If you’re even thinking about retiring early, or really even retiring at all, then the importance of investments absolutely cannot be understated. If you’re struggling to see how investing can play into your ability to retire early then don’t worry – I am here to help!

I personally know people that have piles and piles of cash and they don’t invest it properly, or even at all, and they wonder why they can’t ever get closer to retirement.

You see, simply saving money is not going to be enough to get you to your financial independence (FI) goals…unless you’re making an absolute ton of money. Most of us are not making a ton of money, though, so how can you actually get to FI?

Investing.

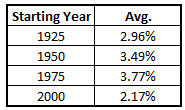

The issue with simply letting your money sit in cash is that you’re going to get absolutely crushed by inflation. Below is a summary of inflation rates through 2019 based on the following starting years:

So, from 1975 – 2019, the average inflation rate was 3.77%, meaning that every year your money lost 3.77% of its purchasing power. So, if you’re not at least getting that same 3.77% return on your money, then you are essentially losing money each year.

Well, if you just have cash, you’re definitely not making those sorts of returns. In fact, my Fifth Third savings account has a yield of .01%! Even my Ally High Yield Savings Account is only earning .5% right now and was at 2.3% about a year ago.

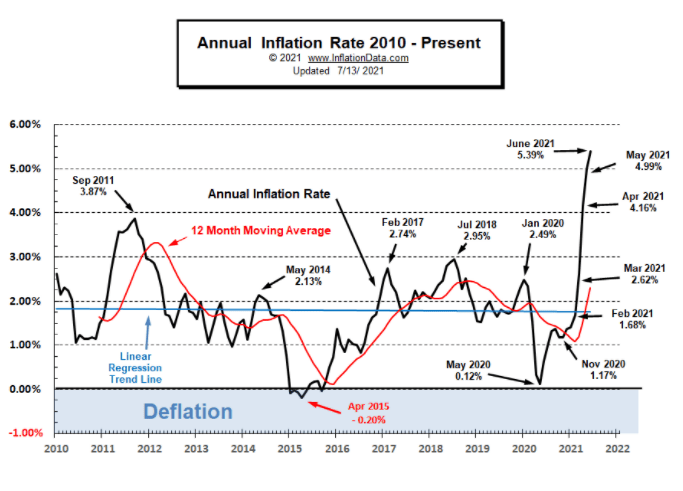

The 2018/2019 average inflation rate was just over 2.1%, so the Ally account was earning more than inflation, but just barely. As we sit here in 2021, people are using inflation as the hot word for the investing world and it’s causing even more of a reason to avoid having your money sitting in bank accounts. According to inflationdata.com, the current inflation rate for July 2020 – June 2021 is over 5.39%!

For all intents and purposes, I’m losing money when it’s in a bank account, but that’s why I ONLY use that savings account for short-term purchases and for emergency funds.

Anything above and beyond that, and certainly anything that is going to be bookmarked for retirement, is going to be invested.

Any honestly, it’s not even a debate in my eyes. Let’s imagine the following scenario:

- You’re 30 years old

- The year is 1980

- You have nothing saved

- Both you and your spouse make $50,000/year

- You can save 30% of your pretax income (which is amazing!) meaning that you’re saving $30K/year total

- You have calculated your retirement number and you and your spouse will need a total of $2 million to retire

