Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew Sather and Dave Ahern to decode industry jargon, silence crippling confusion, and help you overcome emotions by looking at the numbers. Your path to financial freedom starts now.

Dave: 00:34 All right folks, Welcome to the Investing for Beginners podcast. This is episode 80 tonight. We’re going to do something kind of different. A lot of fun. I think this is good. That’d be really interesting. So Andrew took a deep dive into where the 10 percent of returns of the s and p over the last 80 years comes from. And tonight we’re going to talk about the individual components that make up that 10 percent and kind of where it comes from.

Dave: 01:00 I thought this was really kind of fascinating and Andrew, a lot of great work getting this together. So I’m going to go ahead and turn it over to him and we’re going to chat a little bit about it.

Andrew: 01:10 Yeah, thanks Dave. I guess that’s a good disclaimer, right? That A. I did a lot of work and be speculation on my part. Right. Fair enough. Idea and running with it. Yeah. Fair enough. So there’s no academic sources for this other than Google, so don’t come at me with their pitch forks, but I was always, you know, I’m curious.

Andrew: 01:34 It’s something you hear all the time, right? People talk about what’s the average return I can expect from the stock market and it’s been around 10 percent a year for over 80 years, like they’ve mentioned. And you know, you hear a 10 percent, you hear seven percent and seven percent is just the return with inflation taken out because inflation is also been pretty constant, pretty consistent around three percent a year. So it makes for a good kind of estimation, right? If you’re thinking about where are my finances going to go in the future, how am I going to plan and what’s like a reasonable, what are reasonable expectations? You know, I think to think that you could be an average person and become more rich than Jeff Bezos just because you’re going to be a stock market genius. I think that’s obviously absurd, but at the same time it’s not absurd to think that over a long enough time period with consistent deposits and even decent or just average returns from the stock market that you can make a quite a bit of a fortune where it can change your life over the very long term.

Andrew: 02:47 And so if we can kind of look at how, how are these assumptions made? No, I guess we can feel more confident and understanding that when times get tough, you know, and you’re going to hear this on and on and on and, and, and we hear it now with, with the market kind of going sideways lately and you’ll hear it even more as we get into recession, into a bear market and into times where people think that the world is ending and that this economic prosperity that America has had is something that will never ever see again. And everybody wants to talk about it being just this one time event. So you know, it can be really easy to hear all those things and get really caught up and start to think, well, you know what, some of this new data coming out is saying that 10 percent is unrealistic and, and you know, you can, you can easily get into this negative mindset and this, this, this real like Debbie Downer mindset about the economy, especially when things are going poorly.

Andrew: 03:52 But if we can understand like the basic components of it, how, why it’s, you know, why it’s reasonable that we can expect 10 percent for the future in spite of all the other factors that we’ve seen that maybe that could make us more confident to, to stay invested longterm to dollar cost average. Continue to do that. Like we talked about last week, to continue to just stay invested and be confident that we’ve seen 10 percent over many, many decades, 80 years. There are. The world is obviously changing every single day and we will talk about some of those big kinds of factors. And in spite of all of that, I think it’s still reasonable to think that we can get somewhere around that average for the future. And I’m going to talk about why. So to talk about why, let’s break down what are the components that make up this 10 percent return numbers, magical 10 percent return.

Andrew: 04:49 So like I mentioned, three percent is going to come from inflation and the other, I would call them three factors to consider outside of inflation that is going to create this return for shareholders in the stock market. And I guess I should back up a little bit because what drives returns in general, right? We talk about over and over again, buying the stock is buying part ownership of a business. A business creates profits, a businesses able to take those profits, use them to grow. And as the business grows in size, it’s value tends to grow in size. And so the value, obviously the value of a piece of that business ownership is worth more and more, especially in a place like the stock market where people are buying and selling every single day.

Andrew: 05:39 But, so if we know that that average is around seven percent outside of the inflation, you know, what drives that. And so I’ve, I did this youtube video a while back, this was over the summer and I just wanted to see like where, where does that come from? A and just look at some big picture numbers and see if there’s any sort of correlations. I ended up looking at the earnings per share growth of the S&P 500 and the data went back again, decades, I think it was 50 or 60 years. And um, we’re gonna have a lot of resources. We’re going to link up in the show notes. I’m the one I used in the youtube video was a data set by Damodaran. Dave is a huge fan of Damodaran, and he has a lot of really cool data sets so you can just input straight into excel and, and really, really, really quickly, kind of see what the numbers are telling you.

