Updated 4/4/2024

In a speech in Switzerland, Warren Buffett discussed what he means by buying businesses he understands.

“We don’t look for specific sectors; we look for businesses that I can understand. When I say, understand, that means I feel that I have a high degree of confidence in my ability to see what they will look like five, ten, or twenty years from now.”

We need to understand the business model and how different companies make money to understand different businesses. The markets offer many different business models, and understanding them remains difficult.

But in today’s post, we will create a list of business models to help us better analyze those particular businesses.

Companies from Meta to Johnson & Johnson operate from different business models, and to analyze them well; we need to understand the business models.

In today’s post, we will learn:

- What Is a Business Model?

- Examples of a Business Model

- Components of a Business Model

- The 12 Most Common Types of Business Models

Okay, let’s dive in and learn more about the list of business models.

What is a Business Model

A business model is an outline of a company’s plan to earn money from the product or service it offers its customers.

Each business plan contains four core parts:

- The product or service they plan to sell

- The marketing the company intends to use to sell said product or service

- The expenses the company will encounter while creating and selling its products or services

- How they expect to generate profits

Business models constantly change, and in the markets, many companies offer different products or services.

As investors, we need to understand those core parts and how they impact the company’s prospects and its plans to get there.

For example, in the payment space, many companies offer the ability to make payments easier, but some companies focus on smaller niches. Companies such as Fleetcor and Wex offer truck drivers the ability to make payments with a corporate card, allowing the corporation to manage their driver’s usage, track their routes, and manage those expenses.

Business models also allow investors and companies to identify their target market or TAM (total addressable market), which can help both parties determine the viability of the product or service.

Here is a simple question to ask yourself when analyzing a company:

“Does the idea make sense, and do the numbers add up?”

Examples of a Business Model

Let’s explore a business model example to understand how this might work.

For example, one of today’s more popular business models is the subscription model. Subscription models charge a fee (monthly, annually) for customers to access services.

Netflix springs to mind as the most common example of this type of subscription business model.

Each subscription model can adjust to the individual model’s needs; for example, Salesforce charges customers for different uses of its platforms, while Amazon charges different subscriptions for different use cases of its cloud platform, depending on the customer’s usage.

Using Disney+ as an example, let’s break down their model based on the four core points we discussed earlier:

- What kind of product or service do you plan to offer? Disney+ sells an online streaming video service.

- How they plan to market the products or services: Disney+ uses a multi-pronged marketing strategy and markets its streaming service through advertising, social media, email marketing, and word-of-mouth marketing, particularly among kids.

- What expenses does Disney+ expect to face? As a Fortune 500 company, Disney faces extensive expenses, including the costs of running its parks. The streaming service’s focus will include costs to produce or acquire new content, plus any technology and staff needed to manage the service.

- How does Disney expect to turn a profit? Despite its other sources of income from parks, merchandise, and media, Disney expects to generate profit from the subscription sales of Disney+.

The above walkthrough shows how the core questions and answers contribute to Disney+’s subscription service business model.

Using the above process with companies you analyze will help you better understand their business model. It will give you better insights into how the company makes money, its expenses, and how it could grow.

If a company remains unprofitable, this analysis might help you determine what it will take to become profitable. For example, Tesla remained unprofitable for many years, but it built up enough capacity to create more cars, leading to improvements in profitability. Using other car manufacturers as an example, investors could extrapolate profitability per car based on others’ operating margins.

Components of a Business Model

As you study more and more business models, you will discover that models can differ in form and function, as our walkthrough above illustrates.

Despite these differences, all business models contain the same basic components.

According to Warren Buffett, important elements of any business model include a unique value proposition, a realistic target market, and a competitive advantage or moat.

Any business model that does not contain these elements will have a heck of a time generating revenue.

Business models need to focus on the whole business, not just on generating revenue but also on the costs necessary to create the revenue. They must focus on the big picture.

Below are ten components we want to keep in mind when analyzing a company’s business model:

- Value proposition: A description of the company’s products or services and what makes them desirable to customers, stated in a way that differentiates them from competitors.

- Target market: The focus group the company’s products or services target. For example, American Express focuses on the affluent and travelers, whereas Block focuses on the general public. This is also known as the TAM (total addressable market).

