Today I will show you some easy ways to find great investment ideas.

These ideas will help you grow your wealth; best of all, they are free!

Using free stock screeners, financial websites, podcasts, and many more resources to find fantastic investment ideas is the start of building a great portfolio.

Today we will explore the following:

- Free stock screeners

- 52 Week Lows

- Cloning Guru Portfolios

- Insider Buying

- Financial Websites

- Podcasts

Ok, enough chit-chat; let’s dive in.

Free Stock Screeners

In the never-ending quest for finding stock investment ideas, stock screeners are the number one source of investment ideas, at least in my world.

Using a screener to find ideas to investigate is the first step in finding an idea I want to buy with my investment budget.

Today we will discuss some of the screeners I use and others I have investigated along the way to settle on the few I use.

My suggestion is to experiment with them and try them before settling on the ones that best fit your needs. At this stage of the game, I focus on the ones that limit my costs; the leg work of investigation is on me, but I try to limit spending money on researching ideas to help put my money where it needs to go, and that is my investment.

When using screeners, I try to follow the same process with each; not all of them will allow you to adapt them to your investment process. For example, I use fundamentals to begin my screening processes, such as a low P/E ratio or low debt to equity. These items are critical to me, as I don’t want to find an excellent possible investment, and the company is drowning in debt.

The trick with stock screeners is to use them to eliminate ideas that won’t fit your investment criteria, reducing the impacts of overwhelm or analysis paralysis.

In today’s post, I will not discuss in depth the fundamental metrics I use to screen for stocks precisely; if you would like to learn more about those metrics, please go here for a fantastic starter guide.

Ok, let’s look at our first screener.

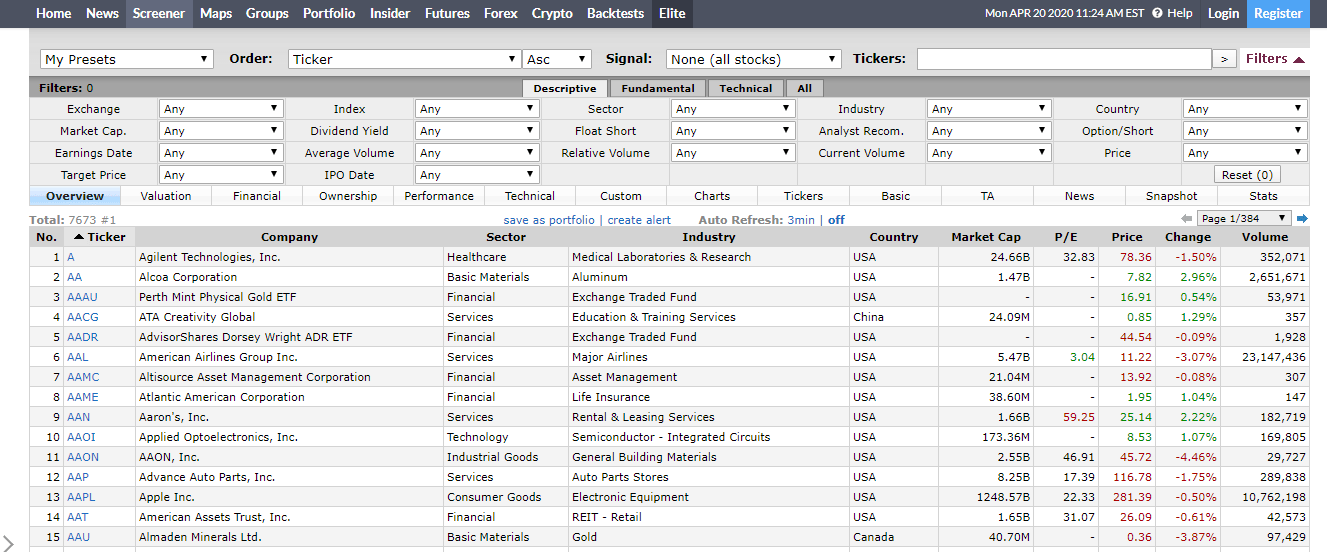

I have used Finviz for years, and it has remained unchanged. It has multiple advantages and it is effortless to use. Like most websites, they have a premium aspect to them, but I have found the free elements of the site to be more than sufficient for my process.

