It’s just money…why do people get so up in arms about it? Well, you’re about to get 101 reasons why with these mind-blowing money facts!

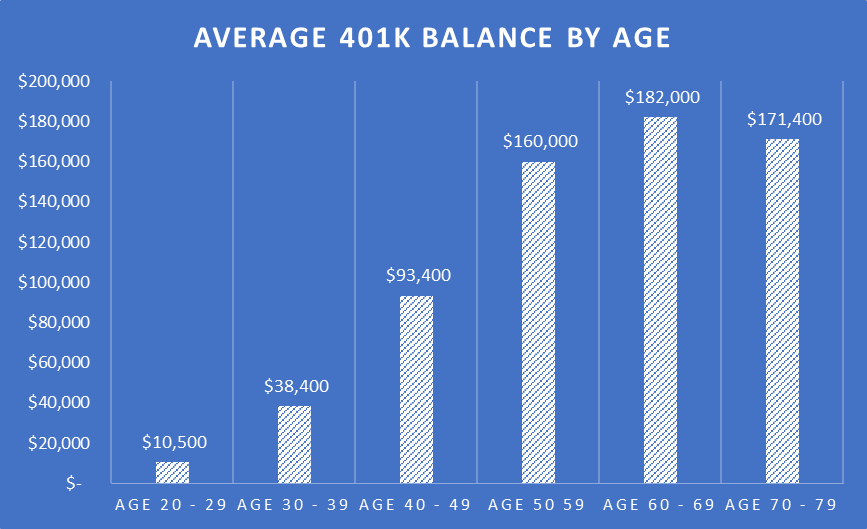

1 – Average 401k balance by age:

2 – Less than 17% of high schoolers took a semester of personal finance

3 – 2 less states conducted personal finance than the previous year

4 – 18% of employees making > $100K/year live paycheck to paycheck

5 – 70% of people under-save according to their own standards

6 – 32% of employees have financial problems that negatively affect their lives

7 – 39% of employees would not come up with $3K in a month if there was an unexpected expense in their life

8 – 36% of people couldn’t pay for a $400 expense out of pocket, down 6% from the prior year

9 – Nearly ¼ of adults were worse off financially compared to the prior year

10 – 43% of adults said their financial status was at least “good”, a decrease of 20% from the year prior

11 – 5% of adults do not have a bank account

12 – 29% of adults that retired last year said the pandemic-related factors contributed to the timing of their retirement

13 – 38% of college-educated people budget while 26% of people with a high school degree or less budget

