Johnson & Johnson (JNJ) has been increasing their dividend for many, many years! In fact, that have increased it for 57 consecutive years, and as they’re a member of the S&P 500, that also makes them one of the sacred Dividend Aristocrats that we talk about oh so often! If you stay tuned, I’ll show you how I find Dividend Aristocrats of the Future, but first, lets take a walk through the JNJ dividend history!

It’s incredible when you hear about a company that is able to have such a long period of sustained success growing their dividend. When you think about all that has gone down in 57 years you will really be shocked with all of the market downturns that they have been able to successfully navigate without shrinking their dividend.

Sure, dividends are just one aspect of importance, but the ability to find a company that is going to continue to grow its dividend is the definition of compound interest because you then can DRIP those dividends right back into future shares of the stock!

I have heard some people say that they don’t like companies that pay dividends and some that say that they only like companies that pay dividends. For me, it depends if I am wanting to be risky or if I want to be conservative, or if I’m playing for the short-term or the long-term.

I view a dividend as a bird in the hand. Sure, you can want your company to keep the earnings to continually reinvest and potentially try to reinvest into the company but that could mean that they’re doing things like buying back shares or investing in the company in a very inefficient way, which is the opposite of what Visa and Mastercard do.

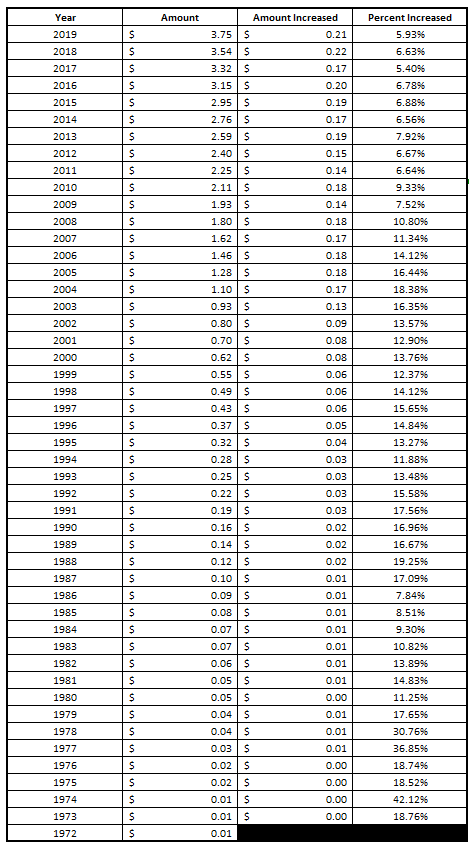

Let’s take a look at this JNJ history and see how things have trended for them in the recent past!

As you can see in that monster of a chart, JNJ has increased their dividend since 1972! That is just insane. Now, if you look at the ‘Amount Increased’ column then you’re going to see that some years didn’t increase, but they actually did, it was just that the decimal was so small that it didn’t register. The next column to the right titled ‘Percent Increased’ shows you how much it increased, and they’re actually some pretty hefty increases!

Companies will typically pay out a dividend on a fixed dollar amount/year rather than a percentage of their earnings, or their payout ratio, which I don’t really like and wish it was the other way, but it at least allows us to plan better! As you might expect, the percent that the dividend payout decreased from year to year as the actual payment amount increased.

For that exact reason, I really like to try to find companies that I think will be dividend aristocrats at some point but are still on their way right now! I find that doing so will allow me the perfect combination of getting a company with a lot of growth potential and still capitalizing on the future opportunity for them to be a long-term dividend payer.

Another incredibly important ratio to know when looking at a dividend stock is the dividend yield. You’ve likely heard some people say, “Don’t Chase Yield” and that is great advice! It’s so great that I even say it myself!

That sounded pretentious lol.

I often hear some people say that they will invest in a stock because it has an 8%, 10% 12% dividend yield! Yeah, that would be absolutely amazing…if the company could actually afford it. The S&P 500 average for a dividend yield is about 2% so if a company is giving 12% then they’re likely a REIT, an MLP, or a company that is destined for failure.

The dividend yield is simply the dividend paid / earnings of the company. So, if a shareholder is paid $1/share in dividends and the company earned $50/share in earnings, or EPS, then the dividend yield was 2%, which is a respectable ratio and in line with the S&P 500.

For a company to get up to a 12% yield, they would either need to drastically increase their dividend, which is very unlikely as it makes it a higher hurdle to clear in future years, or their earnings must drop rapidly. For instance, if that same company was still paying $1/share in dividends, then that company’s earnings would need to drop to $8.33 on an EPS basis.

