Acquisitions, as a part of growth, continue to play a role in the markets. Many companies use this strategy. Berkshire Hathaway, Google, and Constellation Software use acquisitions to grow their companies.

Many of these acquisitions become 100% ownership for the acquirer. But many don’t rise to 100%, and how companies account for the smaller ownership levels impacts the value.

For example, Berkshire Hathaway purchased both BNSF and Kraft Heinz. BNSF, the train company, was a 100% ownership acquisition, whereas Kraft Heinz was less than 30%. Each acquisition impacts the financials of Berkshire in different ways and we need to understand those ownership levels.

To value Berkshire, we need to account for the impact of Kraft Heinz’s performance and how much it impacts Berkshire’s value.

In today’s post, we will learn:

- What is Minority Interest?

- Types of Minority Interest

- The Financial Reporting of Minority Interest (IFRS vs. GAAP)

- Examples of Minority Interest

- Investor Takeaway

Okay, let’s dive in and learn more about minority interests.

What is Minority Interest?

According to Corporate Finance Institute, minority interest refers to:

“having an ownership stake in a company that is less than 50% of the total shares in terms of voting rights. Essentially, minority investors don’t exercise control over a company by way of votes, leaving them with little influence in the overall decision-making process.”

Minority interests, also known as noncontrolling interests, have different meanings according to the two main accounting conventions, GAAP and IFRS. We will cover those differences in a moment.

Minority interests arise in accrual accounting. Referring to the rule, any company owning the majority of shares must reconcile the financials of both the parent and subsidiaries, even if the owner doesn’t equal 100 percent.

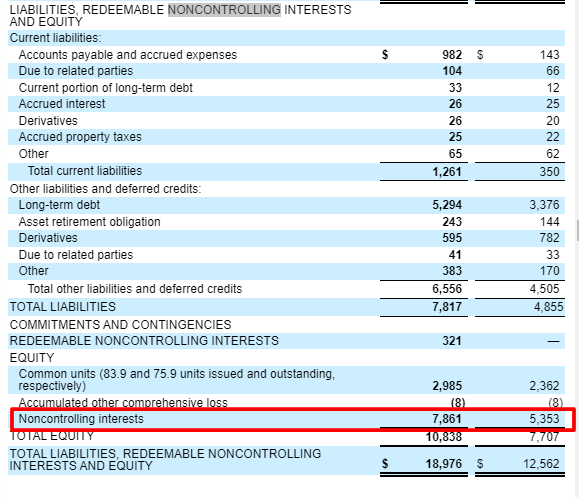

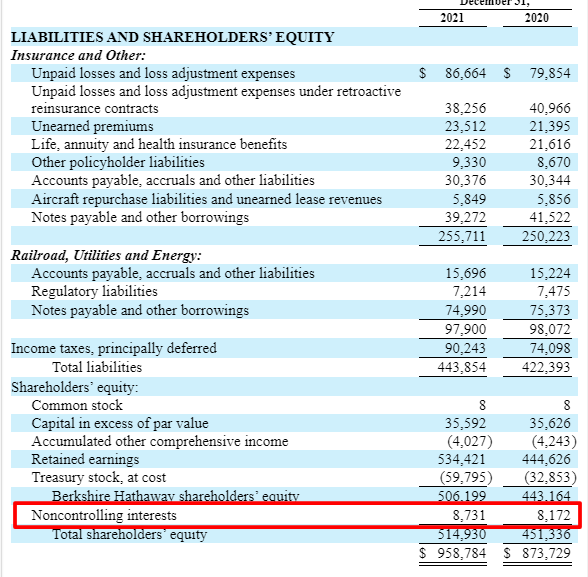

We can find the part of a minority interest on the company’s balance sheet under the equity section. Here the company will list the parent and subsidiaries’ equity as separate line items.

The minority or noncontrolling interests represent the amount owned by the minority shareholders.

Noncontrolling interests are interchangeable with minority interests. You will see both listed in company financials; they both state situations where the controlling entity might not have majority ownership.

Even though a subsidiary might not have majority ownership voting rights, the subsidiary does have some rights, including audit rights.