- Competitive advantage or moat: A feature of your product or service that competitors cannot easily copy. For example, Apple’s iPhone has features and services allowing it to become the dominant cell phone in the US, thus giving Apple a tremendous moat.

- Revenue model: The company’s framework allows it to generate revenues from its products or services.

- Revenue streams: The multiple streams of revenue the company generates. For example, Disney generates revenues from its parks, merchandise, and media. Berkshire Hathaway creates revenues from its insurance business, railroads, and utilities.

- Profit margins: How much the company’s revenues exceed its costs. As a benchmark, we can compare the company’s different margins, gross, operating, and income to others in the same industry. Margins can also create a competitive advantage by discouraging others from entering the industry.

- Cost structure: creating a list of fixed and variable costs a company expects to generate revenue and how those costs impact the company’s potential pricing or sales mix. For example, selling higher-margin products can help expand a company’s margins.

- Key metrics: Also known as KPIs, each industry uses to measure the company’s success. For example, Disney+ tracks the churn of subscribers, and Tesla tracks units sold.

- Resources: These include the total of the company’s assets, including intellectual, physical, and financial. These assets drive the company’s growth, and each company’s assets remain unique.

- Problem and solution: The company’s target market’s pain points and how it plans to solve them with its products and services. The company can tie this to both marketing and product development.

The above items make up the main points of a business model and help give us a framework for analyzing a company.

For example, understanding the pain points of its customers and how the company solves those problems helps us better understand its revenue model.

