Updated 3/27/2024

If you’re wondering, “How much should I have saved by 30?” then let me tell you this—you’re not alone.

It’s scary how little reliable information there is about setting savings goals. Between the lack of discussion in family and school and extreme online financial gurus, it can feel overwhelming.

I just turned 31 this month, and I still question if I saved enough by 30. Now I ask if I’m saving enough by 31. And next year, I’ll be wondering if I saved enough by 32.

However, do you know what’s worse than worrying if you saved enough? Not worrying about saving enough.

Saving money is always in the back of my mind, and I’m guessing that it is for you as well if you’re reading this article. Maybe you’re worried that you simply “started late” (although 30 is still very early), or maybe you want to retire at 35 and simply want to know what to do for the next five years.

Click to jump to a section:

- What’s Your Time Horizon?

- How Much Do You Plan to Save?

- What Do You Want Retirement Life to Look Like?

- Estimating Your Retirement Needs

- Ensuring You’re On Track

Regardless of your goal, you may be wondering if you’ve saved enough at 30. But the question is really this: What is your goal?

If you don’t know what your goal is then you can never know if you’ve saved enough, so that always has to be your starting point. When trying to determine your goal, these are the things that you need to consider…

What’s Your Time Horizon?

How much longer do you have to make money?

If you’re not working, then you’re not saving. Sure, you might have some passive income coming in, which is truly the dream for us all, but if you don’t, then you’re going to be simply depleting your savings.

The time horizon is imperative because it tells you:

- How long you’ll have to save that money

- How long you’ll need to plan to live without income

For instance, if you’re 30 and plan to retire at 65 and live to 90, then you have 35 more years to make money, and once you retire, you have 25 years to live off your savings.

If you’re 30 and plan to retire at 50 and live to 90 then you have 20 years to save and 40 years to live off that stockpile.

You see how these goals are related? It might seem very basic but it’s something that you need to strongly consider when planning your retirement.

How Much Do You Plan to Save?

“Andy, I’m reading this article because I need YOU to tell me how much to save!”

I know, I know, but what I’m asking is this – how much are you saving right now? Do you think you’ll be able to feasibly save that same amount the rest of your career? More? Less?

For instance, let’s walk through a few examples:

Do you get annual raises? If you get a 3% raise, will you spend it all? Save it all? Can you live without that extra money coming in?

Do you think you’ll get a new job at some point? Will that new job have a better or worse income? Maybe you want to retire at 60, but you think you can take a lower-paying job at 50 that’s going to make you more happy but also hurt your savings rate.

Do you have room in your budget to save more money now? Can you reduce expenses to squeeze out any extra savings?

If you have children, they’re likely going to move out at some point—will you be able to save more money then? Or do you plan on having kids? If so, you’re likely going to have less to save. Trust me, I had a child about two years ago, and even though I had a baby budget, it was such a financial shock!

Take some time to really think about income and expenses for retirement. It’s imperative to get a ballpark so you have a general idea of what to prepare for.

I recommend making two estimations: one realistic estimation and one best-case estimation. Don’t forget to include savings in retirement accounts!

These figures will give you monthly savings rates to base your future progress on.

What Do You Want Retirement Life to Look Like?

It is important to know this not only financially but mentally. You need something to retire to, not just something to retire away from. Do you plan to retire early? If so, be prepared for significant health premiums!

Do you want to travel a lot? How often? Maybe be a snowbird and go to Florida? Or just be a homebody and stay where you are now?

Do you want to help your children out financially with their college and other expenses?

What goals do you have? Season tickets for a sports team? “Retire” to start your own business? Buy new cars and go on roadtrips?

You don’t have to have a perfect vision of 30+ years in the future, but the more you can plan for, the more accurate your retirement goal will be.

Estimating Your Retirement Needs

Once you know the answers to some of these questions, you can really get started on this process. I like to use the inverse of the 4% rule to back into what I think I’m going to need.