Andrew: 06:33 But bottom line, I found over that time period, the EPS growth earnings per share growth of the S&P 500 average about six and a half percent. And so if you think like the average return was about seven percent, uh, and then if you reinvest dividends, that brings it back up to 10 percent so you can see that the, an EPS growth in the S&P and it’s shared, you know, the returns you get as a shareholder are very, very correlated. The very, very similar. And, and you know, that makes a lot of sense. So now that we know that, okay, this investment return is coming from a combination, you know, for me personally, it’s coming from a combination of the stocks I own. They’re gonna grow their earnings and they’re also gonna pay me a dividend so I can reinvest that. They would then. So that makes up a big portion.

Andrew: 07:25 Then the other portion is obviously the earnings per share. And so if we can figure out where that six and a half, seven percent growth comes from, then we can maybe look out into the future and say, is that reasonable to expect a to continue? Because you know, yes, we’ve seen, we’ve seen that for over eight years, but that’s no guarantee that that we will continue to see it. So. Okay, well I talked about backed up, right? You keep me on track Dave. So these are a lot of ideas kind of being thrown out there. I talked about the EPS growth being correlated with the returns that I talk about. The three factors of population productivity and ROI that I talk about. They are. No, no, we have not discussed those yet. So you’re, the last one you talked about was inflation and then you kind of went backwards.

Andrew: 08:14 Okay. Sorry, sorry, sorry audience. So okay, let me get my glasses on. No kidding. We set the stage. We’re going to try to figure out where the six and a half, seven percent comes from. We understand why it goes down from 10. So there’s three big things are really going to drive if you really think about what drives business growth, and this is all big picture right across the entire market. You have population growth. I think that’s obvious because the more people that are in the world, uh, the more they will consume the, you know, the more workers or are the more they will consume a, that should make the economy just on its own. The other thing to think about is productivity. Uh, you talk about innovation, technology, all these things that make the business world bigger, better, faster, more efficient. You’re always talking about productivity.

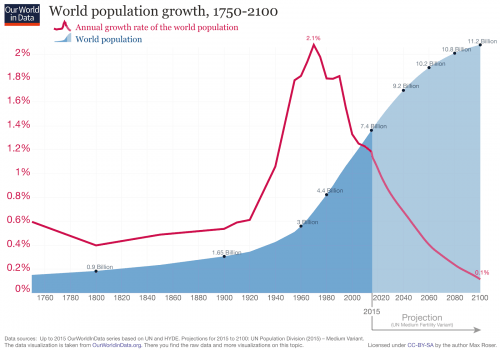

Andrew: 09:12 And then finally you have to consider that kind of, like I mentioned a little bit ago, companies are going to create profits. They’re gonna funnel some of those profits back into their business so that they can create bigger future profits and it turns into its own kind of compounding machine. So let’s talk about population growth first. Uh, I sent this chart over the Dave and I guess we could probably link this up to. I’ll start making promises they have because I know you’re the one in charge of the show notes, so I’ll just shut up and maybe we can talk about this chart for a second. Um, the big takeaways I saw from it is historically for the past, so I’m looking at the past 80 years, which, which is around one. We’ve seen that stock market average return and data before that’s kind of limited, but from 1920 to basically today a population growth went anywhere from point six percent all the way up to two percent, uh, and increase rapidly, um, during the twenties, thirties for these sixties even. But, you know, there’s this range. So I think a point six percent to a two percent population growth, I think we can take that and let’s just say one and a half percent. I think it’s reasonable to say one and a half percent population growth,

Andrew: 10:43 Contributed to part of that seven percent growth we’ve seen historically. Does that sound unfair? Not at all. No, quite fair. I think. Okay. I guess the next part of that idea is that people believe that population growth is going to slow and the almost stop and you can even see it with this chart that I sent you where they have like projection where growth just drops off completely. So, I mean, I guess everybody might have their own viewpoint with whether your thoughts like do you think, because I think it’s obvious, right? If we see growth all the way down, uh, right now from the chart that was 2015 population growth is about one percent. This is across the whole world, right? So one percent,

Andrew: 11:36 And it’s been declining. So a, I guess, do you see it continuing to decline or b, you know, what will be the argument against that? That’s something to consider?

