Kontoor Brands (KTB) announced its first-quarter results on May 7, 2020. The following report will be a summary of those results for the first quarter. No opinion will be offered, and the data will be culled from the latest 10-q.

Numbers from the First Quarter 2020

- Market Cap – $1.08 Billion

- Enterprise Value – $2.08 Billion

- P/E TTM – 13.79

- Earnings Per Share TTM – $1.37

- Dividends Per Share – $1.68

- Return on Equity – 22.21%

- Return on Assets – 4.37%

- Return on Invested Capital – 10.90%

Overview

- Kontoor reported quarter one revenue of $504 million

- Adjusted earnings per share of $0.27 and GAAP earnings of $(0.05) for the first quarter.

- Wholesale revenue declined due to store closures in the first quarter as a result of Covid-19. Digital sales saw an increase of 10 percent and a 41 percent increase in digital whole in the U.S. for the quarter.

- Kontoor amended the credit facility to give the company leverage relief in upcoming periods.

- Likewise temporarily suspended the dividend alongside the credit facility amendment to provide more flexibility

- The company reported significant disruption to revenue and profit as a direct result of Covid-19.

First Quarter of 2020 Income Statement Review

As stated earlier, Kontoor Brands reported that Covid-19 severely impacted the revenue for the first quarter of 2020. The company believes that these impacts are short-term and the initiatives and strategies that they have established before Covid-19 will see them return to the levels prior to the outbreak.

Unless otherwise stated, Kontoor is reporting all growth rates on an adjusted basis.

For the first-quarter revenue declined to $504 million, a 22 percent decrease year-over-year. And comparing that to the first quarter of 2019, that decline was 19 percent. The company attributes the declines to Covid-19 and store closures and stay-at-home orders.

Revenues for the U.S. were down to $379 million, which was a decrease of 16 percent for the first quarter of 2020. Comparing those results to the first quarter of 2019, and you see a decline of 14 percent, which is a direct impact of Covid-19. Offsetting these declines was the growth in U.S. digital wholesale, which saw a growth of 41 percent.

Kontoor reported that international revenue was down 37 percent for a total of $126 million. Comparing that to the first-quarter revenue of 2019 was a decline of 34 percent, again a direct result of Covid-19 with China’s results being the most impacted.

Wrangler brand global revenue declined by 18 percent for a total of $303 million, which, when compared with the first quarter of 2019, was a decline of 17 percent and the U.S. revenue decline of 14% comparatively. The declines were a result of Covid-19, planned exit strategies from select non-core items, and distressed sales.

Lee brand global revenue also saw a decline of 50 percent for a total of $18 million for the first quarter of 2020. Comparing to the first quarter of 2019 saw a decrease of 30 percent. The declines were driven by Covid-19, planned reductions in the sale of goods manufactured by third parties, and Rock & Republic.

Kontoor Brands saw a reduction of the gross margin to 37.8 percent, a drop of 30 basis points for the first quarter of 2020. Declines were driven by increases in inventory provisions to the tune of 340 basis points. The geographic mix also had a hand in the decline in gross margin with the impact being felt most in China for a total of 210 basis points. There were an additional 40 basis points of decline from the closure of plants to help reduce inventory in the short-term to match the decline in demand. Offsetting the declines by 200 basis points were improvements from a restructuring of quality-of-sales initiatives, pricing, product cost enhancements, and improving the channel mix.

The line item for SG&A (Selling, General & Administrative) reported expenses of $191 million. Adjusted, the SG&A was $170 million, which was down $22 million from the first quarter of 2019, and up 310 basis points to 33.6 percent of revenue.

Kontoor reported an operating loss on reported income of $(0.02) million with an adjusted operating income of $22 million. All of which was down from $68 million from the comparable quarter of 2019. The adjusted operating margin decreased 4.4 percent, which was driven by increased inventory provisions, allowances for credit losses, and a fixed cost of de-leveraging of lower sales. All of this more than offset improvements in restructuring cost savings and quality-of-sales initiatives.

EBITDA ( Earnings Before Interest, Tax, Depreciation, and Amortization) as a reported basis was $6.8 million, with adjusted EBITDA of $30 million. The reported basis of EBITDA declined to 1.3 percent of revenue, and the adjusted EBITDA margin declined 610 basis points to 5.9 percent of revenue. All of which coincides with the impacts of Covid-19.