The 4% rule is a good barometer for retirement planning. Keep in mind that the 4% rule isn’t intended to be a perfectly accurate forecast of your needs. Instead, it should be used to ensure your retirement goals are in the right ballpark.

When you get closer to retirement, you will likely need to use a retirement planner to create a real retirement plan. But when you’re 30 and likely have multiple more decades in the workforce, using this is a great barometer.

The 4% rule says that you can withdraw 4% of your retirement savings every year after adjusting for inflation and never run out of money. This is under the assumption that your investments are 60% in the S&P 500 and 40% in bonds. (If this sounds like gibberish, just know that we are assuming your investments will have middle-of-the-road growth.)

To find out what your retirement needs are, you can consider how much you plan to spend annually and then multiply that by 25, as that’s the inverse of the 4% rule. This will tell you what you need to have saved up and easily liquid to withdraw when needed.

Example of 4% Rule

Got it? Ok, good. So let’s dive into this thing.

To figure out how much I’d need to have saved up, I like to go line-by-line in Excel with common expenses that I think I’ll incur as a retired person.

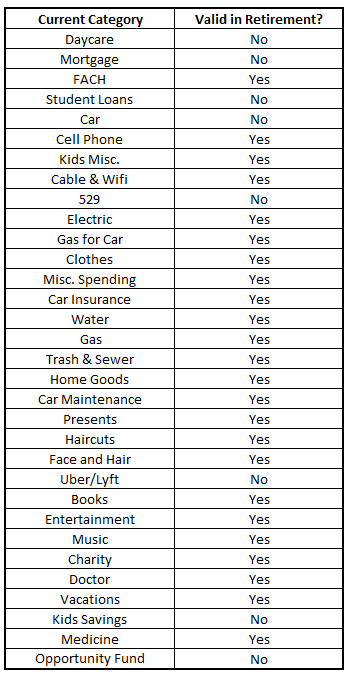

This is a hard list to come up with, so I like to start by looking at my own personal budget (I use Doctor Budget) and then eliminating those expenses that are no longer valid. Below is the list of all of my current expenses and those that I think will be relevant when I retire:

You can see that a lot of these became a “no” because I do not anticipate having these expenses in retirement. For instance, I will not have to pay for daycare in retirement, and I refuse to retire with a mortgage, so those were immediately switched to a “no.”

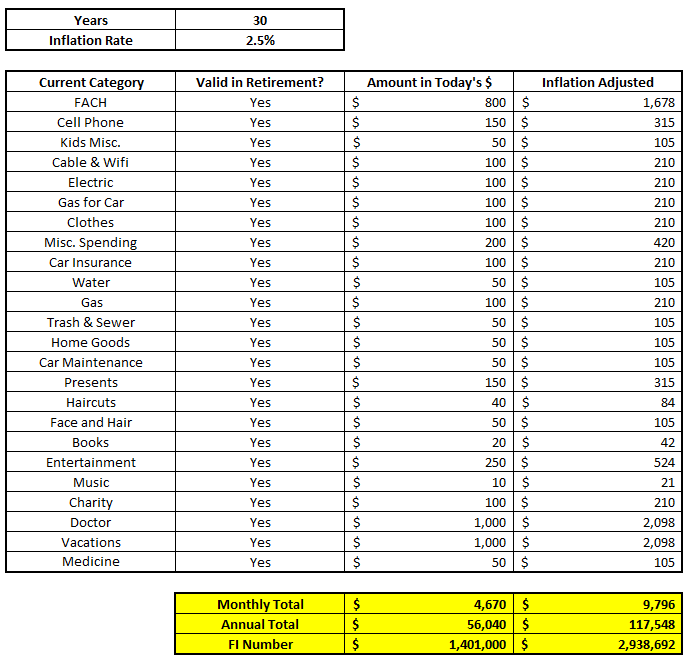

Once I did that, I simply went through and removed the “no” selections from my list so I only had the relevant expenses.

