If you want to learn more about a company or invest in a company, you can find a plethora of information on the company’s annual report, otherwise known as a 10-K. The 10-K offers an in-depth look at a public company’s financials, the risks it faces, and operating results for the previous year.

Warren Buffett is famous for reading 500 pages a day, and the majority of those are 10-Ks. So if you want to invest like Buffett, you must do like Buffett.

Are these reports always the most exciting to read? Probably not, but there are ways to make them more enjoyable, in addition to more revealing. Think of reading a 10-K like a puzzle; it is our job to put all the pieces together to determine whether it is a wonderful company or not.

There are many sections to the 10-K, some of which contain boilerplate language, which means that it is legal language; they must include covering any possible legal actions. As you gain more familiarity with 10-Ks, you will have the ability to skim over these sections and spend more time on the relevant sections.

Think of learning to read a 10-K like any other aspect of investing; another skill to learn that will come with practice. The more you do, the better you will get at them. The bonus is that once you get comfortable with a company, it will be easier to read each year.

What we will cover today:

- What is a 10-K?

- Where do We Find a 10-K?

- Components of a 10-K

- Breaking Down Microsoft’s 10-k by Section

- Investor Takeaway

Okay, let’s get to it, shall we?

What is a 10-K?

A 10-K contains a detailed financial report and management discussions regarding the business. The SEC requires all companies have their financials audited and prepared according to regulations.

Microsoft’s disclosures can’t contain any misleading information or purposely omit any information investors might need to make an informed decision. The CEO and CFO (chief financial officer) must sign off on the 10-K to certify its accuracy.

The SEC reviews every 10-K to ensure accuracy and maintain adherence to all regulations.

A note: each 10-K updates quarterly with the form 10-Q. Companies prepare a 10-Q every three months and don’t require audits for the financials.

The SEC also requires companies to prepare an annual report, which contains some aspects of the 10-K, but has less detail, tend to contain more marketing, and has different functions.

Many investors confuse the two, and some companies include the annual report and 10-K in the same document.

The annual reports contain fancy charts, graphs, and marketing pieces acting as eye candy. They also contain letters to shareholders from the C-suite, such as the CEO and CFO. Annual reports can help potential employees determine a company’s culture.

Where Can We Find The 10-K?

There are many different options to help us find the 10-K of any publicly traded company.

- Investor Relations page for the specific company

- SEC.gov

- Bamsec.gov

- Favorite financial website

The easiest way to find the 10-K of any public company is to use our friend Google. Type in the name of “insert company” and “investor relations”, and you will find an investor relations page for Microsoft.

Not every company will list the 10-K as a separate document; some will include the annual report and 10-K. Or they may list SEC reports separately and the annual report on its own.

Keep in mind that these ideas also work for companies outside the U.S. Companies operating outside the U.S. have different accounting rules (IFRS) and names for reports.

We can also use the SEC’s website to locate 10-K reports, along with Bamsec. These resources allow you to type in a company’s name and search for the particular report by year. The SEC’s website offers 10-Ks back to 1994/1995 for those wishing to dig deeper.

Finally, 10-Ks can be found on many financial websites such as:

Components of a 10-K

To learn more about any company we want to analyze, starting with the 10-K remains a must. The reports contain a narrative about the company, including business operations, financials, and management’s view on current and future results.

