Updated – 11/3/23

Did you know that the #1 reason that people don’t invest is because they’re terrified that Handy Andy’s returns will make their returns look abysmal? JK – that’s a myth…well, actually a lie. But we do see some investors fall victim to other top investing myths.

So let’s look at 9 myths and debunk them for good, so you can make the great returns you deserve!

Table of Contents

- You need a lot of money

- The Stock Market is Risky

- You Have to Buy Low and Sell High to Make Money

- Dollar Cost Averaging is the Right Way to Invest

- You Need to Switch to Bonds When You Retire

- Target Date Funds Are All That You Need

- 12% Returns are Average

- Investing Takes Too Much Time

- You Can’t Beat the Market

Alright, let’s dive in.

Myth 1- You need a lot of money

Oh man, this is about as wrong as can be! You can invest with literally any amount at all and nowadays, there are no hurdles that you need to overcome by investing small.

Many brokers offer trades with no commissions and there are also a lot of brokers that allow you to buy partial shares, such as Fidelity. In the past, if you had $20 and wanted to buy a $50 stock, you couldn’t do anything.

You’d have to wait until you had $50, and then once you did, you’d have to pay a commission of anywhere from $5 – $7 (or maybe more!) to buy that stock. So, you’re paying $5 on a $50 stock, meaning you’re down 10% right off the bat!

Now, you can buy a partial share ($20 worth of a $50 stock is 40%, so you’d get .4 shares) and you wouldn’t owe anything on commission! Fidelity might charge anywhere from $.01 – $.03 for commission, but seriously who cares about three cents lol.

I actually just wrote an article about this and you can truly invest with any amount of money and waiting until you have “a lot of money” is the best way to never have “a lot of money”. Taking advantage of compound interest and putting your money into the market is how you’re going to be able to get your money to multiply many times over.

Myth 2- The Stock Market is Risky

This is my favorite one.

The stock market is not risky at all – it’s volatile! The stock market will change drastically from year to year, month to month, week to week, and day to day, but as long as you don’t sell, then it’s not risky at all.

Sure, you’re likely going to sell at some point, but as long as you hold on for the long term, and you don’t try to time the market, then you’re going to be able to make money just fine.

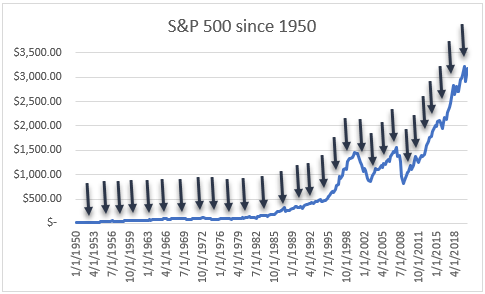

To help make it clearer, I highlighted all of the times that you could’ve bought the S&P 500 since 1950 and bought money:

HA! Get it? You can literally buy anytime because the market just continuously goes up, up and away! The key is just to hold on and not make an impulse decision. If you bought at the peak in 2007 and then sold in 2008, you lost about half your investment. If you had just held on for 10 years, you would’ve doubled your investment!

Sell = lose money. Hold = make money. Simple enough?

Understanding the data is key to seeing how it’s not risky. The high volatility will help create buying opportunities for you, which can provide you even greater returns if you know how to identify when the market is undervalued, which leads me to my next point!

Myth 3- You Have to Buy Low and Sell High to Make Money

You absolutely do not have to buy low and sell high to make money. In fact, similar to how I mentioned above, if you just hold on, then you can make some monster returns.

I looked at some data from 1986 on, and if you bought the S&P 500 at the HIGHEST price and then sold it back at the LOWEST price 5 or 10 years later, your average returns were 22% and 62% for 5 years and 10 years, respectively. The median returns were 22% and 73% for those same time periods.

So, basically, you were the worst investor you could be, timed the market precisely wrong, and still made 62% if you just held on for 10 years! Find me any savings account, any bond or CD, or anything else that’s going to make you that sort of return by timing it in the literal worst way possible.

You can’t.

Myth 4- Dollar Cost Averaging is the Right Way to Invest

I am going to go out on a limb here and guess that you are not going to be the worst investor possible. In fact, you simply reading this shows me that you have initiative and are hoping to try to be a better, more knowledgeable investor, so I am going to trust that you might be above average!

The fact of the matter is that many people, including myself until a couple months ago, preached about dollar cost averaging, which is where if you want to invest $12,000 into the market, you split it up evenly across a certain period, such as $1,000/month, rather than just putting it in all at the same time.

