In a recent episode of the Investing for Beginners Podcast Andrew and Dave take a deep dive into the financials for Starbucks and specifically key in on Negative Shareholders equity.

I highly recommend that you take a listen to the episode to get a really good example of how this is applied when Andrew and Dave look at stocks, but I wanted to take a step back and just talk about Negative Shareholders Equity from a high-level view.

So, what exactly is shareholders equity? Shareholders equity is a very simple formula:

If this formula looks very similar to another formula that you might have seen before, it’s because it is – it is also the same formula as book value.

Essentially what you’re doing is you’re taking all of the assets of the company, selling them off, paying off your liabilities that the company might have, and then the amount leftover is the shareholders equity. The formula is very simple, and you can find it on the company’s balance sheet pretty easily when you’re looking to compare various companies.

The reason that people like to use this formula is because it can give them a general idea about the tangible book value of a company when they’re looking to invest. If the company has a positive shareholders equity then that means that if they sold off all of their assets, they would be able to cover all outstanding liabilities that they had as a company.

If the company’s shareholders equity was negative, then after selling all assets and using the cash to pay down liabilities, they would still have some outstanding debts.

Essentially, you’re trying to measure what sort of situation the company would be in for their worst possible scenario, or in other words, looking for a margin of safety.

When a company has a positive shareholders equity, it provides that extra margin of safety because they have tangible assets, such as infrastructure or cash, that will likely not lose its value. Having these assets make it less likely that you, as an investor, are going to lose all of your investment in that company.

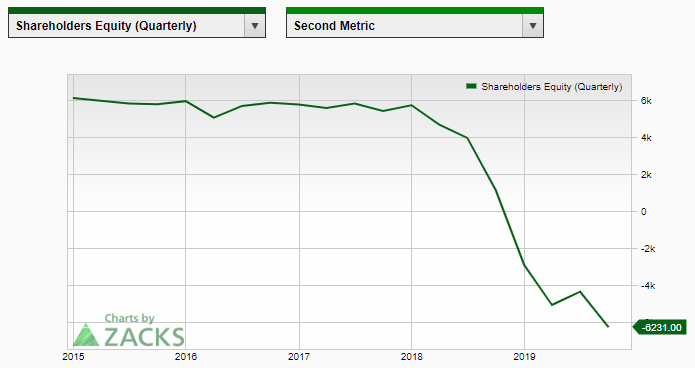

The company that Andrew and Dave really analyzed on their podcast episode was Starbucks. Starbucks historically hasn’t had a negative shareholders equity but had taken a drastic turn as of late. See below:

Source: Zacks

As with anything in investing, things are never able to be taken simply at face value, though. You can’t simply just look at a number or a certain ratio and expect to understand everything about the company or the things that are going on with them.

If you’re particularly curious about the Starbucks reasoning, I highly recommend listening to the episode at the top of my post so you can hear it directly from Andrew and Dave!

So now that you understand the benefit of a positive shareholders equity, it likely is easy to understand what the negative is – you can literally lose your entire investment.

If the worst-case scenario became a reality and a company had to sell all of their assets and they still had outstanding liabilities, you would lose your entire investment with that company. This inherently make a company much riskier than a company that has a positive shareholders equity.

Personally, I am young when it comes to the investing world, so I am inherently riskier than most and very vocal about the importance of risk in your portfolio, but you need to understand that there is a major difference between being risky and being reckless.

On the contrary, a stock that has a negative shareholders equity can be a major red flag. To me, it could mean one of many scenarios, but many people will overlook something like this because they think that the growth potential is just so strong.

Well, maybe they’re only growing revenues because they’re spending so much money on advertising that it’s impossible not to grow their revenues. If they’re spending more on additional advertising than the increased profits that they’re bringing in, then that sounds like a losing situation to me.

Or, maybe they’re consistently dropping under to a negative shareholders equity, then asking for a loan, and then dropping further into even more negative of a shareholder’s equity number. Or, maybe the company is increasing their dividend but it’s because they’re taking out some money in loans to make sure that the dividend continues to grow?

At the end of the day, a number is just that – a number. Now, I am as nerdy as they come, and I think that the term “numbers never lie” is true. But I think that the people that present the numbers to you can sometimes be liars, however. So, you can’t simply take a number at face-value.

In other words, what I am trying to say is that numbers can be manipulated to make you believe something that isn’t true. For instance, a company can try to manipulate EPS growth by buying back shares if they don’t think earnings actually will continue to grow.

Are these types of scenarios common? No. But do they happen sometimes? Yes.

There are times when a company has a positive shareholders equity and you’re going to dig a little bit deeper and learn that it’s actually just some sort of manufactured number to make things look better to investors. Now, I certainly hope that companies won’t do this – but trust me, some will.

More importantly though is that when you find a company that has a negative shareholders equity you can save yourself some time and just walk away right there! I think that digging in a bit more will do you well for your own personal education, but I think that there’s almost never a time where I would find a company with a negative shareholders equity and then still decided to buy the stock because of something I read after that.

If you’re looking to buy the stock and see that the shareholders equity is in fact negative, and then you continue to look to see if there’s a reason so you can still buy the stock, that is in fact confirmation bias, and you need to avoid that at all costs.

Always go into a stock evaluation with an open mind because if you don’t, you’re going to be greatly disappointed by the performance of that choice.

Shareholders equity is nothing more than a ratio that will tell you how big of a margin of safety your investment has…but what does that matter? Well…choose to ignore it sometime…then you can tell me how much it matters to you.

Related posts:

- How to Find Negative Retained Earnings in a 10-K – Does it Indicate Distress? Stockholders’ equity, also called book value, is the company’s assets minus its liabilities. We talk about tangible book value when we value investors discuss shareholders’...

- What’s a Good Debt to Equity Ratio? The Ultimate Guide for Beginners The debt to equity ratio is a great formula for investors to use as a rule of thumb for determining the riskiness of a stock,...

- How Negative Growth Calculations Can Actually Mislead Investors Updated – 12/14/23 Earnings growth is the life blood of Wall Street. You see this with the obsession of earnings season and analyst projections. But...

- How to Tell If Negative Book Value is a Sign of High Risk or Not A negative book value means that a company has more total liabilities than total assets. The numbers simply say the company owes more than it...