Updated 4/21/2023

To continue our series on owner earnings, I thought we would do a deeper dive into maintenance capital expenditures or maintenance CapEx.

When calculating owner earnings, most of the values are pretty straightforward. But maintenance capital expenditures require a little more digging to come up with a number that we can use for our calculations.

As we calculate maintenance CapEx, we will touch on each of the three financial statements: income statement, balance sheet, and cash flow statement.

In today’s post, we will learn:

- What is Maintenance Capital Expenditure?

- Why is maintenance capital expenditure important?

- How to Calculate Maintenance Capital Expenditure

- Examples of How to Calculate Maintenance Capital Expenditures with Real Financials

- Investor Takeaway

Okay, let’s dive in and learn more about maintenance capital expenditure.

What is maintenance capital expenditure?

First, let’s look at what maintenance capital expenditure is.

“Maintenance CapEx refers to CapEx that is necessary for the company to continue operating in its current form. Growth CapEx is expenditure on new assets that are intended to grow the company’s productive capacity.”

Cfsg.com

And this per Investopedia:

“Capital expenditures, commonly known as CapEx, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, an industrial plant, technology, or equipment.

CapEx is often used to undertake new projects or investments by the firm. Making capital expenditures on fixed assets can include everything from repairing a roof to building to purchasing a piece of equipment to building a brand new factory. This type of financial outlay is also made by companies to maintain or increase the scope of their operations.”

Accordingly, these kinds of capital expenditures are listed on the balance sheet as an investment rather than on the income statement as an expense.

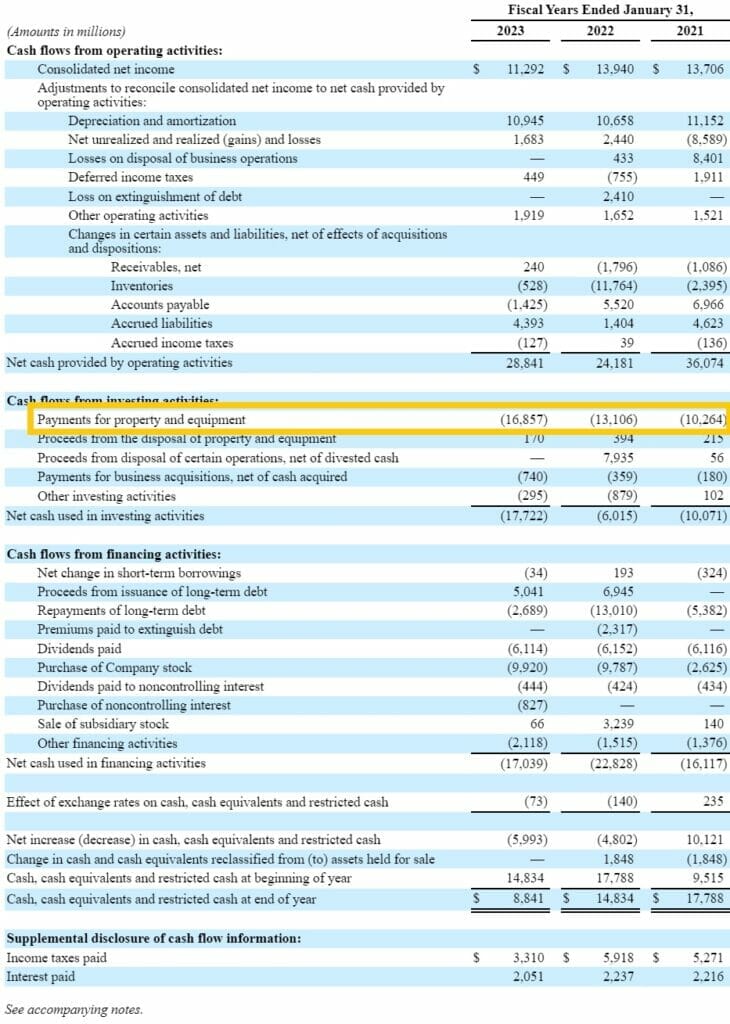

Maintenance CapEx is found on the cash flow statement under the investing activities section.