Well, remember that chart above that showed all the great buying opportunities? Well, that also means that if you spread your money out and invest over a longer time period, then you’re going to likely pay a higher price than you would’ve if you had simply just invested all of it at the very beginning.

For that reason and that reason alone, invest your money as soon as you get it. Of course, only put it into a company that’s undervalued vs. their intrinsic value, so as long as you have some companies in mind, then throw that cash in and stack those gains!

Myth 5- You Need to Switch to Bonds When You Retire

This one gets me so dang triggered! Even if you retire at 65, you will likely have at least 15-20 more years to live! The data shows that you need to keep your money invested in stocks, and if you move to bonds too early, then you’re going to hold yourself back.

Sure, you might not lose money, but you’re not going to be able to get those 11% returns that the S&P 500 has averaged since 1950. Not losing money is obviously essential, but if you have a long time period to invest, because you have many more years of life, you need to keep your money invested in stocks.

Pulling your money out too early is going to really, really hinder you, especially if you’re utilizing the 4% rule and withdrawing 4% of your income every year. You’re going to run out much, much sooner than you think you will.

Long story short – moving to bonds is a safe thing to do, and I do support moving a portion of your investments to bonds when you retire, say maybe 1/3. But anything more than 1/2 will really set you up for trouble.

Think about the long-term and the true outlook for your life before you blindly follow the blanket advice of switching to bonds when you retire.

Myth 6- Target Date Funds Are All That You Need

Similar to my beef with the point above at moving a lot to bonds, you need to be careful about setting up a blanket target date fund.

I am 100% on board with ETFs and target date funds if you really want to avoid being in the weeds with investing you still want some of the rewards, but you have to be sure of what you’re investing in.

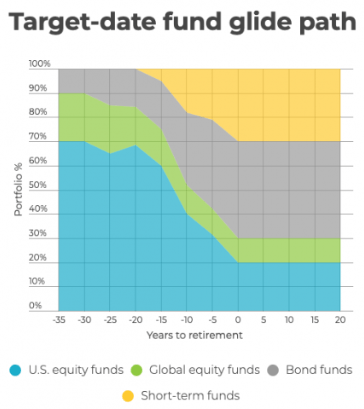

NerdWallet created this pretty cool graph to show the asset allocation of a target date fund as your retirement approaches, and I think it puts it really into perspective:

As you can see, when you have 35 years to retirement, and you’re in a target date fund that is aligned with the date of your retirement, you’re initially in about 10% bonds, which I still think is about 10% high, but whatev.

When you hit your retirement age, you’re in 40% bonds, which is a fair amount, but you’re also in 30% short-term funds, which I deem to be cash, CDs, or some other very safe investment. So, only 30% of your money is in actual stocks!

That’s exactly what I talked about being a bad thing. Even 5 years before retirement is 40% bonds and 20% short-term. That’s just scary.

If you wanted to do a target date fund, maybe set the fund at 10 years after retirement. So, if you want to retire in 2040, get in a 2050 target date fund. That might help the conservatism a bit, but again, you really need to understand what you’re investing in and how the fund is going to be managed.

One-size-fits-all all approaches might fit everyone, but they don’t fit anyone perfectly. Boom. I just thought of that. It might be my new tagline.

Myth 7- 12% Returns are Average

RAMSEYYY! I know that Dave Ramsey says that 12% returns can be used when you’re doing your calculations for returns in the market, but this really, really makes me mad for a few different reasons:

1 – the S&P 500 average since 1950 is 11%, so overshooting by 1% might not seem like a lot, but it is. It’s a huge deal.

2 – this assumes the absolute best and doesn’t include any sort of buffer at all if something bad was to happen. Why does Dave talk about the importance of Emergency Funds? because crap happens, right? Why do you plan for the absolute best return and not build in any conservatism? Makes no sense

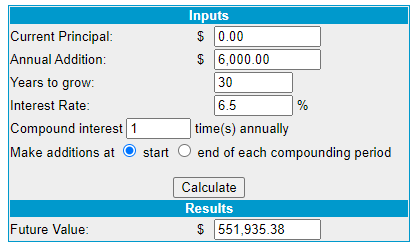

3 – This doesn’t take inflation into account at all. I know that I often say to bank on 8% but that’s because I am building in some conservatism and then also building in some inflationary risk. When I actually sit down and talk about looking at a true apples-to-apples retirement number, I recommend using something like 6.5% for your return rate. 6.5% builds in 2% of market fluctuation from the average and 2.5% of inflation. In other words – extra safe!