The following steps were for me to enter how much I think I would need to budget for when I retire to live the retirement life that I want to have. The most straightforward way to do this would be to guess how much I would spend right now if I were retired and adjust for inflation.

The picture below shows where I have done the math on estimated current spending for someone who’s 60 and how that would look 30 years from now using a historical inflation rate of 2.5%/year:

HOLY CRAP! I need nearly $3 million to retire and live this life?!

Yup, sure do, but let me caveat a few things:

- This is adjusted for 30 years of inflation.

- This is for a “rich” retirement life, which is the retirement life I’d love to live.

- This is a conservative look. I always want to shoot for the stars and, if I come up short, land on the moon. I am always conservative in all of my retirement calculations.

If you want to download this simple budget calculator that I used above, you can do so by clicking here:

Ensuring You’re On Track

The following steps now are to ensure that you’re on track to hit your retirement goal. I like to use a couple of different methods to do this.

Coast FIRE

The first method is called Coast FIRE (Financial Independence Retire Early). With Coast FIRE you don’t need to save any more money, and you can simply “coast” into retirement by letting your savings compound.

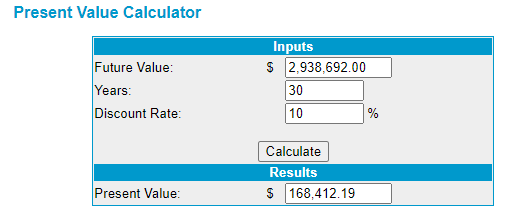

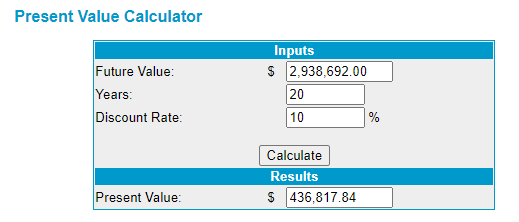

You can do this is by going to Moneychimp and using their Present Value Calculator.

See my example below with the following inputs:

- Future Value – your retirement number that we calculated

- Years – time until you would start withdrawing on those funds

- Discount Rate – the assumed annual rate of return. The S&P 500 has averaged over 10% since 1950, so that’s the rate I used

If you had $168,412.19 saved and simply let that money compound at 10% each year, you’d never need to save another penny to hit your retirement goal. (Assuming you actually get 10% returns; nothing is ever guaranteed!)

Continuing to Save

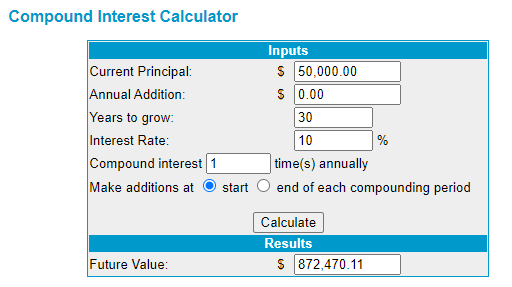

“But Andy, I don’t have that much saved. I only have $50K.”

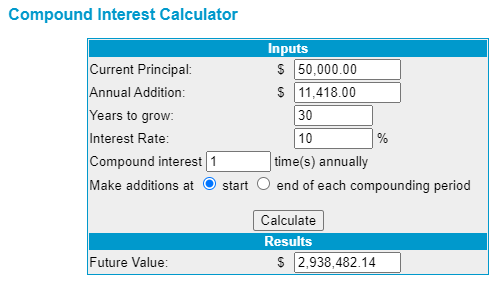

This is when we switch over to a compound interest calculator, also at Moneychimp. Enter a few other pieces of information that might require some thinking, specifically the amount that you can save each year.

As a starting point, let’s see if you just let that $50K compound each year for 30 years at 10%:

Ouch—you’re way short of your goal by over $2 million. Pretty scary, right? You’re probably going to have to save an absolute ton of money!

