Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’ equity. But what happens if a company has negative retained earnings, which drives the shareholder’s equity negative? Does this happen?

Quick answer: you bet!

Last week we discussed the statement of retained earnings, which is made up contents of this statement and retained earnings.

To review, the accounting equation for shareholders’ equity is as follows:

Shareholders’ equity = Assets – Liabilities

If the retained earnings are negative, it could drive the shareholders’ equity negative, leading to bankruptcy. Is that always the case? Not necessarily, as we will see.

Some very public, large companies have negative retained earnings, such as, most recently, Starbucks. The problem with shareholder equity on the balance sheet is that there is no distinction between the capital the owners put into the business and the capital the business produced and retained.

In today’s post, we will discuss the following:

- What are Negative Retained Earnings?

- Where To Find Negative Retained Earnings

- Can A Company With Negative Earnings Pay a Dividend?

What Are Negative Retained Earnings?

If you recall, retained earnings from last week’s post are the balance leftover from net income set aside for dividends, share repurchases, or reinvestment back into the company.

So what are negative retained earnings?

Negative retained earnings would result from a negative net income and then be subtracted from any balance in retained earnings from prior financial reports, i.e., 10-Q or 10-K.

Negative retained earnings could result in negative shareholders’ equity if the company has sustained losses for an extended period.

If the event of sustained negative retained earnings could erode monies received from sales of stock, all in all, not a good situation to be in at any time.

Additional causes of negative retained earnings, besides negative net income, are:

- Large dividend payments: payments that exhausted retained earnings or went above the balance of shareholder’s equity. Continued large dividend payments over several periods could lead to negative retained earnings.

- Borrowing money: If the company borrows large amounts to cover accumulated losses instead of issuing more shares through equity funding, it could lead to negative retained earnings. Typically, with the sale of more shares, the monies would lead to a positive balance in shareholders’ equity. If the company continued with financial losses in shareholders’ equity, any incurred would be a liability. So even if a company borrowed funds to cover the losses, the shareholders’ equity would still be negative.

Negative shareholders’ equity could be a warning sign that a company is in financial duress because this would mean that they have spent all of their retained earnings and exhausted the means of raising funds from the sale of shares.

More on this in a moment.

Where to Find Negative Retained Earnings

Negative retained earnings will be able to be found on both the balance sheet and the statement of retained earnings, as they are linked.

Let’s look at a real company’s financials to get an idea of how to find negative retained earnings.

First, we will look at Starbucks (SBUX), which reported its annual report (10-K) in September 2022.