Not every company will list it directly as maintenance CapEx; some will list it as additions to property, plant, and equipment.

It can be classified as payments for property, plant, and equipment too.

Maintenance capital expenditures refer to capital expenditures that are necessary for the company to continue operating in its current form.

Think of it this way. When a company such as Walmart refurbishes an existing store – laying new flooring, painting the walls, replacing cash registers, etc. – it is engaging in maintenance CapEx.

Likewise, if Walmart opens a new store, this would be considered growth CapEx.

CapEx does not go through a company’s Profit & Loss statement. Rather, the expenditure goes through the cash flow statement and is capitalized as an asset on the balance, with wear and tear periodically recognized as depreciation expense in Profit & Loss.

By contrast, both the purchase of inventory for resale and expenditure on repairs and maintenance of capital equipment go through the company’s Profit & Loss, thus reducing earnings for the period.

Why is maintenance capital expenditure important?

Why is all of this so important? And why does Buffett include maintenance CapEx in his owner earnings?

Simply, it has a bearing on free cash flow.

How so?

If a company’s maintenance CapEx is relatively high, the company’s free cash flow will be relatively low. Free cash flow is the cash available for repaying debt and making dividend distributions after operating expenses and capital expenditure commitments are paid.

If future maintenance CapEx is expected to be high, free cash flow has the potential to turn negative. In these circumstances, the company will need to find new sources to fund this gap (debt or equity), assuming existing cash balances are insufficient.

These funding sources may not be readily available, and may be dilutive or expensive. That is why a potential acquirer of a business will pay close attention to the maintenance CapEx of a potential acquisition going forward.

This is also why a business with high free cash flow is relatively more attractive because it can borrow more heavily to boost returns, can pay out larger dividends to shareholders, and is better positioned to weather any unexpected slowdown.

Hope that makes this subject a little clearer and you understand the importance of maintenance capital expenditures.

How to calculate maintenance capital expenditure

Calculating maintenance CapEx can be a little confusing. Some accounting books suggest you use the formula:

Maintenance capital expenditure = depreciation and amortization

Using the above formula is the quick and dirty way to calculate maintenance CapEx, but what if you want to go further, such as Buffett does?

Then we need to dive deeper into the numbers to get a better idea of what is truly going on.

Depreciation can be misleading by itself; you aren’t entirely sure what is included in this line item, which could lead you to an unrealistically high number for maintenance CapEx calculations.

Next I am going to introduce you to Bruce Greenwald, a professor of finance at Columbia Business School. Yes, that Columbia Business School.

Bruce has written a fantastic book, Value Investing: From Graham to Buffett and Beyond.

On page 96 he is quoted for his method of calculating maintenance CapEx as:

“Calculate the ratio of PPE to sales for each of the five prior years and find the average. We use this to indicate the dollars of PPE it takes to support each dollar of sales. We then multiply this ratio by the growth (or decrease) in sales dollars the company has achieved in the current year. The result of that calculation is growth CapEx. We then subtract it from total CapEx to arrive at maintenance CapEx.”

Let’s simplify this a little bit or put it in English to be able to put it into use.

- Calculate the average gross property, plant, and equipment(PPE)/sales ratio over five years

- Calculate the current year’s increase in sales

- Multiply PPE/Sales ratio by an increase in sales to arrive at growth CapEx

- Maintenance capital expenditure is the CapEx figure from the cash flow statement less growth CapEx calculated above, which is the true depreciation for the company.

Now that we have defined maintenance CapEx and shown how to calculate it, why don’t we use some examples to see this in practice?

Examples of Maintenance Capital Expenditures with Real Financials

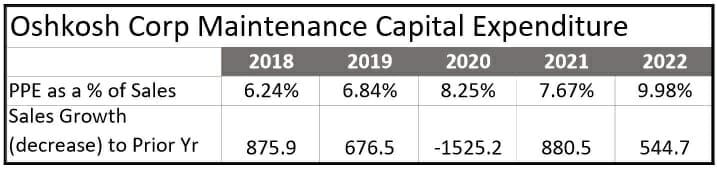

The first company we will work on is Oshkosh Corp; I will lay out the formulas to use and where we can locate the info so you can follow along.

