Is investing fun to you? If not, you’re doing it wrong. Honestly, the investing fun that I have is legitimately indescribable. I know, I know – I sound super nerdy by saying that, but I am legitimately serious. It’s fine if you don’t feel this way too – maybe I can convince you ?

When I first started investing, it was because I wanted to provide for my family and set us all up for success. When I first started investing, I was living with my girlfriend at the time in Chicago, and we weren’t broke by any means, but we definitely weren’t saving a lot of money.

We lived in downtown Chicago. We wanted to “make the most” of Chicago, which was essentially code for going out every weekend, experiencing everything possible that we could, trying tons of new restaurants, and just living the life in Chicago and never regretting it.

It was always a dream for me to live in Chicago – like a legitimate dream. I wanted to live there so bad and was very lucky to be able to do so with my company, so we wanted to leave without any regrets. Unfortunately, that also meant that we were blowing a lot of money…and I mean A LOT.

Along with blowing money, I was saving for an engagement ring, saving to be able to partially pay for a wedding, and saving for a future house down payment as we both knew that we’d be moving in a couple years for my career to a smaller town where we knew we’d want to own a house.

So, in other words…spending a lot…not saving a lot…but needing to save a lot…ruh roh.

If you have read some of my blogs then you know that I am very analytical and number focused, so it shouldn’t surprise you that the way that I came to my epiphany was to start crunching some of the numbers. I started laying the upcoming expenses and my incoming cash, started trying to map out how things would work and essentially the epiphany that I had was that if we kept doing things the way that we were, we would be in big trouble.

Sick and Tired of Being Sick and Tired

I was sick of it and I wanted to get ahead. The way that I decided to do that was to stop focusing on these short-term goals and focus on the long-term. The long-term goal was to be able to retire as early as I wanted to retire, so even if I don’t retire early, at least that decision is up to me and not my financial situation.

If I kept focusing on short-term goals like an engagement ring, wedding, or a down payment, then I’d never get ahead. I told myself to start focusing on the long-term as priority #1 and figure a way to cut costs in my day-to-day life for the short-term goals.

It was hard, but I did it – and I did it with investing.

The short-term inevitably took care of itself with some hardcore budgeting, cutting expenses, and finding ways to make money through optimizing my grocery shopping and also finding creative ways to knock out our “Chicago Bucket List” without breaking the bank.

My investing journey initially started out of necessity, but it quickly turned. Of course, I still invest because I think it’s one of the best wealth creation strategies that someone could have, but I also do it now for another reason – fun!

“What the…Andy, you think that investing is fun?!” Sure do! And for a few reasons:

1 – Competition

Investing is like one big competition to me. My goal is to win. A lot of podcasts nowadays, and even Warren Buffett, will tell you that it’s very hard to actually outperform the market and that instead you should simply just invest into a total market index fund.

You know what I think about that? Screw that.

Maybe that’s true, maybe it’s not. I’m sure for the common investor it is true. But I’m not the common investor and neither are you, and I know that because you’re actively reading articles to try to become a better investor.

You are the OUTLIER!

We will both beat the market if we take the time to understand how.

I always benchmark my performance against the S&P 500 so that I know what my competition is. My competition is investing in SPY, an S&P 500 Index Fund. So, that is the alternative. If I outperform that, meaning I realize 20% gains when SPY has 18%, or I have 10% losses when the SPY has 12% losses, either way, that’s a win. I don’t worry about the dollar amount.

In other words, it’s just like a football game. Would you rather win 7-3 or 49-45? WHO CARES! Either way, you won by four points. A win is a win. It doesn’t matter how much you score as long as you win.

You might think I’m crazy because of course someone would rather have 20% gains than 10% losses, but the mindset that I have is that I cannot control the market. I can only control my performance against the market.

The S&P 500 historically has returned 10% on average, and I trust that this will be the same, or very similar, going forward. So instead of worrying about how the market does, I only worry about how I do against the market and the market will take care of itself. In other words, it’s a competition:

Andy vs. The Market – who’s going to win?

I promise I’ll do the work to make sure that it’s me.

2 – Investing is as Analytical as Desired

Investing is so incredibly analytical, if you want it to be, and it’s invigorating for a number’s person like me. I’m the type of person that gets an extra sort of enjoyment about analyzing each stock, evaluating each buy and sell, post-auditing my positions to see how I have done, understanding all of the balance sheets, and literally just tracking every single thing possible, but I know that most people aren’t like this. And that’s why investing is also great for you.

If you don’t want to have to dive as far deep into the numbers as I do, you don’t have to. Andrew created the Value Trap Indicator that requires a little bit of work but then does the heavy lifting for you to tell you if a stock is undervalued or not. The VTI is a great tool and when I say it requires you to do a little work, it’s because it’s required you understand what you’re looking at.

I firmly believe that tracking and knowing the numbers is essential in anything quantitative that you do in your life and I know that Andrew feels the exact same way, so he has you to the minimal amount of work (and shows you how to do it) to give you that base understanding of how to interpret what the VTI is telling you, and it will make you a better investor for it.

