Updated 9/15/2023

Generating true investment success remains rare, even more so the prospect of long-term success. Nick Sleep and his partner Qais Zakaria (Zak) generated those returns over decades, 18% over thirteen years.

Most of you have never heard of Nick Sleep and his partner Zak, but if there were the Holy Grail of investing letters, then Nick Sleep’s would be those. For a long time, they remained hidden, rumored to contain gems coveted by investors worldwide.

They resurfaced in the last few months, bestowing us many remarkable insights and creativity in investing.

Sleep’s letters contain information that helps give investors an edge, something we all desire. They also allow us to understand great investors’ thoughts and mental models.

We can credit some of the recent fame surrounding Nick Sleep to the fantastic chapter in the wonderful book Richer, Wiser, and Happier by William Green.

The amazing thing about the long-term performance was that they focused mainly on three stocks: Amazon, Costco, and Berkshire Hathaway.

In today’s post, we will learn:

Okay, let’s dive in and learn more about investing lessons from Nick Sleep.

Who is Nick Sleep?

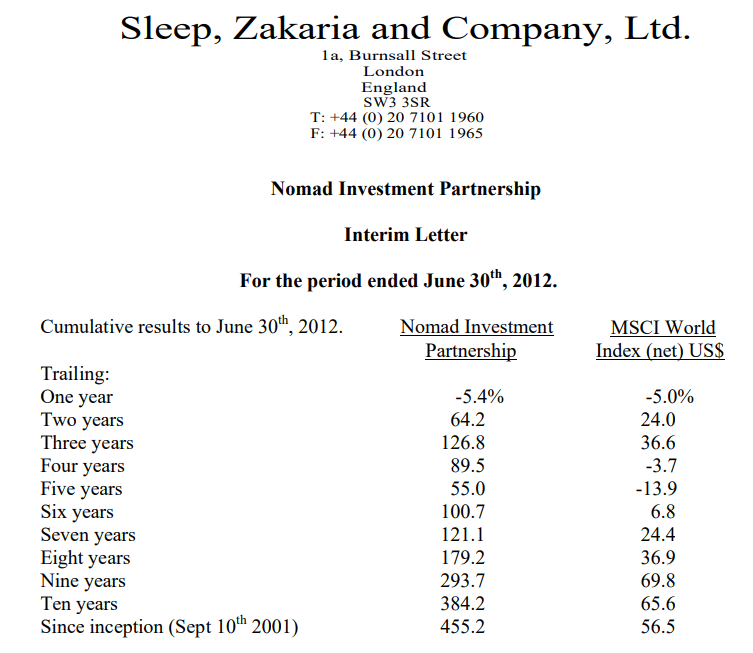

Nick Sleep cofounded Nomad Investment Partnership with Qais Zakaria in 2001 and, over the next thirteen years, generated 921.1% returns versus the MSCI World Index of 116.9%.

To put that into dollar terms, we mortals can understand. If we had invested $1 million in the index, we would have earned $2.7 million. But if we invested the same million in Nomad, our investment would have earned $10.21 million.

So, who the heck is Nick Sleep?

Like many great investors, Nick Sleep found investing from unconventional beginnings. As a youth, he dreamed of becoming a landscape architect. After graduating from Edinburgh University, he took a landscaping apprenticeship at a local company.

But, while in landscaping, he soured on the idea as the job realities shattered his dream. Sleep, who is English, read an obscure book, Investment Trusts Explained, which intrigued him and led him to land a job as a trainee investing analyst with a small Scottish fund company.

The next big change in Sleep’s life was discovering Robert Pirsig’s seminal book, Zen and the Art of Motorcycle Maintenance.

The memoir-as-tutorial book is a strange but brilliant meditation on leading a life dedicated to quality. For Sleep, the book was a discovery that led to the pursuit of excellence despite the context. It gave him an ideal metaphor for living and working in a new way.

Sleep loves to ask basic questions and think deeply about those questions.

In 2001, he and his partner, Zak, launched the Nomad Investment Partnership, guided by Jeremy Hosking of Marathon Asset Management. Nomad spun out in 2006.

Over the years, Sleep evolved as an investor, like many masters. Warren Buffett evolved over the years because of the mentorship of Charlie Munger, and Sleep evolved too.

The first investments for Nomad encompassed the “typical” value plays, discounted asset-based business, and deep value workouts. The typical “cigar butts” characterized the Benjamin Graham style of investing.

During this time, Sleep understood that the current portfolio needed to evolve and achieve a different “terminal portfolio.” The goal remained to own “honestly run compounding machines.”