All numbers will be in the millions unless otherwise stated.

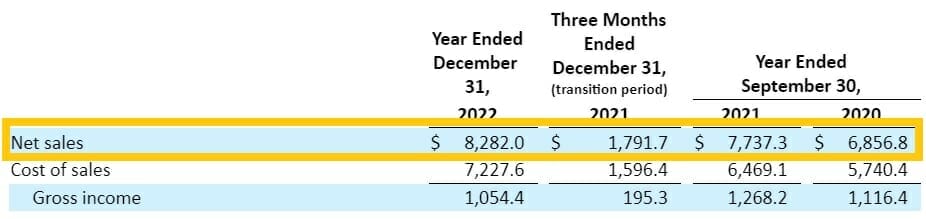

The first numbers we are going to gather are the sales for the company. We will find them in the income statement from the 10-k or annual report, which we will find at bamsec.com.

We will need to locate the sales for Oshkosh Corp for six years. We will use these numbers for two parts of our calculations.

Remember that we will be gathering information to fill in our chart for five years.

One will be for PPE/Sales, and the other will be the change (+/-) in sales from the previous year.

For Oshkosh Corp, the sales will come from the consolidated statements of income.

Sales for OSK will be:

- 2022 – $8,282.0

- 2021 – $7,737.3

- 2020 – $6,856.8

Looking at past 10-ks, we will gather the additional needed numbers of:

- 2019 – $8,382.0

- 2018 – $7,705.5

- 2017 – $6,829.6

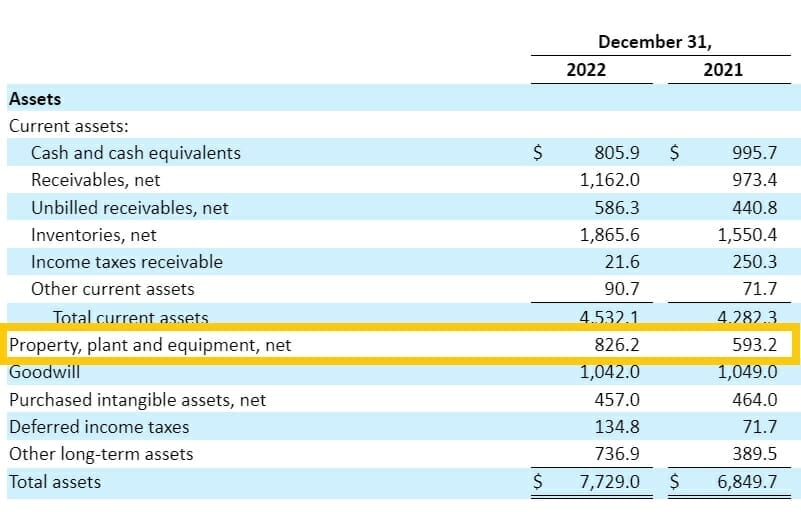

Next, we will need the PPE, or Property, Plant and Equipment. We will find these numbers in the Asset section of the Balance Sheet or the Consolidated Balance Sheets.

So our PPE or Property, Plant and Equipment will be:

- 2022 – 826.2

- 2021 – 593.2

Continuing our search, we will find the other three years in their corresponding balance sheets.

