term in a company, and you pick a great company, then you’re going to smooth out the volatility from month-to-month and hopefully enjoy some great long-term gains.

If you’re always trading in and out of stocks then you’re merely just gambling. You’re hoping that the month that you invested will be one of those good months and if it’s not, you just lost money.

I know some people that like to invest this way but I am absolutely not one of them. I am one that likes to stick to the fundamentals, look at the company’s financials, make sure they fit my investing strategy and then invest in them for the long-term. I do have some speculative investments that have 0 valuation backing, like Virgin Galactic (SPCE) for instance, but even with SPCE I am still investing in them for the long-term.

And I am doing so knowing that they are the most speculative type of investment that I could ever imagine, so I am mentally prepared for that investment to go to $0.

Yesterday they were up 17% – am I selling? NO! I am invested for the long-term. It’s a small amount of money that I wanted to put on black and just let it ride, so that’s exactly what I am doing.

2 – You cannot invest with the goal of making as much money as possible in a month

This is similar to the long-term but also very different – quite simply, you have to be focused on what you can control. Let’s imagine this – You were expecting a bonus in 2021 and didn’t get it so you decided you were going to try to make a bunch of money in the stock market.

You decided to just invest in SPY as it’s just an index fund of the S&P 500 and should be relatively safe, right? Well, what if the S&P 500 lost dropped significantly, just as we saw it drop by 12.51% in February 2020? Now you have compounded your losses. What do you do?

If you sell, you lock-in those losses but you also lock-in the fact that you can’t lose anymore. If you had stayed invested, you would be up 25% from where you bought in, and that includes the 12.51% hit you took right off the bat.

Starting to see what I am saying now? Looking at it on just a monthly perspective is just dumb. I’m sorry, but it is.

No matter how good of a stock picker that you are, you cannot control what the market does. If the market as a whole is going to drop, I am guessing that your portfolio is also going to decrease in value. You need to make sure that you have the right expectations going in or you’re going to be in trouble right off the bat.

In summary, if you can combine realistic expectations with a long-term mindset, you’re going to be setup for years and years of success.

Trust me – it’s worked for me. Partially because I have learned how to find great companies but also because I started with a great base knowledge formed out of the Value Trap Indicator to help me from making massive mistakes.

Related posts:

- Debunking 9 of the Top Investing Myths That Beginners Believe Updated – 11/3/23 Did you know that the #1 reason that people don’t invest is because they’re terrified that Handy Andy’s returns will make their...

- I’m Ready to Invest – How Do I Know What Stocks to Buy? So, I’ve finally been able to sell you on the concept of how compound interest can literally change lives and now you’re wondering how to...

- What is the Ideal Investing Timeframe? Long vs Short! Coming out of the right corner, we have the newcomer, the up and coming, short-term investments, all set to face the current heavyweight champion of...

- An Honest Story about Losing $5,000 on Hot Stock Tips The following is a guest post from Sam Broom. He talks about the first investment he ever made, and how it ended in disaster. He...