Updated 6/24/2023

Companies need financial capital to operate their business. Many companies raise capital by issuing debt securities (bonds) or selling stock. The amount of debt a company has that makes up part of the overall capital structure of a company has many risks and return ramifications.

When analyzing a company measuring the amount of debt a company carries and its impacts on the capital structure plus returns goes a long way toward understanding its future potential.

The balance sheet lists the book value of debt, but to determine its impact, we need to calculate the market value of that debt.

With interest rates the lowest they’ve been, ever….understanding the market value of debt and its impact on its growth is a key component to valuation and finding the “right” discount rate. Along with its use to determine the cost of capital, analysts also use it in the enterprise value ratios such as EV/EBITDA.

In today’s post, we will learn:

- What is the Market Value of Debt?

- How Do You Calculate the Market Value of Debt?

- Market Value of Debt for WACC

- Examples of Market Value of Debt with Real Financials

Okay, let’s dive in and learn more about the market value of debt.

What is the Market Value of Debt?

The market value of debt, according to Corporate Finance Institute, is:

“The Market Value of Debt refers to the market price investors would be willing to buy a company’s debt for, which differs from the book value on the balance sheet. A company’s debt doesn’t always come in the form of publicly traded bonds, which have a specified market value. Instead, many companies own debt that can be classified as non-traded, such as bank loans.”

For example, the book value of the debt and equity on the balance sheet list the price paid for that debt. If Company A sells a bond for $100 and the value decreases to $90, the company still lists that bond at $100. But no investor will pay $100 for a bond valued at $90; therefore, calculating the value of that debt (bond) becomes necessary to determine the current value of that bond.

Many analysts use the market value of debt to calculate the cost of capital or WACC to find the intrinsic value. They also use the market value of debt to determine the company’s enterprise value.

For example, Microsoft has a bond offering in 2021 at $100, trading in the bond markets at $102.56. But if we look at Microsoft’s financials, we see the bond listing valued on the balance sheet at $8.2 billion, which is the amount sold on the market, not the current value.

Because many companies like Microsoft are using debt to help fuel their growth, we need to understand its impact on the company’s financials. Debt is cheaper than equity, and that cost helps fuel the growth of companies because growth comes from the assets that cheap debt can purchase. For example, if a company raises debt at the cost of 2% and buys inventory for sale, and in comparison, they sell equity at the cost of 5% to buy the same inventory. We can see that the lower-cost debt will give the company a 3% margin boost which helps improve the valuation of the company.

With the increase in debt comes the increased risk of default. As a company takes on more debt, the interest payments increase, and if there is a downturn or the company’s business dries up like what happened during the pandemic. The company risks defaulting on its loan payments and causing havoc.

Along with calculating the market value of the debt, we need to analyze the company’s debt by using different ratios such as debt-to-equity, net debt-to-EBITDA, and debt covenants.

How Do You Calculate the Market Value of Debt?

Determining the market value of debt can be challenging because not all the debt on a company’s balance sheet is a bond that trades on the market. Many companies have debt that is not traded on the markets, such as bank loans—those bank loans list as book value and not market value.

A simple way to convert the book value listed on the balance sheet to market value is to treat all the debt on the balance sheet as one coupon bond. That bond would have a coupon set equal to the interest expenses on all the debt, plus have the maturity of the debt set to the face value-weighted average maturity of the debt. We can then value the bond at the company’s current cost of that debt.

The formula sets up like this:

C = [(1 – (1/((1 + Kd)^t)))/Kd] + [FV/((1 + Kd)^t)]

Where:

C = interest expense (dollars)

Kd = current cost of debt (percentage)

T = weighted average maturity (years)

FV = Total debt (listed on the balance sheet)

Let’s try a simple example to put this all together; the formula is not as scary as it looks.

Let’s assume a company has $1 million in market debt on the balance sheet, with interest expenses of $60 million and a maturity of 6 years, with a current cost of debt of 7.5%.

Now, let’s plug those numbers into the formula and figure out the market cost of debt.

Estimated market cost of debt =

60[(1 – (1/((1 + 0.075)^6)))/0.075] + [1,000/((1 + 0.075)^6)] = $930,000

Not too bad, huh?

To calculate the enterprise value of the above company, we would add the cash and equivalents to the market value of debt, and then we have the enterprise value—more on this in a moment.

Market Value of Debt for WACC

The weighted average cost of capital, or WACC, is a formula analysts and investors use to determine what kind of returns we can expect from an investment. The cost of capital is an important method of determining the value of debt and equity, which companies use to finance growth.