Dave: 11:46 Well, I think it would probably start to decline simply for the fact of the amount of natural resources to continue to sustain a growth like that in the population I think is we have a finite amount of resources we can use as human beings. I eat food, a water land to live on land to live on me. You could argue there’s probably plenty of land, but just fly across the Atlantic. Exactly. Yeah, exactly. Yeah. It’s says drive across Nebraska. There was plenty of room to grow. Uh, no offense to Nebraska and south there. Uh, so, you know, thinking about just just you think about water, which is a fairly limited resource and you think about food. We can only grow so much food, although I could argue with being from Iowa, we grow enough corn to feed everybody everywhere. Uh, there’s, I think there’s just the ability to get that food to everybody I think just starts to, you know, there’s just a finite amount of space and food at this point and work that, that would be able to sustain a continual growth of the population.

Dave: 13:02 And when you take into account some of the quote Unquote Third World nations that have risen a I, India recently, China recently, their population growth, population growth, I believe I’ve started to slow and here in the United States, ours is, you know, I think has slowed quite a bit as well with the baby boomers or generation getting older. The generations that have followed them, I think have had less kids and I think in the United States now they’re having, we’re having less kids that were having an older and we’re having less kids and I think that’s a trend that as occurring across the rest of the world, which would help slow the growth of people having more children and the population growing. And I guess that’s kinda why I think that, you know, their projections here with the growth of the population swelling I think is probably a fairly accurate projection. What are your thoughts?

Andrew: 14:07 Well, I’m gonna play devil’s advocate.

Dave: 14:09 Of course you are.

Andrew: 14:12 I have some weird ideas. I think the, yes, there is obviously a trend in the United States, to have less kids and there’s growing movements of people are just not having kids at all. people that just want to travel and you know, there’s not as much a focus on family like there was previously in previous decades and you see that obviously in pop culture and everywhere else, but I don’t know, I, why did hipsters get so popular? You know, like somebody had to start the whole hipster thing and it became, it was something that was born out of a, like essentially contrarians, but like style wise.

Andrew: 14:56 And so my, I think maybe what if that happens with kids and families were something, something changes and all of a sudden it becomes cool to have a family again. I don’t know. I mean maybe that could do something. I will also say, um, I think right now with the one percent growth, even if you have it a slash in half, you’re talking about like half a percent instead of a percent of, of growth. And even these projections don’t have any sort of population. The clients, uh, they’re projecting like a steady decline. But I think the projections a bit extreme. I think a lot of things can happen a technologically and with food and water and as these third world countries kind of build themselves up. I don’t know, I just see, I guess I’m kind of like a half glass full type of person when it comes to the future.

Andrew: 15:56 But let’s say even in a pretty bad scenario for the world population, if, if growth slows from like around the percent to down to like half of that, like let’s say point six percent that’s still around the same growth that we saw during the 19 twenties, 19, 10. Uh, and then it started to pickup, uh, shortly after that. But you know, what we’re talking about half a percent difference. Is that going to make a huge difference on investment returns because I’ll give a spoiler alert. All these factors add up to that seven percent. So there is something kind of cool, right? To say that, you know, okay, yes, population is slowing has been slowing since 1960. Will it continue to slow? Possibly. But will that, will that be devastating, right? All these, all this talk about the baby boomers getting older and not to be morbid, but you know, moving along, is that going to be devastating for the, for the stock market and how are we going to see this, this huge like great depression. I mean maybe, but is that going to be long term? I don’t know. So, so I think those are some things that we can kind of try the challenge because even a going half of this growth, we’re still gonna see just like half a percent difference as far as the overall economy. So that keeps me with my half glass full mentality. Any other thoughts on population?

