Updated 10/12/2023

Visa Inc (V) is one of the leading payment brands globally and its cousin Mastercard (MA). Visa provides payment services to over 200 countries, including individual consumers, merchants, financials, and governments.

Visa provides various services, from authorization, clearing, and settlement for merchants and financials. Fun fact: Visa doesn’t issue debit or credit cards; instead, the cards come from its clients, such as JP Morgan and PayPal.

Visa makes money by selling its services as a middleman between the merchants and financials. Unlike American Express or Wells Fargo, Visa doesn’t make money on interest charged on credit cards.

Visa is one of the more dominant brands globally. It started as one of the first credit card programs in the 1950s. It morphed into the global giant today by creating a network and protocol that enables it to ease the transfer of money between parties globally.

Learning how one of the global payment leaders makes money helps us, as retail investors, understand how we can profit in the payment sector with others such as PayPal, Square, and Stripe. Studying some of the world’s best businesses is also a good idea to help us analyze others in the same field but others outside of payments and financials.

In today’s post, we will learn:

Okay, let’s dive in and learn more about how Visa makes money.

The Visa Business Model

Visa’s mission is to “connect the world through the most innovative, reliable, and secure payment network – enabling individuals, businesses, and economies to thrive.”

To achieve this vision, Visa works through the many different mediums of payment, such as:

- Contactless payments

- E-commerce

- Digital wallets

Visa is the perfect example of a “multi-sided platform.” Visa’s platform creates cross-side network effects by enticing Visa cardholders more usage, which encourages more acceptance by merchants and round and round the flywheel goes. We can consider the merchants on the money side and the consumers on the subsidy side of the equation. Visa spends most of its efforts to encourage consumer usage, which drives merchants’ adoption.

In 1973, Visa developed a revolutionary payment protocol named Visa Net. The goal was to provide a better way to make payments globally, and fifty-plus years later, they succeeded.

Banks use Visa Net’s payment processing protocol to develop and create credit and debit card programs for their customers. As I mentioned, Visa doesn’t issue credit cards or offer any credit on its own; that is done on the banking side.

Instead, Visa operates an open-loop payments network to help manage the flow of payment information between merchants and financial institutions like JP Morgan.