By the time Sleep and Zak wound down the fund in 2013, the portfolio contained compounding machines, businesses deploying scale-economic shared models run by their founders.

Charlie Munger often says, “Take a simple idea and take it seriously,” Sleep enthusiastically embraced that philosophy.

Sleep grasped early on that the market annually undervalued these scale-economic-shared models, such as Amazon, Costco, and Berkshire Hathaway.

Sleep created unusual mental models that helped him create inventive investment ideas. And when he combined these models with a deep understanding of psychology, steadfast patience, and focus on his investment destinations, he achieved an outstanding track record.

10 Lessons from Nick Sleep

We can learn multiple lessons from Nick Sleep’s letters; narrowing those ideas isn’t easy. Sleep’s visionary ideas regarding Amazon lay a roadmap in his early letters. Likewise, his contrarian view regarding Costco remains the conventional thinking about the company.

Below are some of my favorite learnings from his letters:

- Think Long Term

- Focus on the Destination

- Compounding Machines

- Founders & Management

- Scale Economics Shared

- Price Give Back

- Lollapalooza Moat

- Inaction

- Information Diet

- Volatility

Let’s explore each of these topics below.

Think Long Term

“There is a lot to be said for gentle contemplation. And, of course, a long investment holding period allows one time between decisions to ‘retreat and simmer a little.”

Considering the implications of moving out of one investment and into another helps investors create a speed bump. Sometimes, creating a speed bump helps prevent panic or emotional actions.

Preventing the interruption of compounding remains one of the best methods for long-term returns. Sleep understood this quite well, and his focus remained on the business and its destination. He ignored short-term noise or quarterly earnings results and focused on picking good stocks while ignoring the rest.

As long-term investors, we can ignore the following:

- Economic data

- Quarterly financial data

- Wall Street recommendations & sell-side research

- Daily market action

Focus on the Destination

Analyzing the company’s destination helps investors ask better questions and understand what makes a company tick or its DNA.

He felt the only error one could make was the risk of mis-analyzing the company’s direction.

To help focus on analyzing the direction, ask yourself these questions:

- Where will Amazon (insert company) be in 10-20 years?

- What must management do now to reach that destination?

- What circumstance could prevent Amazon from reaching its destination?

Compounding Machines

“If we had out time again, we would hope not to be seduced by some firms (apparent) economic cheapness but weigh more heavily their DNA, if you like. One of the things we have learnt over the last few years is our most profitable insights have come from recognizing the deep reality of some businesses, not from being more contrarian than everyone else. Old habits die hard, but, even so, I am finally attending classes at CBA, Cigar Butts Anonymous!”

The above quote highlights, with emphasis mine, the impact, and strength of investing in compounding machines; those investments remain the holy grail of investing.

Compounding machines like Costco help investors achieve the returns we all desire. Buffett’s and Munger’s superpowers correspond to identifying compounders and buying them at “reasonable” prices.

One of the great axioms Charlie taught Warren was the power of buying a great company at a fair price instead of a fair company at a great price.

Costco remains Charlie’s longest-held investment. He mentions numerous times that buying a company with returns on capital of 6% guarantees you a return not much better than that, regardless of the price you pay. When investing in a company with higher returns on capital, over the long term, you guarantee returns similar to those returns on capital over a longer period, regardless of the price you pay.

Nick Sleep understood that axiom well and followed it throughout the Nomad investment lifetime.

Founders & Management

“The best entrepreneurs we know don’t particularly care about the terms of their compensation packages, and some, such as Jeff Bezos and Warren Buffett, have substantially and permanently waived their salaries, bonuses, or option packages. We would surmise that the founders of the firms Nomad has invested in are not particularly motivated by the incremental dollar of personal wealth… These people derive meaning from the challenge, identity, creativity, ethos (this list is not exhaustive) of their work and not from the incentive packages their compensation committees have devised for them.

Founder-led companies tend to have more skin in the game and different motivations than hired guns. Often, the challenge drives them far more than money.

Consider that Buffett only takes a salary of $100k, leading you to determine that he loves his job and the challenge of finding great investments.

If you look at the recent history of the best businesses, many of them contain founders, now or in the past, for example:

- Berkshire Hathaway

- Amazon

- Costco

- Apple

- Constellation Software

All of the above remain arguably the best-run businesses and some of the best long-term investments. Each company led by a founder who created the company, drove it to new heights, instilled great cultures, and continually updated or adapted to new challenges.

To think of it another way, founders lead the way in the same way coaches lead their teams or head chefs run their kitchens. It is all about performance and striving to become the best. Many of them view it as a game to win.

Search for founders or CEOs who operate like founders; you stand a better chance of finding a great investment.

