Spend less than you earn. Simple words to live by but not really anything that’s truly that helpful, you know? Any person getting started on their financial freedom journey likely starts by asking, “How much should I save a month?” Well, unfortunately for you, I have some bad news…

I don’t know.

Seriously, I really have no idea how much you should be saving each month. No idea at all.

I don’t know your age, your income, your spending, your goals, your current financial situation…I don’t know anything about you!

It’s called personal finance because it’s personal (another cliché you’ll hear a lot). But it really is true. Let’s cover a few examples of how saving greatly differs based on your situation.

Click to jump to a section:

- How Does Your Savings Number change?

- Your Retirement Number

- Example

- How to Increase Your Savings

- How to Reach Your Goal

How Does Your Savings Number Change?

Well, if I’m a 50-year-old with no savings and I want to retire at 60, should I only save 10%? NO! I likely will need to save closer to 90%! It’s going to require some drastic effort to meet your goals.

If you’re an 8-year-old planning for your future (major props!), then yeah, 10% might actually be a perfect number for you. But again, I have no idea what you’ll need to retire.

The same goes for any age and personal situation in between. Your current savings, assets, income, age, and goals drastically swing the needle in either the direction of investing more or less. Plus, your ability to balance your expenses with saving and investing significantly impacts your ability to track these metrics accurately.

There is one thing I know for sure.

I know myself. I know my goals. I know when I want to retire. I know my income. I know my spending. I know all of that. You need to know all of these things as well if you want to answer the question of “How much should I save a month?”

Your Retirement Number

The very first thing that you need to do is determine your retirement number. Your retirement number is quite simply the amount of income you need to be able to retire and live the life you want without stress for the remainder of your life.

Maybe that means you’ll go live like a world traveler and spend hundreds of thousands each year. Perhaps it means that you’re going to downsize and live near family so you can watch the grandkids grow up. Neither option is better than the other – you just need to know what you’re planning to spend.

Admittedly, it takes a lot of work to come up with. A common rule of thumb that people have used is that if you retire, you can withdraw 4% of your savings every year and never run out of money. It might sound strange or hard to believe, but the data does prove that the 4% rule works.

So, if you buy into the data, you can back into the amount you need to save by thinking about what you might need to spend annually and multiplying it by 25 (25 * 4% = 100%).

So, let’s pretend that you currently spend $48K annually. Maybe you bake some inflation in there and then think about how you want to go on some nice vacations. All in, you think that if you have $125K to spend each year then you’re going to be set for your retirement.

So, you take $125K * 25 = $3,125,000. That is your retirement number. If you have $3,125,000 when you retire, you can safely remove $125K each year and never run out of money. Sounds pretty dang nice, right?

Example

Now that you have your retirement goal, you need to think about some of those other items that I listed.

I’m going to run through a theoretical example below to give you an idea of how the process would work:

- Current Age – 30

- Retirement Goal Age – 55

- Current Savings – $50K

- Risk Tolerance* – 8% Returns

- None – 0%

- Low – 5%

- Medium – 8%

- High – 11%

- You will really only get these returns by investing it into the stock market. I use 8% as a ‘Medium’ Risk tolerance because an S&P 500 ETF has returned 10-11% on average over the last century, so after 2-3% inflation, you’re at about 8% returns on a real basis.

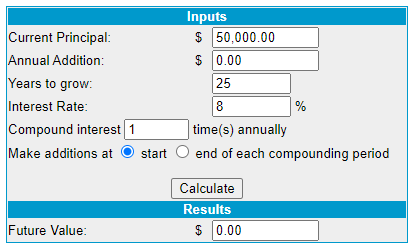

Now that you have this information, we’ll go to Money Chimp for their compound interest calculator and basically back into the amount you need:

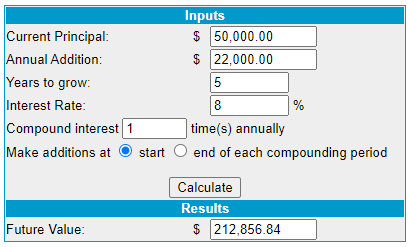

You can see that I added my current savings under “principal,” the years to grow and then the interest rate. The next step is to literally just guess how much you’ll need to save each year under the “Annual Addition” section.

