Have you ever considered investing in eSports? If not, you could really be missing out on some major potential gains.

In a recent Investing for Beginners Podcast episode, Andrew and Dave had a special guest on, Braden Dennis, and they talked about four tips for beginning investors. When they were talking about these tips, the topic of eSports came up and it got me really interested in the opportunity.

Personally, I am a HUGE sports fan. I love all sports and am truly a diehard fan. Don’t believe me? Well, when I was a kid, I would wake up on Saturday mornings and watch SportsCenter for three straight hours, flipping through my baseball cards and just looking at the player’s stats. I wish I could say that I’m lying, but I’m not.

And this was before SportsCenter even had different episodes. I legit just watched the same hour-long episode of SportsCenter three times in a row…

I think part of this really called to my sports love but also a lot called to my analytical mindset. I truly knew so much about baseball, even as a 10-year-old, just from memorizing stats about all different players.

It was something that brought me pure joy as a child.

I never really had a gaming system until late middle school, so I didn’t play video games and in turn it has made me very skeptical of eSports in general, and even made it hard for me to understand. But do you know what isn’t hard for me to understand?

Money.

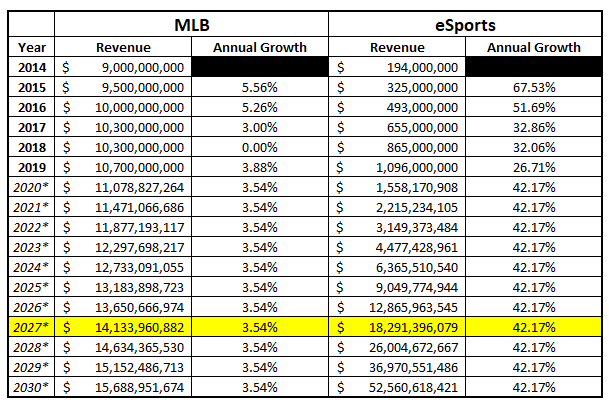

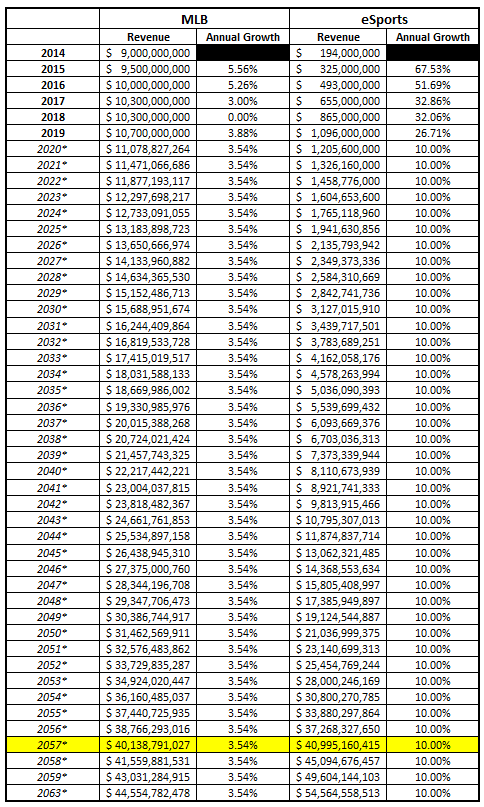

In the last five years (2014 – 2019), the average eSports Revenue growth has been 42.17% CAGR (Compound Annual Growth Rate). Major League Baseball (MLB), on the other hand, has a CAGR of 3.54% over the last five years.

Now, of course, eSports is a much newer industry so the revenue growth should be higher since eSports is really just catching its stride, but if this same growth rate continued then eSports would have more revenue than the MLB by the year 2027:

So, the main question is – is this sort of growth actually realistic? Chances are, probably not. The revenue growth for eSports has slowed over the past five years so it’s unfair to really take just a simple average and blindly attribute it towards future years.