Announcer: 17:31 What’s the best way to get started in the market? Download Andrew’s free Ebook at stockmarketpdf.com. You won’t regret it. Not necessarily,

Dave: 17:43 But I think this can kind of segway into what we’re going to talk about next is the productivity of the people that are here on earth is going to change and as the economy and the types of jobs that are out there changes with the digitization of everything that’s going on in the world. You know, whether it’s manufacturing, whether it’s you know, automation of in the retail world, whether it’s automation in the medical field, there’s just so many different routes that machines and our interactions with computers and all the possibilities out there I think is going to probably increase the productivity which will help increase economies. So even though there may be a school down in the growth of the population, I think there will be an increase in the productivity of people as that changes. What are your thoughts?

Andrew: 18:44 Yeah. One hundred percent agree. And, um, I think I saw, I wanted to discuss this article that I also sent to you, the overall summary. It was, he was saying that after 150 years, the American productivity miracle is over and I don’t think it’s like this crazy idea that not a lot of people think of. I think he, he essentially said that we had huge technological advances that happened, uh, such as obviously the automobile airplanes. What else did he mentioned on there? Just a lot of different inventions that really changed the world. And so this. Yeah, yes, yes, yes, yes. So those are obvious big inventions and he’s saying that that’s what drove all this productivity because because we saw about a historically there was anywhere from two to four percent productivity growth per year. So, so that’s quite a bit. And so there’s this idea now that we’ve kind of invented everything there is to invent.

Andrew: 19:52 We’re approaching the end of Moore’s law, which is for computers basically, that they can only get so small and so fast until you get to like a molecular level and then there’s a limit, like you can’t continue to go that fast. So he really had this idea and this article and I guess you wrote the book about it too, that productivity is just going to decline. It declined during a, I guess the great recession was really when we first started hearing about this and he believes it’s gonna really be bad and we won’t see that same kind of economic growth. And you say differently.

Dave: 20:33 Oh, I see it differently because, you know, he also was mentioning in the article that I was reading that they were talking about the, the change in how we do things and the overall a embrace of technology. I e the computer in our world. So you think about, I mean even in the last 10 years and you think about the evolution of how a computer interacts. I mean, I, I just think about my own, you know, a field that I’m working in the restaurant business right now. I think about how we place our orders for an employee to order food from the kitchen is drastically changed. Gosh, even in the last five years, it’s gone from, you know, very basic computing things to handheld ipads that are wireless wirelessly connected to printers and the kitchen and you know, to the point where the guests can even order from their tables to the kitchen without a surfer interact.

Dave: 21:39 I mean there’s just, there’s so much, you know, productivity in that realm that allows other things to happen to enhance guest experience, whether it’s sitting down to eat and all those things. We to more and more innovation in those types of, of fields. And you know, I just see the different evolutions of all these different things. And you look at the evolution of the phone. I mean, goodness, I mean with the iphones and samsungs lines of products and the technology and the ability of things that you can do with these things. Now you can fax, you can email, you can text, you can scan things. I mean with all the ability to basically run your business from your phone is just allows you to do more things and to be more creative and to have other opportunities and to focus on a lot of different things as opposed to spending hours and hours and hours working on paperwork.

Dave: 22:44 Now you can do it in a very limited time which frees you up to do other things which allows you to be more productive and to get more things done instead of being bogged down with the timeliness of that. I guess the time eating crunch of other things that will hamper your ability to do more productive things to better your business. Whether it’s marketing, whether it’s you know, you know, kissing babies and shaking hands or you know, whatever kinds of things will come up that you could do to have more face time. I mean, I think that’s one of the things that I’ve noticed even just in the restaurant business, the technology’s allowed you ironically, is allowed you to spend more time with your guests because you’re not bogged down with taking a lot of time to make place orders. You know, back in the old days, you know, I’m older than you.

Dave: 23:38 I remember the days when we are going to write things down and go back and hand them to the kitchen and you know, think about the time that it takes to take an order, write it legibly enough that you can give it to the kitchen and they can order it and they can make everything. Just slows everything down so much. And now with the technology, it allows you to spend more time with her guests or to spend more time with your guests. And I just think that there is the, the ability to interact with things and be more productive is going to exponentially explode because of how technology is going to react to everything. And you know, yes, there’s going to be bumps in the road because as more and more businesses are trying to embrace this, there’s going to be financial hurdles to get across, there’s going to be some technology hurdles to get past and there’s going to be other challenges like just teaching people. You think about people that are coming from an industry where maybe they were more blue collar and now they’re going to be working learning computer skills and using those abilities to do other things and there’s just so many things that are going to change with a, with a technology that I just think the productivity will increase.