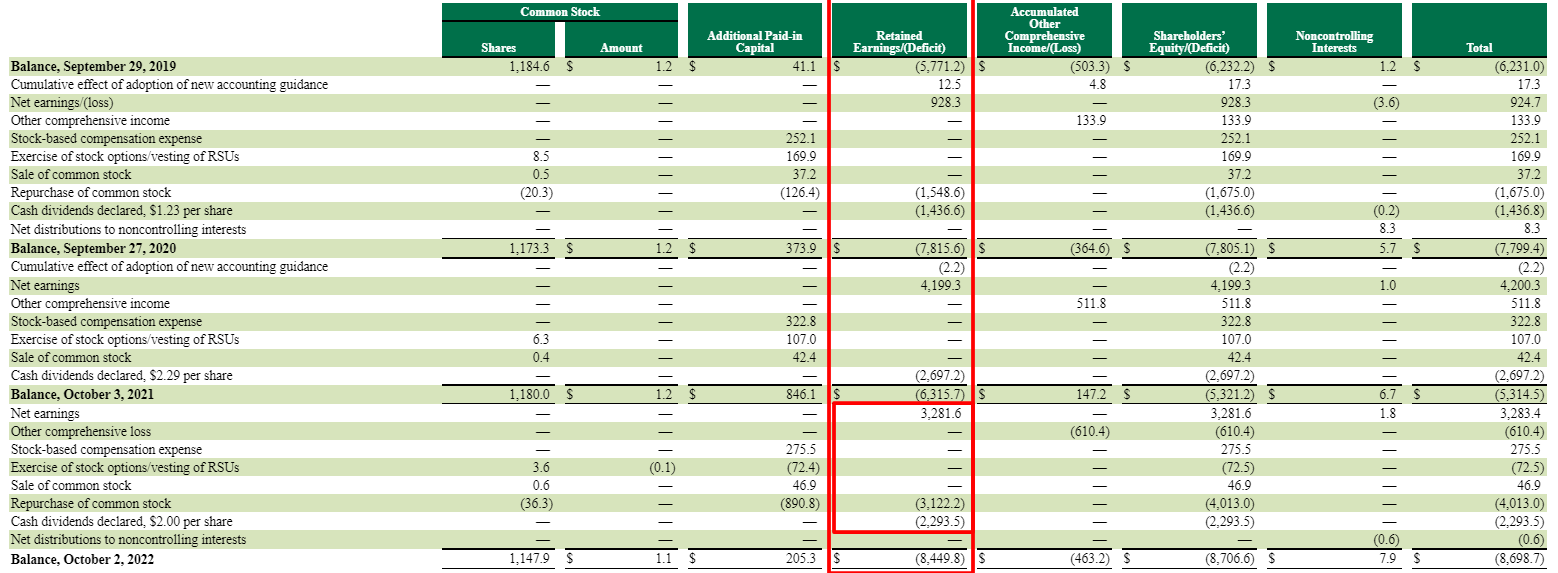

The first report we will look at is the statement of retained earnings.

Looking deeper into Starbucks, you can see that the resulting balance on October 2, 2022, was negative $8,449 million.

Several things I would like to point out to you are:

- Earnings over the two years have seen a downward trend; this remains something to notice over a longer period because such a small sample size of two years isn’t enough to say anything with certainty.

- The dividends paid by Starbucks have been fairly consistent over this two-year snapshot.

- The share repurchases have aggressively repurchased stock, which has resulted in the retained earnings going negative. The retained earnings have turned negative with the decrease in net income and aggressive share repurchases.

The first question I would want to answer– why has Starbucks so aggressively repurchased stock? Are they funding other aspects of the business with debt, or do they have another reason driving this decision?

Remember, one of the ways we can determine the quality of management and their views on shareholder value remains to decipher the retained earnings and what management does with them.

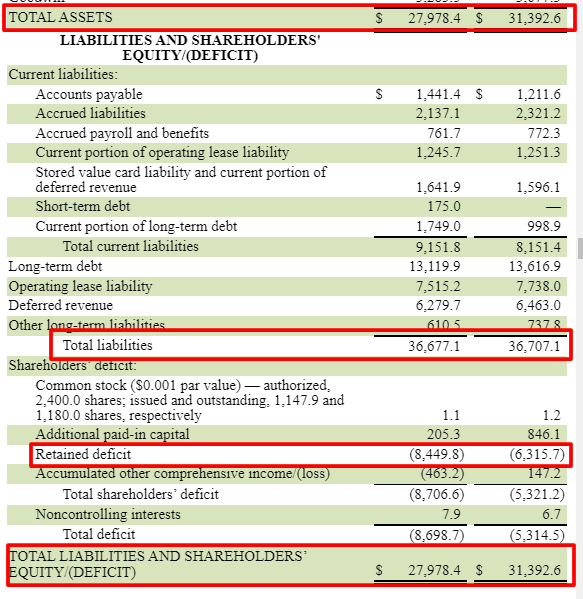

Look at Starbucks’ balance sheet to understand how negative retained earnings could affect the company.

Again, I would like to point out a few things as we dive into Starbucks’ balance sheet.

- Retained earnings are negative, $8,449 million, and Total Shareholders’ equity is negative, $8,698 million, which means that total equity is negative.

- The negative shareholder equity lowers the total liabilities and equity, increasing the total liabilities.

- As balance sheets must balance, the negative shareholders’ equity increases the liabilities in relation to the total assets.

- Notice total liabilities have increased compared to total assets decreasing, which is never good; more liabilities than assets could mean you potentially owe more than you own, not a good place for any company because if something bad happens, you may not be able to recover.

When investigating any company, this analysis remains part of the due diligence process we must go through to determine if we want to invest in this company.

In Starbucks’ case, the question I would ask is– would any answer give you enough confidence to overcome the imbalance of the liabilities versus assets?