If the company’s earnings have literally cut in third then the future outlook of that company is not…well…bright. You should look out for them to either cut their dividend, which is probably preferred here, or pull the usual move and give their executives a huge bonus and then go bankrupt.

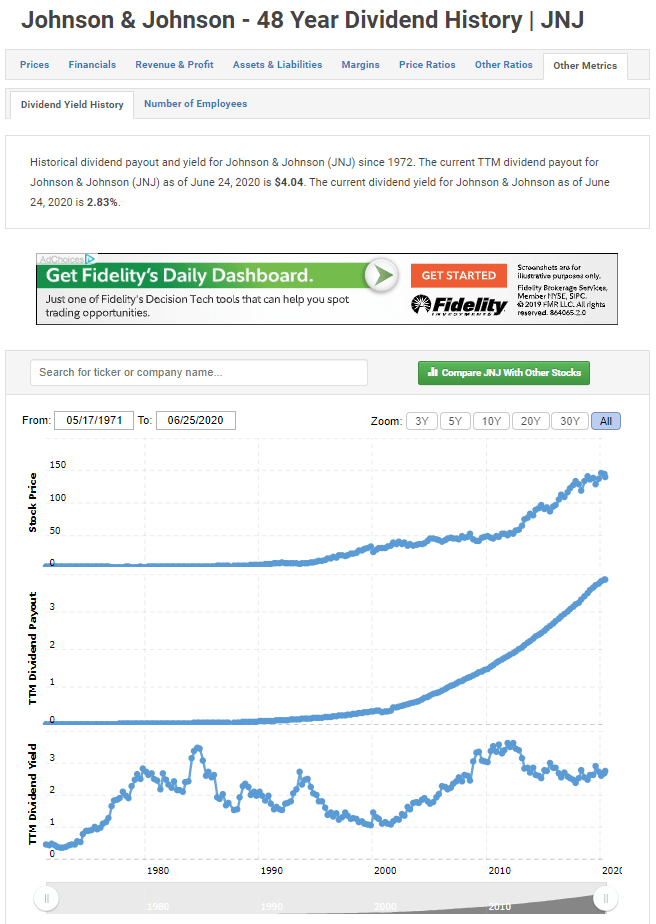

For this reason, I think that it’s super important to understand the historical dividend yield of a company. To do this, I like to go to Macrotrends because they have a ton of data, in a great format that is easy to ready, and it’s completely free! All I did was type in JNJ and then go to the ‘Other Metrics’ tab, then ‘Dividend Yield History’ and then I could see how JNJ has trended over time:

The main things that I am looking for here is to make sure that things are on a pretty steady path, but still an upward trajectory, and that there isn’t a ton of volatility.

There’s enough volatility in the market as it is – I don’t need it in my dividends, too.

So, since the dividend yield has never really been under 1% and it typically stays under 3%, then I think that this stock is likely going to keep their dividend payments right in this same range. However, the payout ratio is something that caught my eye because the payout ratio is continuing to increase.

The last ten years of their dividends have been averaging about a 7% increase, so if the payout ratio is increasing, meaning they’re paying more of their earnings to dividends than they used to, it means that their earnings are increasing at a rate less than 7%. Not necessarily a concern but trying to show you the things that I look at when I’m considering investing!

So, JNJ has shown a very long track record of sustained dividend growth and looks to be very stable! To me, it’s likely a bit too conservative of a stock pick, but I would never make that decision without first checking out the financial with the Value Trap Indicator.

I mentioned before that I am a big fan of trying to find these Dividend Aristocrats of the Future – let me show you why!

Related posts:

- A Look Through 3M (MMM) Dividend History If you’ve been following my posts at all, you probably see that I cover a lot of different topics, so it should be of absolutely...

- [S&P 500] Average Valuation Multiples by Industry: P/E, P/FCF, P/S, P/B, PEG There are many valuation multiples which investors use to compare stocks with their peers in an industry. This post displays the mostly commonly used valuation...

- AOS: Dividend Aristocrat’s Phenomenal 25 Year Track Record In the most recent episode of the Investing for Beginners Podcast with Andrew and Dave, they talked about some of the companies that have recently...

- Realty Income (O) Dividend History: Monthly Income, Long Track Record Realty Income Co (O) is a company that has a really strong focus on providing dividend value to their shareholders, and honestly, I see the...