Andrew: 25:01 That’s a great point about the whole technology thing and you can run a business from your phone. They a can’t remember where I saw or read or heard this, but apparently like air conditioning has spurned on so much growth and innovation and productivity like no other invention because you think now we have all these people who can all, all times of the year sit down in their office and get work done. Huge productivity change. And then that’s just one innovation, right? Obviously phones and everything, computers, they have their own and it spans across every industry. It’s, it’s, it’s amazing. It really is. So that, you know, we’re obviously very optimistic about the future. There are so many different things you can, he can, he kind of talks about, I guess I won’t beat this horse any longer, but if you look at, so historically there’s lots of different, the data graph starts anywhere from like zero to four percent, kind of hovering around the two percent range depending on which graph, which chart you’re looking at. So if we can assume, you know, one and a half, one and a half to two percent came from population growth, uh, say one to three percent came from productivity just increases. That’s obviously going to translate into profits for these businesses because now their labors creating that much more output. So where’s the remaining two, two percent to three percent. This was something that, I didn’t find it from research. I didn’t really.

Andrew: 26:48 I guess I’m still testing if it’s even like a valid idea, but that makes sense in my head. So maybe now I just throw it out into the world and maybe either people are going to be like, no, you’re an idiot and you’re wrong, or actually, hey, this makes sense. So

Andrew: 27:01 I was, I was folding some laundry and I had this thought. So we have obviously the demographics of people and how they can work. And then what’s the other aspect of businesses is they create profits and they reinvest them into their business. So I went back, I looked at this is another data set from damaged door and hope I’m pronouncing his name right. He looked at the payout ratio for, for businesses as we know, the payout ratio tells you how much of a company’s earnings that they pay out in dividends to shareholders. So I was kinda shocked to find out that that’s around 50, 50 percent. Again, this goes back for many decades. I always thought it’d be much less than that. You know, with all these talks about how dividend yields are so low and dividends really aren’t being paid out in my head, it didn’t seem that wow, actually half of what they’re bringing in, they’re just returning to shareholders were the way that’s, that’s actually pretty good.

Andrew: 28:04 So if we, if we know that about 50 a 50 slash 55 slash 45 percent, I think it was 45 percent. So we know half is going back to shareholders. The other half we can kind of assume that generally most of half of that’s going to go back into the business. So how do you reinvest money into the business? A big way that you do that is you buy assets and those are going to be assets that provide an income stream that create more profits in the future. So I ran some other kind of back of the Napkin numbers and I want it to figure out, okay, so let’s take like a really simple example. Let’s say a business earns $100 in profit.

Andrew: 28:48 We already established $50 of those are going to go back to the owners and dividends, whether they do it the other $50 and you know, is there some sort of like basic average where it makes sense that they’re kind of like a rule that this tends to be, this tends to be the average for the majority of companies.

Andrew: 29:13 So I looked at some other averages, so like average return on equity and average return on assets. Basically I’ve found that there was something around the return on assets of about seven percent and so where that number comes from. So we take our $50 again and then if we take seven percent of that, that contributes and that becomes a three, three and a half percent growth. So if you follow me back to where we were with the whole discussion, we have a couple of percentage points and population and a couple percentage points from productivity growth and now we have about 30 percent from return on the assets that we are reinvesting, right? That we’re acquiring. And that’s how we get our magical seven percent number.

Andrew: 30:09 And then if you take that a step further and you think about if I’m a business owner, my options, and this is why seven percent, it makes a lot of sense. I’m a business owner, right? Let’s say I own this business. And so basically these profits are mine. I can do whatever I want with them. I can take, I can take this $100 and I can go buy a $100 car. And that’s if that’s my prerogative, right? That’s what I wanted to do. I can totally do it. But you know, as, as somebody who’s wanting to compete for the long term, I understand that I need to grow. If I want to compete and not let a competitor swallow me up. So you want to at least get like a decent amount of growth. And so let’s say I’m gonna reward myself with $50 in profits and then the other $50 I have to figure out how I’m going to, well I’m going to do with that money.