The use of minority interests dominates holding companies, for example:

- Utilities

- Conglomerates

- Serial acquirer

Many of these businesses might own different percentages of subsidiaries or separate businesses.

Companies need to account for the financial performance of these subsidiaries. These rules help investors understand the impact of acquisitions. They also help us understand management’s capital allocation goals.

Companies with differing levels of ownership include:

- Berkshire Hathaway

- Brookfield Asset Management

- Next Era Energy

These subsidiaries have differing impacts on the company’s financial performance.

Types of Minority Interest

Minority interest refers to the portion of a company or stock not held by the parent company. Most minority interests range from 20 to 30%.

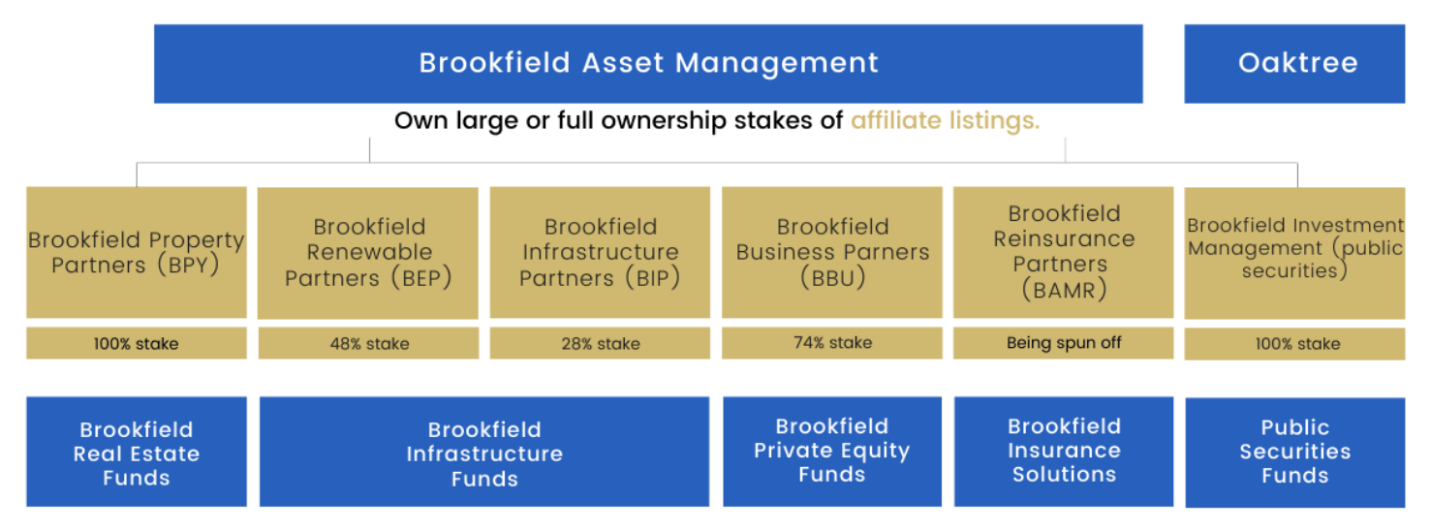

For example, Brookfield Asset Management owns different businesses under its umbrella:

- Brookfield Property Partners – 100%

- Brookfield Renewable Partners – 48%

- Brookfield Infrastructure Partners – 28%

- Brookfield Business Partners – 74%

Graph courtesy of Stratosphere.io

The majority stakeholder, typically the parent company, controls the voting rights. The voting rights allow the company to set policies and procedures.

Minority stakeholders don’t have much say or influence in the company’s direction, thus the term, noncontrolling interests or NCIs.

In some cases, minority stakeholders might have some rights or influence. For example, they can participate in sales. They also have the right to certain audit rights. Also, they have the right to attend shareholder meetings or partnership meetings.

In the private equity world, minority interest stakeholders can control negotiating rights. For example, venture capitalists may negotiate for a seat on the board of directors in exchange for their investment.

For example, from time to time, you see news stories concerning a minority owner forcing their way onto the board of directors. They do this as a means of gaining influence with their investment. The company often accepts because they need the cash and allow the addition.