14 – The median family income last year is $79,900

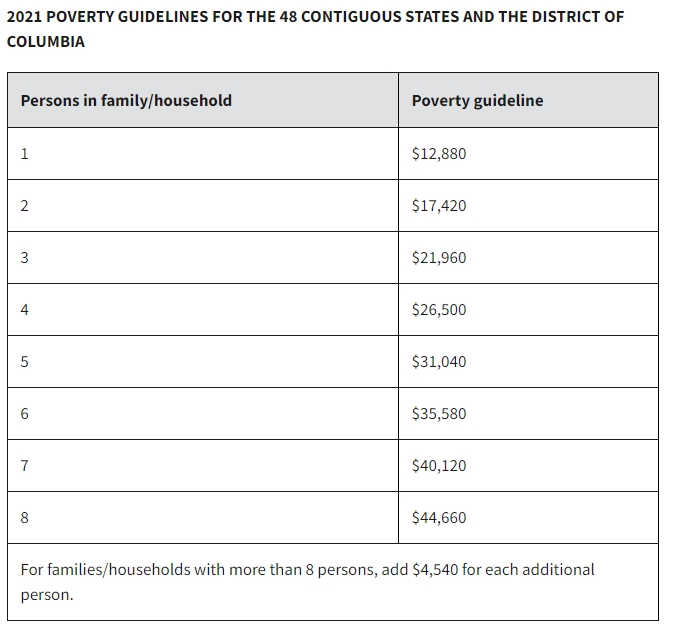

15 – The poverty line for a 4-person household in 2021 was $26,500

16 – Americans are 40% likely to fund a purchase with a credit card

17 – Average credit card debt outstanding is $5,315

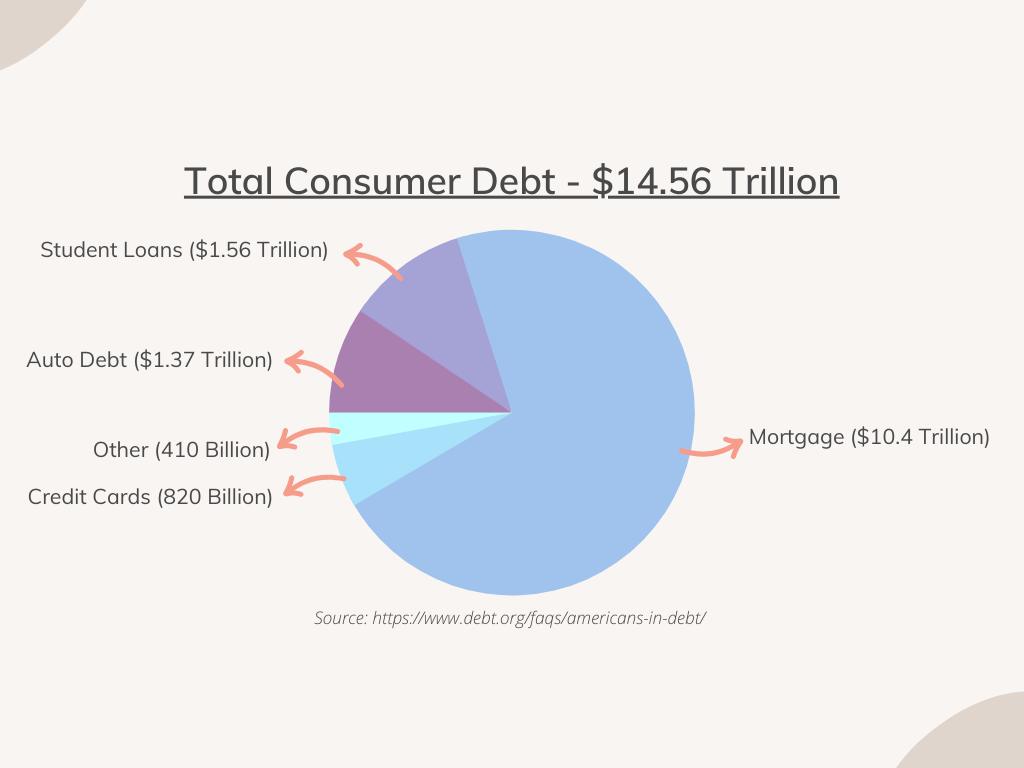

18 – Total consumer debt is $14.56 trillion

19 – 191 million Americans have credit cards

20 – Women graduates are paid 74% of what men make

21 – Women have about $30K in student loan debt after graduating from a public college

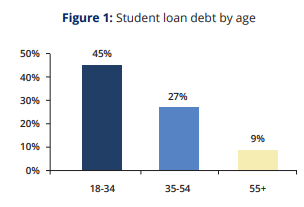

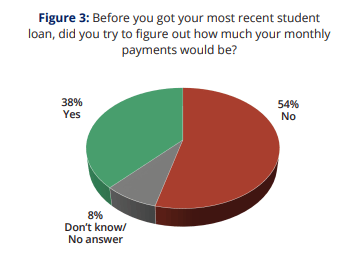

22 – 54% of people received student loans without contemplating what their payment would be

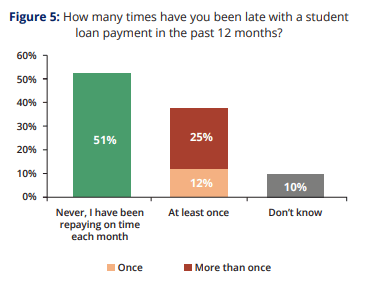

23 – 37% of people have been late on a student loan payment in the last 12 months, with another 10% not knowing if they’ve been late.

24 – 35% of people spent more money than they can afford to participate with friends

25 – 34% were influenced by social media to spend money on experiences

26 – 57% pay more attention to how their friends spend versus save

27- 60% wonder how friends can afford expensive experiences posted on social media

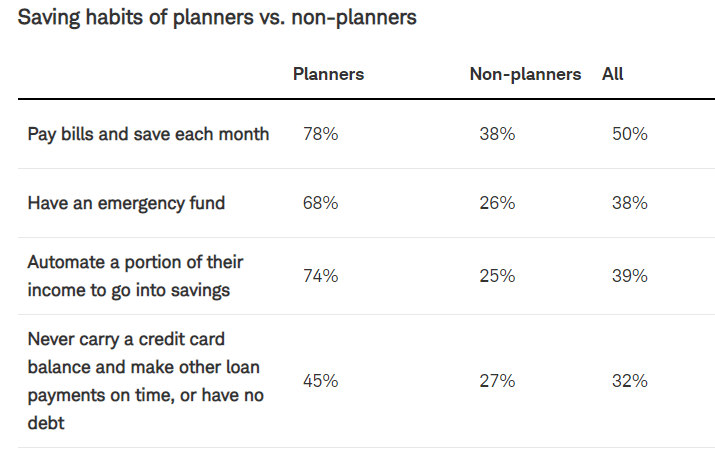

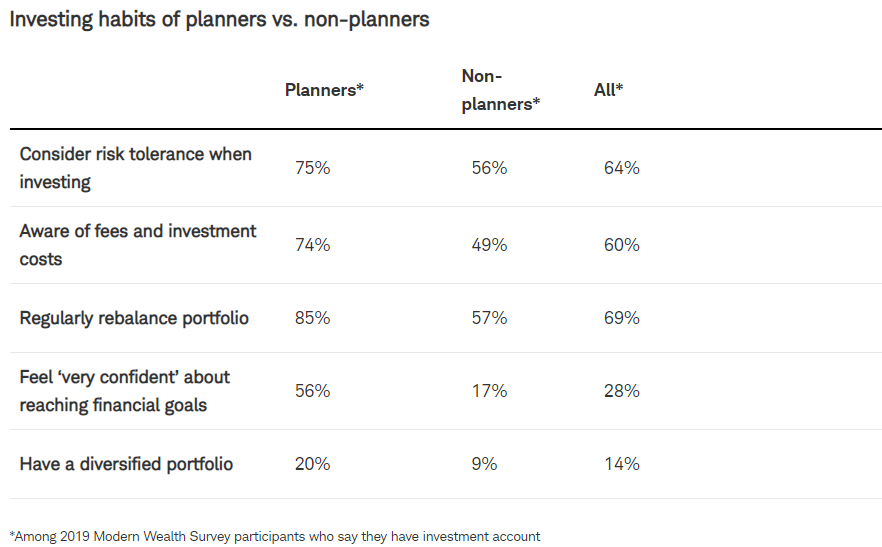

28 – Planners are 40% more than twice as likely to pay bills and save money every month