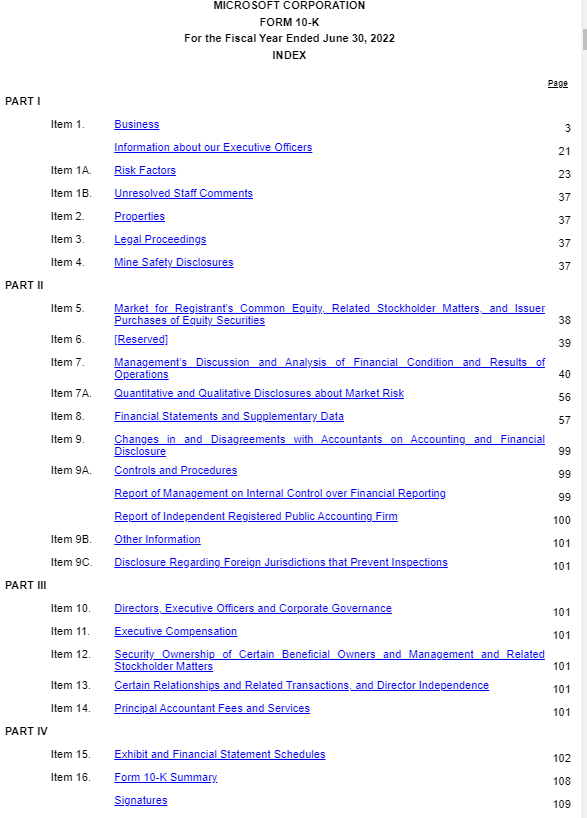

Each 10-K contains different parts, with some sections more important than others. Over time you will learn to seek out the important parts and avoid some of the boilerplate and legalese.

Some of the more essential parts of the 10-K include:

- Item 1: Business (descriptions of Microsoft’s operations)

- Item 1A: Risk Factors

- Item 3: Legal Proceedings

- Item 6: Selected Financial Data

- Item 7: MD&A (management discussion and analysis)

- Item 8: Financial Statements and Supplementary Data

Each Section of the 10-K contains a wealth of information about how Microsoft makes money, any risks they face, what management thinks of past performance, and how they plan to grow.

The best way to work through the 10-K is piece by piece, like a pizza.

Breaking Down Microsoft’s 10-K by Section

For our example walk-thru of a 10-K, I would like to use Microsoft (MSFT) as our guinea pig, if you will. We will cover the company’s latest 10-K, filed on June 30, 2022.

Business Section

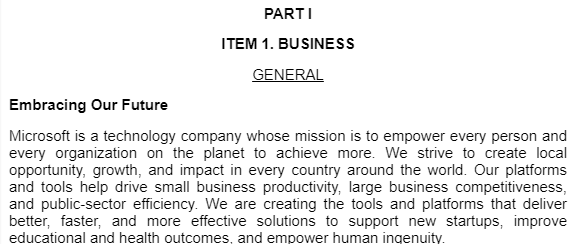

The first section we encounter after the table of contents is “Business”. This section will find all the information about Microsoft and how they make money. We can also refer to this section as the business summary.

Sample of Microsoft’s business section.

Information we will find in the business section:

- How Microsoft generates revenue

- What Microsoft spends money on to grow

- Their marketing strategy

- How they distribute their products and services

- Any competition and how Microsoft plans to take on the competition

**The business section remains one of the most important parts of the 10-K. You might want to read through the section more than once. If you encounter any business you don’t understand after reading the business section, pass and move on to another business.**

In the last paragraph, I can’t re-emphasize enough that if you don’t understand the business, move on; it’s not worth your time trying to learn anything else about the business.

Some good news: if you understand the business, there is little need to read through the business section in the previous 10-Ks. For the most part, it’s going to be similar. However, if looking beyond five years, give the business section a brief look-through to ensure things haven’t changed.

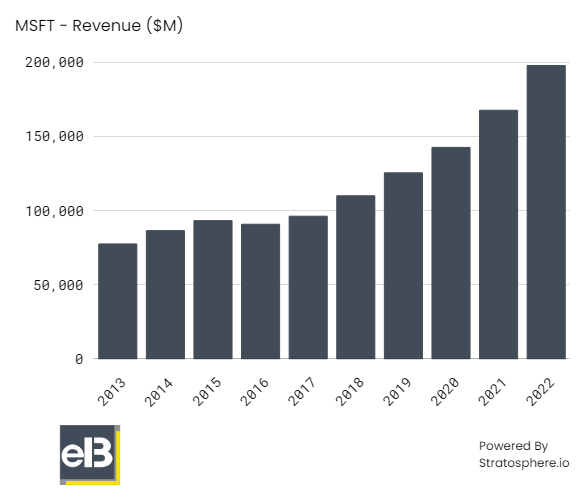

For example, Microsoft has changed its business model over the last eight years since Sayta Nadella has taken charge. He has moved Microsoft towards a more cloud-based business with more focus on cloud products like Azure and subscriptions for Office. All of this was not the case ten years ago.