Every Monday for about six years, I visited the Finviz site, set up my screen, and looked for investment ideas. But not every session produced a successful result, often yielding the same companies. But the consistency of the process helped provide constant investment ideas.

Finviz allows me to alter the fundamentals that I screen with; for example, if I struggle to find ideas, I might expand my P/E ratio from below 20 to less than 30, which opens up more possibilities.

I also like the ability to filter out companies outside the U.S. You can also decide what kind of market cap companies you want to screen, as well as what dividend yields. The list goes on and on.

The dropdowns on the site give you more control than some screeners, which operate with predetermined screeners and don’t allow alterations; one of the features I like best. But it does restrain us because you can’t put in specific numbers, but that’s not a deal breaker. I use Finviz to find ideas; then, I will look at specifics.

Finviz also allows you to set up portfolios you can track on the site, enabling you to set up wishlists you can follow.

Again, these finviz features remain free; you can register if you like, giving you more functionality but remaining free. They do have an Elite plan for the more serious traders.

Schwab Brokerage

If you aren’t already using your brokerage account screener, I encourage you to look. Tradeking and Ally didn’t do much to improve their screening tool.

Since I switched to Schwab, I have been using their screener included with my brokerage account, which is free to open and trade with now that trading fees have gone the way of the dodo bird.

As with Finviz, my Schwab screener allows me to screen using the fundamentals I like. It also allows creating different watchlists because it links to my brokerage account; once I find an actionable idea, I can buy it directly from the report, pretty cool.

I have recently started using this tool to widen my net in an effort to find more investment ideas.

Again, all brokerage accounts will offer this service; some will be better than others.

I receive zero financial compensation for any of these suggestions, so please use whichever fits best for your investment process.

