When performing a DCF valuation, you must make a distinction between using market vs book value for debt. It is a critical part of calculating the weighted average cost of capital (WACC).

The easy way, of course, is to just use book value of debt from the company’s balance sheet and be done with it. The problem is that this can lead to unbalanced weights for the WACC calculation. It’s a quick shortcut, and seems harmless, particularly when analyzing companies with low leverage.

However, using this lazy approach can be dangerous in either understating or overstating the cost of debt in the overall WACC equation. That will ultimately distort the discount rate used in the valuation process.

Market value vs book value is a simple concept. Take equity for example.

Market vs Book Value (Equity)

Market value of equity = how much the equity is worth in the market. In the stock market, this means the market capitalization.

Book value of equity = how much shareholder’s equity is on the books for the business. This doesn’t necessarily equal market value, as various equity/assets can have different earning power and value.

Oftentimes these two metrics are used as a comparison to approximate the expensiveness of equity (such as a common stock) in a simple ratio called the Price to Book Value (P/B) Ratio, calculated as (Market Value / Book Value).

Now let’s look at the difference between market vs book value of debt.

Market vs Book Value (Debt)

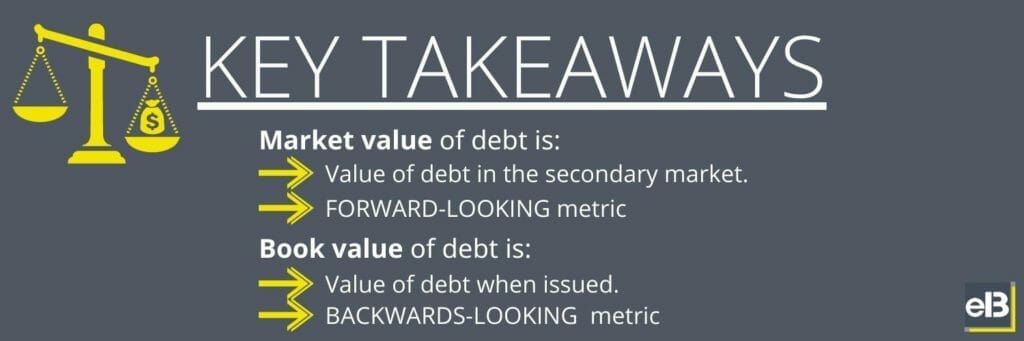

Market value of debt = how much the debt would trade in the secondary market. In the case of corporate bonds, this would depend on current interest rates (opportunity cost of buying other interest-bearing investments) and the perceived risk of the underlying (resulting in higher premium).

Book value of debt = how much the debt was worth when issued (and as recorded in the books). Utilized for both liabilities like debt and fixed assets like Property, Plant, and Equipment.

Notice that:

- The difference between market and book value is noteworthy because of the way accounting standards are enforced today. Assets and liabilities are recorded at cost and are depreciated or amortized over time, but aren’t adjusted upwards even if their true market value has increased (i.e. real estate).

- Market value is a forward looking metric.

- Book value is a backwards looking metric.

The Argument for Using Market Value in Cost of Debt Calculations

Like I said, using book value of debt for a cost of debt formula in a WACC is easy to do, and widely done at times, because it’s another involved step in a long DCF process.

However, the entire point of calculating WACC is to estimate how much a company can raise in capital in order to fund new investments and future growth.

Looking at the debt side, that means determining how much new capital would cost (in the form of an interest rate). How expensive debt was to raise for the company in the past can be helpful in determining additional issuances IF the company has a similar risk profile/liquidity/financial strength.

But the cost of raising new debt capital may be higher or lower than where the company was able to raise capital in the past if interest rates have changed, or other competing investments have had changes in yields, or if inflation has affected the value of money.

In other words:

- Discounted cash flows = value of an asset (equity or debt).

