Have you heard of the January Effect before? The January Effect is a very common topic this time of year in the investing world where people claim that the best performing month in any single year is January. In other words, the market is going to have the greatest return in January than it would vs. any other month. That’s great and all, but is it true?

First, let’s start at why people think that this is occurs. Far and away, the biggest reason why people think that the January Effect occurs is because people are selling off their stock losses at the end of the year to minimize their taxes. For instance, if you have a stock that you sold earlier in the year where you made $2000, and that was the only stock you sold all year, you’re going to be taxed on that $2000 at either your normal tax rate, or the capital gains tax rate if you held it for less than a year (which is substantially higher)!

But, if you sold a stock that has been a major loser for you, and say you’ve lost $1000 on that stock, now you will only owe taxes on $1000 rather than the $2000 noted above. You can use your losses to cancel out some of your gains to minimize taxes.

So, is this valid reasoning why the market might dip in December as people sell off and then regain in January? Yes, absolutely. But – now that so many people are using tax-sheltered accounts like an IRA, 401K, HSA, and many others, this is becoming less and less prevalent.

The next reason that people give is that mutual fund managers, and even individual investors, are rebalancing their portfolios. The mutual fund managers might be seeking for the biggest winders for the next year while maybe the individual investors are rebalancing their stocks that started at 80/10/10 (stocks/bonds/cash) that now has grown to 90/5/5 so now they’re going to sell 10% of their stocks at year end to get back in cash and bonds and take ac vantage of a tactical asset allocation plan.

I understand this logic as well and I don’t dispute it. I think it’s important to rebalance at least once a year and now maybe more that you’re likely not paying fees on your rebalancing.

But the question is – do either of these reasons generate enough of a reason for January to be the best performing month of the year?

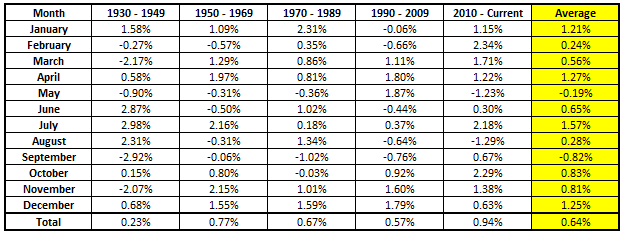

In my analysis, I looked at 20-year time periods starting in 1930 except for 2010 – current, and I compared the return of the S&P 500 vs. other months. Below is a summary of the information:

In all but 1 time period, January drastically outperformed the S&P 500 vs. the average month, which was from 1990 – 2009. That is certainly a good start!

But how did January compare to the other months during that same timeframe?

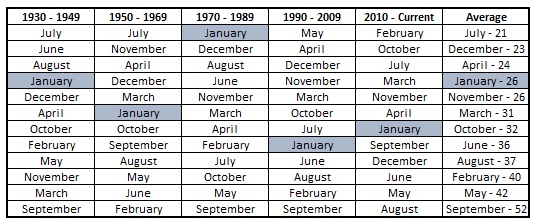

As you can see by the monthly ranking above, January was ranked 4th, 6th, 1st, 8th, and 7th, for a total ranking of a tie for 4th place. How would I describe this ranking?

Meh.

I’ll give it to you; January is a very good month! It is well above the median month of March/October which has a ranking of 30.5 so it’s not bad.

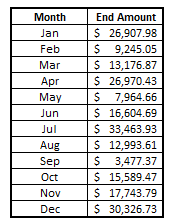

You might be sitting there saying “ok Andy, but this really only shows how months have performed against one another and doesn’t give any context about the percentage of growth that you may have realized.”

Ok – fair point. Let’s look at your returns if you invested $10,000 in 1930, and you bought in the first day of the month and sold out right before the markets closed at the end of the month:

January is still a great month, but it is the 4th best performing month behind July, December and April.

“But Andy – looking at results since 1930 is flawed since that was so long ago.”

Again, fair point! But that doesn’t mean the data is going to be any different.

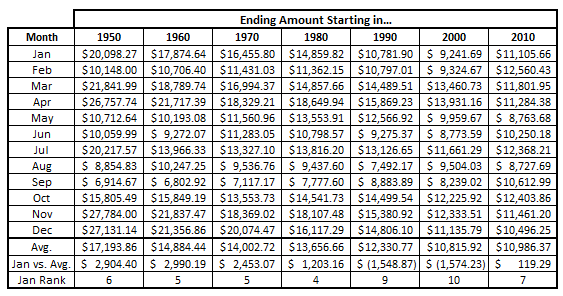

In the chart below, I have broken out how January has compared against other months starting in a certain time period through current day. For instance, the first column is 1950 – current, then 1960 – current, etc.

Two major things stand out to me when looking at this chart:

- January is not special – January is not the strongest performing month, and to be honest, it’s really not even that close

- January might’ve used to be special – but January is old news! As you can see, January performed pretty well towards the average as we were in the earlier stages, such as the 1950’s – 1980’s, but that came to a screeching halt within the last 30 years. This likely is due to the so many people using tax sheltered accounts that the need to sell off in December and buy back in for January doesn’t exist, or at least not nearly as strong as it used to be.

Overall, the January Effect is not a thing. Did it used to be? Quite possibly! But it’s not anymore. January is just an average month when it comes to investing.

Sometimes when investing it’s easy to get caught up in these types of things…you’re almost looking more at trends to try to beat the market instead of relying on the fundamentals and letting your money work for you.

I know it’s easy to get caught up in this type of stuff and it is fun – hell, this is some of the most fun I’ve had writing a blog post! But that doesn’t mean you should partake.

When it really comes down to it, the myth of the January Effect takes me back to my #1 piece of advice – you need to do the numbers yourself and not take things at face value. You must take the time to understand and perform your own research because you’re going to be more invested in your personal finance success than anyone else is!

So, do me a favor – stick to the fundamentals and find undervalued companies at great prices because let’s be honest – I’m sorry, January – but you’re just another, boring, month.

Related posts:

- 5 Historical Stock Market Facts That Can Help Boost Your Returns Investing is tough, right? Wrong! Investing is like anything else – it’s only tough if you don’t know what you’re doing. We’re here to help...

- Stock Market Days Up vs. Down Percentage [Updated] So I was doing some research on the S&P 500 and came across some interesting data. Basically, I wanted to know what the stock market...

- Reason #1 to Invest in the Stock Market? 100 Years of Makin’ Money! Do you like makin’ money? That’s what I thought! Yes, we all do! And guess what – the stock market has 100 years of history...

- Is the Santa Claus Rally a Real Thing? Spoiler – It is! I recently was having a conversation with a coworker where they said that the Santa Claus Rally was one of their favorite times of the...