Are you looking for the grand secret sauce to turn every stock pick into a 10 bagger (10x return), and are you trying to do it in a very short time?

Or are you just trying to buy your first stock, and want to see it double or triple quickly?

Well that’s not what we’re going to talk about here.

Yes, I did happen to buy my first stock and it did happen to 10x. But it became a 10 bagger over almost a decade, and I wish I could say it was easily repeatable.

I will share these lessons that you can take as somewhat of a secret sauce, which might help you with your first (or five hundredth) stock pick:

- Don’t Underestimate the Power of Buy and Hold

- Don’t Underestimate Small Dividends

- Look for Sustainable Returns, and Not Quick Fix Bullets

- Being “Too Big” Isn’t Always Bad!

- Just Get Started!

- The Secret to Successful Stock Investing…

But there are valuable lessons we can all learn from the success of my first stock, and hopefully it will assist in your journey into the stock market if you’re still on the fence on buying your first stock.

1—Don’t Underestimate the Power of Buy and Hold

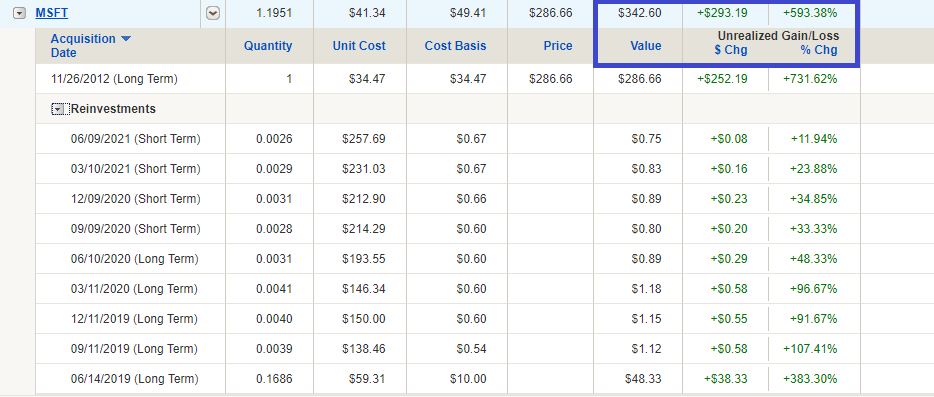

First, let’s get on with the proof. Here’s a screenshot of one of my brokerage accounts where I bought my very first share in Microsoft ($MSFT), back in 2012 at around $27:

Note that I purchased back when there was still commission fees to execute stock trades, so they added the $6.95 fee to my “cost basis.” My true cost basis was around $27, which has made this company more than a 10 bagger in the almost 10 years I’ve held it.

This is a brokerage account that I pretty much left for dead for years, as I focused on other accounts like my 401K and Roth IRAs.

And honestly, I think that had a huge influence on my eventual success with the stock.

Because I literally bought this stock and, after I got over the honeymoon phase of owning it, never really thought about it again.

It was my first stock because:

- I had never bought a stock before and wanted to try it, so I bought just one share of a company I knew

- I knew they were coming out with a new Xbox soon (I think it was the Xbox 360)

That was the extent of my analysis.

I didn’t think about Price to Earnings ratios, growth rates, or the fact that the stock had pretty much been flat since 2000.

I did not have the PTSD of the many thousands of investors who were burned from the stock’s crash in 2000 or had been disappointed with years of underperformance.

I didn’t think about inflation, interest rates, the economy, or what the Fed was doing.

I just bought something and decided I was going to let it compound for the long term.

It’s amazing how a little bit of luck and a whole lot of patience can build serious wealth even when you put little to no effort into it.

