A lot of critical information can be learned from the statement of cash flows. As cash flows to shareholders are what investing is all about, being able to understand all the great information provided by the cash flow statement is very valuable stuff to investors. When doing a valuation, investors will be able to adjust their analysis for non-cash or growth items, as well as spot problems in the business’s sustainability.

This article will discuss some of the most important items in the cash flow statement using Coca-Cola as an example for some important items.

The Direct vs. Indirect Method – A Quick Note

There are technically two methods to produce a statement of cash flows; the direct method and the indirect method. However, it is the norm for major companies, such as Coca-Cola to report under the indirect method. The direct method is, as it sounds, a recreation of the income statement based on cash flows rather than accrual accounting standards. The indirect method can more accurately be described as a reconciliation of net income to cash flows, with all the reconciling items listed out in separate categories which are cash flows from operations, cash flows from investing activities, and cash flows from financing activities.

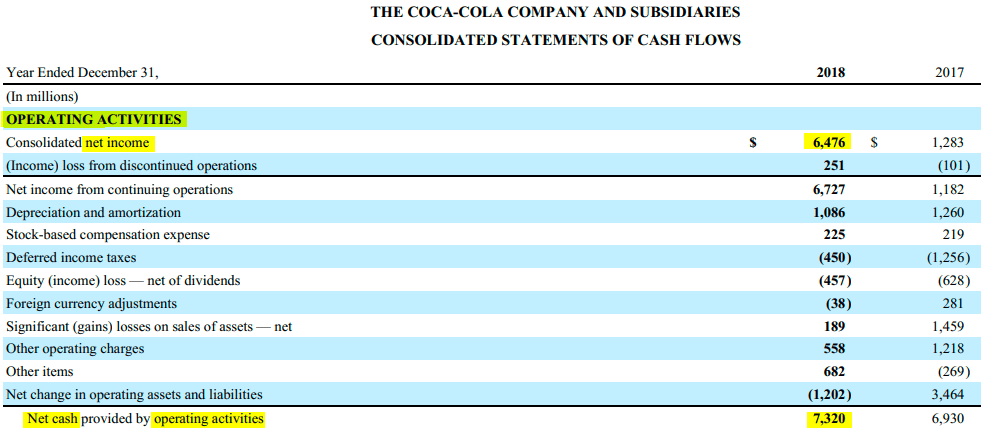

Cash Flows from Operations (CFO)

As the lifeblood of the business, positive cash flows from operations (CFO) prove that the business can sustain general operations before making any long-term investments (to be discussed next). Under the indirect method, the statement of cash flows starts at net income and then adjust for the items where cash hasn’t changed hands. As will be seen, not all income under accrual accounting necessarily makes it into CFO. Current assets and liabilities on the balance sheet will eventually flow through CFO when the actual cash changes hands, which is not always the same as accrual accounting based income.

Working Capital – Working capital is an all-encompassing term for items such as accounts receivable, accounts payable, and inventory. Working capital by itself can be judged as a cash conversion cycles and also by analyzing trends over time to see how good sales terms the company is giving to customers as well as what they are getting from suppliers. Growth in a business requires more working capital to support the sales and, as such, always eats up a little cash flow.

Depreciation – In non-accrual accounting terms, depreciation is a non-cash expense that is the historical cost of fixed assets previously purchased coming off the balance sheet as an expense through net income. Later within investing cash flows on the statement, they will subtract out the actual cash capital expenditures in the period.

Stock Based Compensation – This cash flow item is always interesting as it gives some perspective on the appropriateness of stock based compensation at the company. The stock based compensation expense needs to be added back as it is accrued for along with accounting standards, but no cash is necessarily leaving the company but shareholders are just being diluted by the approximate worth.

Equity Income net of Dividends – Using Coke as an example, their income from equity accounted investments would relate to investments in businesses such as bottlers within the Coke network. The proportional net income owned of this equity investment is included in net income but cash (ie. dividends) are not necessarily received and as such, this non-dividend portion of net income needs to be subtracted from CFO.

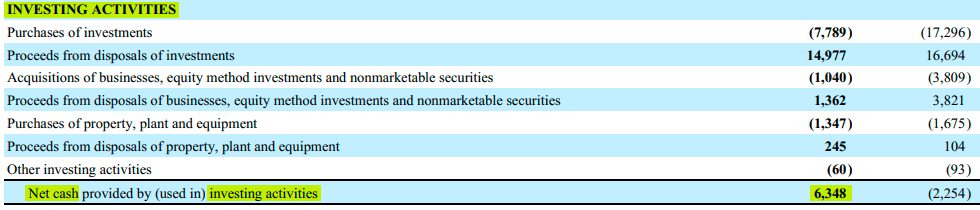

Cash Flows Provided By (Used In) Investing Activities

Long-term assets on the balance sheet are investments that flow through a separate part of the cash flow statement. These investments will have a payback period over many years so they are separated from operating cash flows which are more fluid in nature and linked to net income.