29 – Planners are 3x more likely to feel “very confident” about reaching retirement goals

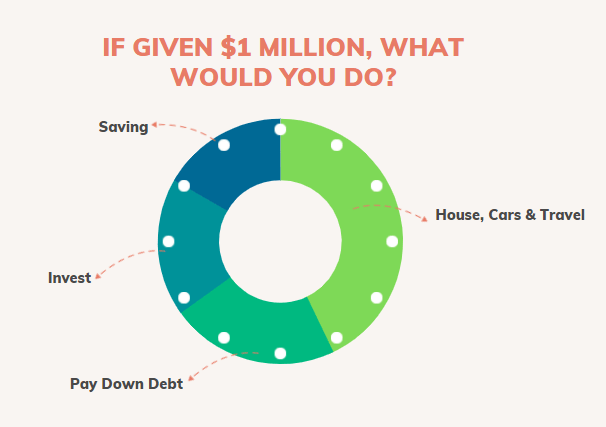

30 – “If you had a $1M windfall, where would you spend your money”:

31 – One in five Americans (21%) have NO retirement savings at all

32 – One in three Baby Boomers (33%), the generation closest to retirement age, only have between $0-$25,000 in retirement savings

33 – Three quarters of Americans believe it is “not at all likely” (24%) or only “somewhat likely” (51%) that Social Security will be available when they retire

34 – Nearly half (46%) of adults have taken no steps to prepare for the likelihood that they could outlive their savings

35 – Among the more than half (55%) of Americans who believe they will have to work past age 65 from necessity, 73% cited “not enough money to retire comfortably” as the dominant driver.

36 – An overwhelming 9 in 10 Americans (87%) agree that nothing makes them happier or more confident than feeling like their finances are in order.

37 – While nearly 7 in 10 Americans (68%) said they feel happy about their financial situation at least sometimes, a good portion also consistently experience a range of negative emotions such as:

- Anxiety (54%) (25% “all the time” or “often”)

- Insecurity (52%) (24% “all the time” or “often”)

- Fear (48%)

38 – Money also emerged as the dominant source of stress (44%), dramatically outpacing personal relationships (25%) and work (18%)

39 – Americans are twice as likely to have accumulated $5,000-$25,000 in debt (33%) rather than personal savings (17%)

40 – 2 in 10 people allocate a staggering 50%-100% of their income towards debt repayment

41 – 1 in 10 (13%) Americans say they will be in debt for the rest of their lives

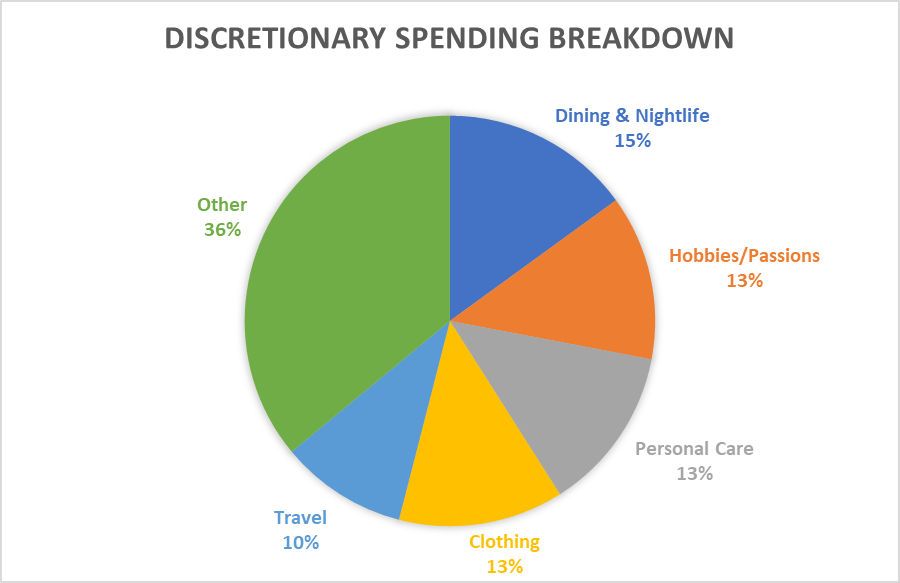

42 – Looking closer at the nature of discretionary spending, dining and nightlife emerged as the top category (15%). Other mentions included:

- Personal passions/hobbies: 13%

- Personal care: 13%

- Clothing: 13%

- Leisure travel: 10%

43 – The vast majority (78%) of Americans said assets under $100,000 would qualify one as middle class. Just over half (52%) said the range is between $50,000 to $99,999, and a quarter (26%) said less than $50,000

44 – In terms of values, it appears that being a part of the middle class is less associated with personality traits like humility (30%) and thriftiness (39%) and more with tangibles like work ethic (84%) and homeownership (69%)

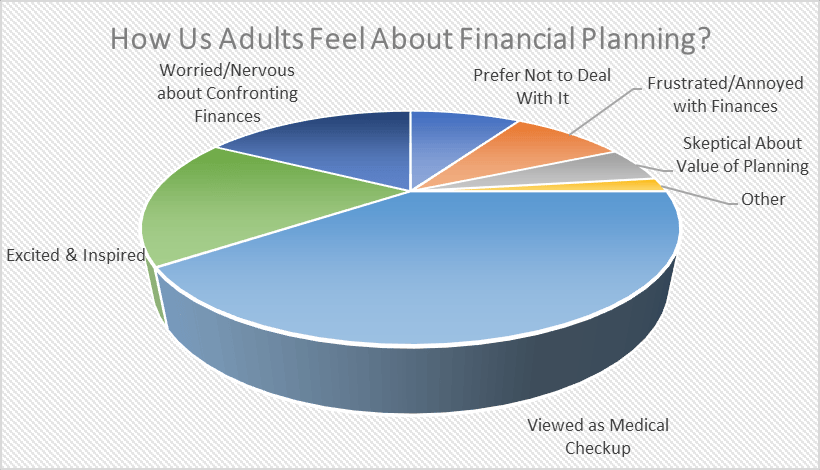

45 – Nearly one in three Millennials (29%) say financial planning makes them feel “excited and inspired”. This is more than double the amount of Baby Boomers (12%) who say the same, and substantially more than Gen Xers (22%).

46 – Only 40% of Millennials say they have good clarity on how much they can afford to spend versus how much they should be saving for the future. That compares to 56% of Baby Boomers and 47% of Gen Xers.

47 – Millennials are carrying an average $36,000 in debt and put 34% of their monthly income toward paying it down. Interestingly, their overall debt levels are exactly on par with Baby Boomers who are also carrying $36,000 in debt, and slightly less than the $39,000 that Gen Xers are carrying.

48 – The single greatest source of Millennials’ debt comes from education loans (21%) and credit card bills (20%), whereas mortgages, followed by credit card bills, top the list for both Gen Xers (32%) and Baby Boomers (25%).

49 – New research from Northwestern Mutual has found that when US adults aged 18+ are asked how they feel about financial planning, the far and away No. 1 answer is, “not my favorite thing in the world but now it needs to get done like a medical checkup” (40%). Nearly one in five (18%) say they are “excited and inspired, love to do it.” Another 40% combined expressed a range of negative emotions about planning, including:

- Worried, nervous about confronting the financial details of my life (17%)

- Prefer to not deal with it until I absolutely have no choice (9%)

- Frustrated, annoyed with my financial situation (9%)

- Skeptical about the value of planning (5%)

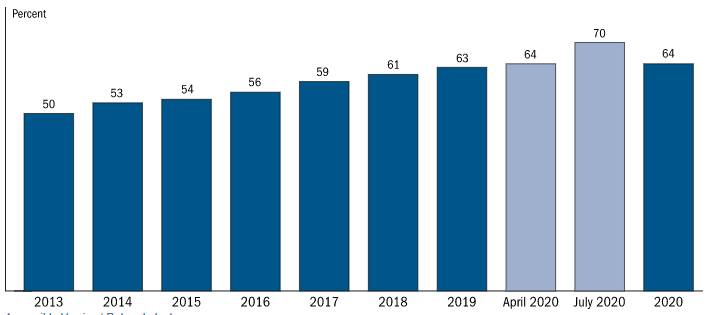

50 – 70% of Americans say their financial planning needs improvement.

51 – 58% of Americans feel comfortable creating a personal budget.

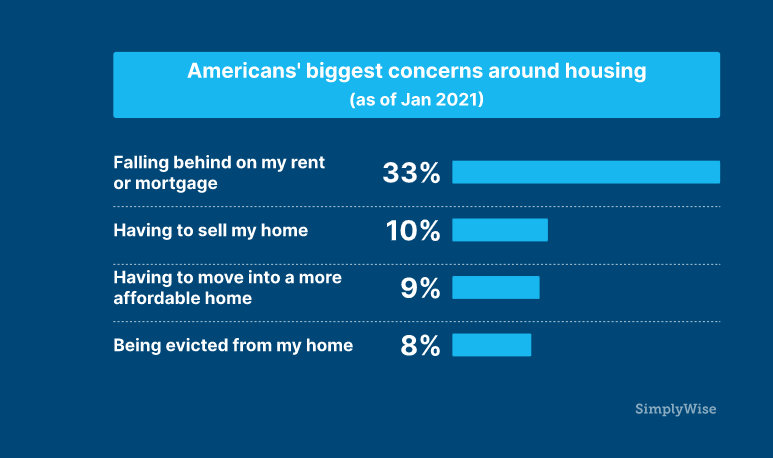

52 – 46% of Americans missed one or more rent/mortgage payments, and 25% have missed more than one.

