Where to Put Your Money? Large Cap vs. Small Cap Stocks!

I love listening/watching CNBC whenever I have free time, solely for the entertainment factor, and it feels like every sentence they’re saying something about “large cap tech” running up the S&P.

I started thinking more about this and I wondered – should I be investing my money differently? Time for a battle of large cap vs. small cap stocks!

This is the most anticipated bout since we debated what the ideal investing timeframe was and this one is debatably even more exciting!

On one hand we have large cap stocks, like Brock Lesnar, who is literally just about to eat you for breakfast, lunch or dinner:

And then on the other hand, you have Conor McGregor and while he was dominant, he was a featherweight that is a much, much less intimating opponent from a pure size standpoint:

So, who do you got?

Brock Lesnar, the heavyweight/large cap, is much more stable and strong, but less quick in his movements. You know what you’re getting and you’re going to trust the performance.

McGregor, the freatherweight/small cap, is much faster in his movements, but for better or worse, but always has the potential to get knocked out by such a major powerhouse as a heavyweight/large cap.

Fortunately for us, our stocks are not actually going to be physically fighting one another, but rather going up against the S&P 500 as a benchmark as we try to beat the market!

So, what even differentiates a large and small cap stock?

It’s one thing – the size of the market cap for that company!

That’s it.

A small cap stock is a company that has a market cap (total outstanding shares*share price) of $300 million – $2 billion while a large cap stock is one that has a market cap of $10 billion – $200 billion.

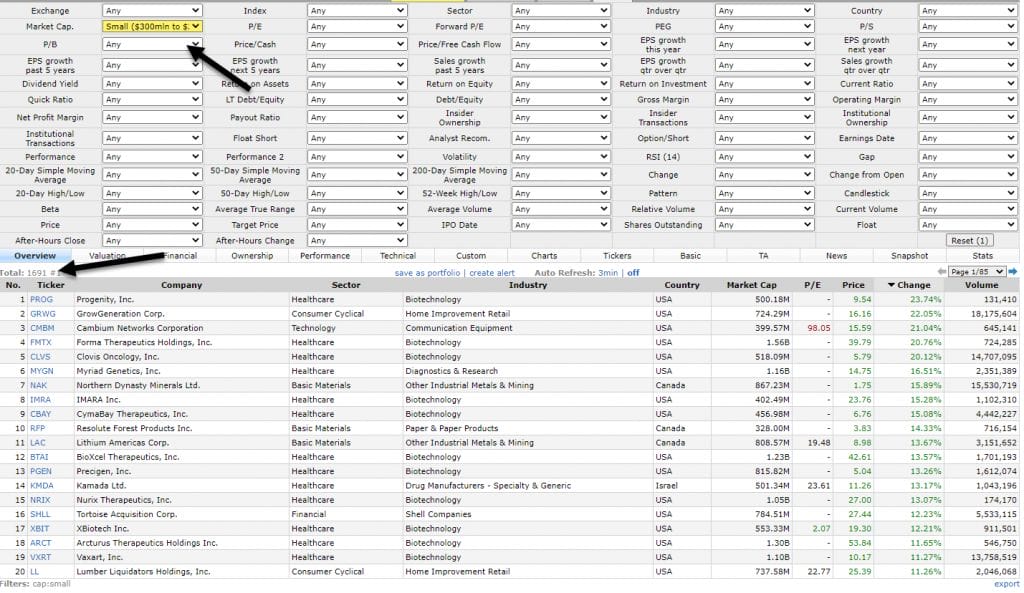

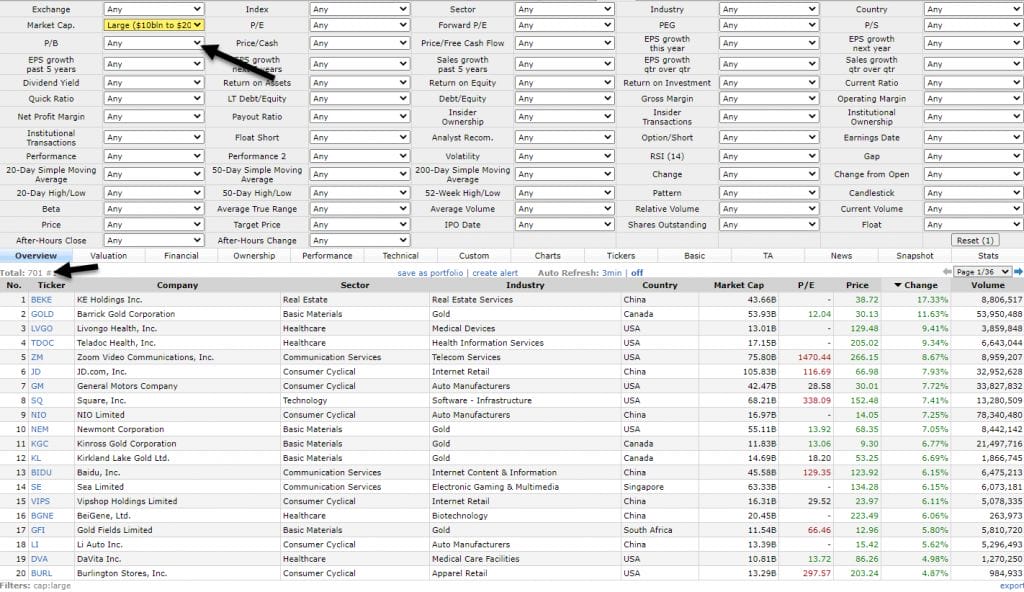

If you’re looking for stocks in the large cap or small cap realm then you can simply us a stock screener to help you sort out these companies.