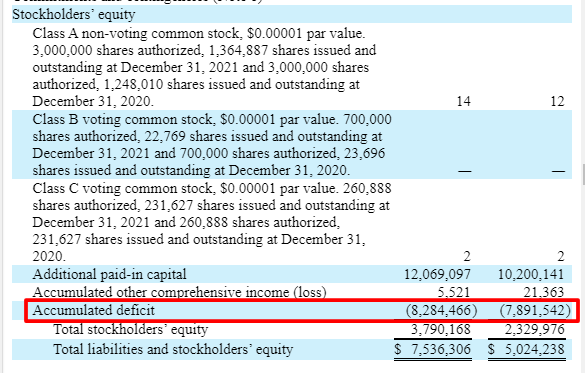

Let’s look at another company’s retained earnings, Snapchat (SNAP). Snapchat’s balance sheet from December 2019 shows an accumulated loss, although the shareholders’ equity remains positive.

Let’s take a look.

We can see from Snapchat’s balance sheet they are experiencing continued growth of their accumulated deficit, which stems from the company’s continued losses in their net income. The additional paid-in capital you see above the line is from additional sales of shares, which dilutes ownership.

Every company has a story to tell through its numbers; our job is to decipher what the numbers are trying to tell us. My favorite finance teacher, Dr. Aswath Damodaran, talks about the stories the numbers are trying to tell us and how we can interpret them.

In Snapchat’s case, they tell me the company struggles to grow its revenue enough to overcome its expenses as its negative bottom line continues. The continuation of negative net income at some point remains unsustainable and could cause problems in the future.

For me, investing in Snapchat at this point in its development doesn’t equal a company I would buy; they have too many losses and haven’t proven they can produce positive earnings.

One of the items you will notice from companies like Facebook, Netflix, and Google, in their early years, they experienced losses from their bottom line. In other words, they were not profitable companies on their own.

Looking at some of their early annual reports, you will see negative retained earnings through the early years. Still, they were able to show positive shareholders’ equity through the strength of selling shares of the company to create capital to use to fund the business.

They could use their brand’s strength to help them keep going until they were profitable. Not all companies can do this, and it depends on where they are in the life cycle; this could spell trouble if they cannot drive sales for the business.

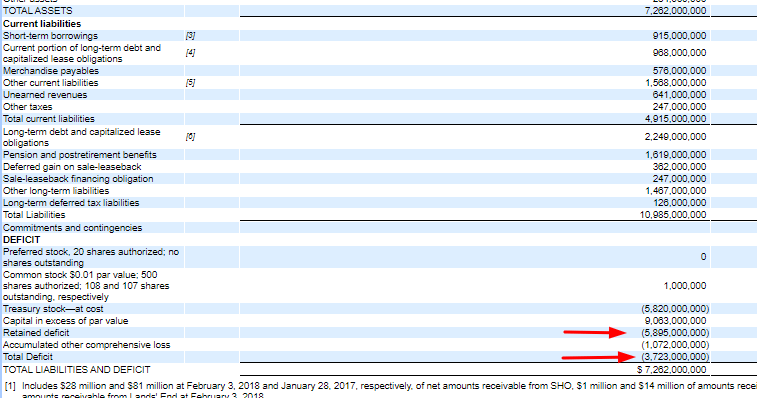

The last example I would like to share is Sears (SHLD), one of the more recent large companies to file for bankruptcy.

It should be plain as day for anyone looking that Sears was in serious trouble when looking at their balance sheet. It shows ongoing negative deficits in retained earnings and negative shareholders’ equity.

All this spelled trouble for Sears; its shrinking margins and declining revenue could not sustain itself. This separates companies like Facebook and Netflix from Sears in that they have been able to grow revenues to the point where they have been able to sustain the company past the point of selling shares to keep themselves afloat.

Can a Company with Negative Retained Earnings Pay a Dividend?

Andrew and I continuously discuss the importance of dividends and how they play a very important role in our, and millions of others, investing goals.

Heck, even Warren Buffett, in his latest shareholder letter, spoke on the importance of dividends to his portfolio and how they contributed so much to his endless pile of cash.

Many investors rely on dividends for their income and the double compounding effect they can have on the growth of our investment portfolios.

