Free cash flow and a DCF go hand-in-hand in estimating valuation. But should levered free cash flow (also called FCFE) be used in a DCF? How does leverage affect a DCF, and future cash flows, and the value of a company?

These are the questions I will be answering in this post.

The way that we will come to these answers will be through the following sections:

- Definitions of FCFE, FCFF, LFCF, UFCF

- Defining the Levered Free Cash Flow Formula

- Levered Free Cash Flow vs Unlevered FCF; DCF Implications for Both

- How to Find Levered FCF Flow in a 10-k [Real-life example]

To define what levered free cash flow is, it is simply the amount of cash available for either (A) redistribution to shareholders, or (B) to reinvest back into the business.

The key to the equation is that this cash is the cash left over after paying all debt obligations have been paid (for the fiscal year).

Defining LFCF and FCFE; UFCF and FCFF

Also, note that levered free cash flow is also sometimes called FCFE (free cash flow to equity). Note the following definitions so you don’t get these FCF terms mixed up for your DCFs.

- FCFE = Free Cash Flow to Equity = Levered Free Cash Flow (LFCF)

- The value of a company if all debt was paid off

- Used to value equity with a Cost of Equity discount rate (only if there are no bondholders and/or preferred shareholders)

- FCFF = Free Cash Flow to Firm = Unlevered Free Cash Flow (UFCF)

- The value of the entire firm (or enterprise)

- Used to value the entire firm with a WACC as the discount rate (stockholders, bondholders, and preferred stockholders, if applicable)

McKinsey & Company, in their Valuation textbook, suggests using FCFE/ levered free cash flow in order to estimate the valuation of financial firms such as banks and insurance companies.

This is in contrast to “regular” companies, where you use FCFF in a DCF model (most people simplify FCFF by just calling it FCF).

The reason for this discrepancy is because banks and insurance companies take-in liabilities such as consumer deposits and insurance premiums which are separate from the financing situation of the firm as a whole.

So to separate the financing on the consumer/operating side with the financing for the firm, it’s better to use levered FCF and discount these at the Cost of Equity rather including the Cost of Debt and discounting with the WACC.

Levered Free Cash Flow/ FCFE: The Formula

We’ve established that LFCF represents money for stockholders after debt is paid. Therefore, the levered free cash flow formula is:

Levered FCF = Cash from Operations – Capex – Debt Principal Repayments (Net)

You can find a myriad of ways to define LFCF/FCFE, but I’ll give you one more levered free cash formula from Damodaran’s Valuation textbook, which he simply called free cash flow to equity:

FCFE = Net Income + Depreciation – Capital spending – change in Working capital – Principal repayments + New debt issues

Note how there can be many ways to arrive at a free cash flow calculation, as even these two basic definitions show.

What’s key is to not confuse FCFE with FCFF, and similarly levered cash flow to unlevered cash flow, and to use the appropriate discount rates with the appropriate FCF estimates.

To really understand when to use what, I think it’s important to understand the logic behind the calculations and formulas and then work backwards to applying the formulas in everyday valuation, and not the other way around.

That’s how my mind thinks anyways. So to get back to why we’re even looking at levered free cash flow in the first place…

Remember that once a business earns cash flows, they have the following options for using it:

- Pay a dividend

- Buyback shares

- Make an acquisition

- Reinvest in assets

- Pay off debt principal

The calculation for levered FCF simply tries to look at what a company’s cash flows would be if they didn’t have any debt to worry about (didn’t have to take action #5).

So in a way, they represent more of an (equity) investor’s “true claim” to a portion of a company’s cash, since paying off debt doesn’t either (A) bring a tangible return of capital to shareholders, or (B) directly create tangible business growth.

Be Careful on the Weight to Apply to This Metric

While the formula for free cash flow (FCF) can be found in any textbook on valuation, I found there’s not much focus on the differences between levered FCF and unlevered FCF since most analysts are looking to estimate equity valuations, and though FCFE has the word “equity” in it, analysts generally use FCFF for their equity valuations.

That’s because most equity valuations are performed on public companies, and to truly arrive at the value of their common stock you must take the bondholders into consideration, thus why we use the Free Cash Flow to Firm and Weighted Average Cost of Capital (which includes Cost of Equity and Cost of Debt).

So it’s probably because of the lack of practicality for equity valuations to why levered FCF doesn’t get much attention.