Andrew: 31:01 Now if, if I was able to let’s, let’s pretend and like an alternate reality. We had bonds as investments and let’s say bonds would give you an automatic 20 percent return on your investment every single time. What’s obvious, right? If, if that was 20 percent, if I know that my return on new assets is seven percent, but I could take that money and go buy a 20 percent in bonds, I would, I would use the corporation to buy bonds because, because you know, these corporations, they can buy assets just like, and they can make investments just like people can. So instead of buying new assets from my business, I would, I would just buy these bonds, returning 20 percent and that would compound my profits much faster than, than growing my business organically with seven percent returns. And so I think it’s, it’s really interesting when you, when you figure out that it almost makes sense, the market almost a plays itself out, that you have the average return on new assets organically in the business tends to be around seven percent. And so that kinda is the even out point because if it, if it was much more right, if a. like if the stock market average 15 percent, then we would have a bunch of companies doing that same scenario that I talked about where where they will be buying up stocks instead of assets for their own business.

Andrew: 32:25 And so I hope that makes sense where I’m saying that the average return on assets to organically grow your business, it needs to. In order for you to be competitive, it needs to be around what could get from alternative investments. And so because this whole discussion today from this podcast episode, we have established that seven percent return from the stock market and we figured out where that comes from. I think I have somewhat of a light bulb moment that when you add up population growth, productivity growth and return on asset growth, I don’t think it’s a coincidence that that magically also adds up to seven percent. Because again, if you take half of your earnings and you get seven percent return on new assets from half of those earnings, that adds up to to the three percent growth which makes up that third and final component of population growth, productivity, growth and organic business growth.

Andrew: 33:26 So I guess that’s my breakthrough insight today.

Dave: 33:30 All right, folks, will. That is going to wrap up our discussion for this evening. I hope you enjoyed our talk about where we are. That 10 percent comes from. I appreciate Andrew taking all the time and effort to dig that up. And that’s really fascinating that he came up with that idea. He was folding laundry. I’m impressed that he was thinking. I was thinking he was thinking and b, he was doing laundry. That’s impressive.

Dave: 33:52 So, I think those are great insights that he came up with and it really helped explain it to me. You and he sat and he saw that all this information earlier this week, it was, I was honestly having trouble piecing it together. But when you’re talking about it this evening before we got on the air, it was like, wow, okay, this all makes sense. This is quite fascinating. I will put indeed put all this information in the show notes so that you guys can see the charts. You can see the links to some of the different papers that we were talking about and it’ll help you get a sense of everything that we’re talking about tonight. I hope you enjoyed our discussion. Go out there and have a great week. Invest with a margin of safety, emphasis on safety, and we’ll talk to you guys next week.

Population growth link

Youtube population link

Productivity link

ROE and retained earnings growth link

Historical payout ratio link

Announcer: 34:37 We hope you enjoyed this content. Seven steps to understanding the stock market shows you precisely how to break down the numbers in an engaging and readable way with real life examples. Get access today at stockmarketpdf.com. Until next time, have a prosperous day.

Announcer: 35:02 The information contained it’s for general information and educational purposes only. It is not intended for a substitute for legal, commercial, and slash or financial advice from a licensed professional. Review. Our full [email protected].

Related posts:

- IFB72: Shareholder Yield Metric: Cheap Stocks with Good Capital Allocation Welcome to Investing for Beginners podcast, this is episode 72. Tonight Andrew and I are going to talk about shareholder yield, this is a term...

- IFB158: Stock Picking for Dummies Announcer (00:00): You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew Sather and...

- From the Vault: Stock Picking for Dummies Today’s episode is from the archive, Andrew and I hope you enjoyed your holiday weekend and everyone is safe. Please enjoy this episode redux concerning...

- IFB58: Efficiency and Financial Ratios Formulas: ROA, ROE, & ROC Welcome to Investing for Beginners podcast, this is episode 58. Tonight Andrew and I are going to talk about financial ratios and we’re going...