Wrong. Completely wrong.

This is where the magic of compounding steps in.

Do you have to make saving and investing a focus? Yes, absolutely, but it’s not an earth-shattering amount to hit your goal:

Just under $12K annually or less than $1K/month will allow you to hit your goal. That’s not bad!

I mean, if you’re married, this can be achieved by you and your spouse maxing out your Roth IRA each year. Of course, $12K annually is nothing to sneeze at, but remember, that is to achieve a rather luxurious retirement.

That doesn’t even take into account anything you might get from an employer match with your 401k or other similar programs.

If $12K does sound like a lot of savings, there are a few things that are worth thinking about:

- Your income is going to increase, hopefully. When it does, can you save more? That’s going to help you hit your goal even faster.

- This assumes saving 100% out of pocket—aka you’re not accounting for any pension, social security, etc. You might have other sources of income, such as something part-time when you retire. Personally, I think I’ll likely work at a golf course a few hours each week just to be outside and be around people (and hopefully get free golf!).

Combining Coast FIRE and Compound Interest

One of my favorite things when seeing if I’m on track for retirement is marrying these two processes.

My goal is to reach Coast FIRE by the age of 40. So, actively saving for the next 9 years of my life and then just coasting. Sure, I’ll likely keep saving because of the tax benefits and my company 401k match, but it’s just awesome to know that once you reach Coast FIRE you don’t have to save if you don’t want to.

First, let’s determine how much I will need at 40 to achieve my ideal retirement.

The process to do this is the exact same as we walked through. Instead of having 30 years in the Present Value Calculator, you’re going to set it at 20 years since your goal is to reach Coast FIRE by 40 and then let that money ride for 20 years.

Second, let’s determine how much to save to reach that goal.

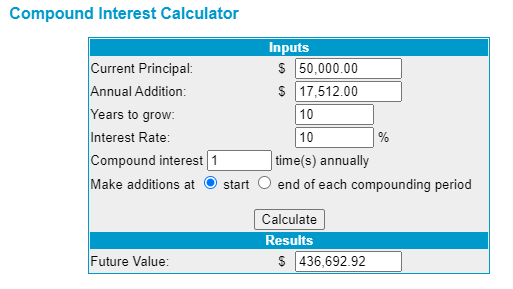

Ok, so you have 10 years (30 years old to 40 years old) to turn your $50K into $436,817. Can you do it? What’s it going to take?

To find out, go back to the compound interest calculator and do some “guess and check” by changing the “Annual Addition” amount until you find what it takes.

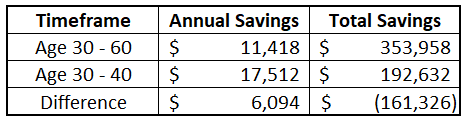

So, if you can save $17,512/year from 30-40, then you can hit the same end amount as if you were to save $11,418 from 31-60.

Saying it differently – if you could find a way to save an extra $6,094/year from age 30-40, then you’d in total need to save $161K less than spreading it out over the 31 years…

See what I’m hinting at? Even if you’re “on track” for your savings goal, finding a way to save even just a little bit more – your future self is going to thank you a ton for it.

So, how much money should you have saved by 30? Unfortunately I cannot answer that for you, but this exercise should help get you on track. A little bit of planning is going to go an extremely long way for you.

And don’t forget – those 10% returns that I spoke of are nothing more than what the stock market has given you. If you want to pick some individual stocks, check out Andrew’s eLetter, where he puts his own cold-hard cash to work!

Related posts:

- Retiring at 55? 9 Tangible Steps to Turn that Goal Into a Reality! Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about...

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...

- Curious How Much Of Your Paycheck Should You Save? I Got You Covered! One of the most controversial debates that occur in the Financial Independence Retire Early (FIRE) community are ones that are based on your savings rate....

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...