And while it’s a nice concept that intuitively makes sense, you’ll see that the direct application of levered FCF is more wistful thinking than it is a widely used metric in the field.

That’s because there are many moving parts to real world public corporations, and lots of options for these businesses to maximize shareholder value outside of the simplistic view that (zero debt = optimal value).

This is particularly true when interest rates are so low, and a balance sheet so conservative, that a company might be wasting opportunity for prudent returns and future growth by taking such an adverse stance against debt (in effect matching levered FCF to unlevered FCF).

That’s not to say that all debt free companies are suppressing optimal return for its shareholders.

The decision to leverage up a company is dependent on so many factors, that you can’t take a black-and-white stance on the topic and a company’s actions in relation to its FCF at any given time.

You have to look at the whole picture: the current balance sheet, the cost of debt, the cost of current risk-free investments, the opportunities for growing the business through reinvestment or acquisition or organically, the macroeconomic environment, the competitive landscape, and all of that and more.

A DCF valuation will not directly apply a levered free cash flow metric into its formula, as it uses unlevered free cash flows as the proxy for estimating an asset’s value.

But levered FCF does indirectly affect a DCF; more on that in the next section.

Levered Free Cash Flow vs Unlevered Free Cash Flow; DCF Implications for Both

Unlevered free cash flow, or just FCF, is different from levered free cash flow because unlevered free cash flow does not account for debt principal payments.

Interest debt payments are part of the free cash flow formula calculation (as interest expense).

While a DCF valuation uses unlevered free cash flow instead of levered free cash flow to form the basis of valuation, the aspect of leverage is not completely ignored in a DCF. That’s because a company’s leverage will be factored into what interest rates they will receive when issuing new debt, which makes its way into the Cost of Debt (which is a component of the WACC).

Said simply, the more debt a company has, the higher you have to discount their cash flows because their cost to borrow is higher.

Remember that cash flows on their own are not discounted equally among various companies.

If a company has strong cash flows temporarily, or if future cash flows are at greater risk of being threatened by competitors, or if safer alternative investments are available at adequate rates of return, or if these cash flows were attained while sacrificing the balance sheet—all of these should persuade an analyst to discount these cash flows at a higher rate than a similar nominal value of cash flows where these risks or outside factors are not present.

That’s not to say that calculating levered free cash flow is a fruitless exercise.

Indeed, all things remaining equal, a lower ratio of levered FCF vs unlevered will stymie future growth potential and/or total return, because those obligations represent real cash that can’t flow more directly to shareholders.

But there are additional benefits to using FCF to pay off debt principal in addition to simply improving the balance sheet (to reduce future cost of debt). Let’s review those next.

Benefits of Using FCF to Pay off Debt

There are several direct benefits to shareholders when a company pays off future debt principal in advance:

- Strengthens the balance sheet, improving a company’s credit quality and thus lowering future cost of debt

- Allows for more levered free cash flow to be used on alternative uses in the future, such as shareholder distributions or reinvestments

- Unlocks greater potential for higher future margins (since a permanent reduction to interest expense is a sustained boost to net income)

For benefit #1, the common ways that a company’s balance sheet quality is measured include:

- Interest Coverage Ratio

- Net Debt to EBITDA

- Credit Ratings from Agencies

There are others, but these metrics are widely used on Wall Street today and often form the scope (among a few other factors, like company size) of how much interest a company will have pay on new bond issuances (and other instruments of credit).

Benefit #2 is relatively simple, as distributions and reinvestments generally contribute to long term total return and compounding.

The last benefit we will cover today is interesting because I don’t see it talked about much, and it can possibly be used to better estimate future cash flows, as impacts to margins naturally find their ways to these flows.

Consider that one of the adverse effects of leverage is in the way it suppresses future profits.

Since debt is not free, companies must pay interest on top of their debt principal obligations. These interest payments, or “interest expense”, are reflected in the income statement and have a direct negative effect to Net Income.

However, interest expense is in-fact tax deductible.

This does not make interest expense “free”, but it does allow for the use of capital at a rate that is partially subsidized by the government (albeit as a small percentage).

I like to think of the tax savings on interest expense debt in the following simplistic way:

A tax deduction on interest expense is like a 25% off coupon at a department store.