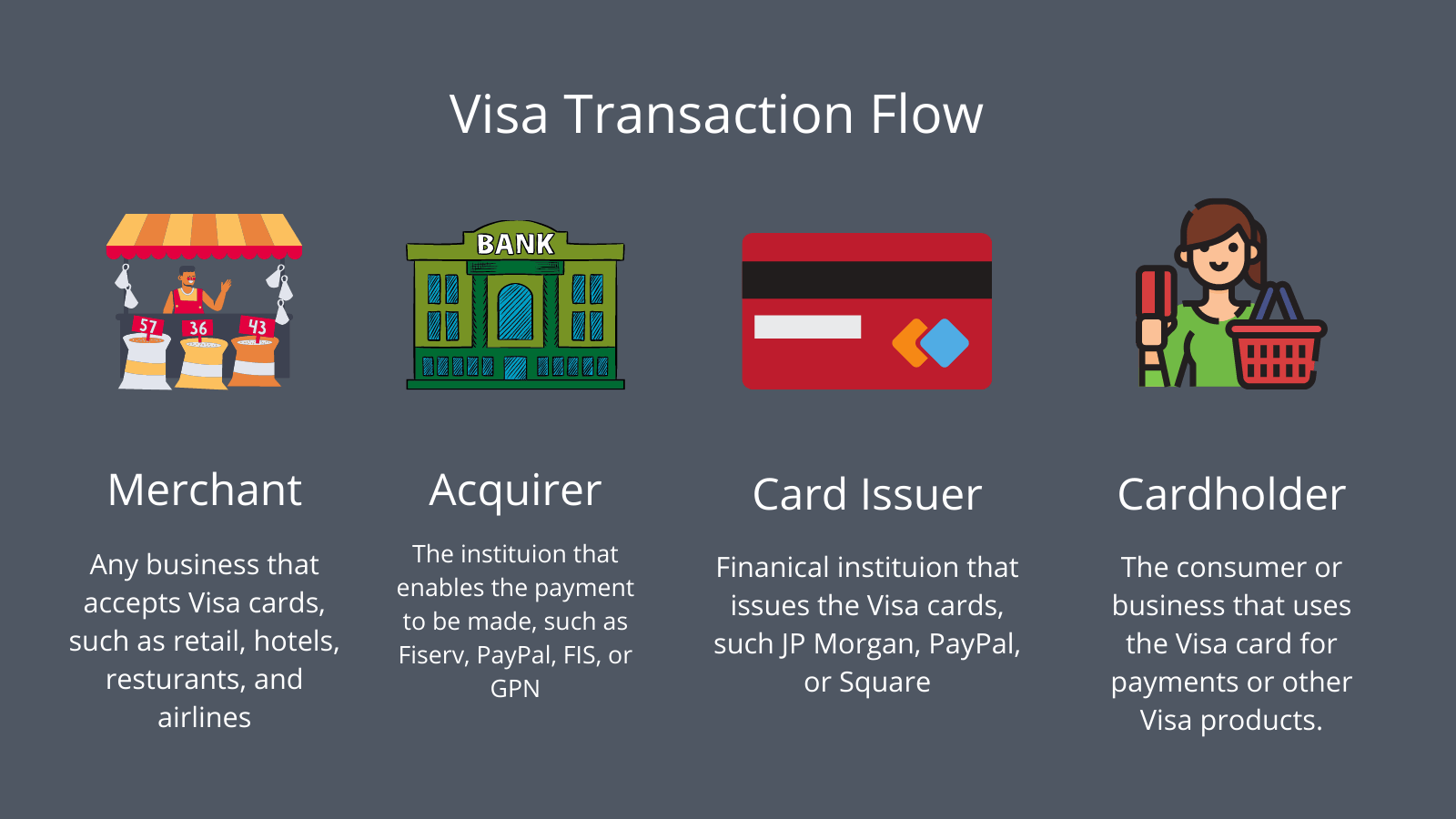

Visa classifies the banks in the order flow as either acquirers or issuers.

- Issuers supply cards (debit or credit) to cardholders; for example, Capital One offers credit cards to its customers, and Bank of America offers debit cards to its account holders.

- Acquirers handle the relationship with merchants; for example, Square handles processing the payment, setting up the hardware to process, and managing any issues with the card payments for the coffee shop on the corner.

To confuse matters a little further, sometimes the acquirer can also be the issuer; for example, JP Morgan processes payments and debit and credit cards to account holders.

New players like Square and PayPal offer both sides of the equation, acquirers and issuers, with their Cash App Cards (Square) and Cash Cards (PayPal). For example, others in the payment processing space or payfacs, such as Stripe, Adyen, Fiserv, and FIS, are strictly merchant acquirers, as they don’t offer cards.

Visa’s ecosystem operates in this manner:

- Cardholders are the consumers who hold a Visa debit card or credit card.

- Issuers, such as JP Morgan, are the financial institutions offering Visa cards to account holders. The issuers also set the interest rates on credit cards and determine any fees they might charge their account holders.

- Payment processors or payfacs are third-party companies with software and hardware that handle payment processing for merchants. Sometimes, these are stand-alone companies; other times, they are merchant acquirers or issuer acquirers. For example, Square and JP Morgan can handle all three business sides: the issuer, the customer, and the merchant.

- Merchants are businesses that accept Visa cards as a form of consumer payment.

- Acquirers are the banks or processors that woo merchants such as Starbucks to accept Visa cards. Merchant acquirers such as Fiserv offer access to Visa’s network connectivity and payment acceptance and negotiate discount rates for merchants accepting Visa cards in their businesses.