Stock Rover

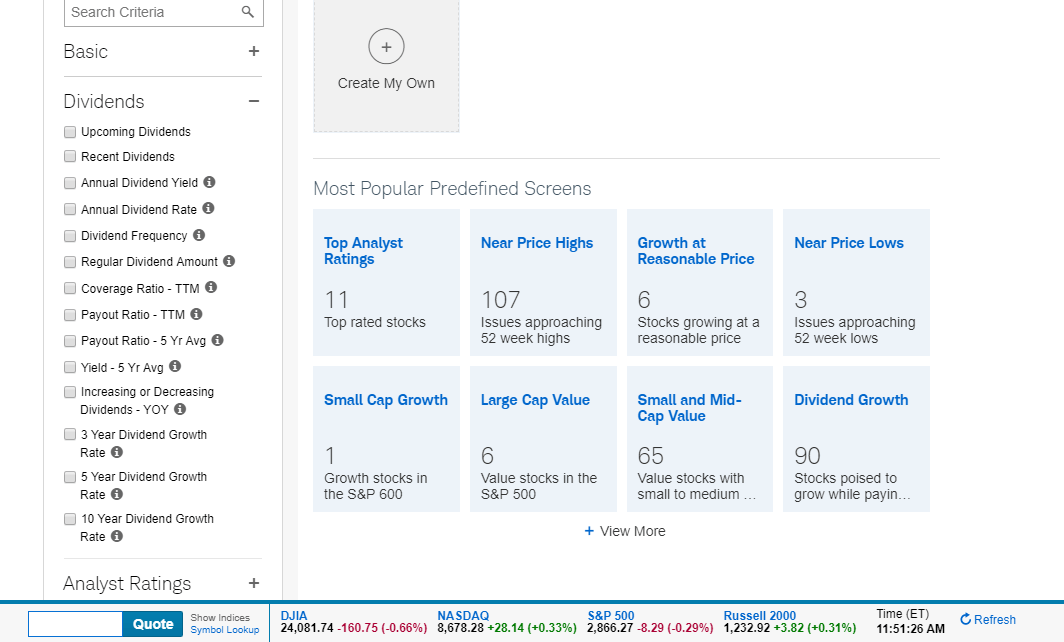

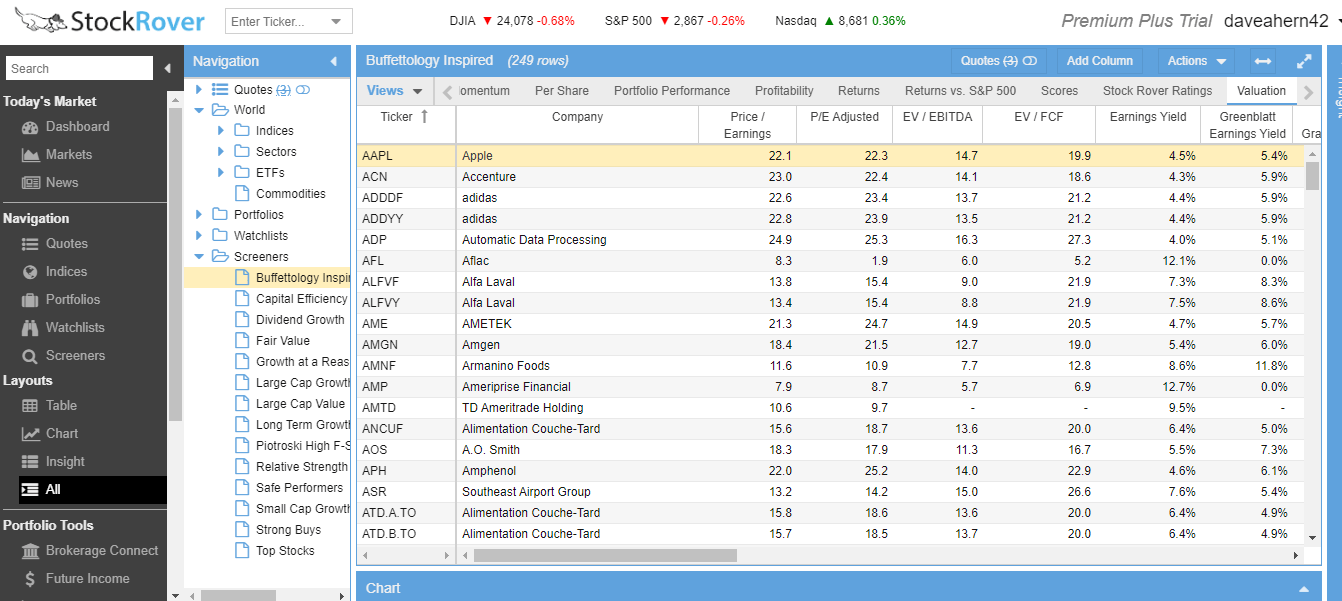

Another service that was mentioned over and over in my research for this article is Stock Rover. Stock Rover requires registration, but it is also free. They have a premium service for further research if you so choose.

I have just started delving into their service, and I like it quite a bit; they have some cool predetermined screens, such as the Buffetology, which is right up my alley.

If you hover over any of the sections, it will give you more detail on what the screens entail and what fundamentals they consider when setting up the filters.

The few flaws I see for me: the lack of ability to filter out companies from other countries. I like to focus on my home country, not necessarily for patriotic reasons, but mostly because that is what I know and am comfortable buying.

The other downside remains the inability to screen for specific fundamental ratios such as debt to equity, P/E, P/B, and so on, but those are minor issues.

Again, the screeners’ focus helps me find potentially undervalued companies for me to research; I don’t use these screeners as vehicles to find companies to buy, and please don’t use them as such. Instead, we should use them as part of your more extensive process.