By using the 25% coupon, I get to buy an item that retails at $50.00 for $37.50, which can be value accretive. But at the same time, I could’ve “saved 100%” by not spending $37.50 at all.

And so for business purposes, if the use of debt has a purpose outside of just the tax deduction, then it can be an unlocking of value with the tax deduction as a cherry on top.

How to Find Calculate Levered Free Cash Flow from a 10-k [Example]

You can find all of these metrics needed to calculate the levered free cash flow formula quite easily in the financial statements. Let’s show a quick example how.

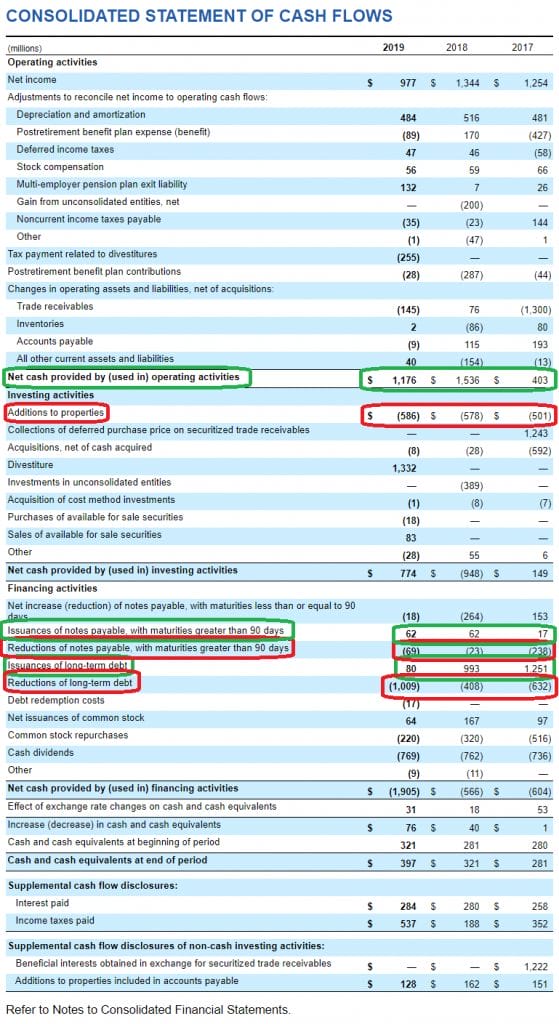

I’m going to take a company with a moderate amount of leverage today, Kellogg (ticker: $K). Looking at the cash flow statement from their latest 10-k, we can highlight the following metrics:

To calculate our levered free cash flow for 2019, we’d take the following (in millions):

- Net cash provided by operating activities = $1,176

- Additions to properties = -$586

- Issuances of notes payable = +$62

- Reduction of notes payable = -$69

- Issuances of long-term debt = +$80

- Reductions of long-term debt = -$1,009

In summary, that is:

- LFCF = $1,176 – $586 + $62 – $69 + $80 – $1,009

- LFCF = -$346 million

Note a few takeaways here. More issuances of debt would actually increase levered free cash flow in the short term, but would also cripple levered free cash flow in the long term (or, eventually).

You can use the same logic to note that just because Kellogg’s LFCF is negative for 2019, doesn’t mean that the business is in a poor spot. Rather, with the heavy repayment of $1,009 million of debt principal, they are likely unlocking much higher levels of levered free cash flow for shareholders in the future.

One year of calculating the levered free cash flow formula is probably not indicative of much, but rather multiple years should be looked at, as well as the context of other financial statements like the balance sheet and income statement.

Related posts:

- Free Cash Flow Yield – Finding Gushing Cash Flow for Future Growth Cash is king, and free cash flow acts as the engine’s oil. Determining free cash flow and its different uses remains a fantastic way to...

- Free Cash Flow Uses: One of the Most Important Metrics in Finance Free cash flow remains the most important metric in finance. Beyond profit, free cash is money that the company can use in many ways to...

- Cash Flow Analysis Example Using Cash Flow Ratios Everyone Should Know Updated 4/4/2024 “There is a huge difference between the business that grows and requires lots of capital to do so and the business that grows...

- Enterprise Value Formula and Definition – CFA Level I & II Fundamentals A company’s enterprise value (EV) is an important point of understanding for investors and is a fundamental learning point in many business schools, as well...