A listener to the IFB podcast recently was asking for some advice on investing inheritance money and some good tips and things to think about.

Andrew and Dave shared their thoughts on the show, which you can also listen to below. Having listened to the episode, and being a young investor myself, I have some thoughts to add as well.

Let’s take a look at the big picture…

In general, you’re going to want to make sure that you’re investing inheritance money in a diversified manner.

What do I mean by that?

Well, you’re going to spread your investment among 15-20 different stocks that are all types of different industries, sizes, sectors, etc., which is going to help limit your risk of investing and will make investing as safe as possible.

It’s important to note that if you get above 30 stocks your returns will start to mimic the stock market, so it diminishes the value of picking stocks over simply investing in an ETF. Not to mention that a lot of ETFs can be commission free depending on your brokerage firm.

So – 20 stocks – seems easy, right? Doubt it.

Chances are, you’re not going to be able to find 15-20 undervalued stocks in a month to invest in.

But even if you do, I wouldn’t recommend dropping all of your money into those stocks all that one time.

If you just throw all of your cash in at the same time, your risk is going to be inherently higher than if you would dollar-cost average over the course of some time to help minimize your risk of the stock immediately dropping and you drastically losing a lot of your investment.

So, what should I actually do then?

If it was me, I would follow these steps:

- Decide how much you would like to invest each month

- Decide how many stocks that you would like to invest in

- Decide how much you want to invest in each stock

- Try to find 2-3 stocks each month to invest in that are currently undervalued

- Dollar-cost average those investments over the course of 3-6 months.

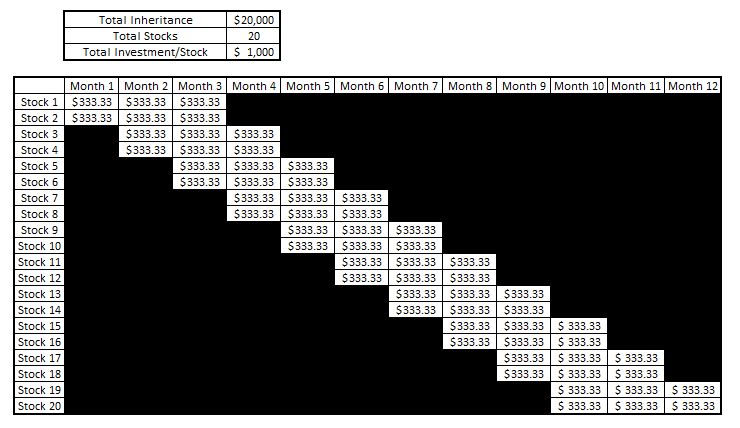

So, let’s try to put this into a real-world, but still hypothetical situation. Let’s imagine that I came across a $20,000 inheritance…

- I want to invest $1000 – $2000/month and be completely invested within 12 months

- I want to take Andrew’s advice and invest in 20 total stocks to make sure that I am diversified but still have great opportunity for a lot of upside

- I want to invest $1000/stock, so I’m perfectly allocated at 5% in each stock

- I am extremely busy, so I think that I will aim to find 2 undervalued stocks each month and if I don’t find a great company at a good value, then I will not invest just to meet my fake “quota” of 2 stocks/month

- I am going to spread my investment across 3 months for each stock

Ok – my plan is figured out! So, this is my checklist:

Month 1

- Find 2 stocks to invest in

- Invest 1/3 of $1000 ($333.33) since I am spreading the total $1000 investment across three months

Month 2

- Invest $333.33 in the two stocks that I found in Month 1

- Find 2 more new stocks to invest in

- Invest $333.33 in those two new stocks

Month 3

- Invest the final $333.33 in the two stocks from Month 1

- Invest $333.33 in the two stocks from Month 2

- Find 2 more new stocks to invest in

- Invest $333.33 in those two new stocks

You will then rinse and repeat this throughout the remained of the 12-month period. If you’re a visual person like I am, your investment “schedule” would look like the following:

If you’re like me when I first started investing, my immediate thought was “dollar-cost averaging is stupid…

Why would I want to spread out my investments and then have to pay commissions every time I buy stock?”

Well, I get your point – but the goal of dollar-cost averaging is to limit your risk, and if you would put all of your money into the stock and then it immediately goes down, I think you’re really going to regret investing 100% into that stock simply to save $5 of commission.

In addition to that, if you were to follow this schedule at $5/trade like Fidelity, Ally, and many other charge – your total commission fees would be $300. $300 is 1.5% of $20,000, so not exactly like you’re losing some crazy advantage.

If you were only going to invest $100/month or even less, then I would recommend “saving up” a few months and trying to put in at least $150 – $200, if not more, to limit your commission fees.

So, now that your plan is scheduled, you need to find some good stocks, right?

If I were you, I would first start with Andrew’s VTI to get a good picture of what sort of stocks are undervalued.

I would also take a look at some of the dividend aristocrats as they have a 25+ year history of paying increasing dividends and are in the S&P 500 so they’re inherently less risky than some other companies that you might be looking at.

One thing to make sure of though is that if you’re investing in a company that is paying a dividend, and I highly recommend that you do, make sure you confirm that you’ve selected the Dividend Reinvestment Plan (DRIP) for those stocks!

DRIP, in essence, is when your dividend payments are immediately invested back into the stock of that company so that those payments can immediately begin receiving the full benefits of compound interest.

If you want to read more about DRIP, or even play around with your own calculator to see the full potential of DRIP, you can take a look at a post I recently wrote breaking it down in a DRIP 101 fashion!

Chances are if you’re reading this article you’ve either received an inheritance recently or you are planning for the future, and both of those situations are extremely sad to think about.

The silver lining is that you can make that person extremely proud by maximizing the money that they’ve worked so incredibly hard for and to set yourself up for success.

I really encourage you to take these words to heart and make the most out of this crappy situation because one day, you’re going to pass away as well and hopefully you will then be able to pay it forward and leave an inheritance to someone else, but it all comes down to how active you are in your planning and preparing for the inevitable.

Related posts:

- 7 Compelling Arguments for Dividend Reinvestment vs a Payout in Cash Is the income stream from dividend payouts the best part of dividend stocks? Not always. Taking that cash instead of reinvesting it leaves serious returns...

- Dividend Reinvestment Calculator to Plan Your Expected Returns (Excel) One of the most powerful forces behind building wealth in the stock market comes from the compounding effects of reinvested dividends. As investors, it’s important...

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...