52 Week Lows

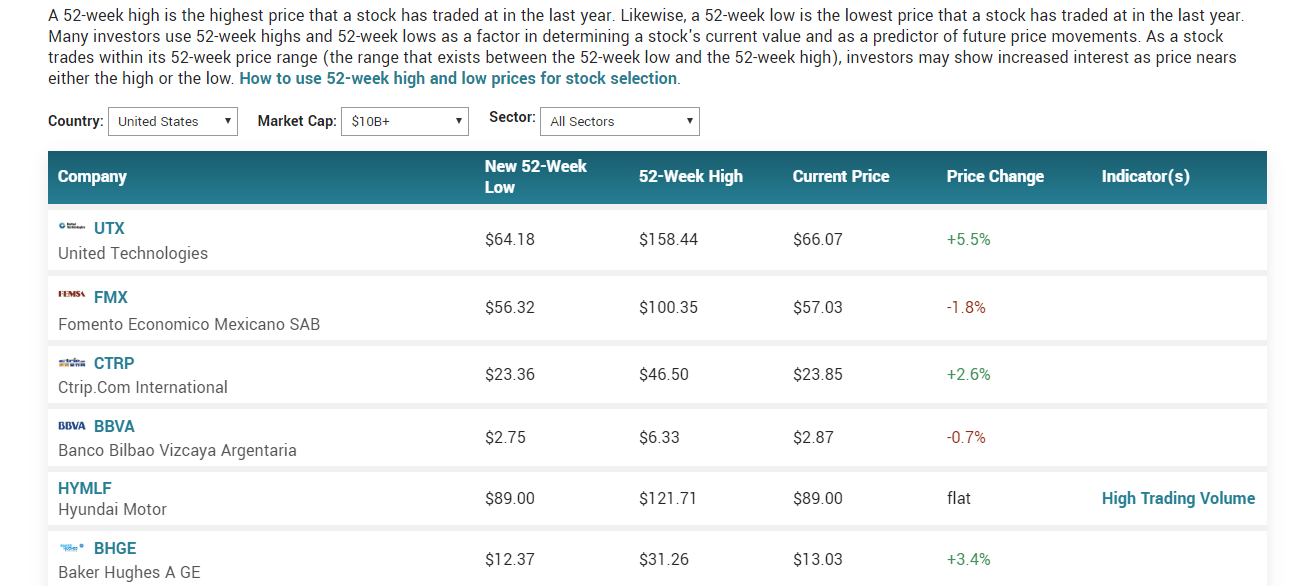

The 52-week low is as simple as it sounds; we are looking for companies trading at their 52-week low.

Day traders use these 52-week lows as technical indicators. But for value investors, it can offer us a place to mine for undervalued companies. I found this idea from Mohnish Pabrai, who used it as a tool at one point to find investment ideas.

The idea evolves around the idea the company trades at the lowest price it has sold for 365 days; it refers to the previous day’s closing price.

I use the site MarketBeat to find the 52-week lows, which is part of the process I use every Monday to find investment ideas. Several other decent websites, such as Yahoo Finance, offer this screening.

The idea behind looking for companies trading at 52-week lows is to find a company beaten down in price over the year and has fallen out of favor with Wall Street.

That doesn’t necessarily mean the company is terrible, but it also could. Take financials or the oil industry right now; they are getting beaten up because of low-interest rates, meager oil prices, and lack of demand.

Not every company you run across on this list will be a winner; in fact, most will not, but it offers us an excellent opportunity to find undervalued companies.

And to me, if it is good enough for Mohnish Pabrai, then it is good enough for me.

Cloning Guru Portfolios

Cloning or coat-tailing the investors we look up to remains one of the more practical aspects of investing. Warren Buffett admits to copying many of Ben Graham’s methods and stock ideas in his early days.

Cloning other gurus’ portfolios remains a quick, easy way to build your portfolios. Plumbing their ideas offers us a great way to find companies to investigate.

Many more famous investors have extolled the benefits of cloning, such as Buffett, Charlie Munger, and Mohnish Pabrai.

Pabrai remains probably the most unabashed champion of this idea, as he has followed Munger’s investment ideas for years and used his influence to find great investments.

Remember that buying a company just because your favorite investor bought it can be hazardous if you don’t understand the reason for the purchase.

As Pabrai has many times, I suggest using our gurus as an investment screen and then doing our research on top of their suggestions.