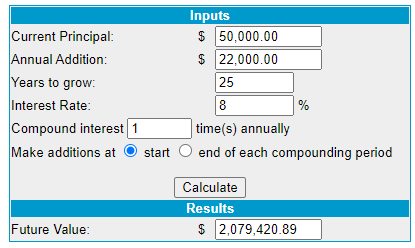

Something that might be eye-opening is if you put in what you’re currently saving now. Let’s say that you and your spouse are maxing out an IRA each year, which is $13K, and then you’re also saving $5K for both of your 401K accounts.

To the normal person that might seem like you’re killing it! $22K in savings does sound really good, but is it going to allow you to meet your goal of $3,125,000?

Womp womp…you’re still over $1 million away from your goal! You need to really kick it into high gear.

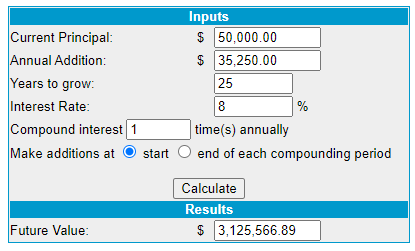

So, how much do you need to save? This is where a little “guess and check” comes into play. Simply put in numbers until you hit your goal. Doing this, I found that $35,250 is the annual amount that will need to be saved each year to get to this amount.

Sounds pretty hefty, doesn’t it? Sure, that’s a big increase over what is currently being saved, but the thing is, you’re finding this out now rather than 5, 10, or 20 years down the road. Another alternative to saving more is that maybe you decide you’d rather keep saving the same amount but retire later in life.

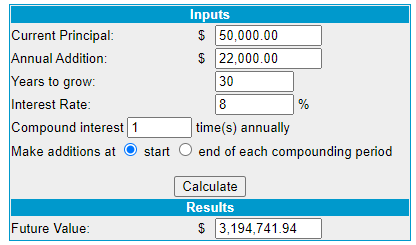

Just change the years until you hit your goal but keep the annual addition at $22K:

You should hit this goal in 30 years, meaning you would be 60. Maybe you hate that, or maybe you’re ok with it, but that’s 100% a decision that only you and your spouse can truly make.

So, if you’re going to save $35,250/year then you need to make sure that you’re saving $2,937.50 each month. I know, that really does sound extremely hard and it is going to be hard but it’s not impossible.

Plan Ahead

The most significant piece of advice that I can give to you is to plan. Do exactly what you’re doing right now. Think about what you will need in the future and aggressively start working towards that. Even if your retirement number isn’t exactly high, you will be better off simply by estimating than if you were saving a blanket amount each month.

How to Increase Your Savings

Let’s keep going on with this scenario, though. You’re currently saving $22K, and you need to get to $35,250, meaning you have $13,250 left that you need to save. What do you do?

Well, there are many things that you can do. Here are a few that I immediately think of:

- Ask for a raise at work or switch jobs. Staying at a job for longer than two years likely means you are underpaid. Don’t think of your day job income as a set figure.

- Avoid lifestyle inflation when you get raises. Instead, have a one-time small celebration and keep your recurring expenses the same.

- Do you eat out every day or pack a lunch? $10 meal out to eat vs. $3 for a homemade packed lunch is $35 in savings/week or $1,750 annually, assuming 50 weeks of work. If you need help finding cheap & healthy meals, I got you covered with some cheap grocery list tips.

- Do you have cable? Maybe you cut the cord and go to Netflix? Savings of $75/month or $900 annually.

- Are you getting coffee at Starbucks every day? Brewing at home can easily save $100/month or $1200/year.

- Have you considered a side hustle? Doing something as simple as Uber/Lyft/Grubhub can make you $100/week in about 7 hours as I’ve heard the typical take-home pay is about $12-$15/hour. Might not seem like a lot, but $100/week is $5200/year.

- Are you spending money unnecessarily on stuff you don’t care about? Simply try to budget a little bit more tightly with Doctor Budget. I guarantee you can find at least $25/week that you’re wasting money on, which is a savings of $1300/year.