Scale Economics Shared

Scale economics shared create some of the most powerful concepts in investment theory.

To help explain this idea, Sleep used the example of Walmart’s cost advantage. Walmart’s business model offers the lowest prices on everyday stuff while gaining scale advantages through larger and larger bulk purchases from its suppliers at lower and lower unit prices, driving even bigger savings for its customers.

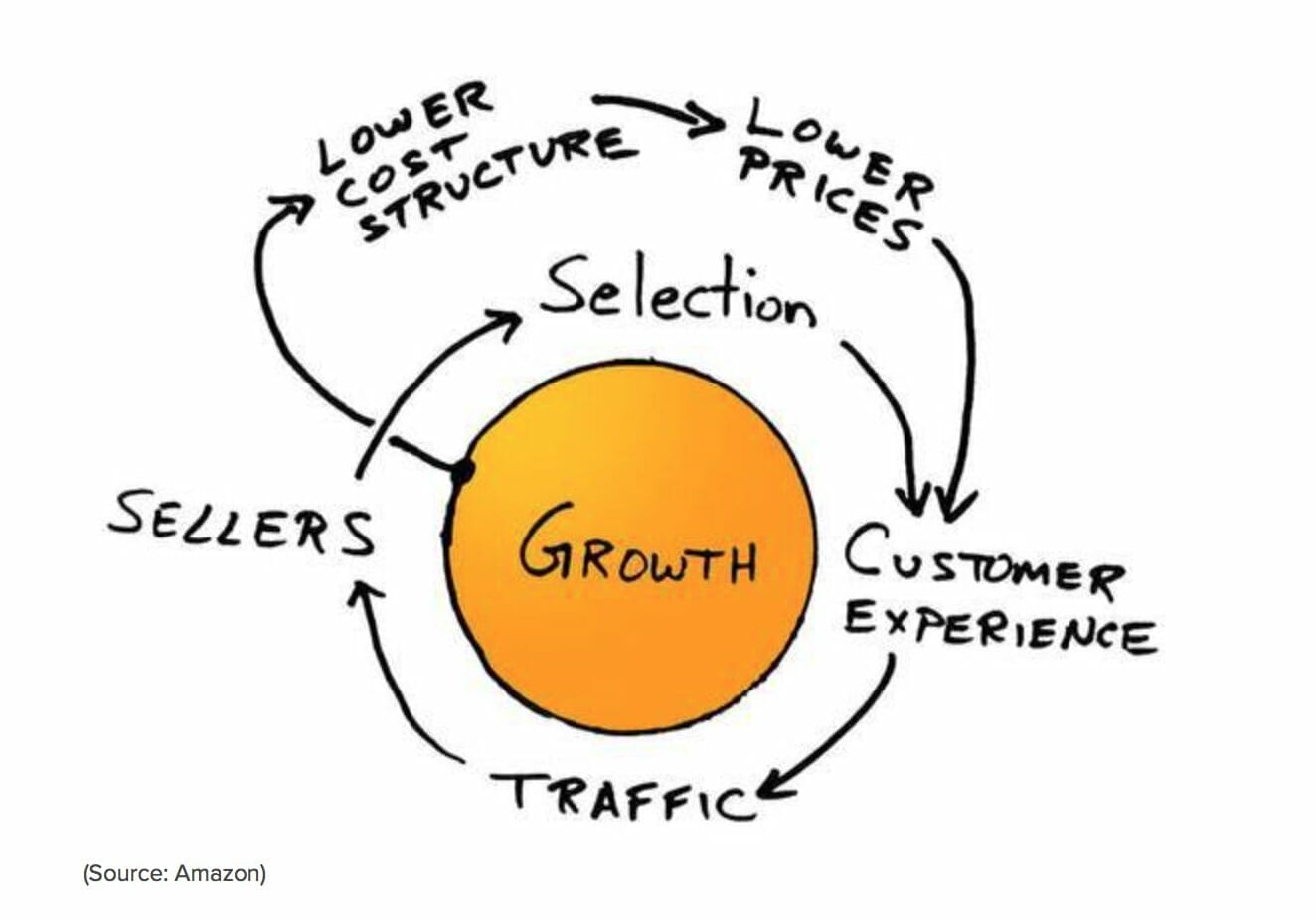

That led to more growth and scale for Walmart, and we can extrapolate the same idea to Costco and Amazon.

Sleep created his term for this business model: scaled economies shared. The term means that Walmart gained scale, but instead of keeping the profits for itself, it passed along the scale advantages to its customers with lower prices.

The passing along of profits dampens near-term profits but leads to far greater profits, creating value for companies like Walmart, Amazon, and Costco.