2—Don’t Underestimate Small Dividends

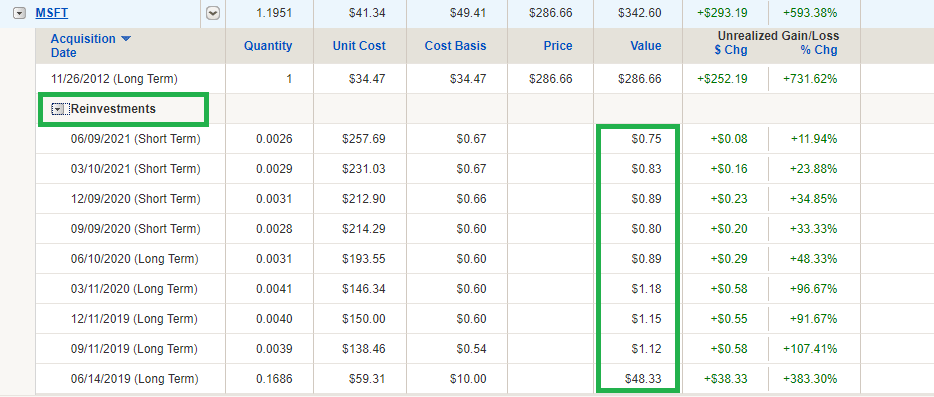

I’ll attach the screenshot again but highlight the value that dividend reinvestment has added to the performance of my first stock:

Not only has Microsoft paid an annual dividend every year since I’ve held the stock, but they’ve raised the dividend every single year as well.

Today, the company pays a dividend of $2.24 per year.

If you remember, I paid around $27 for the stock. That means I’m getting almost 10% of my original investment every single year in a dividend simply because the company has continued to increase their payout as they’ve grown over time.

Also notice how the dividend reinvestments have accounted for over $50 of the holding’s $342.60 in value on today’s terms.

This means that the value of the dividends I faithfully (automatically) reinvested back into the stock through a DRIP are now worth more than what I originally paid for the stock itself!

This is a prime example of the power of compounding dividends, which is made possible when you reinvest dividends into a growing stock, and the stock price’s multiplication in value also multiplies the value of your reinvested dividends.

At the time I bought the stock, Microsoft didn’t have much of a high yield at all.

I probably received literally 10-15 cents for each quarterly dividend in the first year. But you can see how, over time, those little share reinvestments have all added up to a significant share of my overall return, and there’s no reason this can’t continue.

You really don’t realize how little steps like dividends really add up over the long term.

Over 10 years, an investor in a stock like Microsoft receives 40 dividend payments.

All for doing absolutely nothing, and in payments that exponentially increase as you reinvest your dividends and the company continually increases its payouts.

That’s what we should all get excited about with the stock market!

I know it can be fun to watch the stocks in your portfolio increase by 3%, 5%, or 10%+ in a single day, but sustainable returns come from those little 0.5% dividends paid quarterly.

How those little dividends compound is hopefully demonstrated with this example of my first stock.

3—Look for Sustainable Returns, and Not Quick Fix Bullets

There’s something to be said about sustainability in the stock market which isn’t discussed enough. You’ll notice that nothing about a stock market success story such as this has anything to do with frenetic activity and trading.

In fact it’s the exact opposite.

Going back to those “preferred” increases of 3%, 5%, or 10%+, many of those can become part of regular stock market swings. Many times, especially with expensive stocks, as fast as they rise is as fast as they’ll fall.

What you want to see over a long time are those dividend payments which keep increasing. Businesses will tend to pay growing dividends because the business itself is growing.

That supports higher stock prices, which makes the reinvested dividends that much more valuable.

But the wild swings in between don’t mean anything to you, especially if you’re determined that the long term compounding is what you’re after anyways.

So why pay attention to them?

There was a lot of power in the fact that I did not think about this stock over most of the years that I held it.

I did not worry when the Earnings Per Share dropped 44% in 2015; I was simply unaware.

That’s not to say that’s always the best strategy…

But becoming what 100 Baggers author Christopher Mayer calls a “reluctant seller” and worrying less about the headlines and more about your holding periods is how to get results like this with stocks in your own portfolio.

Most investors get too impatient with their portfolio, and expect their stocks to never stumble.

This is very unrealistic, and highly counterproductive to great long term returns!

