A credit card can be a tool or a nuisance depending on how you use it. Keep reading to better understand how often you can apply for a credit card.

The old saying that “cash is king” still exists today, but cash is starting to come in all different forms. No longer will you see a gentleman pull out his wallet with thousands of dollars in it. You won’t see a mom at a grocery store paying for $500 of groceries in cash. And honestly, you won’t even see an 18-year-old kid in a gas station buying a candy bar and soda with cash.

As I stated before, cash didn’t just go away, but the way most utilize it is totally different than 20 years ago. Yes, you will still see some old-school folks carrying around of ton of cash. Those are likely the same people that don’t trust banks. That’s another story for a different day, but you get my point.

The bottom line is credit, debit, and cash apps have taken over the world. Debit and most cash applications like Venmo work very similar to cash. You tie your card or account to a checking or savings account, and you are only able to spend what you have available. This is the safest way to spend money as it’s very difficult to spend more than what you have.

Credit cards and cash applications like PayPal will let you have a line of credit. Based on your qualifications, they will lend you the money, to be paid back later. As long as you pay it back on time there is no interest. However, if you miss a payment, you could be facing interest charges higher than 20 percent.

And while there are certainly some risks to using a credit card (if you aren’t careful), there are also some perks that a lot of people enjoy utilizing. But the question I want to focus on today is, how often to apply for a credit card?

You Don’t Need Multiple Credit Cards:

I don’t want it to feel like I’m preaching about credit cards, because at the end of the day, you need to make the decision that works best for you. But if you are asking me for my advice, I wouldn’t recommend having more than two different credit cards.

This article isn’t focused on this topic, but I think it’s close enough in relation that it’s worth discussing. I like to have a credit card in my name, and one in my wife’s name. That way, we each have a card helping our credit, and we are able to utilize two different types of reward programs.

Any more than two cards and I feel like it just gets harder and harder to manage. You will also find yourself having too much open credit, which can be a slight risk if a card was ever compromised.

Now, you may want to cancel one card and open another which can affect how often you are applying for a credit card, but please make sure you aren’t applying for cards constantly and getting as many as you possibly can. Even if you know what you are doing, that strategy can get you in trouble quickly.

How Often to Apply for a Credit Card?

This is a relatively simple question that has a complex answer. And that answer is, it all depends. There are a lot of different factors to consider when coming up with a conclusion. Not to give a full spoiler alert, but the easy answer is roughly every six months or so. But please keep reading to see what items you should consider that may raise or lower that window.

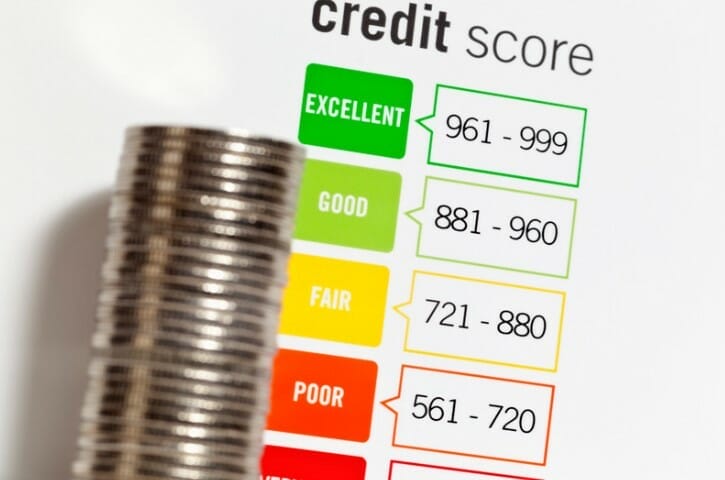

Credit Score:

I’ve been on a big kick about your credit score recently, and if you’ve read any of my pieces recently, you’ll know that a credit score can make or break you when it comes to big purchases. If you have a “good” credit rating (690-719), you fall in the category of not wanting to apply for a credit card any more frequently than six months.

If you find yourself with a credit rating in the “fair” category (630-689), you likely want to wait even longer to apply for a credit card. With a fair credit score, applying for a credit card too often can raise a ton of red flags and make you appear as high risk to certain lenders.

And if you find yourself with a “bad” credit rating, you need to be extremely careful about when and what type of credit card you are applying for. Just because you have a bad credit rating doesn’t mean it can’t be fixed, you just need to be more mindful. There are certain cards with lower limits that are built specifically for building up credit.

My wife is a perfect example. She has always had a good job and made good money, but she had a lot of unpaid medical bills because she moved around so much and didn’t do a great job of keeping track of her mail. It was all small amounts, but at the end of the day, it really damaged her credit.

When we applied for our first home, she had a credit rating under 600. To make sure that we got the best rate possible, we just put the home in my name. That was all the motivation she needed to clear things up.

She followed up with the bank that ran her credit to find out who she owed money to. She called every doctor’s office she had ever visited to find past due claims, and she signed up for a credit card with a low limit but was meant to help build credit.