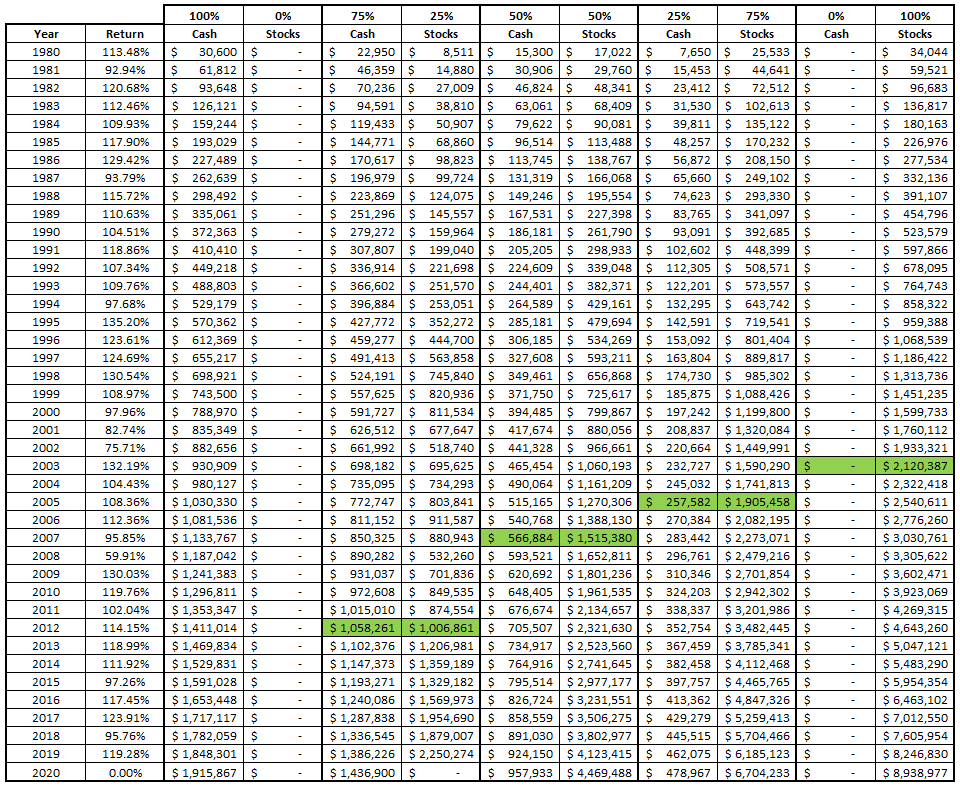

I went through and calculated 5 different scenarios using actual returns. The scenarios ranged anywhere from investing in 100% cash/0% stocks through 0% cash/100% stocks in 25% increments.

For the cash, I assumed that you could capture 2% interest rate annually and as I mentioned, I used the actual returns of the S&P 500 to show how the stocks would’ve performed.

Take a look at the chart below:

As you can see, the results vary drastically, but one message is very, very clear…

The importance of investments in the stock market are ESSENTIAL to giving yourself the ability to achieve FI. 100% stocks and 0% cash would’ve resulted in you having $2 million in 2005. 100% cash and 0% stocks would’ve resulted in you having $2 million…

Well, who knows – not yet. The actual answer is 2020 when I expand the analysis a little further which is just dreadful. A mere 17 years after you would’ve achieved it by investing.

The way that this all works is simply by taking advantage of compound interest. If you make 10% in Year 1 on $30,000, that means you made $3,000.

If you make 10% in Year 2, that means that you made $3,300 because you’re making 10% on your initial $30,000 that you invested and the $3,000 in returns that you had in Year 1!

That’s why time is so important with compound interest as well because it gives you this extra runway of time to be able to be patient and keep watching your account grow, even if you’re not putting a ton of money in.

There are a ton of different ways that you can invest, and while you can find people that are in favor and against any different style such as value, momentum, dividend focused, index fund investing, or one of many others, the fact remains the same – the importance of investing cannot be understated.

If you’re struggling on where to start, I have two pieces of advice

1 – Don’t wait

Buy a small position of a stock that you’re familiar with and absolutely love their product. Don’t even look at the financials. I feel that by doing this, you’re going to be able to learn way faster and things will stick much more because you have some skin in the game!

Every time you hear anyone talk about investing strategies or anything that they look at, you will instantly have that company in mind and it will help develop your investing mind to think that way about future stocks as well. Otherwise, it’s just information and nothing more.

Things will slowly start to stick as you hear more and more about the company because you have real money at play. Chances are, this won’t be your best investment ever from a ROI perspective, but it likely will be from an educational one!

2 – Be an Active (and Unbiased) Learner

Seek information to develop your strategy! When I first started, I was all-in on value investing. I challenge myself daily to be unbiased and listen to all viewpoints like I did with momentum investing and actually really like the Global Equities Momentum investing process.

But when I was first starting, I sought information from everywhere! I started with Andrew’s free stock market PDF and the Investing for Beginners Podcast, but then moved on to various books that have always sparked my interest!

I’ve even found that I can continue to learn on social media and honestly, the investing humor is pretty hard to beat as well!

The thing is – I’ve never just been stagnant and I’ve always been challenging myself to grow and learn more and to listen to everything with an open mind, even if I am reading something that I might initially disagree with.

By being unbiased going in, I feel like that I can effectively learn from the content that I am absorbing, even if I don’t agree with it, I likely still come away with some tidbit or fact that I didn’t know before.

Summary

At the end of the day, as long as you’re investing, that’s really all that matters. You can be an active investor and pick individual companies like I do by utilizing the Value Trap Indicator or you can be an Index Fund investor and pick an ETF like VOO– there is no right or wrong answer!

Well, maybe there is a wrong answer – that’s by not investing. If you’re still not totally sold on it, checkout these 5 insane compound interest examples that are accomplished ONLY by investing.

Related posts:

- 6 Must-Follow Wealth Creation Steps to so You Can Retire Early Do you find yourself in a situation where you’re having no issues living within your means, but you’re really not just getting close to financial...

- How Investing Early Changes Lives: Compelling Data Everyone knows that investing early can dramatically change your future. But how much can it actually change? The answer is a lot. Click to jump to...

- Is it Time to Retire? Find Out with This Saving Money Chart! Have you ever used a saving money chart? Personally, I love them because I feel like I can sit there and look at people in...

- Reach FI Faster With The Seven BEST Compound Interest Investments! If you’re familiar with personal finance then you likely understand compound interest, but do you actually know how to apply that knowledge into your FI...