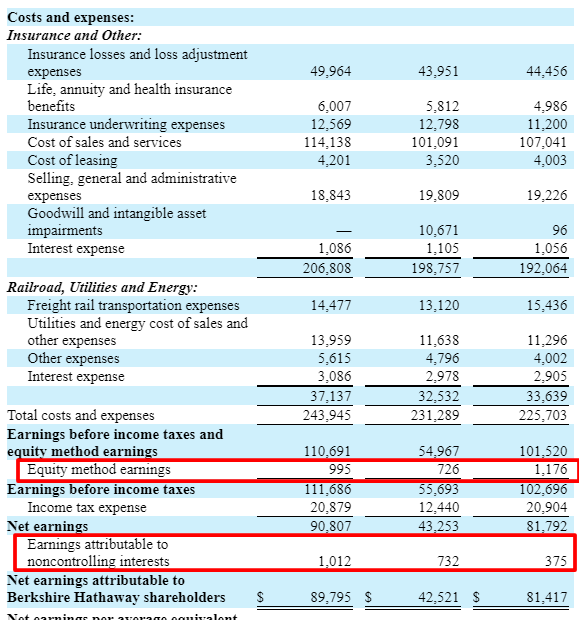

In the corporate world, companies list minority interests on their balance sheet. They also list minority interests on the consolidated income statement representing the share of profits belonging to the minority owners.

The consolidated income statement needs a clear separation between the parent company’s net income and the minority interests income.

There are two types of minority interest:

- Passive

- Active

Passive minority interests concern those where the minority shareholder owns less than 20% of the company’s equity. This level of ownership gives them no material influence on the company’s decisions.

In accounting, they only record dividends received from minority interests. Accountants refer to this as the cost method, which treats the ownership as an investment at cost, with any dividends received treated as dividend income.

Active minority interests, which hover between 21% to 49%, include minority shareholders who can materially influence the company.

Unlike passive interest accounting, companies record dividends and a percentage of income on the income statement for active minority interests. We refer to this type of accounting as the equity method.

For active minority owners, accountants treat the dividend as capital returns, decreasing the investment’s value on the balance sheet. The percentage of income credited to the minority interest adds to the balance sheet’s investment account, increasing the equity share in the company.

Under the equity method, the company records the initial cost or purchase price on the asset side of the balance sheet.

The final accounting treatment of minority interests concerns the term consolidation method. In this method, the acquirer (parent company) owns a substantial stake in the company, exceeding 50% ownership.

Instead of creating a separate balance sheet line item, this method consolidates the subsidiary balance sheet with the parent companies.

Brookfield Asset Management illustrates the different accounting methods because of the different ownership levels of its primary subsidiaries.

The accounting treatment for companies with ownership levels above 50% remains the same, regardless of the percentage. For example, if the company owns 50%, 65%, or 75%, the degree of consolidation remains unchanged.

Accounting treats it as if the company owns the entire subsidiary.

To reflect that the ownership remains less than 100% of the consolidated assets and liabilities, accountants create a new line item titled minority interests or noncontrolling interests.

The Financial Reporting of Minority Interest (IFRS vs. GAAP)

Financial reporting for minority interest only occurs when the parent company prepares separate and consolidated financial statements.

Companies will only adjust for minority interest when the parent company owns less than 100 percent of the minor company. For example, when Berkshire Hathaway purchased 100 percent of BNSF (the train company), they incorporated BNSF’s financials into Berkshire’s. But when Berkshire purchased Kraft Heinz, they only bought 26 percent of the company—leading Berkshire to create separate line items for its 26 percent ownership of Kraft Heinz.

Before 2008, companies reported minority interest as equity or noncurrent liabilities under GAAP (Generally Accepted Accounting Principles) rules, per the US.

FASB (Financial Accounting Standards Board) removed this ambiguity by creating a requirement to report minority interests within the parent company’s equity or liability sections.

GAAP allows minority interests in either equity or liability. For example, the company’s balance sheet shows minority interest as a separate line item.

The separate line item allows investors to see all the controlling interests in Berkshire Hathaway, for example.

