Coming out of the right corner, we have the newcomer, the up and coming, short-term investments, all set to face the current heavyweight champion of the world, long-term investments! This is going to be an epic battle for the ages, so who is going to win – long vs short!

Everyone knows that investing for the long-term is the best plan, right? If you’ve even thought about investing, then you know that investing for the long-term is the most ideal timeframe for you to invest because anything shorter than a few years is just considered trading and not investing. I mean, come on, even Warren Buffett says that you need to be focused on the long-term:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.” – Warren Buffett

I read a really good article from The Balance talking about if long or short-term investments are better, and talking about all of the different aspects at play for each person, so I highly recommend checking that out, but I am here to talk about the numbers ONLY!

In full transparency, I have run all of the analysis but haven’t looked at any of the results, so I still think that long-term investing is absolutely better, but I am trying to go into this with an open mind.

One thing that I am really good at doing in my personal life (maybe even too good if you ask my wife), is playing devil’s advocate and challenging the status quo. I am really good at doing this in my professional life as well but for some reason it’s taking some time to get there with investing.

Relistening to the interview with Tobias Carlisle on the Investing for Beginners Podcast, I keep getting more and more motivated to challenge the status quo and really think outside the box. Just challenge the consensus and see how things look. So, this is what I am doing.

Everyone says that investing for the long-term is better, and they say it’s like significantly better, so let’s see just how much better (if at all) it actually is!

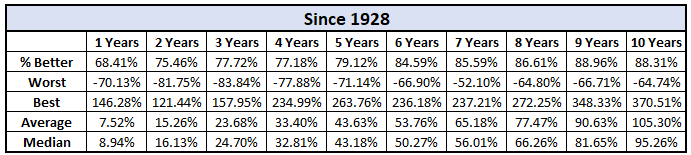

I took the S&P 500 for as long as I could go back in history on Yahoo Finance, which is 1928, and then broke down comparisons for if you were to buy and hold the S&P 500 for anywhere from 1 year to 10 years, in yearly increments. Let’s take a look at the results below!

Alright, let’s decipher what exactly we’re looking at. As you can see across the top, I broke it down into the amount of years that you would hold onto the S&P 500 after buying. So, if you bought on 5/1/1928, which is as far as my data goes back, and then sold in 1 year, that means you sold on 5/1/1929.

On average, if you were to buy 1 share of the S&P 500 and then sell if 1 year later, 68.41% of the time you would be selling at a price that was higher than you bought. That percentage doesn’t seem too bad, but likely not a risk that I would want to take.

The worst year was a huge downturn of -70.13%…ouch! The greatest return on the other hand was a monstrous return of 146.28%, meaning if you paid $100, you now have $246.28!

On average, the return that you would expect would be 7.52%, which really isn’t too shabby! Using an average isn’t always the best indicator to measure what the most realistic outcome actually is because it takes outliers into account, so I prefer to use the median. The median return is 8.94%! Now we’re talking.

I also want to note that this doesn’t include dividends, which is on average right around 2% now, so that’s absolutely something to think of. If you were to DRIP those dividends then the returns would be that much higher, but that doesn’t matter nearly as much in a short-term investing strategy.

As you expand the time horizon from 1 year on down the line, you can see that the returns become much, much larger, which makes sense, right?

A lot of the major downturns in this data were caused during the Great Depression, which while we can’t throw out that data, it was so long ago that it might not seem as relevant. I can see it both sides:

1 – one way is that I see it as being so long ago that if it hasn’t happened more recently, is it really worth including in analysis?

2 – the other way is that if you’re trying to be conservative and invest with a margin of safety, emphasis on the safety as Andrew, Dave and myself all recommend that you do, then including these timeframes is a good decision. Worst case is you plan for the worst, but you end up with much better returns. More money? Oh dang…what a shame ?

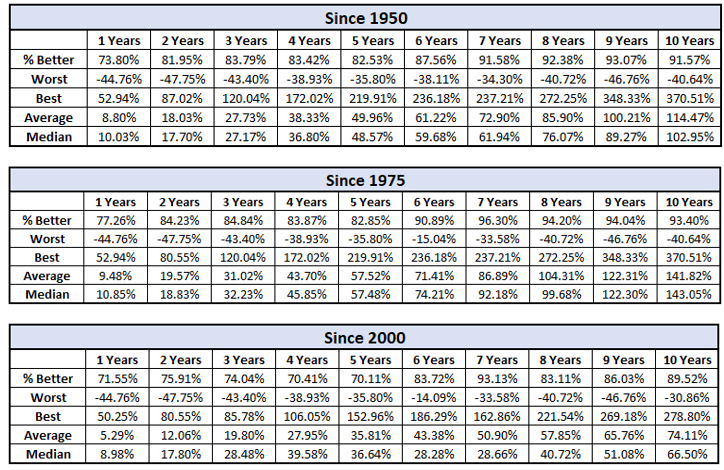

But don’t worry, regardless of your stance, I also included some other data points as well, starting on 1/1/1950, 1/1/1975 and 1/1/2000, all shown below:

The main takeaway that I had from adding these additional timeframes is simple – the shorter the timeframe, the riskier your investment, which again, makes sense.

On average, you can expect some pretty good returns for just a 1-year investment, but you can also experience some very, very low lows, but they’re not solely tied to just 1-year investment time periods.