In just over 12 months, she went from a 575-credit rating to a 750. Nothing in her life was different, but she paid off about $1,200 of medical debt, and continued to utilize a credit card each month and paid it off in full. The card had a $700 limit and she only used it for gas and at the time, that was only $100-200 per month.

My point is if you are reading this article and have a poor credit rating, you too can bring it up. The last house we applied for a mortgage; she actually had a higher credit rating than me!

When considering how often to apply for a credit card and you have excellent credit (720-850), you do have a little bit more leniency and can apply more often. With a good payment history, you are considered much lower risk, and credit card companies are more apt to want to work with you.

Times to be Overly Cautious:

When planning on how often to apply for a credit card, there are different factors to think about. The first one covered today was determining if you actually need another card. The second was looking at your credit score to decide if you should be applying for a credit card. And the last thing I want to cover today is times to be overly cautious.

That means in certain times or certain situations, you may want to completely avoid a credit card application altogether. Keep reading for examples.

Before a Big Purchase: One of the biggest mistakes I have seen is someone applying for a credit card right before a major purchase. The goal when buying something big that requires a loan is the best credit score possible so you get the best rate possible.

No matter how good your credit score is, when you apply for a credit card, it’s going to take a slight hit no matter what. When you are talking about an interest rate for a mortgage, half a percent will cost you more than $160 a month on a $500,000 home (using a 30-year mortgage). That is $1,900 a year and $57,000 over the life of the loan.

I’m the crazy person who decided to build a house at the end of 2021. Luckily for me, I did sell my house before interest rates went up, but I am going to go from 2.75 percent to 5 percent interest on my next home. That is over $400 a month more than I wasn’t planning on, so just imagine if I would have tried to open a credit card 30-days before my loan application. It could have cost me another $50 a month.

Recent Rejection: This one may sound like a bit of a no-brainer, but if you have recently been rejected by another credit card application, it is also best to wait for more than the recommended six-month window.

When evaluating how often to apply for a credit card, you want to avoid red flags, and constant applications do not look good to creditors and show signs of risk.

Instead of reapplying somewhere else, consider calling the card that denied you to better understand why you were denied. That will give you a checklist of things to work on, or you may even catch an error in their system that allows you to be approved.

My mom is retired and applied for a card and was denied. She called and it was because she put no income. She was able to provide a few statements with her retirement money and was instantly approved for the card.

Bad Credit: Unfortunately, if you have a bad credit score, that will also affect how often to apply for a credit card. It’s one thing to lose a few points on your credit score if you are in the high 700s or even 800s, but if you already have a poor rating, you can’t risk lowering your score any further.

My recommendation on applying for a credit card if you have a lower credit score: make sure you do your full due diligence. Dive into the card, understand what it takes to be accepted, and make sure you meet the criteria before applying.

Some cards are extremely upfront and will let you know that it is for “excellent” credit ratings only. These cards may offer zero percent interest or have a high percentage of cashback. Other cards that are meant for lower credit folks will have higher interest, lower limits, and may even require a larger up-front fee.

Having bad credit doesn’t mean you shouldn’t apply for a credit card; it just means you need to make sure you can realistically be approved. If your credit won’t allow you to be approved for any type of credit card, continue to pay off debt and on-time payments to any other type of loan you may have outstanding in order to build up your score.

Trying to Rebuild Credit: The last item I want to discuss today when it comes to evaluating how often to apply for a credit card is a scenario where you are trying to build credit. You may have had a rough financial past but have learned and are trying to better yourself.

In that scenario, you likely will want to wait for at least six months between applying for cards, and some would even recommend waiting at least a year. The key to building back your credit score is consistency. Six months of good data isn’t quite enough for some creditors to believe, but after a year of consistent payments and good habits, you can start to get the benefit of the doubt on some items.

There is a lot of information above to spit out a pretty simple answer to the question, “how often should I apply for a credit card?” But as with anything, there are a ton of outside factors. I joke that your credit score is similar to your weight. You can kill your credit score or gain 30 pounds in a month, but it takes years to build your score or lose the weight.

But remember, if you are truly motivated to improve your credit, there are ways to do it. You may need to call every single company in the United States that you owe money, and slowly but surely you will see things turn around. If you are still young and haven’t had a chance to destroy your credit, keep all of this in mind the next time before you buy something you’re not sure you can afford.

Related posts:

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Credit Cards? Pshh. Let’s Break Down the Debit Card Advantages and Disadvantages In the personal finance community, there are many varying opinions on all topics imaginable. And as you might anticipate, some of them can get pretty...

- Understanding all the Visa Perks on Different Credit Card Options With so many different credit card options available, it’s important to weigh all the possibilities. Check out the Visa perks on these different cards and...

- Understanding the Target Red Card Perks and How They can Benefit You Consumers have a ton of options when looking for new payment options. As with any financial decision, it’s best to weigh all options. Keep reading...