Have you ever heard of the term ‘ multibagger’ before? If you haven’t, then you probably haven’t had any multibagger stocks! Don’t worry, neither have I, but I am anxious for my first time to get there. A multibagger is a stock that has increased in value many times over what you initially bought the stock at.

For instance, if you bought a stock at $10/share and that same stock is now at $100/share, then that is a tenbagger because the current price is 10 times the initial price that you bought the stock at.

It almost feels like a hole in one in golf – yes, talent and preparation do play a huge part in the ability to accomplish the goal, but luck is definitely something that is also needed. Experience and knowledge are so important when picking a stock, but it does take a certain amount of luck to find a stock that is going to be worth 10+ times the value that it was when you bought it.

Typically, stocks that are multibaggers are going to be stocks that you buy at a fairly low dollar value, such as the #1 multibagger example that I like to bring up – when Warren Buffett bought Coke.

Warren Buffett bought Coke in 1988 for $2.45. Coke closed on 11/8 at a price of $52.21. That alone in itself is a 21-bagger but let’s not forget the fact that Coke has had four 2:1 stock splits since when Buffett bought the stock, so in essence, 1 share of stock bought for $2.45 in 1988 was then split into 2 stocks in 1990, then those two were split into 4 total in 1992, then split into 8 total in 1996, and then split into 16 total in 2012.

So, that 1 share of $2.45 stock is now really worth 16 shares of $52.21 stock, so you really could say that it’s actually a 341-bagger! Not too shabby, Warren. Not too shabby at all.

Warren initially invested $1 Billion when he bought the stock in 1988. Just for fun, if he never touched that investment (which I have no idea if he did or not) it would now be worth $221 Trillion. Lol. That is just stupid.

Another great stock that Buffett picked up was American Express (AXP) all the way back in 1963. If Buffett had invested $1 million back in 1963, which really isn’t that much considering he was investing $1 billion in companies in 1988, then his stock would now be worth $281 million as long as he was dripping his investments.

As a quick side note, if you’re ever curious on how to find out what the current value would be of a past decision, you can use this really cool DRIP calculator that Andrew found and has been spreading the word about.

Another great company that many people are likely familiar with is Apple (AAPL). Warren Buffett has been on the record before saying that he felt like he had missed the ship with AAPL before but back in 2016, he finally bought some stock of AAPL. His initial purchase was buying 9.8 million shared in Q1 2016 when the price for AAPL was in the low 100’s. If you haven’t looked recently, the stock just closed on 11/8/19 at $260.14.

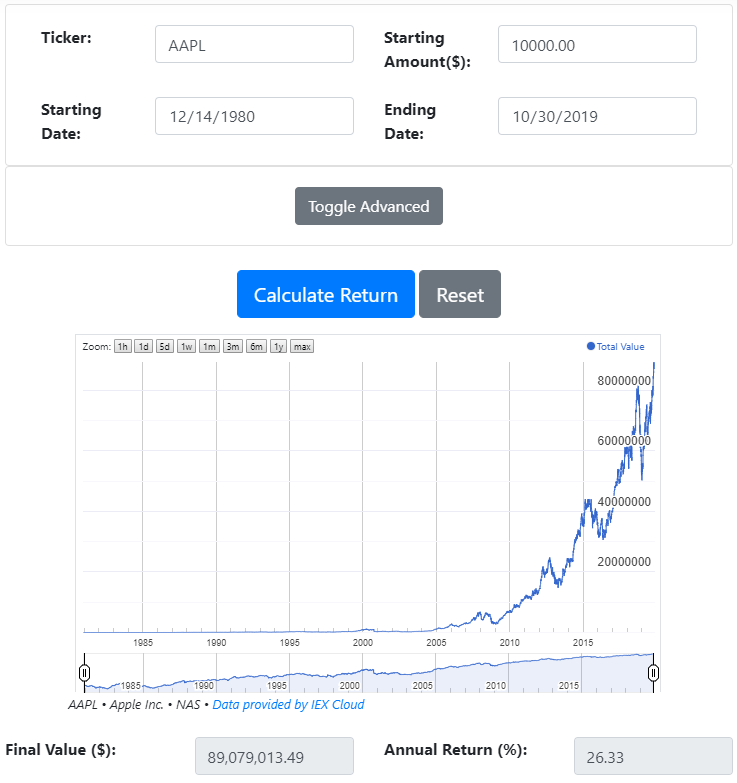

That in itself is a pretty dang good return over the last few years, but what if you had purchased the stock when it had it’s IPO in 1980? Using the DRIP calculator that I told you about above, I went back and wanted to see what a $10,000 investment would look like today…

Wow. I wish I had $89 million from a $10,000 investment. For those of you wondering at home, that is an 8910-bagger…lol.

And finally, to end on one that might seem a bit more realistic with a shorter timeline, but this is yet another Buffett example (if you’re catching onto the trend, I am quite the Warren Buffett fanboy and I would recommend that all of you learn more about him if you’re curious why I am this way).

Back in the first quarter of 2006, Buffett bought shares of U.S. Bank for the Berkshire Hathaway Portfolio. Using the DRIP Calculator, a $10,000 investment, which we know Buffett likely invested billions, is now worth $27,675. That’s a 27-bagger within a span of 13 years!

A lot of investing podcasts/blogs will just talk about “oh man, if you invested in X for X years then you would now have a hundred jabillion dollars!!!”. I’ll be honest – sometimes I fall into this pitfall as well, but the key is that we need to have the right mindset. I don’t make those types of comments to make everyone sit back and think about “what could have been” but instead I do the opposite to try to motivate people to think about “what can be.”

I just showed you three examples, and I truly could show a thousand more, where people invest and get this huge multibaggers because they’re able to buy the stock early on enough and they get these huge returns from it. Like life-changing types of returns.

If seeing this numbers, you’re not walking away feeling motivated then maybe investing isn’t for you – or maybe I am simply just not motivating you, too. Either way, there’s some monstrous returns out there that are just waiting for you to put your money into the market.

I really want to challenge you to stop procrastinating and dive in the fundamentals of investing more than you might have done historically. Andrew has a Value-Trap Indicator that is an AMAZING TOOL to show you some great opportunities for companies and where there might be some intrinsic value for you to invest in a company.

Please, take your investing future by the horns and really dive into the numbers. There are a bunch of great books that you can check out and always take a listen to the Investing for Beginners Podcast. That’s how I got started with my investing.

And while I’m not yet at a multibagger, I am at a 1.5-bagger…lol…just a matter of time until I snag that first multibagger, then my first 10-bagger, and the future will just continue to grow brighter – and it can for you, too, as long as you’re ready to do the work needed for success!

Related posts:

- Walter Schloss – One of the Greatest Value Investors of All Time Have you ever heard of Walter Schloss? I’m guessing not, but by the end of this article you’re going to be referring to him as...

- Graham and Doddsville: A Group of the Greatest Investors of All Time Updated 6/24/2023 “While they differ greatly in style, these investors are, mentally, always buying the business, not the stock. A few of them sometimes buy...

- Famous Growth Investor on Why Conservative Investors Sleep Well Phil Fisher, author of Common Stocks and Uncommon Profits, has been one to always talk about the power of how conservative investors sleep well, and...

- Margin of Safety: Secrets from the MOST Profitable Investors of All-Time Updated 6/7/2023 “Most of the top-ranked business schools worldwide do not understand the margin of safety. For them, low risk and low returns go together, as...