Risk Factors

The second section, directly following the business section, risk factors, contains all the potential risks associated with an investment in Microsoft. Here, management will outline different risks the company faces. These risks could include competition, technology, strategy, and/or finances.

The risk section contains many items that could impact our investment in Microsoft and is important to understand.

The risk section can contain boilerplate or legalese, particularly in financial companies such as banks or insurance companies. But as boring as it can be, it’s important to read through and understand it.

Remember, the lawyers will often write the risk section to help outline all potential risks– in part to warn investors but also to give the company legal cover.

When we invest in a company like Microsoft, we have goals in mind for profitability, cash flows, customer growth, and much more. These risks can prevent Microsoft from reaching those goals and preventing us from achieving higher returns; thus, we must understand these risks.

The good news, in general, is that we only need to read through the risks in the current year as they don’t change much year over year.

Selected Financial Data

The next section we should read is the “selected financial data” section. This section can contain an overview of the company’s performance and showcase some of the numbers and metrics the company wishes to highlight.

The selected financial data can give you a good sense of revenues, earnings growth, operational costs, and debt management.

In many cases, the company will list five years of numbers, which can give you a quick snapshot of Microsoft’s past performance. We can also use this section with your favorite financial website for a longer view.

The selected financial data section offers a great starting point for asking questions. For example, if you see revenues stumble one year, note it and try to learn why. We can begin keeping a notebook or write in the margins about different questions to answer.

We don’t need to dive deep into this section, but it offers a nice snapshot of the company and gives us a starting point to work further.

Management’s Discussion and Analysis (MD&A)

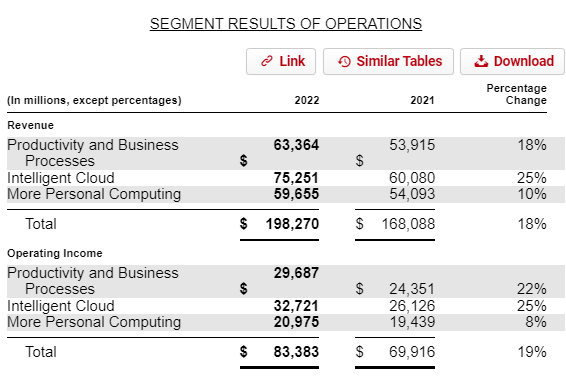

Here we get into the meat of the 10-K, directly after the “selected financial data” section. The management’s discussion and analysis, or MD&A as we will call it, contains some of the most important information in the 10-K.

The MD&A provides investors with crucial insight into what drove the success or failure of Microsoft during the year. It also tells us how Microsoft did compared to its last two years. Over the three years represented, we can see how the company performed. It can give us a comparison of performance based on stated goals and what management thinks will drive the company forward.

For example, most MD&As work through the income statement, focusing on:

- Revenues

- Costs

- Operating income and costs

- Earnings

Next, it will focus on the balance sheet, the company’s debt management, and the company’s liquidity.

Finally, it will wrap up by discussing Microsoft’s cash flow from the different sources, along with the company’s liquidity or any needs they might need to fulfill, either from operations or other sources such as debt or equity.

Ultimately, the MD&A section is the section on which we should spend most of our attention in the 10-K. A great practice is to read through the MD&A section of multiple 10-Ks if you want to buy and hold Microsoft, or any company, for long periods. Even better, read through ten years of the MD&A section for any company you analyze.

By focusing on the MD&A, we can get a great sense of management, understand how the strategies might change, and how well management executes their plans.

We should focus on parts of the MD&A where management explains any economics and the results of operations for the last three years. We should also focus on any estimates or assumptions management makes and how they impact the financials.

Again, we should focus on asking questions about different aspects of the company’s performance. Some good ones to investigate are:

- What prevented Microsoft from growing, and how did that impact the business?

- What boosted margins in a way management didn’t expect?

- Does the company experience drops in margins often? If so, how often do they happen, and what is management doing to improve margins?

