Markel 10Q Summary

Markel (MKL) reported first-quarter earnings on April 28, 2020, for the quarter ending March 30, 2020. The following report is a summary of those results, and no opinion will be offered regarding those results, only the facts presented in the quarterly report. If you would like more details regarding the 10Q, please follow the link below:

Markel First-Quarter 10Q Filing 2020

Highlights from the First-Quarter 2020

- $1.3 billion in earned premiums in underwriting

- Markel Ventures reported operating incomes of $511.2 million

- Net Investment losses of $1.7 billion for the quarter

- Earnings per share of $8.61

- Revenue of $335.67 million

Financial Metrics from First-Quarter 2020

- Share Price at Quarter End – $927.89

- Market Cap – $12.8 Billion

- Enterprise Value – $12.589 Billion

- P/E Ratio – 0

- P/B Ratio – 1.32

- Return on Equity – (53.47)

- Return on Assets – (15.30)

- Return on Invested Captial – (19.65)

- Debt to Equity – 0.37

Financial Results for First-Quarter 2020

Markel reports the financials for the company in four segments:

- Underwriting/Investing

- Markel Ventures

- Insurance-related securities

- Program Services

Any losses shown during the quarter Markel attributes to the impacts of Covid-19 on investing and underwriting losses. The change in income or loss from the previous quarter was due to primarily the pre-tax investment losses of $1.71 billion in first-quarter 2020 compared to $612.2 million in the same quarter of 2019.

Markel also experienced underwriting losses in both segments of underwriting, which now includes $312 million of net losses and loss adjustments, which was attributed to Covid-19.

Underwriting Results

Markel had a combined ratio of 118% for the first quarter of 2020, compared to 95% in the previous quarter. The underwriting results included $325 million or 24 basis points of net losses and loss adjustment expenses that Markel attributed to Covid-19.

Of the $325 million in losses, Markel attributed $293 million of those losses to the insurance segment and $32 million to the reinsurance segment. Further, of the $325 million, over $181 million was a result of event cancelations boh in the US and Internationally. The remainder of the losses were a result of business interruptions, which totaled $144 million.

Insurance Segment

The combined ratio for the insurance segment was 119%, which included 26 basis points for Covid-19 related expenses, compared to the 95% combined ratio of 2019.

The increase in the combined ratio was a result of $293 million in losses attributed to Covid-19. The company reported higher earned premiums in the first quarter of $1.330 billion, compared to the total of $1.203 billion from 2019.

The insurance segment combined ratio contained a favorable impact of $116.1 million on prior’s loss reserves, compared to $72.6 from 2019, as a result of more favorable improvement on loss reserves compared to the prior year. The increase was a result of improving professional liability, marine, and energy lines of business.

The expense ratio for the quarter declined due to the favorable impacts of higher earned premiums mentioned earlier.

Reinsurance Segment

The combined ratio for the reinsurance segment was 115%, which included 14 basis points for Covid-19, compared to the combined ratio of 99% for 2019.

The first-quarter’s combined ratio was driven by an increase of $32 million in losses attributed to Covid-19. The current accident loss ratio for the quarter increased as a result of higher net attritional losses on Markel’s property and worker’s comp product lines.

The segment also saw an increase of $13.9 million in adverse development on the prior year’s accident loss reserves, which impacted the combined ratio for the quarter. The adverse development was most felt on the public entity product line.

Finally, the expense ratio fell during the quarter as a result of lower acquisition costs and lower general expenses.

Premiums and Net Retentions

Markel’s gross premium volume in underwriting increased by 13% compared to 2019 for a total of $1.414 billion.

Gross premium’s volume in insurance increased 19% for the quarter, and the reinsurance segment was flat for the quarter.

Markel saw an improvement in pricing in most of the product lines, with the exception being the worker’s compensation product line, which has continued to see rate decreases despite improvements in loss experience.

Net Written Premiums and Earned Premiums

Net retention of gross premium volume for the underwriting operations was 85% for the quarter, a decrease of 2% compared to the prior-year quarter.