Doing those 5 things gets you an annual total of $10,350! Pretty dang close to your goal. There are so many other small things that you can do as well, such as not wasting your birthday/Christmas money on things but rather investing it. Or, when you get a raise, save all of that extra money that you’re going to make.

Making up this extra money is all about the effort you are willing to put in. Opportunities are out there, you just need to find the time and determination. I recently listened to a podcast where a couple chose to mow lawns on their weekends, and they made about $300 per weekend.

This meant they were working 7 days/week, but even if you do every other weekend, or just one day/weekend, you’re making an extra $150/week or $600/month. Do that for half the year during the mowing season, and you’ve just made $3,600 or ~55% of your IRA contribution.

How to Reach Your Savings Goals

When it comes to saving and preparing for retirement, it’s not an all-or-nothing game. If you’re $13,350 short, like I mentioned above, you don’t have to do one thing to make it up.

And if you can’t possibly get an extra $13K saved but you can get $10K, DO IT! That is still so much better than just not doing anything at all.

The question of how much should I save a month really can be answered by saying “as much as you need to comfortable and conservatively hit your financial goals.”

I know that’s not nearly as exciting as saying a true dollar amount, but it really does vary from person to person. I might be saving $500/month, and you’re saving $1500, but I am on track for my goals, and you’re not. It just depends on your goals.

Truthfully, blog posts like this are some of my favorite ones to write because I really think that if people can take 10 minutes out of their day to go through this process, as I have shown you today, it can literally change your life.

Can you imagine if that person investing $22K just kept doing that over and over for 5 years before updating their strategy? They would be in a really, really bad situation!

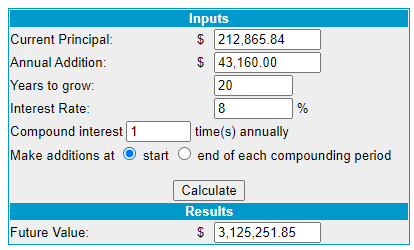

At the end of those 5 years, they would now have $212,856.84:

Do you know what they would need to save for the remaining 20 years? Take a guess.

Over $43K. Annually.

Do you see why time is such an important piece of the plan? This couple could save $35,250 for 25 years or $22,000 for 5 years, and then $43,160 for 20 years.

$35,250 * 25 years = $881,250 for the actual cash that they have to save while the other method is $22,000 * 5 years PLUS $43,160 * 20 years for a total of $973,200.

So, by this couple simply not planning and being aware that they were missing their goal, they cost themselves nearly $92K in the amount that they have to save to end up at the same point.

I don’t know about you, but $92K is a big freaking deal and could buy some pretty nice vacations throughout the years…

Closing Thoughts

So, in summary, don’t blindly save. Don’t blindly listen to people say that you should save 10% or 25% or any percent. Don’t do anything blindly at all.

Take 10 minutes and do these three steps:

1 – Find your retirement number

2 – Make sure you’re saving enough to hit that

3 – If not, evaluate all possibilities to get closer to your essential monthly savings

If you are willing to take the time to just plan, you’ll be so much better off than so many other people out there.

I know that this is tough for people, but you need to do it. I feel myself getting preachy but I feel like our educational system has failed us by teaching us things like geology and art but not how to understand compound interest or to use a budget.

I’m not slandering you if you’re a geologist or an artist, but let’s be honest – most of us are not. But ALL of us should know how to live within our budget and not overspend.

One common pitfall I would always fall into is that I’d blow it when I had extra money at the end of the month. Don’t be like me. Saving money straight from your paycheck really is easy to do, especially with these three simple money-saving methods!

Related posts:

- Finding the Perfect Balance of How to Spend and Save Money Are you struggling to figure out how much to spend and save each month? Keep reading for tips to find the perfect balance in your...

- Finding Different Ways to Save Money, Live Better in 2022 Nothing is more thrilling than financial freedom, just like there is no bigger burden than insurmountable debt. Follow these keys to save money, live better....

- What the Sinking Fund Formula Is – How it Can Help You Save Money Have you ever heard of the sinking fund formula before? To be honest, I hadn’t but it was something that I had used before without...

- Monthly Budget Busters: Saving Money by Cooking at Home Sometimes the smallest thing can make the biggest difference. See how saving money by cooking at home can have more than one positive effect. Have...