So what happens when a company has negative retained earnings or is losing money?

Many companies aren’t allowed to pay dividends if they lose money and have no retained earnings, except under special circumstances.

Many investors find it confusing that companies can pay a dividend, even when losing money. The main reason paying a dividend remains possible is when a company retains earnings from a previous period, they reserve the right to pay those out as a dividend, share repurchase, or other ways to reinvest in the business.

When a new startup comes out of the gate, it typically loses money from the start, so it cannot build up its retained earnings to pay a dividend or reinvest into the business.

Once the company stabilizes or becomes more mature, it will build up enough retained earnings to pay dividends.

One question popping into my mind is whether it is legal to pay out a dividend when the company has negative retained earnings or a net income loss.

The answer is yes, they are allowed to, but is it prudent to do so? That is not for me to answer, per se.

When considering decisions based on balance sheet investigations, we must remember the balance sheet is a snapshot in time and not necessarily what is transpiring with the company.

Think of companies like dividend aristocrats; they have built a shareholder base expecting them to pay a growing dividend yearly. Paying a dividend may not be possible based on the balance sheet.

For example, when a company goes through a cyclical change causing a downturn in net earnings, this could show on the balance sheet as a decrease in retained earnings, or they might produce enough cash to grow the retained earnings, but the company might decide to “eat” into their savings, so to speak, to keep the dividend payment going.

Let’s say, for example, that the company has ample cash and marketable securities on the balance sheet, along with good operating cash flow; then, it makes sense that they would be able to continue to pay a dividend.

Always remember that GAAP net income is subject to many non-cash adjustments, where operating cash flow is a fact.

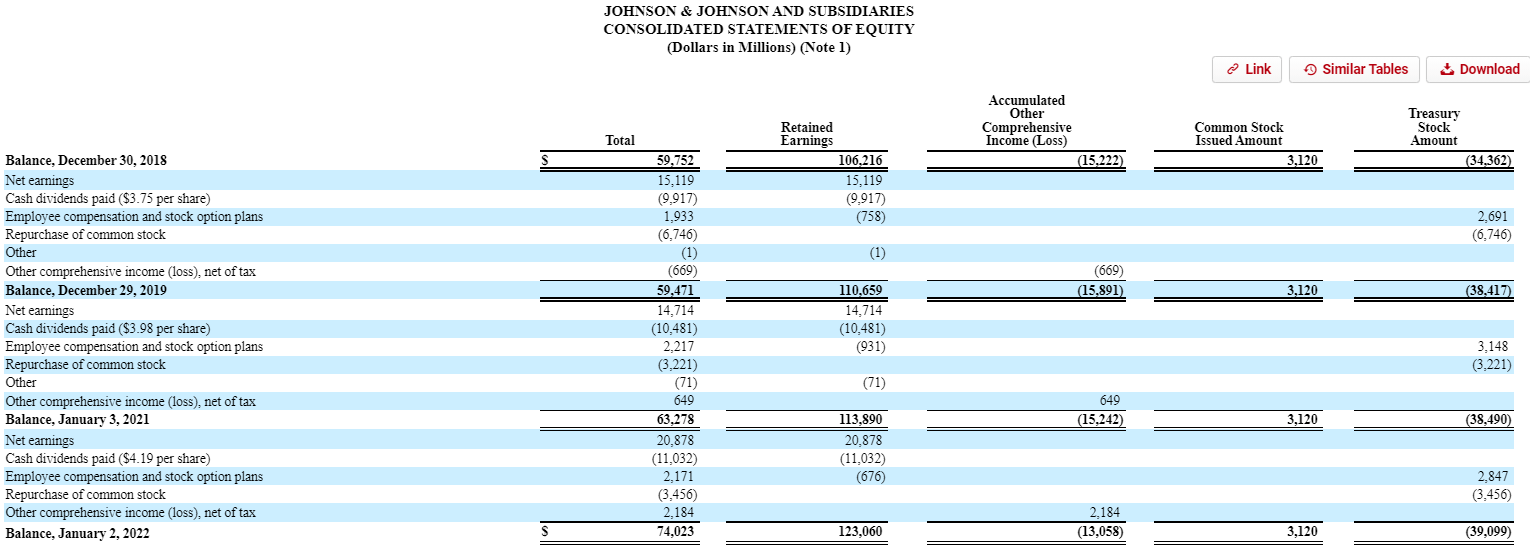

I want to reevaluate a moment to discuss a company that is not growing its retained earnings but still paying dividends. Johnson & Johnson, in their latest 10-K, showed an annual payout of growing dividends and share repurchases, but if you look closer, you see their retained earnings decreased from the previous year.