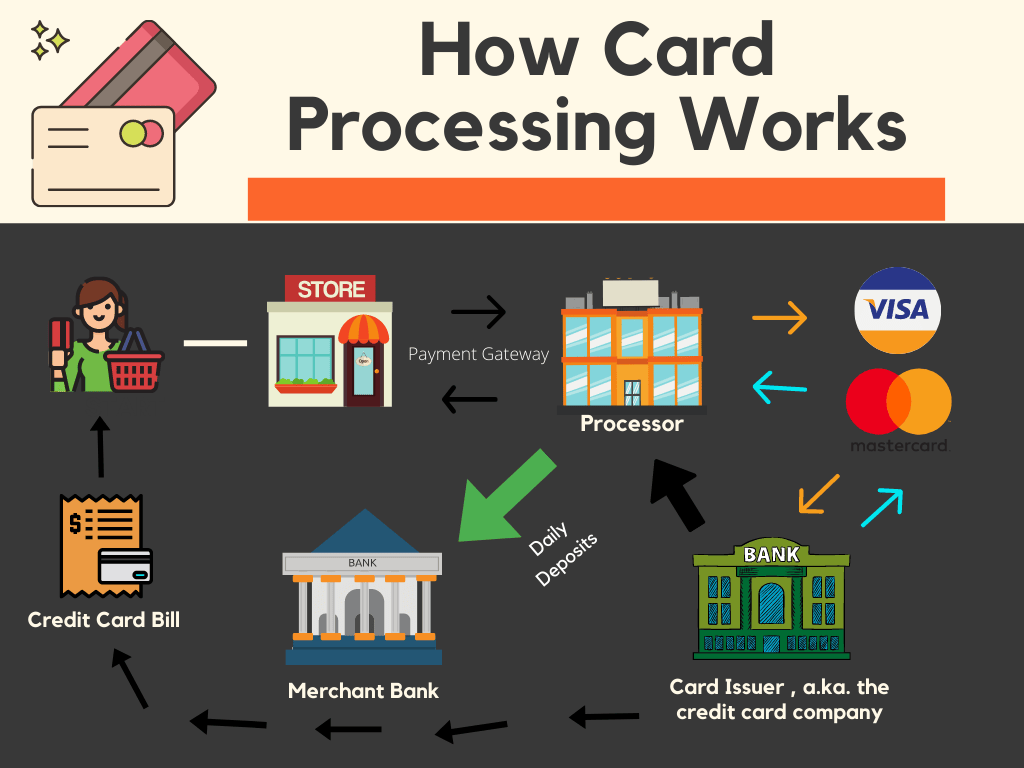

The payment flow when a cardholder offers their Visa card for payment of their double latte is as follows:

- When the customer offers a Visa card for Starbucks, they send the payment to the acquirer.

- The acquirer contacts the issuer over the Visa Net network.

- The issuer relays sufficient funds available to process the transaction, with that information transmitted back to the merchant.

- If the balance is adequate, the merchant accepts the payment; if not, they reject it.

- The issuer bills the credit card holder monthly, and the consumer pays the issuer the balance due.

If the transaction is all good, Starbucks delivers your double latte to you, remembering that the above process takes mere seconds to complete.

Next, we uncover the settlement and clearing process, which transfers the money to the merchant account with the acquirer.

The clearing process is as follows:

- The merchants forward relevant sales information such as account numbers and transaction amounts to its merchant acquirer or payfac. For example, Starbucks sends my coffee order details to Square.

- The merchant acquirer or payfac formats the data into a clearing message and transmits that message to Visa. For example, Square formats the clearing message and sends it to Visa.

- Visa then routes the clearing message to JP Morgan, the card issuer, and calculates the settlement obligation for JP Morgan (issuer) and the amount of my coffee to Square, less applicable fees or charges.

That is all part of determining whether I have enough money to pay for my double latte at Starbucks.

The settlement process is as follows:

- The issuer (JP Morgan) sends the money to Visa’s designated settlement bank in the amount of payment settlement obligation.

- Visa’s settlement bank sends the money to Starbucks via Square.

And that is how Starbucks receives my payment for my double latte; again, all of this happens in seconds without the consumer being aware of the flow.

These payments flow over the Visa Net payment rails on Visa-branded cards, whether they are from Square or JP Morgan. It doesn’t matter whether Visa enables a merchant payment at Walmart or a bill like Netflix; they all occur over the Visa Net payment rails.

That is how Visa serves each of its customer segments, through the payment rails, and why it offers a multi-sided platform:

- Issuers of financial institutions

- Acquirers, also financial institutions

- Cardholders

- Merchants

Visa offers many different products and services to its customers, including:

- Products: including Visa-branded debit cards, credit cards, commercial cards, prepaid cards, and mobile and money transfers

- Services: authorization, clearing, settlement services, mobile financial services, for example, mobile payments and money transfers.

