The misery index in economics is used to describe the severity of the negative effects of inflation and unemployment on the population. The misery index is the combination of adding together the inflation rate and the unemployment rate. Let’s explore what the misery index means, its history, and how investors can mitigate the effect on their retirement nest egg.

The effects of inflation erode a saver’s purchasing power and increase the cost of living which causes stress for the population. The unemployed people in the economy are suffering additionally due to their lack of income (which should ideally be rising alongside inflation!). The higher the combination of inflation and the unemployment rate, the more miserable and stressed out people are with the economy, particularly the unemployed.

Historical Highest Reading of the Misery Index

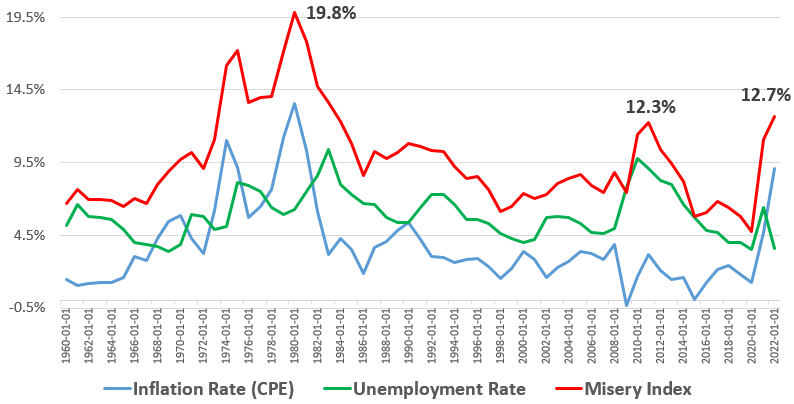

It is during the late 1970’s oil crisis and high inflationary period when the misery index was created by Arthur “Art” Okun. It is also during this time that after the 1979 oil crisis brought on by the Iranian revolution, the misery index hit its high of 19.8% in 1980 due to the whopping 13.5% inflation rate combined with the 6.3% unemployment rate.

How does the Misery Index Read Today?

The misery index and inflation, in general, are hot topics in the news at the moment. The current high U.S inflation rate of 9.1% combined with the unemployment rate of 3.6% as of June 2022 is yielding a combined 12.7% misery index.

The high 9.1% consumer inflation figure is driving the majority of the misery index but that is small condolences for the 3.6% of the population that is unemployed. As the central bank hikes interest rates to fight inflation, the unemployment rate will likely rise as the economy slows down and possibly enters a recession.

What the Misery Index Means for Savers and Investors

Inflation decreases the real value of your retirement nest egg if returns are not keeping up. The risk of unemployment is always present and prudent people would keep larger emergency savings in times of greater job uncertainty.

Equites are a good long-term hedge for inflation because strong companies will be able to pass on increases in cost of goods sold to end consumers. The pace at which such increases will be passed on is what will differ between strong and weak companies. Weak companies might get squeezed in the value chain over the short or mid-term, but should still eventually be able to pass costs on to the consumer and will see their margins recover.

Th relationship with inflation and stocks can be analyzed through the Grinold-Kroner model which calculates a macro view on stock market returns. Inflation is added into the equation and contributes to long-term returns. That being said, higher inflation is often normally associated with higher risk-free interest rates which negatively effect stock valuations through the discounted cash flow process. This contraction in stock multiples and valuations is something we are seeing at the moment with interest rates rising.

Inflation can be terrible for savers if the rate of interest they are earning in their bank accounts is less than the rate of inflation. To mitigate, savers should always shop around for the best rate between banks and be sure to bank with multiple banks. Personally, I have three different banks and will often move my emergency savings between the groups depending on rates.

In regards to fixed income, the effects of high inflation and rising interest rates are detrimental to bonds as the principal of the bond being paid back at the end of the day generally does not adjust for inflation and is worth less in real terms. Also, higher interest rates being offered by new bond issues make the older issues less attractive and additionally hurt their price.

Takeaway

The magic of compounding works best over the long term. A portfolio’s long-term returns should take into account inflation risk if equities are the asset class of choice. The current supply chain stress in the economic environment is driving inflation along with demand rushing back after COVID. A slowdown in the economy and an increase in the unemployment rate could set the misery index to the old highs of the 1970’s.

Related posts:

- How Unemployment and the Stock Market Have Been Linked Through History Updated – 11/17/23 You might want to know how unemployment affects the stock market. It would seem that logically, high unemployment should lead to a...

- Common Indicators of Rising Interest Rates and Its Impact on the Economy How can you tell when interest rates might rise and what the impact would be on our lives? You can use simple tools to answer...

- How Fed Economic Stimulus Works and Its Effect on the Economy The Central Bank of America is the Federal Reserve, responsible for deciding how much money is in the economy. To most people, that means that...

- How Interest Rates and the Stock Market Are Intricately Intertwined “The most important item over time in valuation is obviously interest rates.” –Warren Buffett Quite a statement, and my thought is, how much do we...