This type of screening works best for value investors; when looking for companies to investigate, it remains best to look for gurus with a long-term strategy who don’t trade in and out of companies quickly, taxes being the main reason. Keeping fees down remains essential; lessening your capital gains by holding your stocks will improve your long-term success.

Studies have shown that shamelessly cloning some of the more famous value investor portfolios based on their 13F filings has proven successful over the long term.

To find out what your favorite guru is buying, there are several places you can look.

One includes looking at their 13F filings, released every quarter; these filings list their current portfolios as of the filing dates. These remain free to the public and a great source of information.

Other options include Whale Wisdom and Insider Monkey.

The information we receive from 13F filings is 45 days from the end of the quarter, meaning the date we act on is dated, indicating the company you might want to buy could have dropped or risen substantially in those 45 days.

I like to use the idea of cloning as a source of investment ideas, not necessarily to build a portfolio, although the approach has some validity.

Insider Buying

In today’s stock market, with the chaos around us, finding insiders buying up their companies’ stock is reassuring and an indication that they feel the company trades for less than fair value.

Knowing who knows their company best, anyone intimately involved, such as the CEO, CFO, COO, and so on, would be a great indicator as to how the company is performing, and much more reliable than Wall Street may indicate.

Remember, price does not equal value, and if a company or sector has fallen out of favor, it doesn’t mean the company has poor prospects or is going out of business. It may mean something fundamentally wrong is going on, such as low-interest rates or oil demand.

Using that tidbit of information is a great place to look for potential companies to research.

My favorite website to look for insider buying remains gurufocus.com; one of their calling cards tracks what gurus do, as well as tracking any insider buying or selling of shares by upper management.

The SEC requires filing a form 4 for any insider buying or selling, and you can receive these alerts by signing up for them on a company’s website. In fact, you can receive alerts of any SEC filing from that company through the website.

Financial Websites

Another great source of investment ideas is your favorite financial websites. On those sites, you will find great information on a company’s financials, along with screeners.

But another idea is to look at companies written about; for example, one of my favorites is Seeking Alpha. Seeking Alpha has zillions of articles written on just about every company. Many write from a buy-side point of view, but they also represent the sell-side.

For example, Tesla is a hot topic on the site, and you will see a wide range of views about the company there. Along with the excellent analysis you can find from the authors, there are some nuggets you can plum from the comments to these articles as well.

For example, I was reading through the comments; you can find other thoughts on the company that the analysts didn’t cover, as well as other suggestions of other companies to investigate.

An article that I wrote about Chubb, an insurance company, had a suggestion to look deeper into Prudential, which I did.

Looking at the number of articles written about a particular company can give you ideas of possible research targets.

In addition to all the great analysis, you can also find financials for each company. My particular favorite for additional investing ideas comes from the Peer tab, which lists other peers to the company you are investigating.

Exploring peers to the company you are researching can lead to other great opportunities.

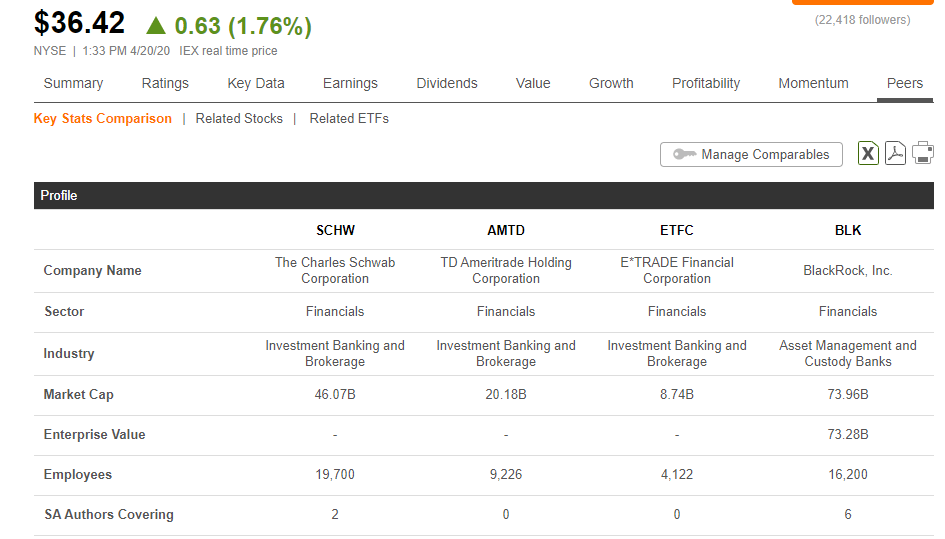

For example, when researching Schwab (SCHW), I can also investigate its peers to see if they might be more promising than Schwab.