Microsoft’s stock has dropped by 5%, 10% or 20%+ plenty of times throughout my holding period, and to have fretted about those drops would not have mattered one bit. So I’m glad I never did.

No stock grows in a perfectly straight line upwards, though they might appear to for short stretches.

4—Being “Too Big” Isn’t Always Bad!

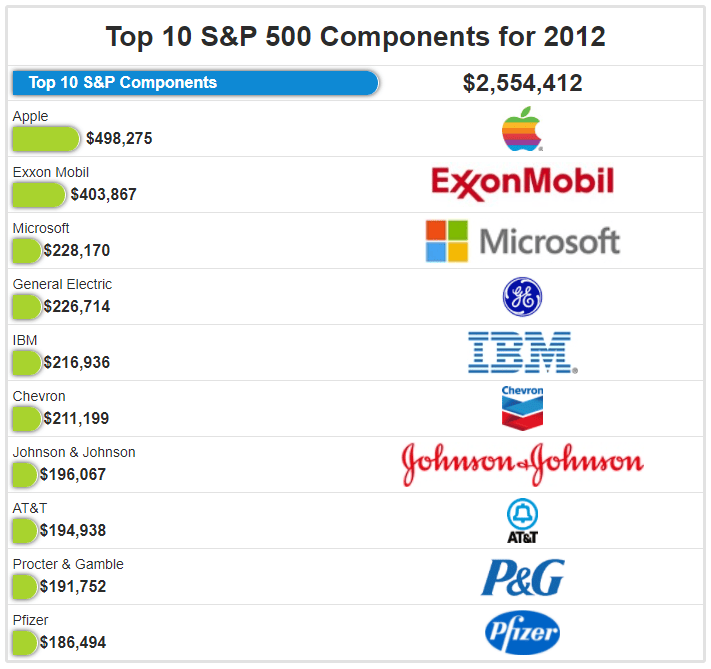

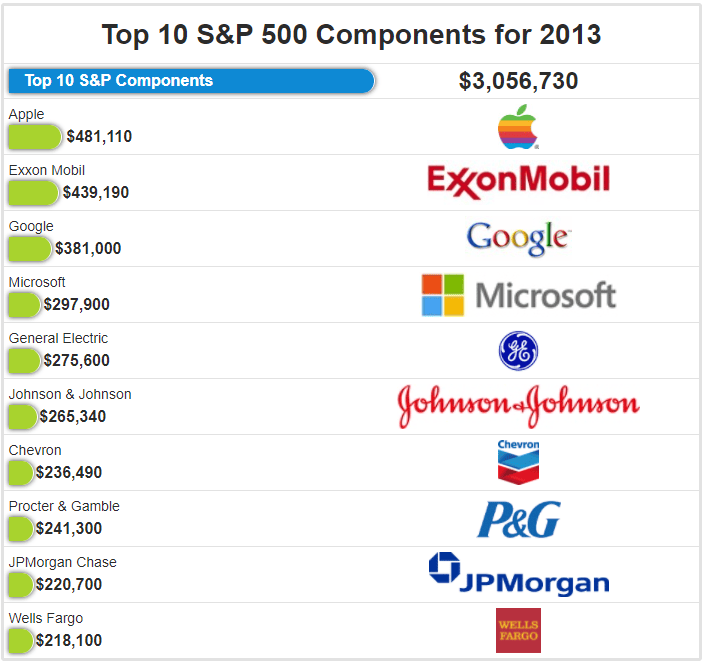

Check out these two charts from ETF Database, showing where Microsoft ranked in the S&P 500 for 2012 and 2013.

That means that yes, it was one of the biggest back then and it’s one of the biggest (#2) now. You can see Apple on that chart as well, and they’re still number #1 today.

Coca Cola has been another classic stock which was atop the stock market in size for decades.

Some companies just excel and continue to compound their growth at superior rates, and can continue to do so even if it seems like they’re too big to continue to grow already.

Especially if you’re looking to buy your very first stock, why not try an already very popular one like a Facebook, Apple, Google or Microsoft?

