Confidently Estimate Company Valuation

Using the 3 Drivers of value, free cash flow, returns on capital, and cost of capital

Presenting the Little Package of Valuation

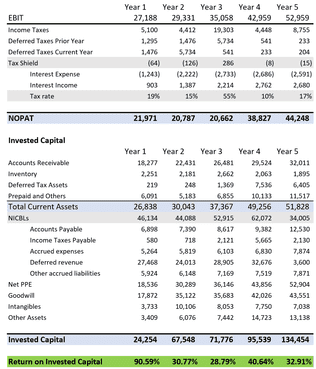

Includes calculations for DCF (FCFF and FCFE), ROIC and WACC, DDM, Multiples, and Residual Income Valuations

FCFF

FCFE

ROIC

WACC

DDM

Multiples

Bring Simplicity, Efficiency, and Accuracy to the Valuation Process

Most of the valuation models online take hours to fill out, with tons of inputs to find the value. And if you make one wrong input, then it becomes even more time wasted tracking down the mistake.

Not to mention the fact that they give you one variable, Free Cash Flow (FCF), with no mention of what drives the growth of the FCF, just estimates. It’s like whistling in the dark.

The fact is that there are two versions of FCF, Free Cash Flow to the Firm (FCFF) and Free Cash Flow to Equity (FCFE); this package gives you a model for both.

Feedback on Using the Little Package of Valuations

Solve the Riddle of Valuation

Frequently Asked Questions

Does this tool work with non-US stocks such as Canada or the UK?

Yes, as long as a company has posted GAAP or IFRS compliant financials publicly, you can use that data for these models.

What if I am not satisfied with the tool, can I get my money back?

Yes, you may refund the product for any reason at all in the first 30 days. Email [email protected].

How do I use the LIttle Package of Valuation exactly?

The Little Package of Valuation was created using a combination of models to allow for the estimation of intrinsic value with as little pain as possible. The FCFF, WACC, and Normalized DCF models have preprogrammed formulas with a few inputs that allow you to see results right away. With automated calculations for 7 different valuation methods and up to 10 years of forecasted financials, simply input historical metrics and navigate the spreadsheets for each ending valuation.