The desire for clarity serves two purposes:

- It helps investors make informed decisions and helps them compare shareholding patterns between different companies.

- The separate line items also help give the minority shareholders a little extra protection as most remain in a disadvantaged position. As we discussed earlier, minority shareholders have little to no say in governing the parent company, and any extra protection offers a little help.

The GAAP rules differ from the accounting rules outside the US. For example, IFRS (International Financial Reporting Standards) governs accounting outside the US. And per their rules, minority interest falls under equity, period.

The difference between GAAP and IFRS accounting continues to close, but differences remain. So when investing in a country outside your normal domain, a good practice is to ensure you use the accounting rules of the governing country.

For example, suppose I am analyzing Adyen, the Dutch payments company. In that case, I need to ensure I realize they use IFRS accounting rules, whereas if I analyze PayPal, the US payments company, I need to adhere to GAAP accounting rules.

Examples of Minority Interest

As we mentioned, minority interests arise when a parent or holding company owns less than 100 percent of the controlling interest in the subsidiary.

The claim of the minority shareholders on the company’s net assets is known as the minority interest. These minority shareholders have differing buy equal claims on the different earnings and assets of the subsidiary.

The consolidated balance sheet encompasses all of the subsidiary’s assets and liabilities. Also, the consolidated income statement includes all of the subsidiary’s revenues and expenses.

The parent company’s controlling interest gives it rights to manage all the assets of a subsidiary, including 100 percent of the subsidiary’s assets, liabilities, revenues, and expenses in its consolidated financial statements.

But the parent company doesn’t have a 100 percent claim on the assets or earnings.

Enter the consolidated financial statements, which help recognize the minority shareholder claims.

Let’s use a hypothetical situation to help illustrate these ideas using simple numbers.

Let’s assume that Apple acquired 80% of the equity shares of Berkshire Hathaway for $650,000 in January 2024. On the date of the acquisition, the book value of equity equals $650,000 (made up of $500,000 equity and $150,000 of retained earnings.

Here is a chart explaining the ownership breakdown:

| Total | Apple (80%) | BRK.B (20%) | |

|

Equity shares |

$500,000 |

$400,000 |

$100,000 |

|

Retained Earnings |

$150,000 |

$120,000 |

$30,000 |

|

Total Equity |

$650,000 |

$520,000 |

$130,000 |

Next, let’s look at how we calculate goodwill for the above acquisition. Goodwill represents the amount the company pays above the fair value of the equity. In other words, it represents the overpayment for the value of the purchase.

Calculations of minority interest:

20% x $650,000 = $130,000

Calculations of Goodwill

Apple paid $650,000 overall for 80 percent of Berkshire’s equity. The actual value of the 80 percent of the equity equals $520,000, which we arrive at by multiplying 80 percent by $650,000, the original purchase price.

80% of Berkshire Equity = $650,000 x 80% = $520,000

To determine the value of the goodwill or excess purchase price over the actual value, we subtract the purchase price from the 80 percent value of the equity. For example:

Goodwill = $650,000 – $520,000 = $130,000

To help record all of these transactions for Apple, we look at the company’s balance sheet, where we would see two separate line items:

Shareholder equity

Minority interest = $130,000

Assets

Intangible assets

Goodwill = $130,000

A note about the accounting for the above transaction: the $130,000 will not appear on the separate financial statements for Apple or Berkshire. Instead, it will appear on the consolidated statements for Apple.

Let’s look at a real-life example to see how it might impact a company’s financials.

Berkshire Hathaway, Warren Buffett’s conglomerate, acquires portions of different companies and sometimes acquires total control of the company over a long period.

His acquisition of GEICO offers the perfect illustration of this idea. Buffett first purchased shares of GEICO in 1951, continuing to buy shares until buying the entire company in 1996.