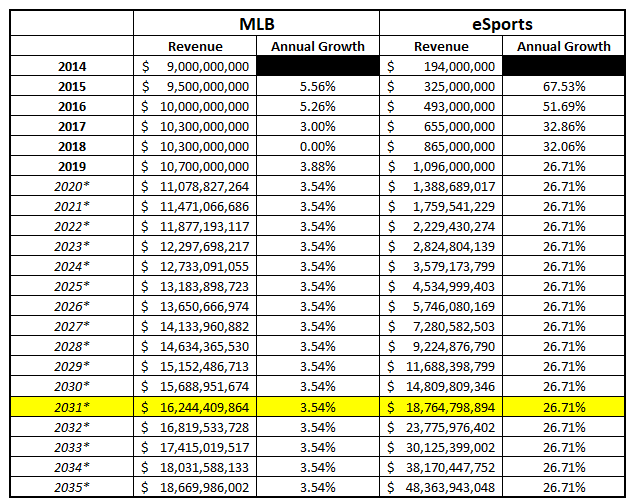

So, what is an appropriate CAGR for eSports growth? What if we just said that the CAGR in the last year (2019) was going to be replicated in future years?

As you can see, if we assign a 26.71% CAGR, which is the actual CAGR seen from 2019 vs. 2018, then eSports will outpace the MLB by 2031.

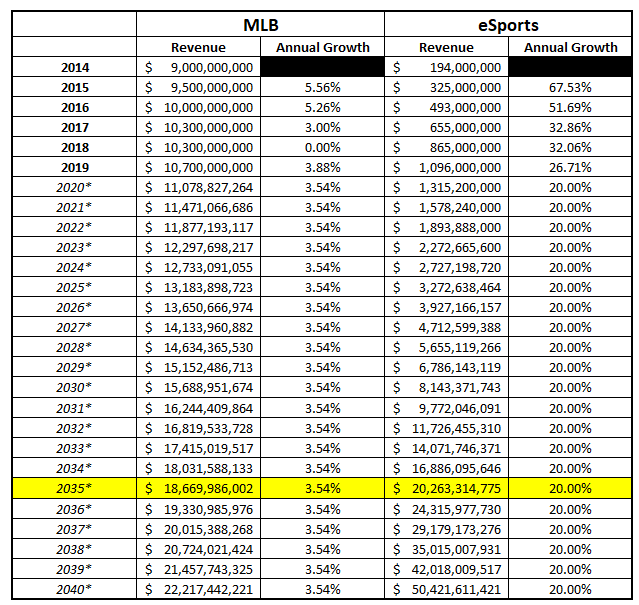

This might still seem a bit unrealistic though…so let’s keep going. How about 20%?

At 20%, eSports will surpass the MLB by 2035.

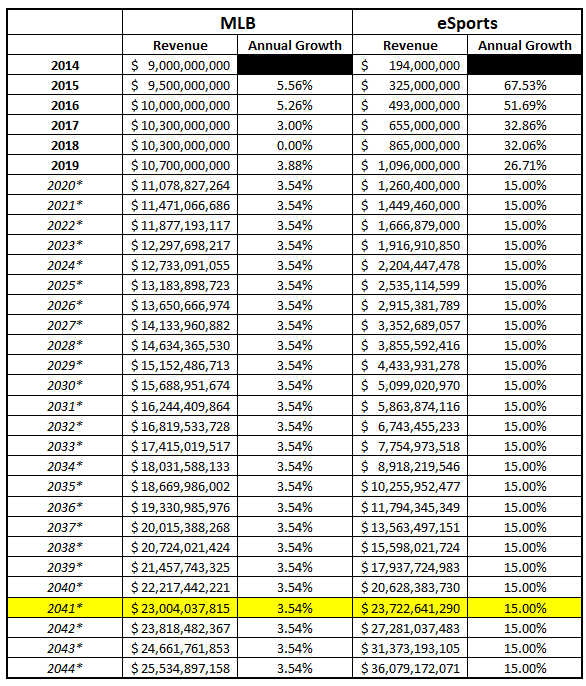

What about 10%?! Well, my friends – that would be 2057.

I know that 2057 seems like a really long time from now, but do you think you’ll be alive in 2057? I mean, that’s only 37 years. Hell, I’ll probably still be working then! (fingers crossed lol).

The key takeaways of these charts are really two things:

- eSports isn’t a trend – it’s an actual investible industry and is quickly catching up to actual sports

- DO YOUR OWN ANALYSIS!

Looking up eSports and MLB revenues and putting them in excel took me maybe 10 minutes total. And while I’m absolutely not going to invest solely on this, revenue is a fantastic way to understand about how the public accepts a certain product.

The public is clearly accepting eSports and some of the statistics are absolutely staggering, such as how 22% of millennial males watch eSports and that 61% of eSports viewers are under 35.

Do you know what that tells me? They’re capturing the younger generation, which is exactly what I want as an investor. I want my investments to capture the young generation that is going to be a consumer of the product for the rest of their lives.