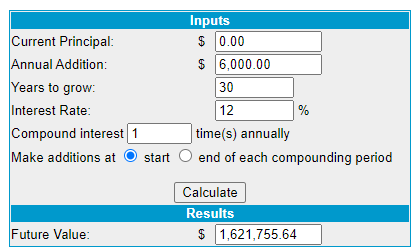

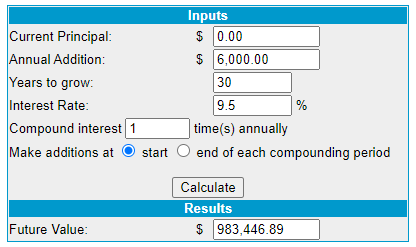

Maxing out a Roth IRA at $6K/year for 30 years, using Dave’s 12%, you’d have a nice nest egg at the end:

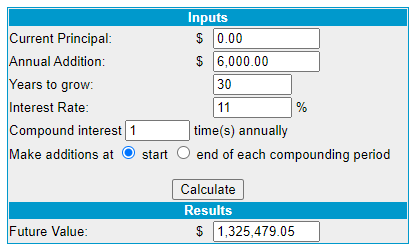

Well, as I said, the S&P 500 average is actually 11%, so you’re really looking at something that’s about $300K LESS! OUCHY MAMA!

And then, if you take a 2.5% inflation rate into account, you’re going low low low low low low low low low (T-Pain voice):

It might be a bit depressing to see how much lower this real number is, especially since I would use the 6.5% like I mentioned, and that’s even worse:

But you know what’s more depressing than coming to this realization now? Coming to this same realization when you’re about to retire and finding out that your plan has been destined for failure from the get-go! And that it was 100% preventable. That’s why I’m here to help!

Myth 8- Investing Takes Too Much Time

This is nonsense! If time is really the issue, you can hire an advisor or even just put the money in ETFs, but I highly doubt time is the issue. Investing is too important not to do, so you need to make the time, even if that means that you’re outsourcing it and the time is simply taking the time to go to meetings with your advisor.

You need to be involved in the process because you’re the one it effects, but if you can get 8%/year on your 401k or all total investments, eventually, that yearly return likely will be more than you make in a year!

And you’re telling me that you don’t have time?

Nonsense. Make the time!

Myth 9- You Can’t Beat the Market

WRONG! You absolutely can beat the market. Sure, it’s tough, and many experts can’t do it, but I really think that it just takes some time, willingness to learn, and some education. Take the time to learn from blogs, podcasts, YouTube, Instagram, Twitter, anything!

Take the time to completely fail when you’re investing and then learn from it. Make stupid mistakes. Take gambles. Speculate. Read books. Watch CNBC. Love Buffett. Think that Buffett has lost a step. Learn ratios and financials.

Do anything and everything possible! The key is trying to learn as much as you can from as many sources as you can so you have a great foundation and then you can build on it. Then you can build your own opinions about things and invest with your own strategy.

Personally, I got my start with the Investing for Beginners Podcast, and I simply reached out to Andrew to tell him how much I loved it and if he had an interest in me writing content from an actual beginner perspective and it was a good fit. Doing that, I was able to find a mentor, per se, to really help me learn even more about investing.

I am a huge fan of the VTI and think that it’s a great way to quickly see if a company is a value-trap or not, which is pretty important to know when you’re about to invest! But I have been able to gather a ton of great opinions and info and it has helped me beat the market so far in my journey.

Of course, some of it is luck – it always is. But I also like to think that a lot of it is my intense, insatiable desire to learn more and continuously become a better investor.

Hopefully, I have been able to shift your mind totally and now you have a new opinion on these nonsense myths that you have been told for years. Don’t worry, Handy Andy is here – Debunker of the Universe!

Related posts:

- Series I Bond Guide: How to Buy One and What Returns to Expect Updated 3/24/2023 Today’s historically low interest rates drive many investors to search for better returns than banks offer today. Many of us looking for safe...

- Do You Know The Total Expense of Your Investments? “It’s a Must!” When I first started reading Money Master the Game by Tony Robbins, I honestly thought the book was starting off like it was a motivational...

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- A Guide to Investing for Beginners— Your Path to Financial Freedom “Investing is the process of laying out money now to receive more money in the future.” Warren Buffett Most people think they need thousands or...