Visa, operating one of the world’s largest payment protocols, is also one of the simplest businesses. It can turn off the lights at the office, and it will still make money. The protocol and network they created fifty-plus years ago still hum right along.

Once you understand that they are the middleman in the payment processing order flow and act as the toll booth to all payments, it is easier to understand the business.

How Visa Makes Money

Visa makes money from transaction fees charged to merchants like Starbucks, Walmart, the local yoga studio, and e-commerce sites.

The easiest way to understand how it works is with an example.

Imagine we pay $100 to our favorite restaurant; the restaurant or merchant fee is 2.40%, and the restaurant nets $97.60 for our $100 meal. The $2.40 fee gets split between the card issuer (JP Morgan) and merchant acquirer (Fiserv) unevenly, depending on the interchange fee. If the interchange fee is 1.80%, JP Morgan keeps $1.80, and Fiserv would receive $0.60. JP Morgan keeps a higher cut of the pie because of the higher risk from possible default of payment.

Visa makes money on payment volume, transaction processing, and other value-added services. So, instead of receiving monies directly from the transaction, they receive monies from both the issuer (JP Morgan) and merchant acquirer (Fiserv). Instead, they make money from overall transaction volumes and the total number of transactions processed.

Visa doesn’t directly profit from the interchange fees, even though it administers the collection and payment of interchange fees through the settlement process explained earlier.

In the transaction example above, Visa would generate about 0.13% for a credit card transaction and 0.11% for a debit card. That percentage comes from the 2.40% that the issuer and acquirer split. For example, the 0.13% for a credit card equals $0.003, which they split between the two. Now, that does not sound like much, but when you consider that they processed 140.8 billion transactions in 2020, don’t feel too sorry for Visa.

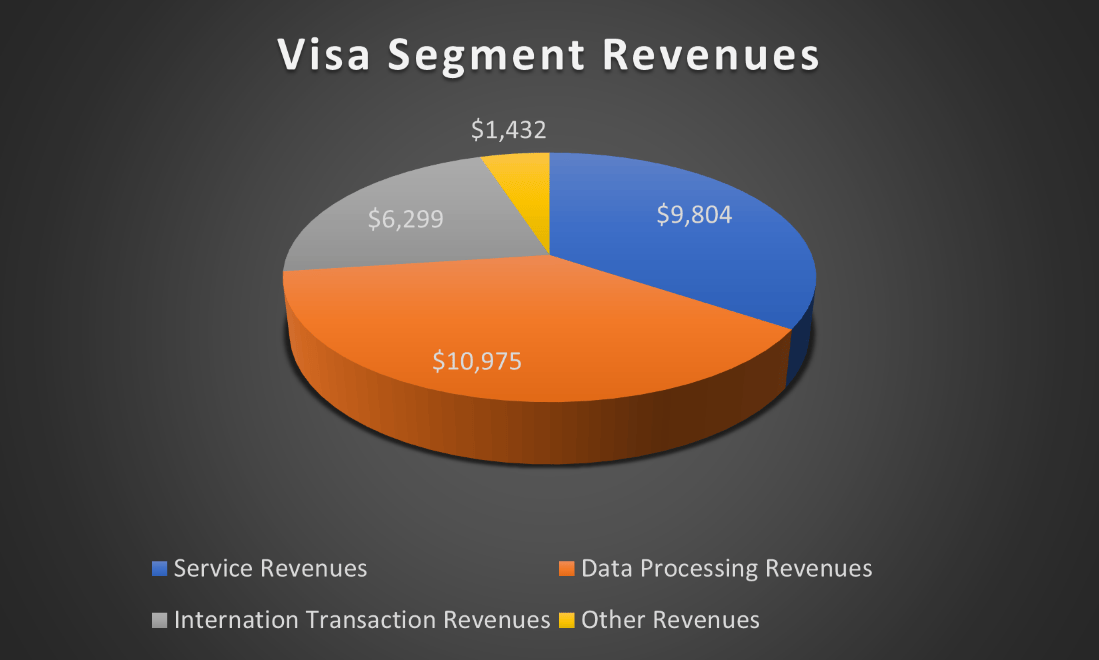

Visa collects revenue through four different segments:

- Data processing revenues are approximately 0.13% for credit cards and 0.11% for debit cards. Visa collects these fees for authorizing, clearing, settling, and transaction processing services for the issuer and merchant acquiring banks.