The WACC, or cost of capital, uses both debt and equity to determine how much it will cost a company to borrow money. Generally, the cost of debt is cheaper than the cost of equity because interest expenses are tax-deductible.

The debt portion of the WACC represents the cost of capital for company-issued debt, and it accounts for the interest expense the company pays on its common bonds or loans taken from a bank.

Let’s look at the debt for Paypal using the cost of debt from the WACC formula. Where the:

- Market cap = $319,000 billion (E)

- Long-term debt = 6952 million (D)

- Enterprise Value (E + D) = $325,952 million

- Cost of debt = 3.00%

- Tax rate = 17.51%

Debt weighting of the WACC

= D / ( E + D ) * Cost of debt * ( 1 – tax rate )

= 6952 / (319,000 + 6952) * 3.00% * (1 – 17.51%) = 0.05%

Compared to the weighted cost of equity, which is 8.17%, we can see that Paypal could borrow tons of money to grow as that cost is WAY cheaper.

Breaking down the WACC is a great way to determine the impact of debt and equity on the company’s financing. The capital structure is an important analysis area to determine how a company grows, debt or equity.

Let’s say we run the debt through the market value of debt and see how much it affects the weighted debt cost.

The market value of debt for Paypal with a three-year maturity would reach $7,003 million. And plugging that into the weighted cost of debt gives us a value of:

= 7003 / (319,000 + 7003) * 3.00% * (1-17.51%) = 0.053%

Not a huge difference, but an interesting analysis.

Paypal is a company that doesn’t use a lot of debt to finance its growth because it generates tremendous cash flows and can finance its operations with those cash flows.

Examples of Market Value of Debt with Real Financials

To help illustrate all the above ideas, let’s pull some financials and look through the information-gathering process to calculate the market value of debt.

Let’s look at AT&T since we showed how that all shakes out for our first guinea pig.

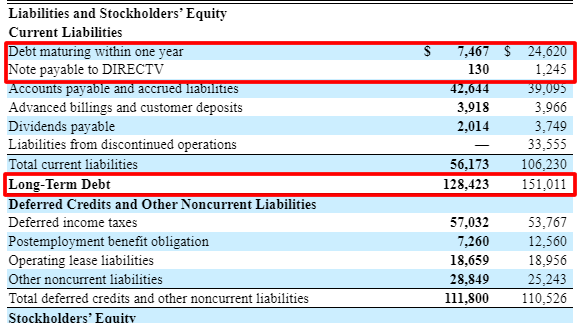

The first step is to look at the balance sheet to find the company’s total debt.

The total debt for AT&T as of the fiscal year-end 2022 was:

- Short-term debt = $7,597 million

- Long-term debt = $128,423 million

- Leases = $18,659

- Total debt = $154,679 million

And now, we can determine the weighted average maturity of the debt by looking at the debt by maturity dates and dividing those by the total debt to find the weighting.

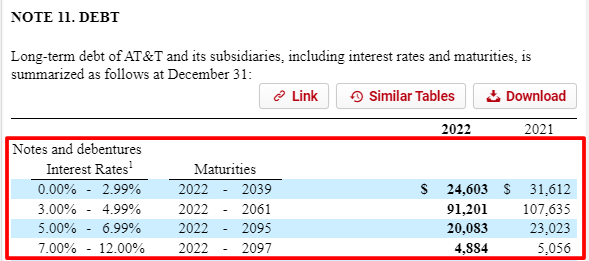

AT&T lists their debt and interest rates, plus the maturities in note 12, and then we create the following chart to determine the weighted average maturity of the debt.

Tranche | Maturities | % of Total | Weighting |

$25,603 | 17 years | 16% | 2.65 years |

$91,201 | 39 years | 55% | 21,64 years |

$20,083 | 73 years | 12% | 8.92 years |

$4,884 | 75 years | 3% | 2.23 years |

To determine the weighting, we multiply the maturity in years by the percentage of the total, which gives us the weighting, for example:

Weighing average maturity = 17 years x 16% = 2.65 years

Then to determine the average weighted maturity of the debt, we add all those weightings to give us our average weighting.

