If you’re coming here from my blog post about Global Equities Momentum to learn more about a MSCI World ETF, welcome! If not, I highly recommend checking it out so you understand how the proper utilization of this ETF is so incredibly important!

Basically, Global Equities Momentum (GEM) relies on the utilization of three different investment options:

- S&P 500 ETF (VOO or SPY)

- T-Bills

- MSCI All World ETF

When you use these three different investing options in the way that GEM recommends, you’re going to realize some absolutely insane returns. In fact, those returns have outperformed the S&P 500 over a 40-year period by 5%! That is a monstrous amount of outperformance.

So, the question is – What MSCI World ETF should be used?

The answer is simple – use ACWI.

ETF.com as “ACWI tracks a market-cap-weighted index of large- and midcap global stocks, covering 85% of the developed and emerging markets capitalization.”

Basically, it’s an index fund that’s going to help get you some exposure to some stocks that are in emerging markets as well as in the U.S.

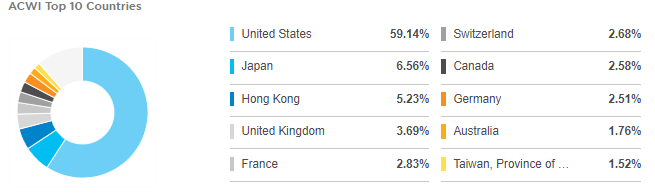

As you might anticipate, the U.S. is a very large chunk of the companies included in the ETF, but there is still another 40% of companies that are split amongst the rest of the world with the second largest country being Japan:

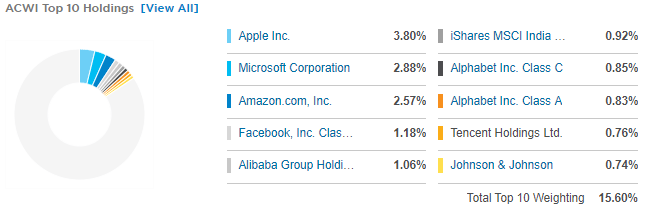

One of the first things that I do when I look at an ETF is, I like to see what sort of companies are included in that ETF. As you can see below, a lot of these are some of the normal staples that you might expect – Apple, Microsoft, Amazon, Facebook, Alphabet (Parent for Google – is it time for them to split their stock?) and Johnson & Johnson:

A couple that stood out to me though were Alibaba and Tencent as those are huge companies in China and both companies that I think might be worth having some exposure to! Alibaba is the Chinese version of Amazon and Tencent is a very large tech company that has its hand in a lot of different companies.

You might also notice that there is an iShares MSCI India ETF within this ETF which totally blew my mind. I honestly had no idea that an ETF could contain other ETFs but it makes sense when you really think about the goal of these ETFs.

If you’re looking for some exposure to the world, then what better way than to just have a lot of other ETFs included that already get exposure to individual countries?

Honestly – this is something that you could do on your own but with ACWI having a relatively low expense ratio at .32%, just stick with this one!

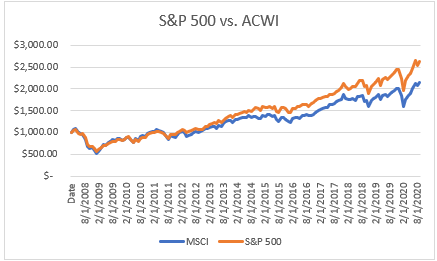

Looking at the performance of ACWI since March 2008 (the latest that the data goes on Yahoo Finance, you will see that the index doesn’t outperform the S&P 500.

Below shows a quick graph that I made with the hypothetical growth of $1000 if you invested it in the S&P 500 and in ACWI:

Your $1000 would turn into $2,629 in the S&P 500 and $2,144 in ACWI, meaning an outperformance of 22% over the last 12+ years.

And this is where it all comes down to your reasoning for wanting to invest in this ETF – if you’re simply looking for the best returns, maybe you’re better sticking with SPY to replicate the S&P 500. If you want some exposure to some other emerging markets, then ACWI might be a great option if you don’t want to just buy those individual country ETFs.

But for me, I am investing in ACWI when I am using GEM because it offers me some variability to SPY. Basically, I am simply looking at the last 12 months of data to see which ETF has performed best and then deciphering where I think I should put my money.

Basically, I am simply looking for some sort of disconnect between the two indexes that might give me some sort of opportunity to shift my money from one ETF to the other.

Volatility and Returns

Over the course of these 12+ years, the average monthly variance between the S&P 500 and ACWI has been 1.18% while the average annual variance has been 3.35%. The median has been .98% monthly and 2.88% annually, which is really right in line with the average.

But, again, I am looking for some monstrous volatility and blowouts. Think of a market crash that might affect the US but not the entire world. We’re living in a COVID-19 world right now and the U.S. is getting a ton of stimulus money, or at least we were, with some very optimistic talks that things might pick up again on the stimulus front.

So, you might think that the economy is being propped up more than some other countries and since March 2020, the S&P 500 has outperformed by just over 1% over the ACWI.

Now remember that it’s going to be hard to see some major variances because 60% of ACWI is made up of U.S. companies, but we still have seen some big disparities over time.

In 2010, ACWI outperformed the S&P 500 by 9%! That is huge when 60% of your portfolio is U.S. companies. So, what that means to me is that the 40% was actually up 69.75%!

If you had chosen to directly invest only in the ETFs of those other countries over that time, you’d be extremely happy. But of course, we can never pick and choose like that and have perfect accuracy. But that’s why GEM is great.

If you use GEM the way that it’s supposed to be used, you’re going to realize some amazing returns just as the data has shown.

It might sound like this is some super complicated strategy that takes a ton of number crunching and day trading, but it’s anything but that. All that you will do is take a few minutes at the beginning of each month to see if you need to change where your investments are and then change them.

But guess what – more often than not, you’re not even going to change how you’re investing your money. It’s going to stay in the same exact place that you have it now.

So, is ACWI worth investing in as a standalone? Maybe! But is it worth investing in as part of a Global Equities Momentum strategy? Yes – 100%!

Related posts:

- Market Bottom Indicators Based on Past Bear Markets If you are a human, you’re likely wondering when the heck is, we going to get to the bottom of this bear market, and I...

- Time to Settle the Debate – Are We In An ETF Bubble? One thing that I have heard many times before is that we are in an ETF bubble. Personally, I kinda see both sides of the...

- Expanding Your Circle of Competence by Investing in Cloud Stocks Pre-2020, cloud stocks were never anything that I really even looked at investing in. The numbers just absolutely never made any sense to me but...

- Can You Get Rich Only by Sector Investing? I feel like the debate of sector investing is one that has lasted ages and so many people have different opinions on the practicality of...