- Service revenues – these revenues Visa generates from payment volume on Visa-branded cards and payment products for goods and services. In other words, the more a product costs, the more Visa makes from processing the payment. For example, they make far more from a jewelry purchase than buying eggs, making this segment inflation-proof. If prices rise, so do Visa’s revenues.

- International transaction revenues – the revenues Visa collects for cross-border processing and currency conversion actions. These are primarily created from cross-border payments and volume; think traveling to Italy and using your Visa card to buy wine and pizza, a hotel, and your new leather purse. These revenues carry larger discount fees because of the additional processing services and currency conversion fees. The international segment is typically the highest margin segment for Visa because of the additional fee revenue.

- Other revenues are revenues generated from licensing fees for using the Visa brand, account holder fees, and licensing and certification, a catch-all for additional add services that Visa offers.

To capture value for its clients, Visa built global processing centers with connected infrastructure consisting of multiple synchronized processing centers, all interlinked and engineered for redundancy. Visa’s processing centers are:

- Ashburn, Virginia

- Highlands Ranch, Colorado

- London, England

- Singapore

Ensuring the safe, efficient, and consistent processing of payments for its banks, cardholders, and merchants is part of Visa’s guarantee. In this day and age of hacking, Visa’s network has never gone down, knock on wood.

Visa’s Competitors

Visa has a few major competitors in the global payments space, including its cousins Mastercard, PayPal, Square, and American Express.

Visa and Mastercard are similar in that they offer an open-loop system, encouraging transactions, which generates revenue for both companies.

Others, such as PayPal, Square, and American Express, offer different kinds of competition.

American Express operates from a spend-centric business model with a closed-loop network. In American Express’s closed-loop network, payment services are provided directly to merchants and consumers, with American Express acting as both the issuer and merchant acquirer.

American Express makes money from its cards on two sides: the higher discount rates they charge merchants to offer their cards. For example, American Express charges as high as 3-3.5% for its cards. However, it drives higher revenues for the merchant by offering bigger discounts to its cardholders to encourage more usage.

American Express also earns interest on any credit card balances its members carry because they offers the cards to its members as the issuing bank, like JP Morgan.

PayPal and Square are creating a similar type of closed-loop payment system that encourages cardholders to stay on their platforms to conduct all kinds of transactions. Encouraging money transfers to friends, e-commerce, card payments, investing, and more encourages customers to stay in the closed loop and generate higher revenues from the additional services and transaction revenue.

The three competitors’ biggest challenge is encouraging merchants and others to embrace these closed-loop systems instead of offering Visa payments.

Investor Takeaway

As individual investors, it is important to understand how companies make money. At the same time, this might sound like a duh; many invest in companies without knowing how the business makes money.

Of course, some businesses are easier to understand than others, such as Walmart, Target, Starbucks, and Nike. They are all fairly obvious, and most understand that Nike makes money from its sneakers and Starbucks from its coffee.

But Visa, albeit one of the most recognizable brands in the world, and with most of us carrying at least one Visa-branded card in our wallet, is probably confusing to most and downright scary to others.

Visa offers great, stable returns over the long haul, but its business model is often misunderstood, and my hope is this post helps clear up the confusion about the business model and how to think about the ways that Visa generates revenues.

I have found that once you understand the business model, investing or analyzing a particular company, even Visa, is far easier.

And with that, we will wrap up our discussion today on how Visa makes money.

As always, thank you for taking the time to read today’s post, and I hope you find some value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...

- How Payment Processing Works: A Guide for Beginners Updated 4/4/2024 How many of you still carry cash, or how many of us still pay for anything with cash? If you are like me,...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- The Fascinating History of Visa and the Credit Card Industry Visa is arguably one of the world’s most recognizable logos and brands. Fun fact: they took the name because it is simple enough to sound...