The worst 1-year investment is down nearly 45%, which is brutal, but the worst 10-year investment is down nearly 41% as well, so both are really, really tough.

So, where do I land in the epic battle of long vs short, then?

What’s Your Investment Philosophy?

Well, it’s simple – it all completely comes down to what you’re investing for and your investing philosophy.

If you’re investing for a down payment on a house and just want to invest for 3-4 years, are you ok with losing 40% of that money? If you are, then invest! The gains could be incredible as long as you’re ok with the alternative. If you invested $25,000 for 4 years in the ‘Since 1950 timeframe, your bookend would be either ending up with $15,268.57 or massive gains resulting in a new total of $68,005.19.

Is the potential to make that really big return worth the risk of losing nearly $10K? If it is, do it. If it’s not, then don’t. It really comes down to that.

My synopsis for my own personal investing strategy is simple – there is nothing wrong with investing for the short-term as long as you’re ready to feel the burn! If you can’t stand the heat, get out of the kitchen!

Personally, I have three different investment accounts. I have one account that is based solely on buying and holding for forever, one that is essentially the same thing but focused towards identifying future dividend aristocrats, and then another that is more focused on short-term. Not trading by any means, but more of a hands-on approach than my other portfolios.

I do this for a few different reasons:

- I can stomach the risk of losing a lot of money in my short-term portfolio

- My short-term portfolio is only 1 out of 3 of my investment portfolios, so I feel like not only am I diversified in my investments, but I am also diversified in my investment strategies

- My short-term portfolio is 100% discretionary

income. If I lost 100% of it, of course

it would suck, but I have gone in with the mindset of being risky to try to get

a head start on my investing journey since I have a lot of time left.

- And I also know that if things went really crazy, I would simply just hold onto what I have and turn my portfolio from short-term into long-term. I wouldn’t sell just because it was my “short-term portfolio” but I would give myself the option to simply just be patient, hold onto what I have, and keep looking for good, undervalued stocks.

Regardless of my timeframe, my strategy is the same – finding companies that are undervalued vs. their intrinsic value, it’s just where that stock should fall in the long or short portfolio.

Short-term portfolios definitely have a place for those with the appetite and mindset to handle it, but I know that not everyone is like that. When I first started investing, I thought that I could handle it, but I couldn’t. I made a lot of mistakes when I started and bought high and sold low, locking in losses at low points and making my portfolio look like a giant pile of crap!

My issue was that I would sit there and look at my portfolio everyday and then sell as soon as things got bad, just to have the stock rebound the next day. I actually think that looking at your portfolio every single day is a good thing and I am happy I made these mistakes early because I think they’ve made me a better, more patient investor later in life when I have more money at risk. I would’ve hated to make that mistake later in my investing life because theoretically, the later in your life, the more money is at risk, and the larger impact that those mistakes are going to cost you.

When I invest in the short-term, I almost view it as going to the casino. I sit there and ask myself “will my life be impacted if I lose 100% of this money?” If the answer is yes, avoid the short-term investing strategy AT ALL COSTS.

Feeling Stressed vs Stress-Free Investing

If you feel that way, then the long-term investing strategy is really the only strategy that you should even consider. When I was first investing, the answer to that question was a ‘yes’ and that’s what made me such an irrational investor that overreacted to everything, causing me to sell low and buy high. The thing about buying high and selling low is that you can still make money, and a good chunk of money, as long as you HOLD ON!!

So, basically, I knew that if I lost that money it would change my life, and I knew that I didn’t have an appetite to lose it, yet I did it anyways – sounds pretty freaking stupid, right?

Right.

But I wouldn’t change it for anything because it’s made me a better short-term AND long-term investor. So, in short, what side of the fence do you land on in the long vs short debate?

I think that every person should always have some sort of long-term investments in their portfolio for no other purpose than hedging your bets. I think that a long-term position is built for all to succeed with and a shot-term investing timeframe is more of a supplemental approach.

For me, the short-term approach helps me keep really focused on the market and is a truly fun for me! I legitimately think that investing is one of the most fun activities that I have ever done and allowing myself to have some discretionary income to play around with and make bets keeps me more in touch with the market as well as it eliminates any sort of temptation that I might have in my long-term retirement accounts.

It’s natural for someone to want to dip their toe into some high risk, high reward companies and not only do I think that this is totally fine, I encourage it! But I encourage you to segregate those sort of decisions from your long-term portfolio so that those lines never get blurred and you end up making decisions with your investments that were made with the intention of buying and holding that you’re now selling out of to try to make some risky, short-term decisions.

So, who actually won the battle of long vs short? It was a very tough, hard fought battle but at the end of the day, I’ll continue to put a large majority of my investments into my long positions for the fear that the short might just come up a little bit…short.

Related posts:

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- How to Use Jensen’s Alpha to Measure True Investor Performance Updated 1/5/2024 Measuring investment returns continues to be something everyone looks to do when investing in the markets. The search for “alpha,” or market-beating investment...

- Portfolio Leverage Portfolio leverage is the classic double-edged sword, magnifying returns to the upside and cutting deep on the downside too. Portfolio leverage needs to be understood and...

- A Guide to Investing for Beginners— Your Path to Financial Freedom “Investing is the process of laying out money now to receive more money in the future.” Warren Buffett Most people think they need thousands or...