- Men missed more payments than women, with 48% of men saying they missed one payment, and 45% of women.

- An overwhelming majority of Americans -67%- say they have taken on some kind of debt, with the largest section being in the $1,000 – $4,999 range, at 21%.

53 – 27% of Americans received unemployment for the first time, while 46% say they received some sort of unemployment.

54 – Younger generations were hit the hardest – 36% of the 18 to 24 age group and 33% of the 25 to 34 age group say they received unemployment benefits for the first time.

55 – 55% of people are more concerned about retirement today than this time last year.

56 – 44% of Americans worry they’ll never be able to retire—an all-time high.

57 – 69% of Social Security beneficiaries experienced at least 1 scam attempt in the last 3 months.

58 – 23% of Americans don’t have any kind of retirement plan.

59 – 64% of Black Americans could not last more than 3 months off their savings, compared to 48% of White Americans.

60 – 25% of Americans in their 60s could not last more than 3 months off their savings—an all-time high.

61 – 75% of people who were laid off due to COVID-19 couldn’t come up with $500 cash.

63 – 45% of Black Americans now fear falling behind on their rent or mortgage, compared to 44% of Hispanic Americans, and 28% of White Americans.

64 – An Index-high of 32% of people in their 50s are now planning to postpone retirement from work. And a record 21% of people in their 60s are now planning to postpone retirement from work.

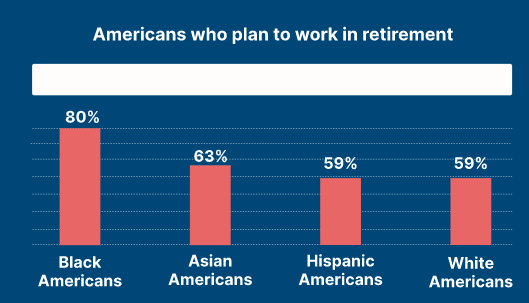

65 – The January Index found that 71% of workers plan to continue working in retirement.

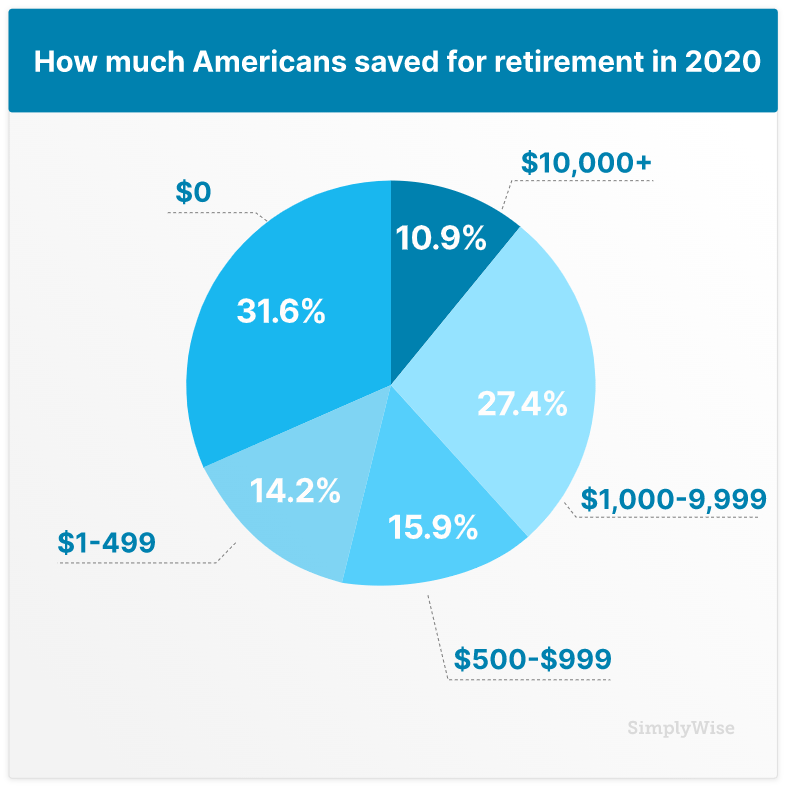

66 – January 2021 Index found that 32% of Americans saved $0 for retirement in the last year.

67 – Men saved more than women across the board. For example, 63% of men versus 47% of women saved $500 or more for retirement in the last year. Moreover, just 26% of men saved $0 for retirement in 2020, compared to 36% of women.

68 – 61.7% of Americans saved under $1000

69 – Beyond retirement savings, the overall financial and savings reality for many Americans today remains grim. When asked how long they could afford to not work and live off their savings, 37% of all Americans could not last a month. 58% of all Americans could not live off their savings for more than 3 months.

70 – A survey found that an Index-high of 52% of Americans would not be able to come up with $500 cash right now without selling something or taking out a loan. This is up from 43% reported in November 2020 who could not come up with $500 cash.

71 – 1/3 of Americans largest housing concern is that they will fall behind on their mortgage

72 – Financial statistics show that if you’re going to start saving for your retirement once you’re 45, you’re going to have to save FOUR times your annual salary, as opposed to only 25% in your 20s.