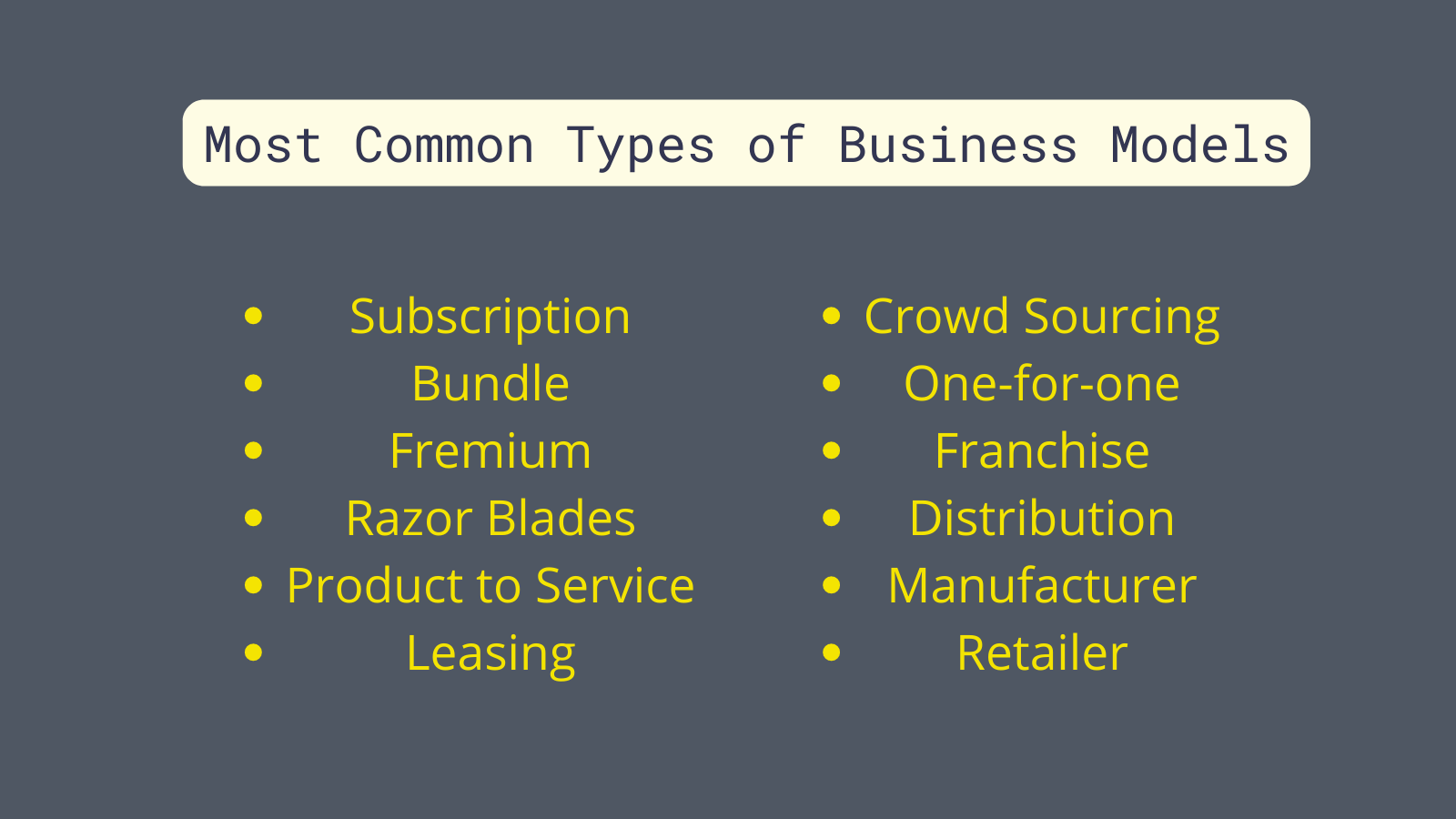

The 12 Most Common Types of Business Models

The list below is far from comprehensive, and there remain as many business models as stars in the sky. But the list below remains the most common type.

1. Subscription Model

The subscription model can apply to both brick-and-mortar and online businesses. The basic foundation of the model remains the customer paying a recurring payment regularly, i.e., monthly or annually, for access to the company’s product or service.

The company may ship its product via mail, deliver it through an app, or provide access to its space.

Examples include Netflix, Disney+, Hulu, StickFix, Duolingo, Audible, Planet Fitness, Peleton, YouTube TV, and many more.

2. Bundling Model

The bundling model involves companies offering two or more products or services together, often for a lower price than if charged individually.

The bundling model allows companies to create greater revenues while selling products that might be difficult to sell individually. A downside to this model is that the margins tend to shrink because the company discounts the products to move them.

Examples include Verizon, AT&T, Adobe, and the universe of fast-food restaurants offering combo meals like Chick-fil-A, McDonald’s, and Taco Bell.

3. Freemium Model

The freemium model exploded during the Covid pandemic with the rise of the SaaS businesses (Software-as-a-Service).

The SaaS basic framework works like this: a software company offers a proprietary tool hosted on its platform that users can access freely via an app or website. But to drive desire, the company limits the use of certain key features that regular users will likely want more access to over time, thereby enticing users to pay for a subscription to access those features.

Spotify and Pandora follow this model in the music industry. Both give free access to music while interspersing ads throughout the catalog. Users will sometimes pay to eliminate ads from their listening pleasure or to access additional features like creating playlists. I fell for the Spotify model, hook, line, and sinker.

Examples include Spotify, Pandora, Mailchimp, Roblox, Minecraft, and every Apple app ecosystem.

4. Franchise Model

The franchise model is probably the most familiar business model. Most of us visit franchises daily or weekly.

In a nutshell, franchises consist of an established business blueprint that investors can buy, reproduce, rinse, and repeat throughout a geographic area.

The franchisor (seller) often assists the franchisee (buyer) with financing, marketing, design, and operations to ensure the franchise succeeds. In return for the assistance and access to the model, the franchisee pays the franchisor a fee, typically a predetermined percentage of profits.

Examples include Starbucks, McDonald’s, Taco Bell, Domino, Subway, UPS, and Chick-fil-A.

5. Distribution Model

The distribution model consists of distributors bringing manufactured goods to the market for sale.

Hershey’s, for example, produces and packages its delicious chocolates, but it outsources the distribution of its products to third-party agents for sale to retailers. For distributors to profit, they must buy in bulk and sell for a higher price to retailers.

The distribution model abounds in the food and liquor industry, in particular.

Examples include W.W.Grainger, HD Supply, US Foods, Fastenal, Southern Glazer’s Wine & Spirits, and Reyes Beverage Group.

6. Manufacturer Model

The manufacturing model remains the OG of business models,

where the manufacturer turns raw materials into products.

Manufacturers have changed from the old days of more industrial focus to include companies like Dell or HP, who assemble computers from manufactured parts made by other companies. The old standards, such as US Steel, A&P, and Nucor, create steel and aluminum from raw materials before shipping to others to create products from their products.

Examples include Intel, Stanley, Black & Decker, Dell, HP, Weyerhauser, and Nucor.