- 2.65 years

- 21.64 years

- 8.92 years

- 2.23 years

- Total average = 37.66 years

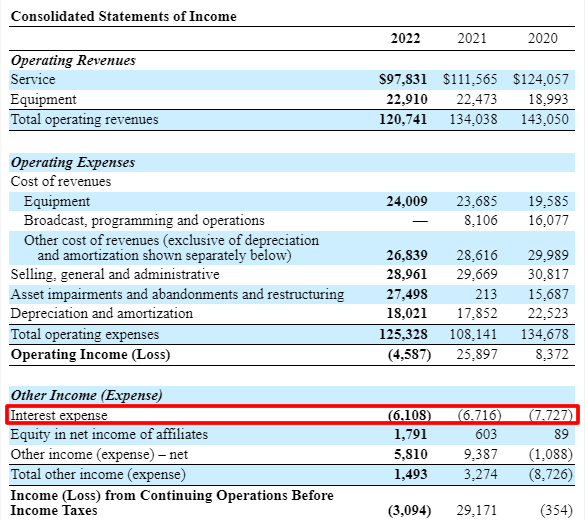

Next, we need the interest expense, which we will pull from the income statement.

Pulling the interest expense from the above income statement, we get $6,108 million for 2022.

To determine our cost of debt, we divide the above interest expense by the total debt of AT&T and then account for the company’s tax rate to find an after-tax cost of debt.

Cost of debt = (Interest expense / Total debt) x ( 1 – tax rate )

Cost of debt = (6,108 / $154,679) x ( 1 – 0%) = 3.95%

Now, we can pull our numbers together to determine the market value of AT&T’s debt for the fiscal year 2022.

- Interest Expenses = $6,108

- Cost of debt = 3.95%

- Average weighted maturity = 37.66 years

- Total debt = $154,679

After plugging all of that into our formula, we get the market value of debt of $154,679, equal to the book value. Now, if we look at the averaging the total debt over the last several years, we get:

- 2022 = $154,679

- 2021 = $199,956

- 2020 = $179,447

- Average = $178,027

And plug that average into our above formula; we get the value of $178,027.

Let’s try this with another company in the same field, Verizon, to see how that will play out, but this time I will pull the numbers for you:

- Interest expense = $3,613 million

- Cost of debt = 1.32%

- Average weighted maturity = 8.73 years

- Total debt = 202,032 million

After all that, we came up with Verizon’s debt’s market value of $209,789 million. Some assumptions plugged into those numbers were:

- Tax rate = 26.2% for the fiscal year 2022

- Included in the debt were long-term leases of $25,692 million

I include an Excel spreadsheet with the formulas that will allow you to plug the numbers from the financials to calculate your market values of debt. It will allow you to adjust numbers and add or subtract weighted average maturities. I hope it helps.

Some additional factors to consider when calculating the market value of debt:

- Interest rates – as the interest rates rise, the market value of debt will fall, and vice-versa. There is an inverse relationship between interest rates and debt because most companies’ debt is in bonds. That is why keeping an eye on the interest rates, especially as we move out of the pandemic, will impact the prices of those bonds in the markets.

- Company performance – the better a company performs and generates better cash flows, thus enabling the company to service its debt or pay it down, the more value of that debt will rise.

- Covenants – any debt borrowings come with covenants or rules that the company needs to adhere to, and if the company breaks those rules or covenants, that will negatively impact the market value of the debt.

Investor Takeaway

Calculating the market value of debt is a great way to determine if the company defaulted on its loans and what the market would pay for that debt if the company sold it.

The formula looks scary, but it’s easy to implement once you understand and find the inputs. We didn’t discuss the ability to use the market value of debt to calculate a company’s enterprise value. If you take the market value of debt, we add the cash and equivalents, giving you a company’s enterprise value. Using the enterprise value is a part of the metric EV/EBITDA that many use to value companies or compare them across sectors.

And with that, we will wrap up our discussion today on the market value of debt.

As always, thank you for taking the time to read today’s post, and I hope you find something of value in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, stay safe out there and take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- What is the Cost of Capital and How to Use It Updated 12/12/2023 “I’ve never heard an intelligent discussion about ‘cost of capital.'” The value of any company or investment is the present value of future...

- Debt Financing Vs. Equity Financing: The Grudge Match Updated 7/24/2023 CEOs have one job, to deploy company capital in a way that grows the company. To do this, they have a choice: use...

- The 3 Important, Main Components of Debt Analysis (+Metrics) Updated 7/24/2023 “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.” John Maynard Keynes...

- What a Good Debt to Asset Ratio Is and How to Calculate It Updated 1/5/2024 Many businesses use debt to fuel their growth in today’s low-interest business world. Because debt costs are far lower than equity, many companies...