73 – More than 21% of Americans 75 years or older carry their mortgage debt into retirement.

74 – The average monthly maintenance fee on a checking account is now $14.39.

75 – Shoppers blow around $5,400 a year on impulse purchases, which amounts to a shocking $324,000 over a lifetime.

76 – The average American pays $237 a month for subscription services

77 – Almost 65% of parents with children under 18 said they would be fine with adding to their card debt during the holiday season and more than half (56%) said that it was fine to do so,

78 – The average American pays about 6% for their down payment, according to data from Attom Data Solutions.

79 – Projections for 2022 salary increase budgets jumped almost a full percentage point from 3.0 in April to 3.9 in November.

80 – Average 2021 actual total salary increase budgets jumped from 2.6 percent in the April 2021 survey to 3.0 percent in the November 2021 survey.

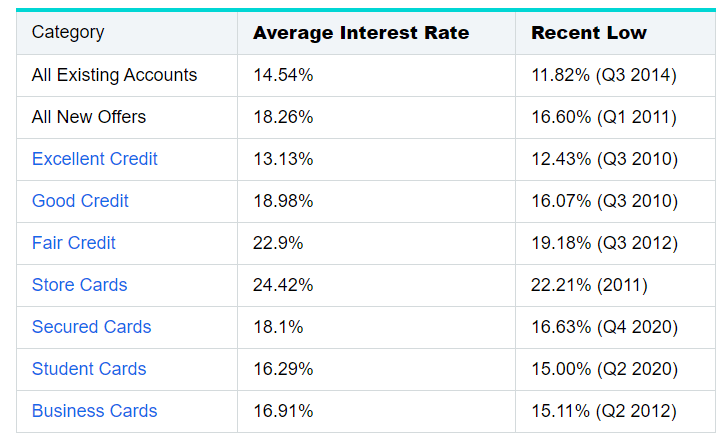

81 – The average secured credit card’s APR is currently 18.1%, for example, while credit cards for people with excellent credit charge 13.13%.

82 – According to the Social Security Administration, its retirement benefits are only designed to replace approximately 40% of the average worker’s wages.

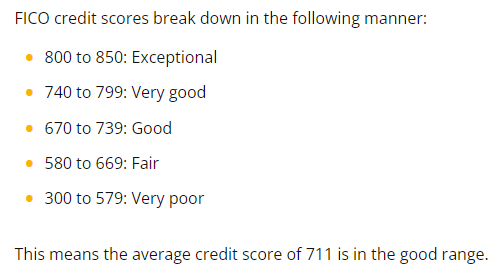

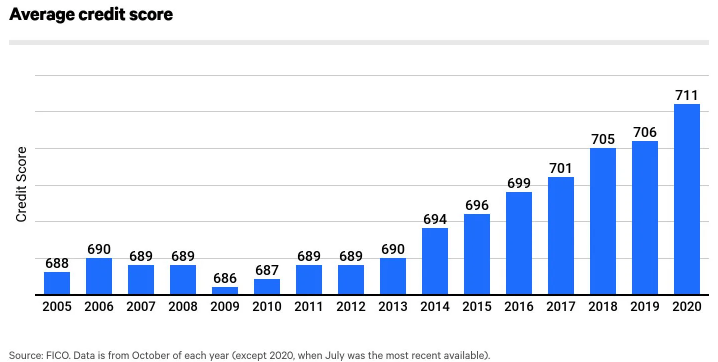

83 – The average credit score in the U.S. is at an all-time high of 711

84 – The average credit score for a consumer is 711, up 5 points from the year prior

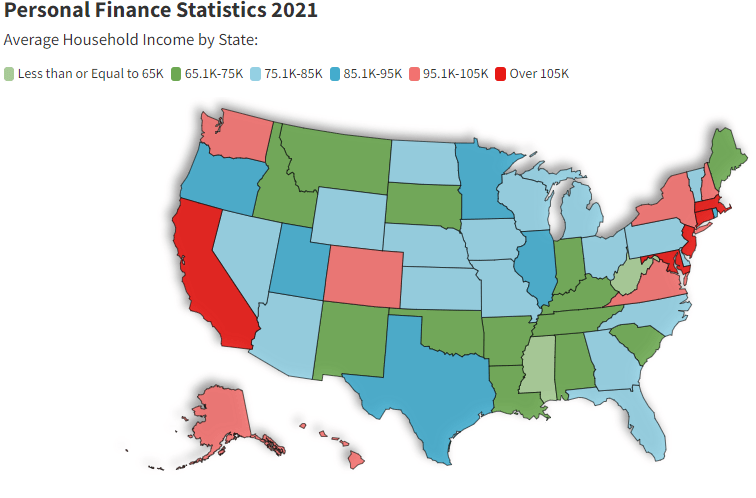

85 – Average Household income can greatly differ from state to state, as noted below:

86 – The consumer price index climbed 7% in 2021, the largest 12-month gain since June 1982.

87 – The personal savings rate in the US in 2020 was 13.7%. This is the highest since 2012’s 12%. This is reminiscent of the 13.2% savings rate posted back in 1970.

88 – Because of the pandemic, 26% of Millennials had to withdraw from their emergency fund/savings accounts.

