At the end of the day, the goal for every company is to make money, and an incredibly popular metric to track this is known as Earnings per Share, or EPS, but is it possible for a company to have Negative EPS?

Key Takeaways

• Earnings per Share, or EPS, is a popular investing metric (insert link) that quickly allows an investor the ability to understand how much money the company makes for every share they’ve issued.

• It is very possible for a company to have a negative EPS

• Companies with a negative EPS are typically younger companies in their growth stage that put more emphasis on growing market share than achieving a path to profitability

• Sometimes companies will have their EPS turn negative during times of massive hardship, as we saw with the oil, airline, and cruise line industries during the first wave of COVID.

Now, the whole point of a company being in business in the first place is obviously to make money, but sometimes things can completely turn upside down. Think about some of the major pitfalls that some companies went through in 2020 with the coronavirus. A lot of companies were hit extremely hard that rely on people going out and traveling.

For instance, three different industries immediately come to mind – Oil & Gas, Airlines, & Cruise lines. Let’s take a look at some EPS charts from Zacks.com.

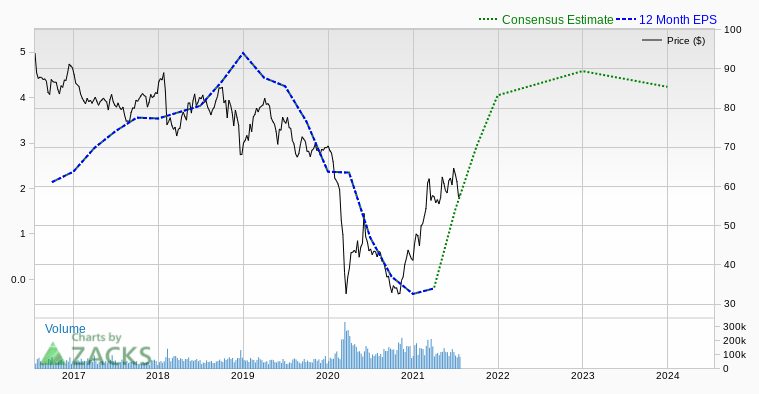

Below you can see the EPS for Exxon Mobil (XOM) over the last 12 months showing that they just barely dipped into negative EPS territory during COVID, right at the beginning of 2021:

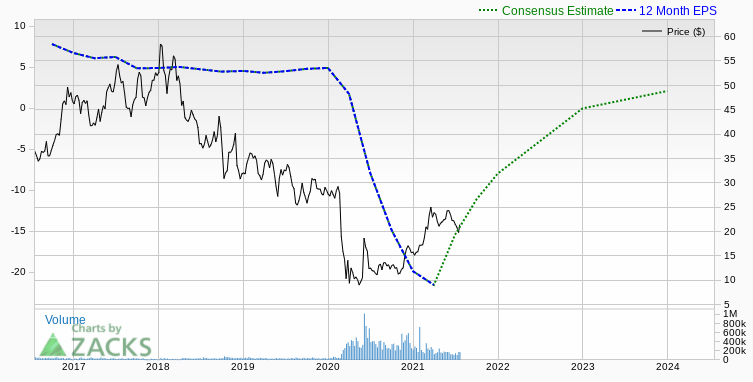

Now let’s take a look at American Airlines (AAL) – a company that wasn’t as fortunate as XOM:

Ouch! Down to an EPS that was below negative 20! That is absolutely insane. You can see that their EPS is starting to rebound a bit but it’s still sitting at a negative EPS of 15. Not exactly the territory that I would be salivating to invest into…

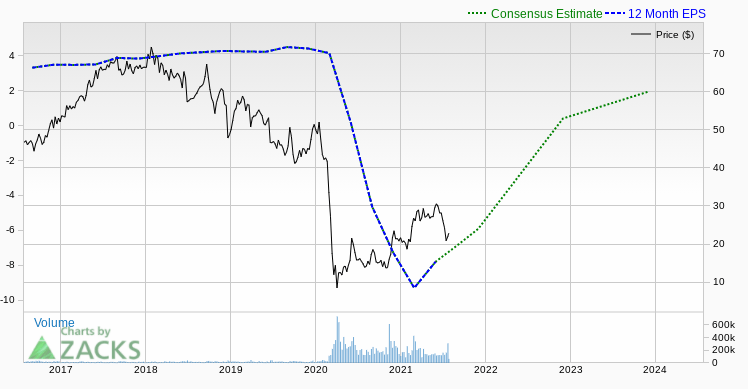

And finally, let’s take a look at Carnival Corporation:

Not nearly as bad as AAL but much worse than XOM as they’re really sitting in the middle of the two companies. Again, you can start to see their rebound in EPS but it’s still sitting in dangerous territory.