The MD&A is a great place to get a sense of the important KPIs for the business. Every company has important key performance indicators, or KPIs, and some remain more open about discussing those KPIs.

For example, KPIs Microsoft focuses on are:

- Azure revenue growth

- Office 365 Commercial seat growth

- Microsoft 365 consumer subscribers

These specifics help Microsoft track how effective their different marketing and sales initiatives are. They also give investors insight into the company’s performance and metrics to track.

Each industry will have different KPIs they track, and we can use those KPIs to compare others in the industry.

For example, subscribers are an important KPI for streaming services such as Netflix and Disney+. And analysts and investors spend a lot of time focusing on those metrics because they help explain each company’s performance.

Financial Statements and Supplementary Data

The next major section of the 10-K is for us to read is “Financial Statements and Supplementary Data”. This section includes the three major financial reports and any supplemental data, typically over three years.

The three major financial reports include:

In the interest of some brevity, I will assume you know how to read and analyze each of the three financial statements.

This section contains the heart of the 10-K and connects well with the MD&A section. Aswath Damodaran, NYU Stern finance professor, says, “numbers tell us a story; as analysts, our job is to figure out what those numbers are trying to tell us.”

Notes to Consolidated Financial Statements

The final section to read, in connection with the financial statements, is also known as the “notes.”

The notes section represents a glossary for all the terms management might use during the MD&A. The notes section also includes any supplemental information for the financial statements. The notes help explain different line items from the financials in deeper detail. For example, we can discover the reasons behind any changes in capex or PP&E (Property, Plant, & Equipment).

Unlike the MD&A and financial statements, the notes section is something I might not read in its entirety. I often use the notes section to answer questions or dive deeper into particular line items from the financials.

For example, we can dig deeper into Microsoft’s debt situation. We can determine how much interest the company pays now and in the future, along with when the long-term debt will mature.

We can also decipher any segment information not shared in the MD&A. Some companies keep the information slightly less obvious, which means more sleuthing. Or if the company is expanding its operations, it will need to spend cash to do this, and the notes section can open up how the company might need to raise funds.

Some sections I like to focus on in the notes:

- Property and Equipment

- Investments (Financials)

- Mergers and Acquisitions

- Debt

- Stock-based compensation

- Segment information

Investor Takeaway

Reading a 10-K is an incredibly important process that you must do to become a better investor. Besides the numbers, you can gather a lot of information from these documents.

Focus on these six sections as a great starting point:

- Business

- Risks

- Selected financial data

- MD&A

- Financial statements

- Notes to financial statements

Like Munger and Buffett say, learning as much as possible about each business you buy is critical, not just about the numbers, but the people running the company.

There is no shame in declaring that a company is too hard to understand either because the business model is too complicated or the financials are very disorganized and not very clear. Instead of forging ahead and buying the company, it is better to move on and investigate a different company.

For me, it doesn’t mean you can’t learn about a business you are truly interested in, such as banks. Finding businesses that fall in our circle of competence can be difficult, but sticking to that circle can help prevent losing a fortune.

Reading the 10-Ks is instrumental in becoming a better investor; they can appear daunting, but I think we have seen that because they have become data dumps lately. We can filter through the chaff to find the wheat.

Remember that practice makes perfect, and reading 10-Ks requires practice, like performing a discounted cash flow calculation. The more you do it, the better you will become at reading a 10-K.

I hope you enjoyed this article and found something valuable for your investing journey. Reading a 10-K can appear daunting, but if you have a plan and follow that roadmap, you can do this!

If you have any further questions or if there is anything else I can do to be of assistance, please let me know.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- How to Look Up Debt Covenants: A Real-life Example from a 10-k Out of the many aspects of fundamental analysis, reading debt covenants is probably among the most arduous, discouraging, and ignored part of the job. But...

- Financial Statement Footnotes: Treasure Trove of Information from the 10-k Reading the 10k of a company is required reading if you want to invest in the company, and part of that reading is scouring the...

- Simple Balance Sheet Structure Breakdown (by Each Component) “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.” Peter Lynch The ability...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...