89 – In 2019, about 46.4% of American households owned mutual funds. This is the highest since 1980.

90 – The number of mutual funds in the US in 2019 was 7,945. This is a drop from 8,094 in 2018.

91 – In 2020, the value of assets managed by ETFs reached $7.736 trillion. This is a sharp increase from 2019’s $6.194 trillion—a trend that continues since 2003. In 2003, the total value of assets being managed was only $204.3 billion.

92 – In 2020, the number of assets under management or AUM by ETFs in North America reached $5.6 trillion.

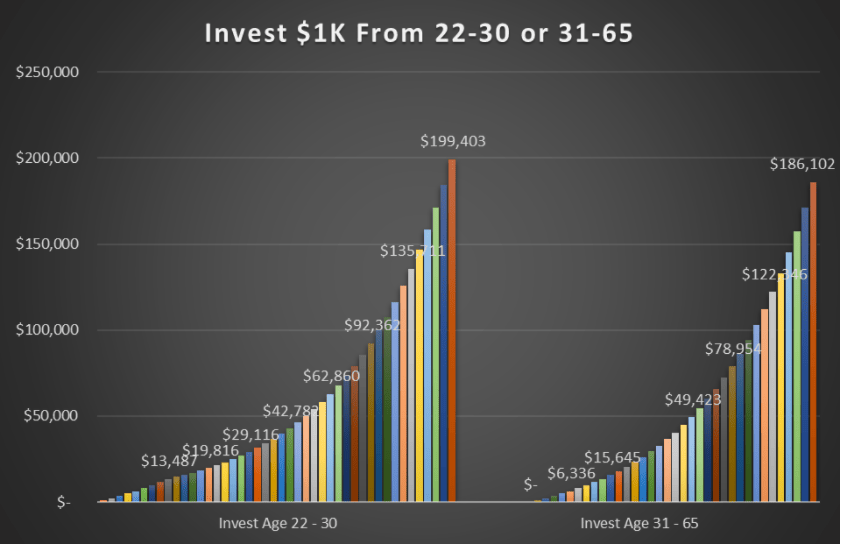

93 – If you invest $1000/year from age 22-30 and never invest another penny, you’ll have more money at age 65 than if you invested $1000/year from ages 31-65.

94 – ETFs Post a Record $1 Trillion of Inflows in 2021

95 – 3% of all US families owned publicly traded stock in some fashion, up from 32% in 1989

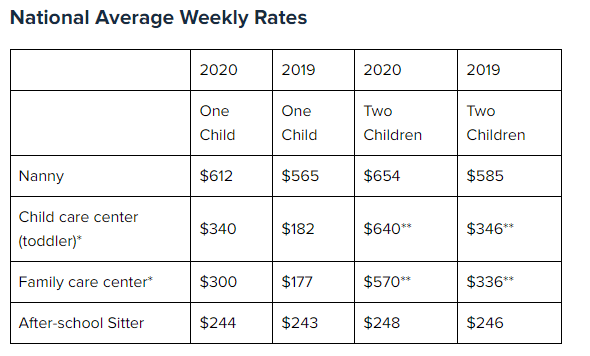

96 – 85% of parents, compared to only 72% in 2020, report they are spending 10% or more of their household income on child care.

97 – The average cost of groceries for U.S. households is $4,942, based on 2020 data from the U.S. Bureau of Labor Statistics. This works out to about $412 per month.

98 – The most common 401k employer match is 50% for every percent up to 6%, meaning your employer would match 3% if you put in 6%.

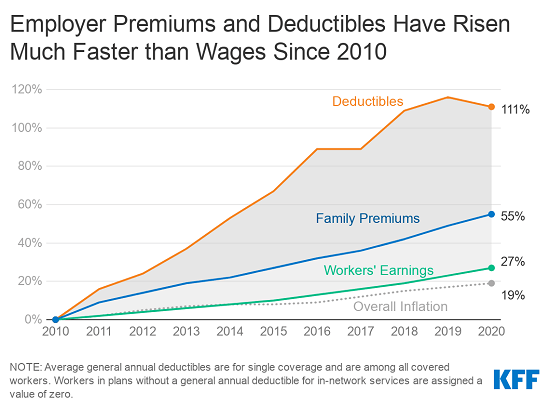

99 – Employer Premiums and Deductibles have increased 55% and 11%, respectively, since 2010, compared to 27% increase in employee wages:

References/Sources:

- https://www.investopedia.com/articles/personal-finance/010616/whats-average-401k-balance-age.asp

- https://www.councilforeconed.org/wp-content/uploads/2020/02/2020-Survey-of-the-States.pdf

- https://www.councilforeconed.org/wp-content/uploads/2020/02/2020-Survey-of-the-States.pdf

- https://www.willistowerswatson.com/en-US/News/2020/02/despite-improvement-in-their-financial-wellbeing-US-workers-remain-worried

- https://www.willistowerswatson.com/en-US/News/2020/02/despite-improvement-in-their-financial-wellbeing-US-workers-remain-worried

- https://www.willistowerswatson.com/en-US/News/2020/02/despite-improvement-in-their-financial-wellbeing-US-workers-remain-worried