7. Retailer model

The retailer continues as the last link in the supply chain. These businesses purchase goods or services from distributors for resale. They must sell these goods or services enough to cover the costs and turn a profit.

Retailers often focus on a specific niche, for example, sports memorabilia, clothing, shoes, kitchenware, or books.

Examples of this popular business model include Home Depot, Walmart, Amazon, Target, Best Buy, and Restoration Hardware.

8. Razor Blade model

Yes, I know, it’s a strange name for a business model, but let me explain. To better understand this model, take a stroll through Walmart and notice that replacement blades cost more than the actual razors.

Companies in the razor industry offer cheaper razors with the understanding that we will buy more expensive blades in the future. And thus, the name “razor blade model.”

Companies also use the reverse razor blade model to offer a high-margin product and promote cheaper or lower-margin products as accompaniments.

The classic example of the razor blade model remains the Apple iPhone. Apple sells you the high-margin iPhone and then pushes additional products and services combined with the iPhone.

Examples include Apple, Xbox, Keruig, Gillette, and Brita.

9. Product-to-Service Model

The product-to-service model follows the idea that instead of creating parts for a product yourself, you outsource the idea to someone who specializes in creating that particular part.

Companies that follow the model allow customers to buy a result instead of the equipment to supply the result. For example, instead of buying a car to go to a movie, you buy a ride from Uber.

Examples include Uber, Lyft, Zipcar, Delta, United, and Southwest.

10. Leasing model

The leasing model allows companies to buy products and then lease them to buyers for a periodic fee. This model works best in the high-ticket fields of medical devices or manufacturing.

Examples include U-haul, Enterprise, Avis, and Rent-a-Center.

11. Crowdsourcing model

The crowdsourcing model allows companies to tap into a much larger pool of talent without hiring employees for the work. It involves using opinions, information, or others’ work using the internet and social media.

For example, the travel app Waze encourages drivers to report different road conditions in real-time to assist other drivers.

Examples include Wikipedia, YouTube, Waze, and IMDB.

12. One-for-one model

The last in the business models line, the one-for-one model, includes a company donating one item to charity for every item purchased by customers.

The model appeals to the charitable nature of the public and customers’ social consciousness to encourage further purchases. It also allows customers to do good while buying products or services they want or need.

Examples include TOMS, Warby Parker, and Smile Squared.

Investor Takeaway

To better understand a potential investment, we need to understand how a company makes money. The ideas can range from products and services offered to the target market, costs, and business model viability.

The list of business model failures litters the news, ranging from Blackberry to Sears; many companies failed because they didn’t adapt their business models or failed to anticipate possible changes.

The airline industry offers a great cautionary tale for finding business models that stopped making sense.

Joan Magretta, the former editor of the Harvard Business Review—which is a big deal—suggests sizing up business models. When a business model stops making sense, it comes down to the story not making sense anymore, and the numbers don’t add up to profits.

As investors learning how to analyze businesses, we must understand their business models and how they make money. The above list of business models and the four-part questionnaire are great starting points.

With that, we will wrap up the discussion of the list of business models.

Thank you for taking the time to read today’s post, and I hope you find something of value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

When you’re ready, there are 2 ways we can help you:

Little Package of Valuation: Learn how to value companies using various methods, from discounted cash flow models, multiples, and much more. We have put in the reps to help you simplify a complicated process. The models included are customizable to allow you to adapt to your needs.

Value Spotlight: Stock market investors can save time and find success by discovering the right tools and resources. If you don’t know where to start, or are simply tired of wading through the endless sea of financial information, Value Spotlight was created for you.

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- A Beginner’s Guide to Cloud Computing What is cloud computing? How does the cloud work? To invest in companies such as Microsoft, Shopify, Google, or Crowdstrike, we need to understand the...

- The Map is Not the Territory: Investor Lessons on Failures Using maps to find our way remains great for vacations, but blindly following models in any other field can lead to errors in judgment or...

- Understanding the Importance of Revenue Recognition Policy “It’s easier to fool people than to convince them that they have been fooled.” -Mark Twain Understanding a company’s revenue streams and how they generate...

- Decoding the Revenue DNA: An In-Depth Analysis of Revenue Streams Revenue is the most important factor in investing. And most investors focus on revenue growth and profits. But we should also consider the different revenue...