It might just be one of those stocks to continue to do well, even if it’s a big company/stock already.

5—Enough About This Stocks Stuff. Just Get Started!

We’re starting to get off track with these lessons from my first stock, and I apologize for that (I just get too hyped about stuff like this).

At the end of the day, just pick a stock and buy one.

And simply commit that you’re going to hold it for a decade, if not many decades.

I was recently a guest on the LandGeek Podcast and one of the co-hosts, Mark, talked about how one of his first stocks many decades ago was Apple, and how he bought 2 shares. He paid about $37.

Because this was a sentimental pick for Mark, he did not sell it, even when many people thought that the company was going to go bankrupt.

He did not sell when Steve Jobs got ousted from the company he co-founded.

And to say he’s been rewarded for his patience would be an understatement.

Those two shares have been split many times over the years, and are now worth $37,000+, which is absolutely incredible! (I didn’t ask but I assume he reinvested those dividends to get a return like that.)

There is tremendous power in having belief in a stock and letting it ride.

I don’t want to imply that these results are typical, or that it’s this easy.

But if you were to buy a basket of stocks over time, like we stress through strategies like diversification and dollar cost averaging, then it could take just one great stock to power huge returns for you.

And that’s just talking about what you do today, or next month.

What about if you made this into a habit, so that every month you have a new opportunity like this? After month after month after month of making investments into the stock market, you’ll greatly increase your chances of finding a 10 or 100 bagger.

But it all starts with getting your feet wet.

Today, I know way more about businesses and how to analyze them than I did in 2012.

Today, I know all sorts of things about the history of the stock market, and the economy, and how various factors all play into what creates the prices of stocks.

But the point is that I didn’t need to know those things to have conviction in a great company and hold it.

And it’s been the most successful investment of all-time for me, even after I started my monthly newsletter in late 2014.

You really can’t replace the compounding effect of time.

I know this might not be the most exciting message, or the fastest way to riches. I’ll just tell you that quick riches are not worth pursuing in the stock market, because easy come, easy go. We’ve seen it time and time again.

But disciplined and patient investing like this is possible for anybody, whether it’s your first stock or your five hundredth.

6—The Secret to Successful Stock Investing Is No Secret At All

Investing, at the end of the day, is about putting money at risk to receive a return.

Those returns don’t happen all at once, and they aren’t all that impressive until they start to compound. If you can grasp the power of compound interest, and how that juices returns, then you’ll really understand why a simple decision like my first stock pick was more powerful than all of the research Wall Street could’ve provided me.

I got lucky, for sure.

Microsoft sprouted one of the greatest businesses of all time, one called Azure, and it’s fueled a second life of growth for the company in so many amazing ways.

But just because I got lucky with Microsoft doesn’t mean that there weren’t many other investors who also had great returns, in companies who just kept doing what they’ve been doing.

- Making money.

- Paying dividends.

- Compounding capital.

In fact, that’s what the rest of my stock portfolio looks like, pretty big and established companies (mostly) which are successful already and look like they can continue to be.

I’m confident that this first 10 bagger won’t be my last one, and that there will be many more.

But I also understand that it might take me waiting another 10 years, 15 years, or longer, until any new stocks I add to my portfolio can get returns such as these.

But that’s okay, because there’s no gun to my head saying I need to get rich quickly.

I can just enjoy the process, and I hope you do too.

Editor’s Updates for clarity: 01/23/2023

Related posts:

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- How Compounding Dividends Make the “Secret Sauce” of the Stock Market Post updated: 6/16/2023 The sweetest source of returns in the stock market are compounding dividends. To generate serious wealth from investing, you need compound interest;...

- The High Yield Potential from REIT Dividends: Considering Taxes and Safety Many investors look for companies with great dividend yields and distribute great dividends, and REITs are one of the best sources of dividend payers and...

- Beginner’s Guide: 7 Steps to Understanding the Stock Market Updated: 4/06/23 This easy-to-follow beginner’s guide will help you learn how to invest in the stock market. We’ll be leaving out all the confusing Wall...