Not every year will you see a growth in retained earnings, as evidenced by Johnson & Johnson.

Notice that over the last two years, their retained earnings have declined year to year.

One way a company can continue to pay dividends even with a negative net or retained earnings for the year is through loans.

One company, in particular, that has utilized this approach lately is Chevron (CVX). Chevron has paid a growing dividend for over 32 years and is a charter member of the Dividend Aristocrats.

For 2015, Chevron’s dividend payout ratio was over 100%; typically, a payout ratio over 50% is considered high. So how was this possible?

Chevron has had to borrow money to the tune of $2 billion a quarter to fund the dividend. They had already cut their capital expenditures to zero, cut share repurchases, sold assets, and trimmed administrative expenses as much as possible.

Does this mean Chevron is going bankrupt? Not at all, but it signals the company is struggling financially, and the only way to attract investors is to entice them with a growing dividend. With the price of oil continually forced down and the demand around the world low, the price looks to be depressed ongoing. Chevron is doing what it needs to do to continue to attract investors while trying to struggle through a downturn in a cyclical business.

Let’s take some numbers for a second. Currently, Chevron earns $1.51 TTM, with a current dividend of $4.46 per share, and a dividend yield of 4.46%.

So logically, if Chevron earns $1.51 a share and they have to pay its dividend out of earnings, but they continue paying $4.46 per share for the dividend, then where does the money come from?

It can come from various sources: retained earnings, or in Chevron’s case, they continue borrowing short-term monies to pay for the dividend in the hopes that they can pay the money back on time.

Another note to mention is that Chevron’s current P/E ratio is 72! Talk about overvalued, jeesh.

Does this mean Chevron is going under? Nope, but it does mean we have to remain vigilant with any company we buy, and we must do our due diligence and check the financials at least once a year, if not quarterly, to ensure they stay on track.

Chevron operates as a commodity business and will have ups and downs during its business life. Chevron and all the oil majors will have to deal with the possibility of replacing oil since various types of electrical power have started gaining more traction, such as solar power, electric cars, wind power, etc.

Chevron is not alone in this trend; among others are Exxon Mobil, Verizon, and many more.

Investing in a commodity requires us to remain aware of all trends, and by reading the financials regularly, we can stay informed on the life of our businesses.

Final Thoughts

Negative retained earnings is the status any company could enter from time to time. Is this a complete death knell for the company?

Sometimes yes, sometimes no. One of the aspects to keep in mind is where the company is in its life cycle.

Say the company is brand new and has just gone public, then we might expect it to carry negative retained earnings because it will lose money at this point in its growth.

As the company matures, it is reasonable to expect them to climb out of the negative retained earnings status and become a grown-up company.

As always, we must explore and investigate every company we buy and do our due diligence to ensure we buy an outstanding business.

As always, thank you for taking the time to read this post, and I hope you find something of use in your investing journey.

If I can be of any further help, please don’t hesitate to reach out.

Take care,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- How to Find the Statement of Retained Earnings in a Company’s 10-K When reading through any financial statements on annual reports, I always zoomed by the earnings statement because I didn’t know what it was. Or what...

- What is Return on Equity and How Do I Calculate it? Updated 1/5/2024 “Focus on return on equity, not earnings per share.” Warren Buffett In the investing world, there always seems to be a big divide...

- Everything to Know about ROE, with Average ROE by Industry Data “Focus on return on equity, not earnings per share.” –Warren Buffett One of my favorite Buffett quotes of all time. Focusing on the returns on...

- Negative PEG Ratio Implications: What Does It Mean? Why Does It Happen? Updated 10/12/2023 The implications for a negative PEG ratio might not be as bad as you think. It all depends on the reason behind the...