- https://www.willistowerswatson.com/en-US/News/2020/02/despite-improvement-in-their-financial-wellbeing-US-workers-remain-worried

- https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-dealing-with-unexpected-expenses.htm

- https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

- https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

- https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

- https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-executive-summary.htm

- https://www.creditdonkey.com/budgeting-statistics.html

- https://www.huduser.gov/portal/datasets/il/il21/Medians2021.pdf

- https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines/prior-hhs-poverty-guidelines-federal-register-references/2021-poverty-guidelines

- https://shiftprocessing.com/credit-card/

- https://shiftprocessing.com/credit-card/

- https://www.debt.org/faqs/americans-in-debt/

- https://www.debt.org/faqs/americans-in-debt/

- https://www.aauw.org/resources/research/deeper-in-debt/

- https://www.aauw.org/resources/research/deeper-in-debt/

- https://gflec.org/wp-content/uploads/2016/11/GFLEC-Brief-Student-loan-debt.pdf

- https://gflec.org/wp-content/uploads/2016/11/GFLEC-Brief-Student-loan-debt.pdf

- https://gflec.org/wp-content/uploads/2016/11/GFLEC-Brief-Student-loan-debt.pdf

- https://www.aboutschwab.com/modernwealth2019

- https://www.aboutschwab.com/modernwealth2019

- https://www.aboutschwab.com/modernwealth2019

- https://www.aboutschwab.com/modernwealth2019

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://www.aboutschwab.com/modernwealth2019

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://news.northwesternmutual.com/planning-and-progress-2018

- https://clutch.co/accounting/resources/why-budgeting-is-important-advantages-budget

- https://www.gobankingrates.com/about/press-releases/nearly-half-of-all-americans-missed-rent-or-mortgage-payments-as-the-nation-hits-one-official-year-of-covid-19/

- https://www.gobankingrates.com/about/press-releases/nearly-half-of-all-americans-missed-rent-or-mortgage-payments-as-the-nation-hits-one-official-year-of-covid-19/

- https://www.gobankingrates.com/about/press-releases/nearly-half-of-all-americans-missed-rent-or-mortgage-payments-as-the-nation-hits-one-official-year-of-covid-19/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://www.simplywise.com/blog/retirement-confidence-index/

- https://moneydoneright.com/personal-finance/saving-and-budgeting/financial-statistics/

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-spotlights-mortgage-debt-challenges-faced-by-older-americans/

- https://www.badcredit.org/how-to/personal-finance-statistics/

- https://www.prnewswire.com/news-releases/slickdeals-shares-new-survey-data-showing-americans-spend-324000-on-impulse-buys-in-their-lifetime-300601768.html

- https://www.westmonroe.com/perspectives/point-of-view/americas-relationship-with-subscription-services

- https://www.creditcards.com/credit-card-news/holiday-debt-poll/

- https://www.rocketmortgage.com/learn/what-is-the-average-down-payment-on-a-house

- https://www.conference-board.org/blog/labor-markets/2022-salary-increase-budgets

- https://www.conference-board.org/blog/labor-markets/2022-salary-increase-budgets

- https://wallethub.com/edu/cc/average-credit-card-interest-rate/50841

- https://wallethub.com/edu/cc/average-credit-card-interest-rate/50841

- https://www.valuepenguin.com/average-credit-score

- https://www.valuepenguin.com/average-credit-score

- https://www.debt.com/statistics/

- https://www.bloomberg.com/news/articles/2022-01-12/inflation-in-u-s-registers-biggest-annual-gain-since-1982

- https://financesonline.com/investment-statistics/

- https://financesonline.com/investment-statistics/

- https://financesonline.com/investment-statistics/

- https://financesonline.com/investment-statistics/

- https://financesonline.com/investment-statistics/

- None

- https://www.investopedia.com/etfs-post-a-record-usd1-trillion-of-inflows-in-2021-5212935

- https://usafacts.org/articles/what-percentage-of-americans-own-stock/

- https://www.care.com/c/how-much-does-child-care-cost/

- https://www.nerdwallet.com/article/finance/how-much-should-i-spend-on-groceries#:~:text=What%20is%20the%20average%20cost,out%20to%20eat%20less%20often

- https://einvestingforbeginners.com/average-401k-match-ansh/

- https://www.kff.org/wp-content/uploads/2020/10/Chart-for-EHBS-release_resize_use.png

Related posts:

- 75 Motivational Quotes about Saving Money and Investing Effectively Updated 8/25/2023 Personal finance is something that requires a lot of hard work and dedication. Let’s be honest – it’s hard to find motivation when...

- 403b Calculator: Making Sure You Have Enough Money to Retire!! Do you have a 403b? Isn’t it frustrating how in the personal finance world always talks about a 401k but not your 403b? Don’t worry...

- Handy Andy’s Lessons – How to Save Money WITH Credit Cards Welcome back to the second of the most anticipated series of all time, HANDY ANDY’S LESSONS! In the first episode of Handy Andy’s Lessons, we talked...

- 5 Debt Solutions for the Average Person that Don’t Cost Money Somebody in debt is the last person who should be spending more money to try and get out of it. Having been there and done...