Obviously, with newer industries, it can certainly lead to a lot of volatility, but I don’t think that’s a bad thing at all as long as you trust the companies that you have invested in.

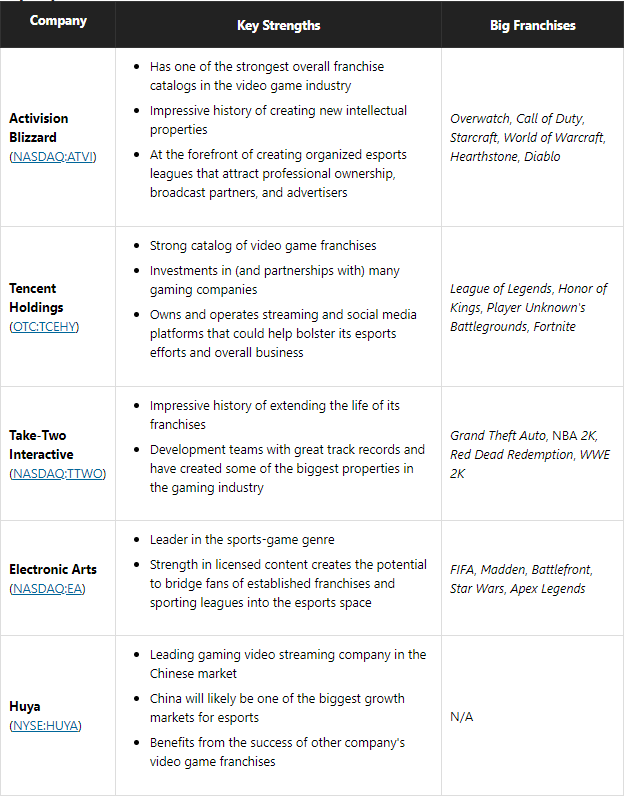

Motley Fool did an awesome job at listing out some of the popular eSports companies that you could invest in if you wanted to get some exposure to eSports, which I’ve included below:

And Braden Dennis also talked about 2 examples of companies in the eSports sector on the Investing for Beginners podcast espisode as well:

Now, of course – you need to take these companies as absolutely nothing but a starting point for your stock evaluation. You need to take a thorough look at the balance sheet and the qualitative data of the company to make sure that you trust the company and think that they are poised for great things to come.

If they’re not – don’t even, consider investing in them.

Fortunately, most of these companies have been around for years and years, so looking up historical data isn’t going to be an issue whatsoever. The shortest timeframe for any of these companies is with Tencent Holdings, and they have been publicly traded since 2010.

If you’re struggling on what sort of analysis to do, I highly recommend that you utilize the Value Trap Indicator to get you off on the right foot. The VTI really does a great job at keeping you out of value traps and making sure that you’re investing in companies that have great financials and look poised to perform well in the future.

Of course, that is only one part of the equation, though. The most important investing advice that I can give is to make sure that you’re investing within your circle of confidence.

You need to be familiar with the industry and the company to make sure that you’re making a sound investment.

Earlier I said that I really don’t understand eSports that well, so if I think that I might want to invest in it, I really have two options:

- Learn more about the industry

- Don’t invest in it.

It’s that simple. I will never invest in a company in any industry unless I at least know enough to be dangerous. As Warren Buffett says, “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

I think that really sums it up best – if you don’t know anything about the company or industry, would you take a risk to invest in it for 10 years? Hopefully not.

So, don’t take that to mean you can’t invest – take it to mean that you need to learn more about the industry!

Personally, from the small amount of research that I’ve done, I think that there seems to be an opportunity for some massive gains in the near future – I can’t promise that I’m going to invest in it, but I do promise that I’m going to do my research!

Related posts:

- 1,066,590 Reasons to Buy This Investing Newsletter I’ll be the first to admit that I was a major skeptic when it came to investing newsletters. All it takes is some quick research...

- I Know Micro Cap Stocks are Risky, but do They Generate Massive Returns? “Micro Cap stocks? I thought it was only large cap and small cap!” Nope. You’re wrong. Remember how I used a comparison of Brock Lesnar...

- Expanding Your Circle of Competence by Investing in Cloud Stocks Pre-2020, cloud stocks were never anything that I really even looked at investing in. The numbers just absolutely never made any sense to me but...

- Can You Get Rich Only by Sector Investing? I feel like the debate of sector investing is one that has lasted ages and so many people have different opinions on the practicality of...