- The cost of issuing new debt depends on what investors will pay

- What investors will pay depends on how they value the cash flows from the asset

- The cost of debt = market value of that debt = value of its discounted cash flows

That’s why most analysts would be better served to use market value instead of book value of debt when calculating cost of debt in most cases. If that market value is much higher than its book value, for example, then the Market Value of a Firm’s Debt compared to its Equity (and Preferred) will shift that ratio higher, misrepresenting the real weighting between equity, debt, and preferred.

A DCF to estimate a company’s market value of debt is probably a good idea when performing the DCF of a firm and trying to calculate its true WACC, and thus, discount rate.

The Argument for Using Book Value in Valuation (Tobin’s Q Example)

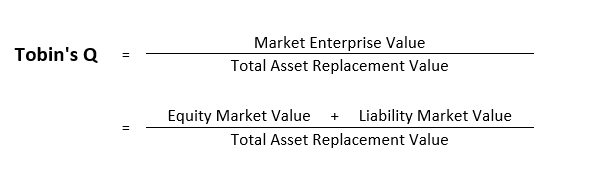

The Tobin Q theory was created by James Tobin of Yale University to adjust the value of assets over time in accordance with inflation’s impact. Like I mentioned in the first group of bullet points in this article, accounting standards require assets to be recorded at cost.

Jeremy Siegel from the Wharton School of the University of Pennsylvania summed the problem with historical cost accounting for fixed assets in his masterpiece, Stocks for the Long Run:

“If a firm purchased a plot of land for $1 million that is now worth $10 million, examining the book value will not reveal this.”

Jeremy Siegel; Stocks for the Long Run

As a response to his own observance over long periods of time, Tobin created a formula to capture what he believed to be a common sense valuation for a firm based, essentially, on its book value adjusted for inflation.

To illustrate this formula, I’ll reference another excellent post about the Tobin Q that goes in-depth into the formula and its implications:

Using a simple formula like this, analysts should be able to (in theory) simplify a firm’s expected market value calculation with the book value-focused Tobin Q.

If the Q ratio dips much lower than 1, then a competitor in an efficient market should recognize that value and acquire the firm. If the Q ratio went much higher than 1, then competitors would recognize that success and enter the market place—eventually increasing competition and lowering profit margins and overvaluation until the Q ratio hit an efficient equilibrium.

However, in practice, the historical Tobin Q ratio has been 0.78x in the United States market, and can vary depending on many other factors.

The Right Answer for Market vs. Book

As is true with all metrics and valuation, the answer is that it depends. Valuation of assets is an art, and as such, so is the interpretation of financial figures.

At times, it might make more sense to reference a company’s book value, or the market value of debt, or vice versa. It really depends on the context, and what message needs to come across.

While I’ll say that DCF valuation models, WACC, and Tobin’s Q Ratio are all fantastic resources to decipher financial statements and assist in estimating the valuation of a company or asset, there’s no magic bullet or “always correct” method.

Historical data and ratios work and correlate until they don’t, markets and economies perform exactly as expected and projected until they don’t, and so intelligence is paramount.

And so is your understanding.

So educate yourself deeply, and take shortcuts sparingly.

Updated: 7/8/2022

Related posts:

- Tobin Q Ratio – CFA Level 3 The Tobin Q ratio is an asset-based valuation model that has found its way into many value investor’s playbooks due to its economic logic based...

- What is the Cost of Capital and How to Use It Updated 12/12/2023 “I’ve never heard an intelligent discussion about ‘cost of capital.'” The value of any company or investment is the present value of future...

- How to Calculate Market Value of Debt (With Real-Life Examples) Updated 6/24/2023 Companies need financial capital to operate their business. Many companies raise capital by issuing debt securities (bonds) or selling stock. The amount of...

- Sales to Capital Ratio: Measuring the Efficiency of a Company’s Reinvestments One of Warren Buffett’s favorite metrics to measure a business’s efficiency to grow revenues is the metric, ROIC, or return on invested capital. When Buffett...