Investing is an endless rabbit hole for those that love numbers but can be as simplistic as desired as well – strictly depends on your appetite for it. For me, I’m at an all-you-can-analyze buffet!

3 – The Unexpected Comradery

The investing world really seems like a pretty tightknit community to me. Yes, everyone is trying to get ahead, but people seem so willing to be upfront, open and honest with one another about their experiences and want to teach one another.

That’s one thing that attracted me to it and made me want to help out others. Personal finance education is hard to find unless you’re actively looking for it, so in a sense, you almost don’t even know that your lack of financial and investing knowledge isn’t an issue…but it is. You don’t know what you don’t know.

I’ve found that the people I intimately discuss investing with tend to really take pride in their recommendations and opinions because they know that it can directly affect my finances. It’s hard to explain, but when you talk investments with someone, it’s just a weird commonality that you have with someone else…and it’s thrilling to say the least. You will make friendships and bonds that last a lifetime – I know that I have.

And you know what my favorite part of my journey of posting blogs on the Investing for Beginners website has been? I know that you all find that investing is fun as well!

Of course, you’re all here to make money – but I know that many of you are here for fun as well!

Do you know how I know that? Because of the data.

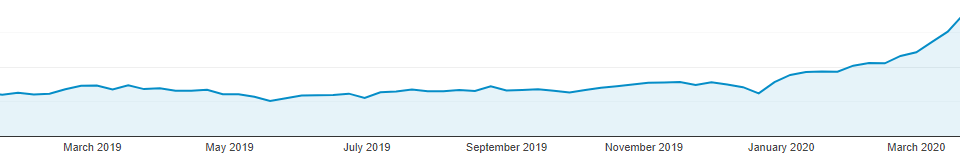

Since 1/1/19, the Investing for Beginners website has grown rapidly! And I mean very rapidly:

As you can see, look how things have really increased in 2020 over a fairly flat 2019. So, what’s changed? Andrew and Dave are still doing the podcast, the VTI and Newsletter are still some of the best tools out there for an investor, I am still writing my blog posts…the thing that has changed, honestly, in my eyes, is YOU!

I thank you all for your continued interest in the product that we’re putting together for you, and I’m loving seeing these results that the people coming to the website are increasing, because we’re here to help you, and it shows that you’re clearly having fun!

I love going through some of the topics that are the top hits that really are tailored for the new investor and that legitimately makes me feel warm inside because that means we’re transforming you from a non-investor into an investor. You’re changing from someone that is focused on the short-term to being focused on the long-term.

You’re becoming someone that doesn’t have to work until 65 but has the ability to choose how long they want to retire because they’re financially independent.

You’re taking the first step towards your financial autonomy and I applaud you for that, because that average person will never do that. But guess what, you’re not average. You’re going above and beyond to set yourself and your family up for the future and that is the best thing that you could ever do as a contributor to your family.

The common things that I see people are always seeking help with include the basics – understanding financial tools, how to get started, planning for retirement, etc. Do you know what that tells me? You are starting out of a position of need, and I assure you, that the fun part will come shortly after it!

Of course, we’re all investing for the money side of things. Money is the reason that you started investing and most likely, if you’re anything like me, you started due to compound interest and understanding the serious gains that you can achieve when maximizing it.

I am a firm believer that while money cannot buy happiness, it absolutely can put you in a situation to be happier.

Do you love to golf? Money can allow you to play at nicer courses with nicer clubs, get a country club membership, go on golf trips, retire early to play more golf…the list goes on and on.

Want to spend more time with your family? Money can allow you to retire early, pay for a family vacation (getting you uninterrupted time with them), visit them frequently, etc.

I can honestly give tons more examples, but the point is that if you take care of your finances now, you’re going to get into a groove and it will seem like it’s on auto-pilot mode and you can just coast through the rest of your career while the money takes care of itself.

You might have started investing for the money, but as I mentioned, the fun will come after that. You don’t have to be a number cruncher like I am to get super geeked about the stock market. All that you really have to do is find yourself a compound interest calculator. Take a look and see how things look if you invest at an 8-10% return for 30 years. Then do 35. Then 40. Seriously, do it now.

Having fun yet? I know I said that money can’t buy happiness…but making a ton of it sure is fun!

Related posts:

- Real Data Shows What the Best Times to Be Bullish and Bearish Have Been We know when investors are bullish the stock market tends to go up, and when investors are bearish it goes down. But have you ever...

- Stock Market Data on the January Effect: Is it a Reliable Indicator? Have you heard of the January Effect before? The January Effect is a very common topic this time of year in the investing world where...

- Average Operating (EBIT) Margin by Industry – 22 Years of Data [S&P 500] Updated 4/21/2023 Operating margin is probably the most useful profitability ratio because it’s much less volatile than net margin but includes all operating expenses to...

- Data that Reveals the Best Performing Growth Factors (Historically) Not going to lie – the title of this article is so good that it almost seems like clickbait, am I right? Good news for...