As you research any company on Seeking Alpha, you can click on the Peers tab to get new companies that might offer an opportunity.

Gurufocus, which I mentioned above, also offers many excellent areas to cull for investment ideas. Among them are the guru sections following almost any investment manager, beyond the more famous names such as Buffett, Pabrai, Dalio, and many others.

They also have a section on insider buying and selling (which we discussed above), along with a stock screener, which is quite in-depth and offers extensive metrics to choose from, with the ability to select specific numerical targets to screen.

I am a massive fan of this site and use it in conjunction with SEC.gov, Seeking Alpha, and quickfs.net.

Podcasts

Podcasts can be an excellent source of entertainment. But they can also provide investment education, as well as investment ideas.

Take, for example, Motley Fool Money, which has a daily show providing an overview of the markets every week and some commentary on particular sectors and companies they think are interesting.

Another great podcast is The Investors Podcast, run by Preston Pysh and Stig Broderson. Preston and Stig are tremendous Buffett fans and incredibly entertaining; they are also incredibly intelligent and provide fantastic market commentary. They have also lately been discussing intrinsic value with guests pitching different companies.

A great source of investment ideas, plus educational, are the mastermind roundtables they do once a quarter. They invite several guests, besides themselves, to discuss different investment opportunities. One of my favorite roundtable guests is Tobias Carlisle, an incredibly smart value investor with great views on companies I connect with and a great resource.

The last podcast I would be remiss if I didn’t mention is the one I do with Andrew Sather, The Investing for Beginners podcast. Andrew and I discuss many different subjects relating to investing from a beginner’s point of view. Along the way, we try to use real companies in our examples to help contextualize the information. Plus, we come at it from the angle of a beginner and try to talk in a language we can all understand.

Using podcasts as an opportunity to find investment ideas is an underutilized tool. I have seen many ideas for companies that I would have never considered if I hadn’t heard about them on a podcast.

Final Thoughts

As we have seen, multiple areas are available to find investment ideas. Using free stock screeners is one that I use every week; it is part of my weekly process and works for me.

The free stock screeners are probably the best source of ideas I have found, but all the above ideas are great resources to add to your process, which I have done over the years.

You will not find the next Amazon every week; the trick is to create a routine and stick to that routine. Once you discover something interesting, you can begin the research process.

Under no circumstances should you buy a company solely on a screener, recommendation from a Seeking Alpha article, or podcast suggestion.

Always use these ideas as a springboard for your analysis, whatever that may entail.

That is going to wrap up the post today.

As always, thank you for taking the time to read this post, and I hope you find something of value along your investing journey.

If you have any questions or if I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care and stay safe,

Dave

Related posts:

- The Best Free Value and Dividend Stock Screeners Compared: Example Screen The competition for which tool is the best stock screener is intense. Like brokers—there’s many to choose from. Because I’m a proud dividend value investor,...

- Our Favorite (Free) Value Stock Screener: A Comprehensive Guide Chances are that if you have been investing for any period at all, you’ve likely used a value stock screener to try to find certain...

- 3 Simple Steps to Use Stock Market Analysis Tools to Find Great Companies The most common question that I get from new investors is “how do I find stocks to invest in?” Unfortunately, that’s not a simple question...

- The Intelligent Investor: Is it Outdated? Is it for Beginners? Should I Read it? Edited 3/24/2023 Warren Buffett started learning about investing when he was seven or eight. I know a late bloomer. Buffett’s father started a small investment...