Capital Expenditures (CapEx) – These are the actual cash capital expenditures (CapEx) for fixed assets, or property, plant, and equipment (PP&E) in the period. These expenditures are being capitalized and will later be depreciated through net income. These capital investments can be either maintenance CapEx made to sustain the ongoing operations, or growth CapEx made to increase the value of the business. When growth CapEx is a major percentage of CapEx, investors could consider adjusting away some CapEx in a zero-growth valuation analysis. In Coke’s case, we can see that purchases of PP&E ($1,347M in 2018) are similar and not significantly greater than depreciation ($1,086M). This sort of general increase is expected and is due to inflation as the assets being depreciated are purchases made years ago at historical deflated prices.

Side Note on Free Cash Flows: The largely talked about Free Cash Flow (FCF) figure that is used in net present valuations methods can be quickly approximated by taking cash flow from operations (where non-cash depreciation has been added back) and subtracting CapEx. To get even more accurate, adjustments to changes in working capital and maintenance CapEx can be made.

Purchase of Investments – These are short-term investments which show as the “equivalents” in cash and equivalents on the balance sheet. Think about Coke investing its substantial cash on the balance sheet in short-term investments and money-market funds.

Acquisitions – When a company chooses to buy another business’s assets outright rather than slowly build the assets themselves through CapEx, this is separately disclosed on the statement of cash flows. Acquisitions can generally be regarded as growth CapEx but if acquisitions are regular and form part of the company’s business strategy, then the amount should at least partially be included in a net present valuation of cash flows.

Purchase of Goodwill & Intangibles: When an acquisition is made above book value, purchase of goodwill and intangibles that are not tangible PP&E will be broken out separately. In this way, the proportional cash outflows of the investment are being separated into the associated asset category that these items will be added to on the balance sheet.

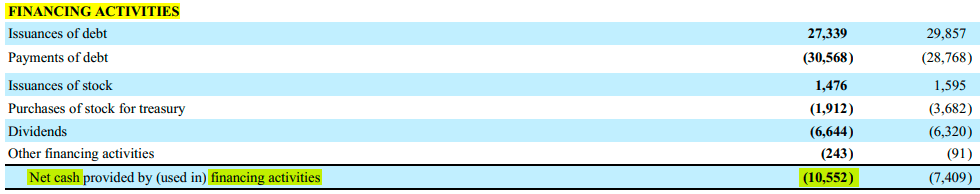

Financing Cash Flows

This is probably my favorite part of the cash flow statement because it shows what money is getting returned to shareholders. In addition to shareholder capital and equity, financing cash flows also include changes in the capital of the business due to debt issuance or repayment. Other more exotic capital raising instruments such as warrants would also be part of financing cash flows.

If a business is investing more cash into the business than it is generating from operations, these excess cash needs will have to be financed from outside investor capital. For each item within financing cash flows, one can think of it as whether the business is raising capital from investors, or my favorite, returning capital to investors.

Cash Dividends Paid –Just as it sounds, this is capital being returned to equity investors in the form of dividends. Notably, if the company has a dividend reinvestment program (DRIP), these stock dividends would not be included here in these cash distributions. It is important to always give a look to see if dividends, whether cash or DRIP, are truly being covered by free cash flows as discussed earlier.

Shares Repurchased (Issued) – The amount of money spent on share buybacks can be seen in this figure. The amount of share repurchases can be added to dividends to come up with total shareholder yield figures. In Coke’s case, they returned $6,644M to investors in dividends during 2018 and purchased stock (net of stock issuances) of $436M. This indicates total shareholder yields of $7,080M which can be divided into the current market capitalization of the company to give a total shareholder yield.

On the other hand, share issuances are often referred to as dilution to shareholders and could be subtracted from the dividends to obtain the true shareholder yield.

Debt Repayment (Issued) – Additional cash needs are often first financed by issuing debt until the growing debt load becomes unsustainable. If capital expenditures aren’t covered by CFO or if cash dividends aren’t being covered by FCF, a good place to look for where that extra cash might be coming from is debt issuance.

Being able to intepret the statement of cash flows is a key learning for every investor. For investors interested in a pre-built financial model where they can punch in the financial data of any company of interest, they can check out our financial model and valuation template!

Related posts:

- Basic Cash Flow Statement Breakdown (by Each Component) Updated 4/21/2023 Cash is king, and finding companies that generate cash is the holy grail of investing. The basic cash flow statement provides answers to...

- Maintenance Capital Expenditures: The Easy Way to Calculate It (With Calculator) Updated 4/21/2023 To continue our series on owner earnings, I thought we would do a deeper dive into maintenance capital expenditures or maintenance CapEx. When...

- Capital Expenditures Explained Capital investment, also referred to as capital expenditures or CapEx for short, is the spending necessary for a company to maintain and grow its operations....

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...