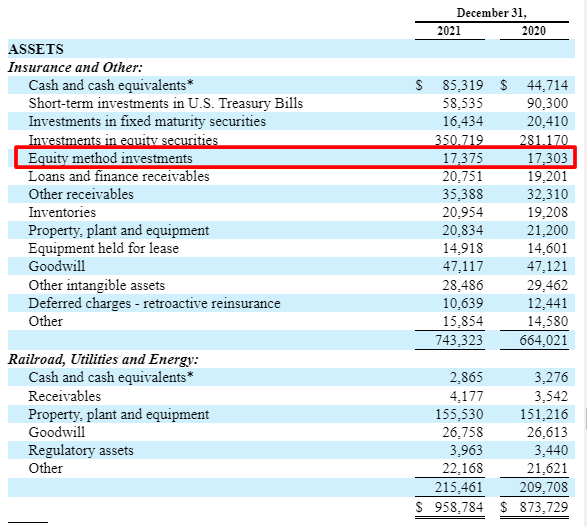

Below is an excerpt from the latest 10-k (2/28/22), highlighting the status of the different minority holdings for Berkshire Hathaway.

“Berkshire owns 26.6% of the outstanding common stock of The Kraft Heinz Company (“Kraft Heinz”). Kraft Heinz is one of the largest food and beverage companies in the world, with sales in numerous countries within developed and emerging markets and territories. Kraft Heinz manufactures and markets food and beverage products, including condiments and sauces, cheese and dairy meals, meats, refreshment beverages, coffee, and other grocery products, throughout the world, under a diverse mix of iconic and emerging brands. Berkshire subsidiaries also own a 50% joint venture interest in Berkadia Commercial Mortgage LLC, a 38.6% interest in Pilot Travel Centers LLC, a 50% joint venture interest in Electric Transmission Texas, LLC, and a 50% noncontrolling interest in Iroquois Gas Transmission System L.P.”

Of the companies Berkshire doesn’t own outright, the following ownership for each:

- Kraft Heinz – 26.6%

- Berkadia Commercial Mortgage – 50%

- Pilot Travel Centers – 38.6%

- Electric Transmission Texas – 50%

- Iroquois Gas Transmission – 50%

The minority interests show up in different spots in the financials.

For example, in Berkshire’s balance sheet, we, too, see examples of line items showing the recording of a minority or noncontrolling interests.

Equity method investments for Berkshire of $17,375 million and $17,303 million, respectively, for 2021 and 2020. These investments represent the income generated from the above companies concerning Berkshire’s ownership stake.

The above noncontrolling interests represent the minority shareholders’ equity interest from Kraft Heinz and others that Berkshire owns less than 50% of those companies.

The equity method earnings represent the amount of revenue generated in proportion to Berkshire’s equity investment in the other companies in an amount proportional to the ownership percentage.

The earnings attributable also relate to the minority or noncontrolling interests of Berkshire’s percentage ownership.

Investor Takeaway

Minority interests provide investors with important information when looking through financial statements. It also helps investors make informed decisions about capital allocation and what direction management wants to take the company.

The percentage of minority ownership of acquisition determines the influence and ownership rights. Along with the possible dilution of the power of the current board of directors.

Capital allocation decisions remain job number one for the CEO. And communicating the plans for any forward growth remains relevant to shareholders.

Most companies play the acquisition game, at least on a minimal level. But many use it to full advantage:

- to get technology

- customers

- new products

- or create an edge over competitors

The amount of partial ownership impacts the financials of the acquiring company. And understanding those impacts helps us make better decisions.

With that, we will wrap up our discussion on minority interests.

Thank you for reading today’s post; I hope you find something of value. If I can be of any further help, please don’t hesitate to contact me.

Until next time, take care and stay safe out there,

Dave

Related posts:

- What is a Def14A Statement and Why is it Important for Investors? Updated 12/12/2023 Did you know that Warren Buffett made $380,000 in 2020, of which $100,000 was his salary, and the balance was security protection for...

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- Is Value Investing DEAD?? The 2 Reasons YES… and The 2 Reasons NO. With growth investing absolutely destroying the market lately, people are wondering if value investing is dead. After all, the post-internet economy is much different than...

- 13F Filings: The Easy Way to Find Awesome Investment Ideas from the Greats Updated 3/6/2024 Looking for a place on the internet to get a detailed portfolio snapshot of the world’s greatest investors, all regularly and for free?...