Balance Sheet Review for First-Quarter 2020

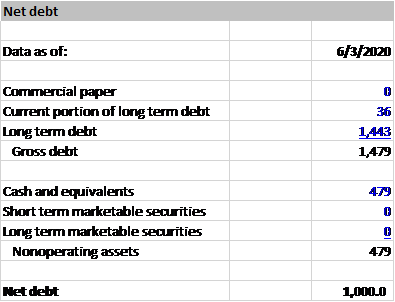

Kontoor ended the first quarter of 2020 with $479 million of cash and cash equivalents and about $1.4 billion in total long-term debt.

During the first quarter of 2020, Kontoor paid a cash dividend of $0.56 per share. And they ended the first quarter of 2020 with $489 million in inventory, down 6 percent when compared the prior quarter of 2019.

Terms of the amended credit facility:

- Covenant relief in upcoming quarters of the second and third of 5.5x for each quarter, and 5x in the fourth quarter of 2020. Scaling down to 4.5x in the first quarter of 2021, and 4x in the second quarter of 2021.

- Minimum liquidity of $200 million through the end of the second quarter or earlier, provided certain requirements are met.

- Plus, the suspension of the second and third quarter dividend payments of 2020, with “restricted payments”, including dividends, which would be permitted provided certain requirements are met.

Outlook

Kontoor Brands is withdrawing any future guidance for the rest of 2020 due to the uncertainty surrounding the business as a result of Covid-19. Including suspension of the dividend for the second and third quarter of 2020, there will be no share repurchases as well.

The company has performed multiple stress tests to ensure the current liquidity will meet the short-term needs of the company and is confident that they are in a good position to be ready for the economic recovery whenever that might occur.

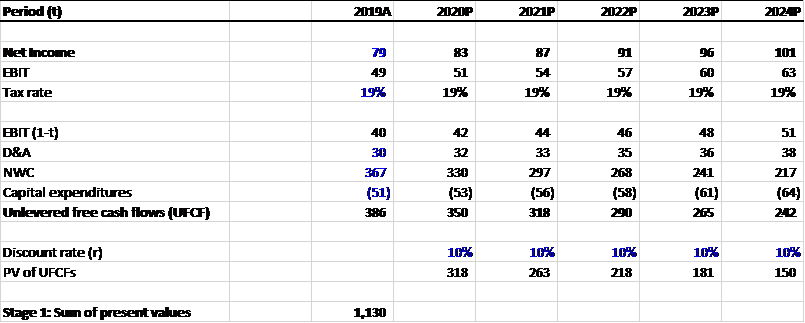

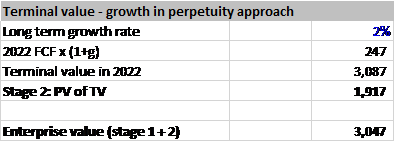

Valuation

Below will be a discounted cash flow valuation of Kontoor Brands based on the latest information available and will include numbers from the trailing twelve months or TTM. The valuation is not meant to be a guide for buying or selling shares of the company, rather as a tool to use for your own analysis.

Growth Rate of Free Cash Flow – 5%

Discount Rate – 10%

Terminal Growth Rate – 2%

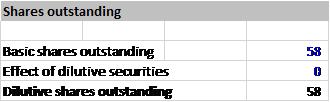

For a range of discount rates:

9% – 42.33

10% – $35.36

11% – $29.92

Final Thoughts

That wraps up our summary of the first quarter 10Q results for Kontoor Brands. No opinions were offered on the results, rather this guide is meant to be helpful getting an overview of the performance of the quarter.

Thanks for reading and I hope you find some value in this work.

Take care and be safe out there,

Dave

Related posts:

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...

- Markel 10Q Summary First-Quarter 2020 Markel 10Q Summary Markel (MKL) reported first-quarter earnings on April 28, 2020, for the quarter ending March 30, 2020. The following report is a summary...

- Nike 10Q Summary Fourth-Quarter 2020 Nike (NKE) announced results for the fourth quarter of 2020 on May 31, 2020. The following report is a summary of those results for Nike...

- Cisco 10Q Summary Third Quarter 2020 Cisco reported quarter ending results for April 25, 2020, on May 13, 2020. The following report is a summary of those results, no opinion on...