The above sketch by Jeff Bezos perfectly illustrates the power of scaled economics shared. Sleep suggested that companies sharing their profit would have customers reward them with more sales.

Walmart, Costco, and Amazon exhibit Sleep’s business model and achieved great success. But the real key to Sleep’s success was he noticed that even though investors understood the business model, they still undervalued these companies because they placed too much emphasis on short-term noise, for example:

- Seasonal same-store sales

- Quarterly margins

- Business cycle

The focus on short-term noise detracted from the real value, the cost advantage that was hard for competitors to repeat.

Price Give Back

“We would suggest that investment in price-giveback, so favoured by Nomad’s firms, is the most long-lived of the investment spending items if it engenders consumer habit. It may, therefore, be the most valuable to long-term investors.”

Intimately tied to scaled economics shared, companies focus on price give-back investments by actively lowering customer prices. Those price give-backs allow customers to enjoy 2-10% savings on their purchases at Costco, compared to shopping at other places.

Even though these “lost” revenue investments don’t appear on the income statement, they can dwarf other R&D, sales, and marketing investments.

Sleep believed price give-backs would generate the most enduring investment spending by creating long-lasting customer habits.

Lollapalooza Moat

Sleep believed that little things could add up, making a big difference over long periods. He preferred to invest in companies whose competitive advantage stemmed from doing dozens of little things well instead of leveraging one big idea, such as location, brand name, or patents.

Compare this idea to scaled economics shared. For a company to outcompete Costco, the company has to execute a million little things to compete, a much tougher feat that also makes that company harder to replace.

Charlie Munger termed the phrase “lollapalooza” effect during one of his speeches; during that speech, he described several ways psychological biases could combine to determine a person’s decisions.

Sleep applied that idea of multiple biases coming together through a company’s action, creating action by the customer for the company’s benefit.

Inaction

Portfolio inactivity is an active decision. One of the hardest mental activities remains doing nothing at all. Humans struggle with that idea; we all need to feel like doing something to move forward.

Avoiding buying and selling or lots of activity for the sake of activity is a portfolio decision and, in many cases, the right one. Only let new companies into the portfolio if they are superior to present companies.

Information Diet

Garbage in, garbage out. Sleep thought we should spend less time collecting information and more time thinking about factors that make businesses great.

He felt that information, like food, had an expiration date. For example, how long does a quarterly earnings report stay relevant?

Not very long.

Instead, Sleep focuses on information with the longest shelf life and the highest concentration on the most relevant.

Volatility

Ups and downs in the markets will continue as long as there are markets. Resist the urge to sell your winners to buy losers. Or, as Peter Lynch liked to say, “Don’t pick the flowers and water the weeds.”

Investors have little control over the sequence of good and bad years, and Sleep didn’t trade around his holdings. Instead, he bought and held; for example, he has held Costco for over 18 years.

After all, share prices will fluctuate, and Mr. Market has a job to do. But business values move far more slowly, which will grow over long periods.

Charlie Munger says you make real money by sitting on your assets!

Here is a link to Nick Sleep’s letters:

Nomad Partnership Letters 2001 – 2014

Investor Takeaway

Nick Sleep’s letters don’t reveal any shocking formulas to success; instead, they offer a continuation of the same ideas Warren Buffett and Charlie Munger shared over the years.

Sleeps offers a different take on some ideas, but finding strong companies with enduring moats leads to investment success. Buying those same companies at a fair price will deliver great results over long periods.

Try this idea instead of stressing about the next big idea to add to your portfolio.

Make a list of the top 50 companies containing the characteristics we discussed in the post:

- Scaled economics shared

- Price give backs

- Lollapalooza moats

Then, take a deep look at the companies in your portfolio and determine if any of those stand up to those standards.

That idea will drive my thoughts for the next few weeks.

The key idea of the exercise is to spend a lot of time thinking about the sources of enduring business success.

And with that, we will wrap up our discussion regarding investing lessons from Nick Sleep.

Thank you for taking the time to read today’s post, and I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Qais Zakaria: The Investor Who Outperformed the Market by 800% A fund called the Nomad Investment Partnership had one of the greatest 13-year runs of all-time. Started by investors Nick Sleep and Qais Zakaria, Nomad...

- What is a Quality Company and Why Should I Pay Up? “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” -Warren Buffett Many investors use...

- Famous Growth Investor on Why Conservative Investors Sleep Well Phil Fisher, author of Common Stocks and Uncommon Profits, has been one to always talk about the power of how conservative investors sleep well, and...

- Strategic Asset Allocation: Unique in Nature, Critical for an Uncertain Future “You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.” Ray Dalio Today we...