- 2020 – 565.9

- 2019 – 573.6

- 2018 – 481.1

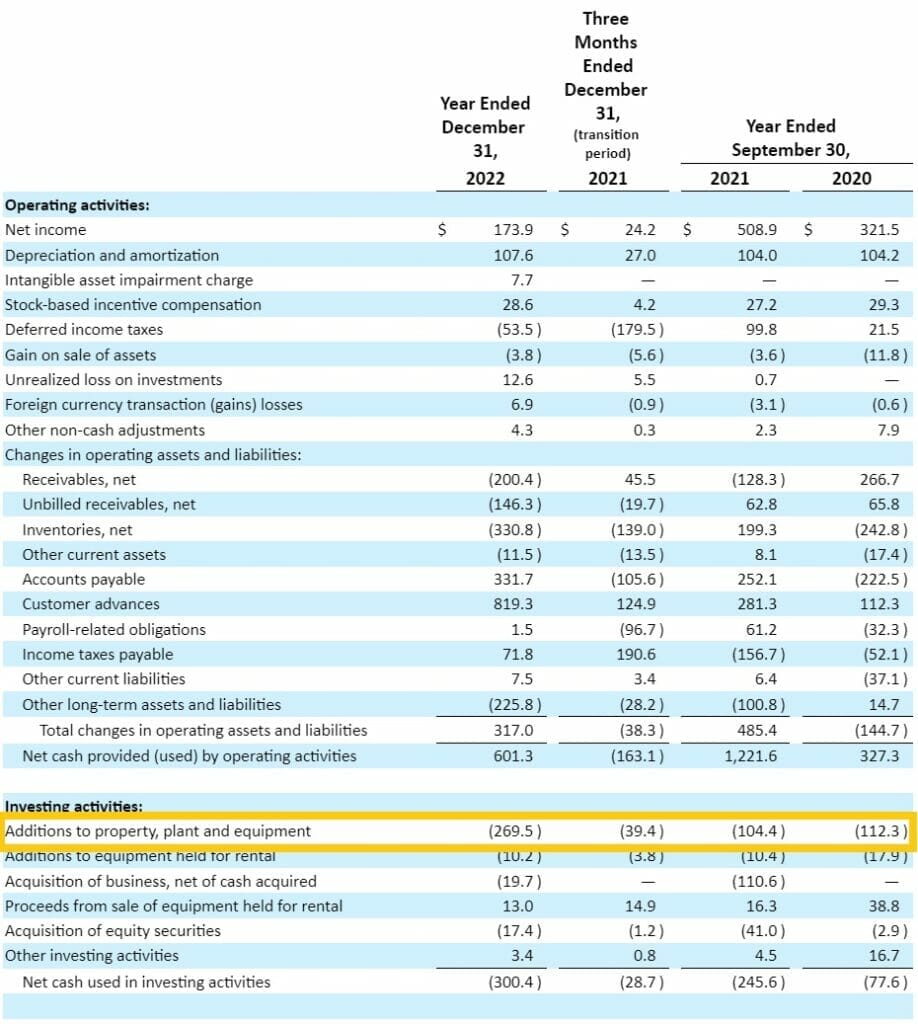

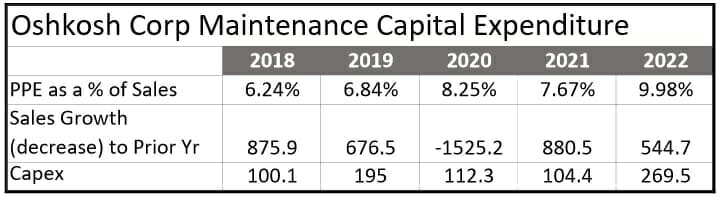

Now that we have those two numbers, we will locate the CapEx for Oshkosh Corp.

We will find the CapEx in the Cash Flow Statement or Consolidated Statements of Cash Flows, under section Investing Activities.

We are referring to this line item as CapEx because it is the largest payout of cash for capital improvements such as buying a new plant, new equipment, and so on.

Our CapEx for the three years listed on the cash flow statement:

- 2022 – 269.5

- 2021 – 104.4

- 2020 – 112.3

Gathering additional information for previous year’s annual reports, we get:

- 2019 – 195.0

- 2018 – 100.1

Now that we have gathered our numbers, we can begin to plug them in so we can arrive at our maintenance CapEx for Oshkosh Corp.

The first calculation we need to do is figure out what our PPE is comparing Oshkosh Corp’s sales per year.

The first year of 2022 we take our PPE of $826.2, and we divide that by our sales of $8,282.

PPE % of Sales = PPE / Current Years Sales

PPE % of Sales = 826.2 / 8282

PPE % of Sales = 9.98%

Now that we have done that for 2022, I will go ahead and do that for our remaining years.