Personally, I like to use finviz.com as my screener and it’s a simple drop-down option:

As you can see when I do this there are 1691 companies that meet this criteria. If I change the selection to be large cap then the amount of companies decreases significantly down to 701 companies, which makes sense as it is going to be naturally harder for a company to get to the large cap status than it would be for one to only have $300 million in annual revenue.

Naturally, the smaller the cap is for the company, the riskier that this investment is going to be for a few different reasons:

1 – the company is in its early growth stages so they’re going to be very volatile. The hare price can jump on some great news and it can plummet on anything that might seem like a negative. The smaller the company, the more volatile the investment tends to be.

2 – With these small cap companies, obtaining capital can sometimes be a big issue for the company. Simply put, just as we as investors might have less faith about the longevity of a small cap company, so do banks that are loaning money to these companies.

I mean, when we buy shares, we’re essentially loaning our money to that company until we decide to sell those shares. Obviously, the money doesn’t go directly to the company, unless they’re issuing new shares, but the concept is very similar.

3 – You’re simply not going to know as much about these companies. Chances are, you likely haven’t used their products so you’re going to go in blind, and the research that you’re able to do is likely going to be limited.

Fortunately for us, we live in a time where we constantly have information at our fingertips and can google whatever we need or go to a well-established website like seekingalpha to get information, but it’s still going to be much harder to uncover than with a large cap stock.

But on the other hand, more risk should mean greater returns, right? Well, in theory, yes, I would completely agree with you, but it’s very hard to find those small cap stocks that are actually going to make it out alive.

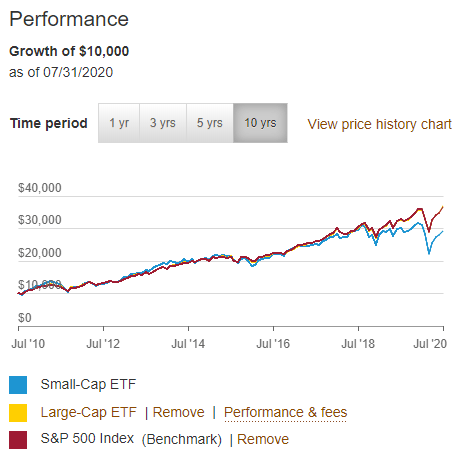

Vanguard has two different ETFs, one for a large cap stock portfolio (VV) and one for a small cap stock portfolio (VB), so let’s take a look at their performance over time!

One of the things that I love about Vanguard is their website makes it super simple to look at ETFs and get a lot of the information that you need. For instance, let’s take a look at VB, the small cap ETF:

The most important thing for me, personally, is to simply see how the ETF has performed over the long run. Of course, this isn’t a perfect predictor by any means, but I think it is good to get a general idea of how it has performed.

You have the ability within the website to compare two different ETFs against one another as well as an index, which is absolutely perfect since I want to see how both large caps and small caps have performed vs the S&P 500, which I consider the benchmark.

It is nearly impossible to see the large cap ETF but that’s for 2 reasons:

1 – it essentially is identical to the performance of the S&P 500, which makes total sense as the S&P 500 is made up primarily of the largest 500 companies in the U.S.

2 – the trend line is in yellow for some reason lol

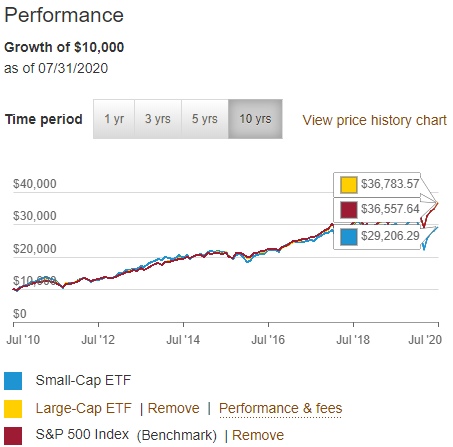

But it is very clear to me that over the last 10 years, they have both outperformed the small cap ETF significantly.

When I say significantly, I mean by over $7K on a $10K investment – that’s a big deal!

The average return for the large cap ETF was 13.91% over these 10 years while the small cap was still a pretty strong return at 11.32%.

Personally, I am a fan of buying small cap stocks but I like picking those stocks individually rather than buying an ETF. I think that the value in a small cap is trying to find that diamond in the rough and get some monster gains from it, so if all that you’re trying to do is simply buy an ETF, then I think you’re likely to drown out any potential gains that you might get with a bunch of losers.

My recommendation is to stick to businesses that you know, which ire likely going to be large caps, but if you really want to have a small allocation of your portfolio dedicated to some small cap stocks that are basically “fun money”, then feel free.

I do this and I have experienced some pretty good results from it, but I also make sure that it’s 15% of my total portfolio or less.

Truthfully – it’s really about knowing your risk tolerance and operating within that. If you’re the type that is going to panic and sell low, then small caps are likely not for you. But don’t be upset about that – there are things that you can do to increase your risk appetitie!

Related posts:

- How to Make Money with Stocks by Understanding Risk vs. Reward Myth #8 that Tony Robbins outlines in his book is that “You gotta take huge risks to get big rewards”. I’m sure that many of...

- I Know Micro Cap Stocks are Risky, but do They Generate Massive Returns? “Micro Cap stocks? I thought it was only large cap and small cap!” Nope. You’re wrong. Remember how I used a comparison of Brock Lesnar...

- Do you Trade Volatile Penny Stocks? A common pitfall that I often see new investors fall into is that they get sucked into the “get rich quick” mantra that they think...

- Investable Themes for 2020 Stocks and ETFs So, 2020 is finally upon us! First of all, congrats to everyone for making it through another decade and hopefully you’re a decade closer to...