Comparing price and enterprise multiples across investment alternatives is a good place to start when analyzing a company. Using the justified approach to calculating multiples can shed additional light on if the company’s market price can be “justified” based on fundamentals.

The justified method can also help investors and analysts break down the current multiple valuations being paid in the market by plugging different inputs/assumptions into the formulae and then using algebra to solve for the missing piece such as growth, ROE, discount rate, etc.

This article will discuss a few of the main justified multiples and use Walmart as an example to to see if its valuation can be “justified”.

Here is what the justified multiples valuation will imply:

- When the justified multiple ratio is closely comparable to the market multiple, the implication would be that the stock is fairly value.

- If the justified ratio is higher than the market multiple, the implication would be that the stock is undervalued.

- If the justified ratio is lower than the market multiple, the implication would be that the stock is overvalued.

Now that we have covered the implications, let’s get into how to calculate some of the most common price and enterprise multiples using the justified approach. As we look at the formulae, keep in mind that they are not using dollar figures but are instead using percentages to derive the multiple ratio.

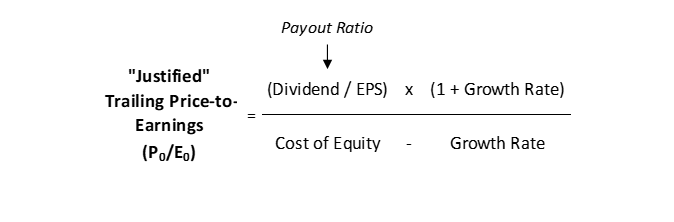

- “Justified” Trailing Price/Earnings – Studious investors will notice the similarity of the formula to the Gordon Growth Model (GGM) which is a form of a dividend Discount Model (DDM). However, instead of using the dollar value of dividends, the formula uses the dividend payout rate in a percentage form by dividing the dividend in dollar form by the EPS figure. The formula then adds growth to the dividend payout rate in the numerator before dividing by the discount rate less the growth rate in the denominator.

Fundamental Relationships of the P/E Ratio:

- Inversely related to the cost of equity (the required rate of return on equity) which means that the higher the cost of equity, the lower the P/E ratio will be.

- Positively related to the growth rate, which means that the higher the growth rate, the higher the P/E ratio will be.

- Positively related to the payout ratio, which means that the higher the proportion of earnings paid out, the higher the P/E ratio will be.

Side Note: By converting the dividend in dollar form to a payout ratio in percentage form, the GGM formula is transformed into a justified trailing P/E ratio. The GGM model solves for the Price (“P”) of the security but if we divide both sides of the formula by Earnings (“E”), we now get a price/earnings (“P/E”) ratio.

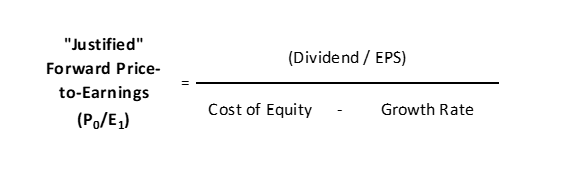

- “Justified” Forward Price/Earnings (P/E) – The formula for the justified forward P/E ratio is almost exactly the same as that of the trailing P/E ratio except that the numerator in the formula no longer increases the payout ratio by the growth rate. What this difference accomplishes is making the numerator in the justified forward P/E ratio smaller compared the justified trailing P/E ratio. Unless growth is negative, the forward P/E ratio should always be less than the trailing P/E ratio and that is accomplished by the absence of the growth rate in the numerator.

Example with the Justified P/E of Walmart

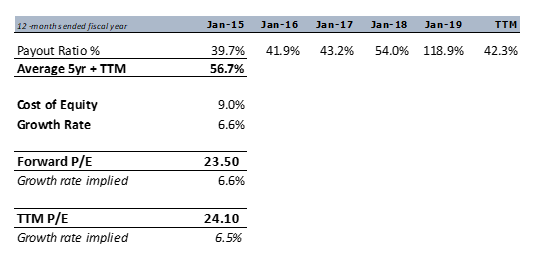

For all those visual learners out there let’s look at Walmart as an example. As of the writing of this article, November 19th, 2019, Walmart is currently trading at about 24.10 TTM P/E and 23.5 Forward P/E. According to Morningstar, the company’s average payout ratio over the past 5 years and TTM period has been 56.7%.

We will use a 9% cost of equity to represent the opportunity cost of missing out on long-term historic equity market returns. Now using the current price, we can solve for what kind of growth rate the market is currently pricing into Walmart.

