In this next chapter of The Essays of Warren Buffett, Buffett talks about something called “Look Through Earnings”. To the average investor, you are likely unaware of the accounting practices that companies must follow when they invest in other companies, but I was extremely surprised when I read this chapter.

If a company has an ownership percentage of > 50% of another company, then they will report all of that company’s earnings in their own earnings statement and simply just put that the other company has a minority ownership share.

For instance, if I Andy’s Badass Company (ABC) owns 75% of Apple (AAPL), then when ABC reports earnings it would include all of the revenue, expenses, and earnings, and then just have a caveat saying that AAPL owns 25% of their own company.

Now, if ABC owned anywhere from 20 – 50% of AAPL, then ABC wouldn’t report any of the revenue or expenses and would simply just include the proportionate amount of earnings.

So, if AAPL earned $100 million in earnings and ABC owned 40%, then ABC would just put that it earned $40 million ($100 million of AAPL earnings * 40% ownership share) in its earnings report.

And finally, if a company owns < 20% of a company, then they will only report the earnings on the dividends paid out by that company. So, to stick with the same example that we have been using, if AAPL made $100 million and paid out all $100 million of that in dividends and ABC had a 10% ownership share, then ABC would report 100% of their dividend received, which would be $10 million ($100 million in total dividends paid by AAPL * 10% ownership share by AAPL).

The Effect of Dividend Strategy

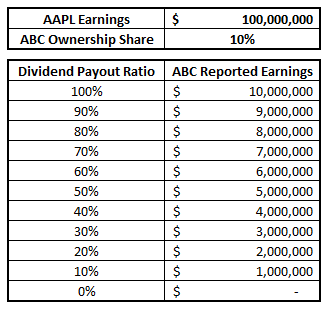

Now, of course, this can change drastically depending on the dividend strategy of AAPL. For instance, if AAPL only paid out 10% of their earnings in dividends, which would be $10 million total ($100 million earnings * 10% dividend payout) then ABC would report $1 million ($10 million total AAPL dividend payout * 10% ownership share). The chart below shows a better picture to help portray this:

As you can see, as the dividend Payout Ratio changes, so does the amount of earnings that ABC will actually report. If you’re unfamiliar with the term ‘payout ratio’, then I highly recommend that you read a previous blog post that I’ve written because it’s a very important term to understand in dividend investing.

So, you might be sitting here going, “ok, this is pretty cool to understand, but why do I care?” And if you’re asking that question – it’s completely valid, because I was wondering that when I was reading it.

The answer really is pretty simple – If you’re investing in a company that also has ownership in other companies, say Berkshire Hathaway for example, then you’re going to be very interested in that company’s earnings, so you will also be interested in the earnings of the companies they’re invested in.

Buffett goes on to say that Berkshire Hathaway frequently invests in great companies but in a smaller scale that is less than 20% of the overall company. So, since they’re investing in under 20%, the only earnings that they report are dividend payments.

That doesn’t mean that they’re not receiving the benefit of those earnings, but it means that the Berkshire Hathaway shareholders might not see them unless they dig deeper and understand this accounting process.

Buffett gives a fantastic example about a forest – if a tree grows in a forest, and you only own 10% of that forest, then you still own a portion of that tree even though you don’t get to report it. In essence, the company is being forced to underreport earnings.

Thus, even if the company is perfectly valued for their reported earnings, there are still earnings that the company is receiving a benefit for that they’re not allowed to report because they own less than 20%, making the company undervalued once again.

Personally, I learn best with examples and analogies – so the forest example is great and all, but Buffett gives a real-life example to really make this stick.

Berkshire Hathaway owns a 17% share of Capital Cities/ABC, Inc (note that this is not my made-up company, Andy’s Badass Company). Proportionately, this 17% share would generate $83 million in earnings, which means that Capital Cities/ABC, Inc. generated a total of $488 million in earnings.

But, since Berkshire only owns 17% of this company, they are not able to report this proportionate amount of earnings. They can only report the amount of dividend payments that they received. Berkshire received a total of $600,000 in dividend payments (.72% payout ratio) which after taxes resulted in $530,000.

So, Berkshire can only report $530,000 of earnings for this ownership despite owning 17% of a company that made $488 million in earnings and Capital Cities/ABC, Inc. will report the entire earnings amount for the Berkshire ownership share and add that small caveat that Berkshire owns a minority share in their own earnings statement.

Buffett talks about the importance of knowing this because these earnings are “Forgotten-but-not-gone” to investors, and it’s important to make them remembered!

The important takeaway is to make sure that when you’re investing in a company, you’re looking to see if they have any minority ownerships in other companies and you’re evaluating their look through earnings as well to make sure you’re properly accounting for the true earnings of that company.

In addition to that, you should apply this to your own investment portfolio. Take your ownership share of the company and then multiply that by the earnings of the company to create a total earnings value for your portfolio. I know that your ownership percentage is likely extremely small, like .0000001% of a certain company, but this will help you get a really good grasp on the performance of your portfolio.

At the end of the day, this is simply just another thing to consider when investing. The key takeaway here is to ALWAYS dig a little bit deeper. Don’t just look at earnings and think that’s the entire picture – take the time to truly understand the business.

Oh, and another piece of advice is that if you want to be a value-investor, and the greatest value investor of all time writes a book outlining his key tips and things to consider when investing, and it’s only about $30 on Amazon – go buy it.

Related posts:

- Understanding Buffett’s Owner Earnings for Beginners As we continue to get more and more into the weeds with Warren Buffett in his book, ‘The Essays of Warren Buffett’, he focuses on...

- How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’...

- How to Find the Statement of Retained Earnings in a Company’s 10-K When reading through any financial statements on annual reports, I always zoomed by the earnings statement because I didn’t know what it was. Or what...

- Investing Implications of Earnings Before Interest and Taxes (EBIT) “We are trying to look at businesses in terms of what kind of cash can they produce, if we’re buying all of them, or will...