Now, I’m sure that literally none of you are shocked that these three companies have a negative EPS. In fact, I am honestly surprised that XOM isn’t worse. These companies were absolutely crushed during the pandemic because nobody was traveling. People didn’t have a need to fly anywhere, didn’t drive anywhere, and definitely weren’t going on any cruises where you naturally have an eclectic mix of people from all different hometowns that are creating this melting pot infestation of the coronavirus.

The reason that I really wanted to talk about EPS is because when it comes down to it, for more or less the most important part of a business is the earnings that they produce. The reason that I said “for more or less” is because with some young companies that are in their growth stage, they likely are focusing more on revenue growth over earnings with the goal to monetize those revenues later, but they’re primarily speculative companies.

There’s nothing wrong with speculative companies as long as you trust the process that the company is going down and like the “path to profitability” that so many companies talk about.

My fear with established companies like XOM, CCL and AAL is that they’re not growth companies. They’re companies that have been in business for a long time and this negative EPS is not a strategy of theirs but rather a pandemic literally crushing them.

I recently had a friend text me and say that he was about to start investing in stocks and that he had identified a couple he wanted to go after.

“2 that I was looking at that I think are bound to go up are Carnival and International Airlines Group.”

I followed up and asked him why and he essentially said it’s because they got crushed during COVID and now things are opening back up again. While I don’t necessarily disagree with that, I had two questions that I asked him:

1 – Carnival has lost quite a bit of money last year…if the Delta variant is as bad as everyone thinks and things go back to more strict guidelines, do you think that Carnival can hang on?

2 – How long do you think Carnival can manage losing money without going bankrupt?

When I asked him these questions, he said that he had no idea and I 100% expected that, and honestly I don’t think it’s bad that he didn’t know that. You see, I am a firm believer that when people are first looking to invest, they’re better off to just put some thoughts together and invest in a company that they’re familiar with. Eventually they will learn to read and understand the numbers like we preach at Investing for Beginners.

But until then, my friend bought a very small amount of those two companies and I challenged him to learn about the companies and try to answer those two questions that I had. Obviously once he had those answers it didn’t mean he should back up the truck, but it at least would give him some more knowledge about the company and their future outlook.

My point of giving that example is that I strongly feel like if he had looked and saw how much the company was losing, he might not have invested in the company. Now this theoretically could mean that he’s actually getting in at the low and is going to make a killing, or it could mean that the company is on a dangerous path to being the next value trap and filing for bankruptcy.

Personally, outside of any company that is a purely speculative growth play for me, I will avoid companies that have a negative EPS like spoiled milk. EPS is one of the first metrics that I look at when reviewing a stock and it’s also very correlated to Price/Earnings, or P/E, as you cannot have a positive P/E with a negative earnings number.

I know that I am not the only one that strongly advises against a company with negative EPS and in fact, it is one of Andrew’s hard rules to never invest in a company that has negative EPS over a 12-month period. And if he owns a stock that has a negative EPS, he will sell no matter what because of that danger and it being a huge indicator of a value-trap.

Value-traps are something that we all fall into and looking at the EPS can certainly help you potentially avoid one. Now, that’s just one beginning metric, but if you want the whole shabang you can get that with the Value Trap Indicator – Andrew’s backtested method to help you identify the difference between a company that has value and one that’s a value trap!

Related posts:

- How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’...

- NEGATIVE PE RATIO – What to Do? Post updated: 7/14/2023 A negative P/E ratio can be concerning. You can’t really compare a negative P/E ratio with other stocks’ P/E’s. I’ll discuss 3...

- 5 Key Metrics: Balance Sheet vs Income Statement (Example with $AAPL) Financial statements can look intimidating. There can be many line items. To learn how to navigate a company’s balance sheet and income statement– break it...

- 4 Types of Company Growth Rates and How to Calculate Them Investors demand growth from companies. Wall Street loves growth. But how is company growth defined exactly? In this post we’ll examine 4 separate types of...