After running the calculations, we can see that the implied growth, given our other inputs, is 6.5% for the TTM P/E and 6.6% for the forward P/E. Given Walmart’s actual 1.6% average growth rate of revenue over the past 5 years, an investor might come to the conclusion that the implied growth rate of 6.6% is too unrealistic and that Walmart is overvalued at the current P/E multiple.

Side Note: We have only solved for growth but an investor could infer different fundamental elements of the valuation by inputting different variables such as using a lower total cost of equity to make up for low risk-free rates or, adjusting the earnings and payout ratio for one-time items.

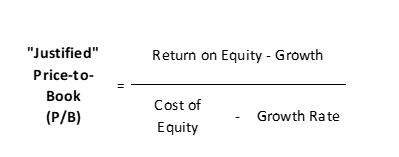

- “Justified” Price-to-Book Value (P/B) – This ratio is probably one of my favourites due to the fundamental comparisons at its core between return on equity (ROE) and the cost of equity (also referred to as the required return on equity). The output of the P/B formula is a multiple of how much the equity of the business is being valued at. As can be seen from the formula below, one can also adjust to make assumptions about growth just like in the P/E formula. Growth is included in the numerator and subtracted in the denominator to adjust for growth from the estimated rates of return.

Fundamental Relationships of the Price-to-Book Ratio:

The result of the calculation is that if ROE is equal to the cost of equity, the company would be fairly valued around 1.0x P/B.

- If a company is able to earn a higher return than their cost of equity, this company would rightly be able to command a price greater than 1.0x book value.

- On the other hand, a subpar company with inadequate returns should be trading below 1.0x P/B.

Examining the Justified P/B of Walmart

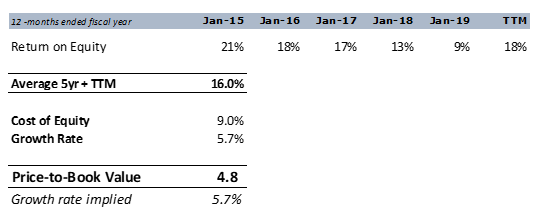

Continuing on with Walmart as an example, let’s see if the market P/B level of 4.8x can be justified. Using trusty Morningstar data, we can quickly learn that the past 5 year and TTM average ROE is 16.0%. The same historical approximate 9.0% cost of equity will be used and we will solve for the required growth rate.

As can be seen below, the market’s current price to book value of 4.8x would imply a growth rate of 5.7% given our other inputs. An investor could also conclude that since Walmart has a strong ROE averaging 16.0%, it will likely always trade above book value.

Wrap-up Using All Actual Inputs to Solve for Valuation

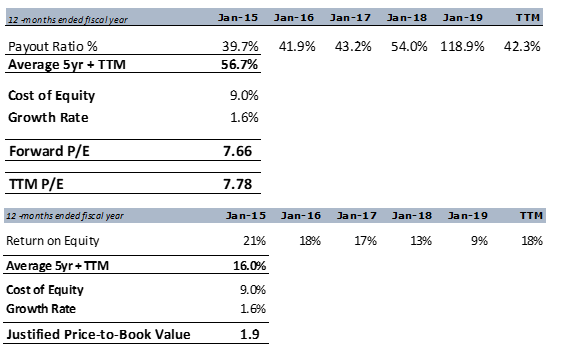

As one final example for some fun, let’s input Walmart’s actual average revenue growth rate of 1.6% over the past 5 years along with the 9% cost of equity, actual 56.7% dividend payout and actual 16.0% return on equity. We will see below what valuation is implied when using the actual fundamental ratios for this 5 year period.

As can be seen, Walmart’s valuation could “justifiably” be fairly valued at 7.7x forward P/E, 7.8x TTM P/E or 1.9x P/B based on the inputs with a 1.6% growth rate.

These multiples make Walmart look far overpriced in today’s market and investors might want to go back and re-examine the inputs to do some sensitivity analysis.

The justified multiples approach provides a powerful way to break down the market valuation into its fundamental elements.

Related posts:

- Valuation Basics: Market vs Book Value – and The Argument for Both When performing a DCF valuation, you must make a distinction between using market vs book value for debt. It is a critical part of calculating...

- Calculating Growth: Internal Growth Rate vs Sustainable Growth Rate There are more than a couple of methods which can be used to get an estimate of the growth rate for a company. Some can...

- How to Calculate Market Value of Debt (With Real-Life Examples) Updated 6/24/2023 Companies need financial capital to operate their business. Many companies raise capital by issuing debt securities (bonds) or selling stock. The amount of...

- Tobin Q Ratio – CFA Level 3 The Tobin Q ratio is an asset-based valuation model that has found its way into many value investor’s playbooks due to its economic logic based...