- 2018: 6.24%

- 2019: 6.84%

- 2020: 8.25%

- 2021: 7.67%

- 2022: 9.98%

Next, we are going to calculate the sales growth or decrease from the prior year.

Again we are going to use some simple math. Our sales from 2022 were $8,282 and for 2021 were $7,737.3.

Change in sales = Sales 2022 – Sales 2021

Change in sales = 8282 – 7737.3

Change in sales = $544.7

Now that we have figured that out I will go ahead and do the calculations for the remaining years.

A note, you will have years where there is negative sales growth. Negative sales are ok and expected from time to time. It is unrealistic to have a company growing its sales every single year, more on this in a little bit.

Next, we will add Oshkosh Corp’s CapEx from the numbers we located earlier.

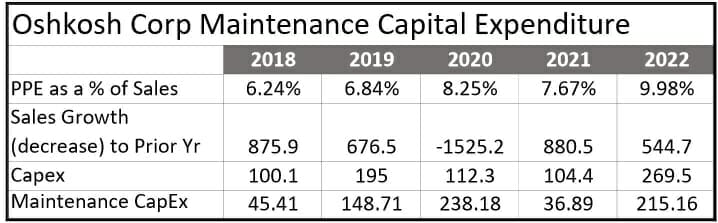

Now we are the stage where we calculate the maintenance CapEx. The formula for this is pretty simple once we have gathered all of our numbers.

Maintenance CapEx = Capex – ( PPE % of Sales * Sales growth (decrease))

Let’s calculate the numbers for 2022 with our formula.

Maintenance CapEx = 269.5 – ( 9.98% * 544.7 )

Maintenance CapEx = 269.5 – ( .0998 * 544.7 )

Maintenance CapEx = 215.16

So, our maintenance CapEx for 2022 is $215.16.

Pretty neat huh, and not so complicated.

Because of the fluctuations that you will see in the chart that we have constructed, we like to average the maintenance CapEx number over a five-year time frame.

You can go back over ten years and calculate this number and then average it over every five years or use the whole ten years.

There is no wrong answer here; the world is your pearl in this regard.

If we take these five years and calculate an average, we come up with a maintenance CapEx of $136.87.

This is the number you could plug into our owner’s earnings formula that we calculated in our last post.

Investor Takeaway

Hopefully, this exercise has helped clear up some confusion and lay out how to calculate the maintenance CapEx for companies.

To help make this process simpler, I am including a simple calculator with inputs to help you calculate the math for maintenance capex.

Understanding why as well as where we gather the information starts to enlighten us to how each company works.

Diving into the nitty-gritty of the owner’s earnings and how to find each number helps us get a better idea of whether the company is worth what we calculate it is.

Using the formula put together by Bruce Greenwald makes it much easier to compute the maintenance CapEx. And understanding why we need to find this number will make it easier to calculate as well.

As with any formula we have put together, they will only work as well as the numbers we plug into them.

Additionally, remember that there will never be an exact right number we can come up with to help us decide whether to buy or sell a company. It is far better to get a range and use our experience, smarts, and wisdom to determine which is a better outcome.

If you have any questions or would like additional clarification, please let me know, I am here to help.

Thanks for taking the time to read this post and I hope you found some value in it.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Capital Expenditures Explained Capital investment, also referred to as capital expenditures or CapEx for short, is the spending necessary for a company to maintain and grow its operations....

- Depreciation Expense: How to Decode Updated 8/7/2023 Depreciation is an accounting term that has a big impact on a company’s future profitability. It is a controversial topic because, as Warren...

- How Amortization of Intangible Assets Works; When it Unleashes Higher ROIC The amortization of intangible assets can sometimes be hidden in the consolidated financial statements because amortization is grouped in with depreciation. But as the economy...

- How Purchase Obligations (in the 10-k) Affect Inventories and Capex Purchase obligations can be a key part of understanding future cash flow. In 2002, the SEC made the disclosure of purchase obligations (POs) a requirement...