Markel reported an increase of 11% in earned premiums in the first-quarter, which the company attributed to an increase in earned premiums in the insurance segment.

Investing Results

Markel reported significant losses attributed to Covid-19 in the investing results. The losses were a result of the equity method investments falling during the period beginning in March.

There was a decline in the net investment income from $114,182 million in 2019 to $88,243, along with a recorded loss of ($1,681,441) million due to the recognition of GAAP accounting rules of unrealized gains in the equity investments.

The taxable total investment return fell to (7.0)% in 2020 from 5.4% in 2019.

Markel Ventures

Operating revenues for Markel Ventures in the first-quarter $511,211 million, up from $455,015 in 2019. Operating income and EBITDA for the segment increased to a total of $41,757, from $29,140, and EBITDA increased to $67,460 from a total of $54,744 in 2019.

Interest Expense and Income Taxes

Markel’s interest expense was $45 million for the quarter, compared to $40.3 million in 2019, and the effective tax rate for the first quarter was 21%.

Financial Condition

Investments, cash, and cash equivalents for the first quarter were $20.5 billion in the first quarter compared to the level of $22.3 billion. Equity securities were $5.7 billion in the first quarter, which was 28% of invested assets.

Net cash from operating activities was $65.7 million in the first quarter, compared to the $18.7 million of 2019. Net cash from investing activities was $906.6 million, compared to $342.1 million in the first quarter of 2019. Net cash from the financing activities was $20.9 million, compared to $0.1 million of net cash from financing activities in 2019.

Markel has no unsecured senior notes maturing in the next 24 months, with a fixed maturity portfolio consisting of securities with a “AA” rating. Despite the decrease in the equity portfolio of $1.7 billion in the fair value, unrealized gains on the portfolio were $2.5 billion at the end of the quarter.

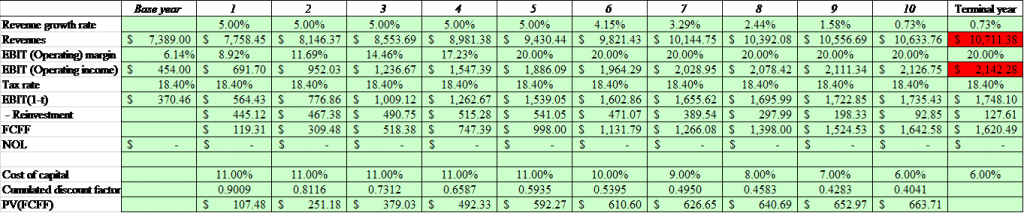

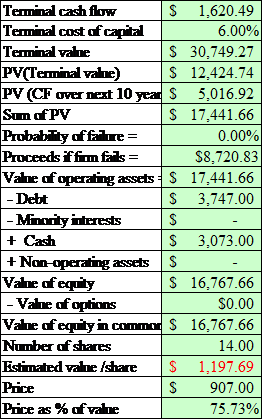

Valuation

Below is a discounted cash flow valuation for Markel based on the trailing twelve-month values as of the end of the first quarter of 2020. The valuation is not meant as a buy or sell recommendation, rather as a possible reference to the price based on the current financial condition of the company. I will include my assumptions so you can follow along.

Growth of Free Cash Flow = 5%

Discount Rate = 11%

Terminal Value = 0.73%

11.5% – $1161.22

11% – $1,197.69

10.5% – $1,235.44

Final Thoughts

That is going to wrap up our summary of Markel’s first-quarter results for 2020. There are no opinions offered in summary, and it is meant solely as an educational piece to help share the financial results for Markel; no investment guidance is shared during the report, and the valuation is meant as an educational exercise.

As always, thank you for taking the time to read this report, and I hope you find something of value for your investing journey.

Until next time, take care and be safe out there,

Dave

Related posts:

- Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential Financial Inc announced its first-quarter 2020 results on May 5, 2020. The quarter was as expected, given...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...

- Verizon (VZ) 10Q Summary First Quarter 2020 Verizon released its first-quarter earnings on April 24, 2020. In this post, we will discuss a summary of those results. Financial Metrics: Market Cap –...