Chances are, you might be familiar with the term ‘Backdoor Roth IRA’, but what if I told you that there was a MEGA Backdoor Roth IRA?

WOAH!

Doesn’t that sound just so much better? I’m having flashbacks to middle school where everything I described started with mega, super, enormous, or another adjective where you were about to hear a hyperbole.

But this is different! This actually is a mega backdoor Roth IRA.

So, let’s start with some of the basics – first, what is a Roth IRA?

Personally, I am a huge fan of a Roth IRA as you will probably be able to pick up by the end of this post. Hell, you could even call me a ‘stan’ if you wanted to, since that’s what all of the kids say nowadays, which is essentially just a superfan, but I digress.

A Roth IRA is a form of a retirement account where you can input post-tax dollars that will compound interest free and then you can withdrawal them at the age of 59.5 without any penalty and tax-free.

If you want to compare some of the differences for an IRA and a 401K, you can read about that here. A Roth IRA does have some stipulations though, like you can only input $6000/year (as of 2019) and that there is a maximum amount of earned income that a person can have to be eligible to contribute to the IRA.

For instance, in 2019, this limit was $122,000 for an individual for full contribution, anything $122,000 – $136,999 was a partial contribution, and anything $137,000+ was ineligible to contribute.

But – what if there still was a way that you can contribute?

Spoiler – it’s called a backdoor Roth IRA.

With a Backdoor Roth IRA, essentially you can take any money from a Traditional IRA and convert it into a Roth IRA. So, you can contribute to your Traditional IRA, which doesn’t have an income limitation, and then convert it into your Roth at a later point in time.

It is important to note that when you do this backdoor Roth IRA, your money is going into the traditional IRA tax-free.

So, when you transfer that from your traditional IRA to your Roth IRA, you will be taxed accordingly on it.

It is very important to be aware of these potential tax implications and to plan ahead.

The best time to execute on a Backdoor Roth IRA might be a time where you were laid off for a point in time and your income was lower than normal, therefore reducing your tax bracket.

All in all, I recommend you consult with an accountant or a tax professional before pursuing an option like this to make sure that you’re properly aligned.

So, what the heck is this Mega Backdoor Roth IRA that I speak of? Well, let’s get down to it!

Essentially, it is the same thing as a Backdoor Roth IRA, but it allows you to take after-tax contributions from your 401k and convert them into a Roth IRA.

It is important to note that these are after-tax contributions and not Roth contributions.

So, for instance, think of it this way – you are legally allowed to contribute $56,000 into your 401k as of 2019. Now, of that $56,000, only $19,000 of it can be pre-tax. So, lets imagine this situation:

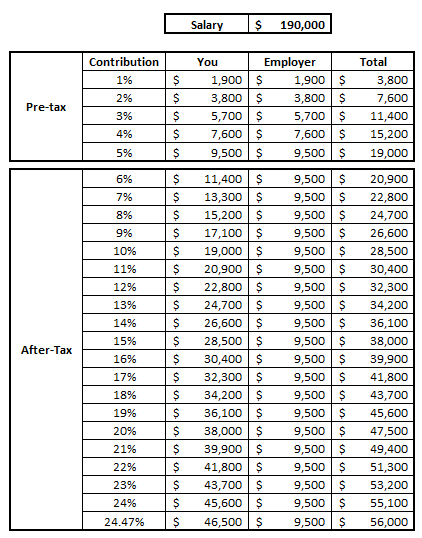

- Your annual salary is $190,000

- Your company matches your first 5% at a ratio of 1:1

- You will max out your pre-tax at $19,000 and then max out your after-tax contributions

As you can see, you would need to contribute 24.47% of your salary to max out the total $56,000 contribution.

So, now that you have done this, you will have contributed $37,000 of post-tax money ($9,500 was pre-tax from your contributions and $9,500 was pre-tax from the company match).

Getting as much money into this 401k is the first step in completing the Mega Backdoor Roth IRA.

So, now that you have done this, the next step is to move your after-tax money to a Roth IRA.

If your company 401k plan doesn’t allow you to do this, unfortunately this is where your Mega Backdoor Roth IRA journey will end– until you decide to leave your company.

And for this reason, if you’re truly considering this as an option, you should start with this step first before going any further to see if you can even have the ability to perform this suave move.

If your company 401k plan does allow you to move post-tax money to an IRA, then you’re all set! You can simply rollover all of this money into your Roth IRA.

So, why is this really beneficial?

Well, if you’re someone that really believes in the value of a Roth IRA (like me), then this will be an ability for you to cram pack that Roth IRA even more full than the $6,000 annual contribution limit that you normally will have.

Essentially, this is just another very creative way to really max out the amount that you can contribute.

Again, a Roth IRA is not for everyone. I am someone that feels like my taxable income will be higher IF, and hopefully not when, I need to withdraw from my Roth IRA, so I like having my post-tax money in my account so that I can capture the value on the back end by paying the taxes upfront.

In addition to that, I think there is a very serious peace of mind that can be gathered by being able to simply look at my account and know that 100% of that money is mine.

As long as I wait until I am 59.5 then I will be able to keep 100% of that money. I won’t have to pay taxes to pull it out, or any sort of penalty on it, and I won’t even have to pay anything on the growth that has occurred in my IRA.

So, my plan will be to always take advantage of any way that I can to put any additional money into my Roth IRA, and I strongly think that this is something that you should consider as well.

Related posts:

- Optimize Your Retirement With This Roth vs. Traditional 401k Calculator! To many people, the terms “Roth” and “Traditional” only apply to their IRA, but I am here to tell you that this is not the...

- Simple Guide: 457 vs Roth IRA Explained for Non-Finance Types Maybe you’re a firefighter hearing about a 457(b). Maybe you’ve heard words like Roth, 457, IRA, and 401k thrown around and don’t know what they...

- IRA vs 401k, Roth vs Traditional – Retirement Accounts Made Simple You decided to open a 401k. Finally! A smart decision today. But now they want to stump you with some investing jargon. Do you want traditional?...

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...