“In the end, banking is a very good business unless you do dumb things. You get your money extraordinarily cheap, and you don’t have to do dumb things. But periodically, banks do it, and they do it as a flock, like international loans in the 80s. You don’t have to be a rocket scientist when your raw material cost is less than 1.5%.”

Warren Buffett remains one of the leading investors in banks and one of his keys to successful investing is his ability to stay in his lane. By this, I mean he invests in companies he understands. And part of this understanding revolves around speaking the language of banks.

Banks, Insurance, and other financials operate similarly to Microsoft. They create, offer, and sell products for revenue, offset by related costs.

But the language they speak is different. For example, terms like net interest income and non-interest income can muddy the water.

To invest in banks or any financials, we must understand the language of finances. And today, we will break down the net interest income metric.

In today’s post, we will learn:

- What is Net Interest Income?

- Where Does Net Interest Income Come From?

- How Do We Calculate Net Interest Income?

- Examples of Net Interest Income with Real Companies

Okay, let’s dive in and learn more about net interest income.

What is Net Interest Income?

Net interest income, or NII, is the difference between a bank’s income from its interest-bearing assets and the costs incurred in satisfying its interest-bearing liabilities.

But more simply, a bank’s assets generate income from interest-bearing assets. And the bank also generates costs from servicing deposits.

Net interest income represents the difference between the revenue and the costs. Or we can define it as the difference between interest income and interest expenses.

Each bank has different assets they use to generate interest income, such as:

- Mortgages

- Car loans

- Personal loans

- Credit cards

- Or commercial real estate

The interest we pay the bank represents the revenue the bank earns from those assets.

The bank then pays interest to customers to encourages them to deposit their money in a savings account, for example.

To determine what net interest income Bank of America generates remains simple. They subtract interest expense from deposits from the interest earned from loans.

The bigger the spread between the two, the larger the margin the bank earns.

The difference between rates earned and paid helps drive profits for any bank. This is why rising interest rates help banks and falling rates hurt them, and helps explain why all the focus is on rates in financial media.

Another factor to account for is the differences between rates paid. For example, if a bank offers higher rates for loans and lower rates for deposits, they will earn a better net interest income. But they could struggle to attract customers with the higher rates/lower rates.

Where Does Net Interest Income Come From?

Many banks, such as Ally, Wells Fargo, and Citibank, earn net interest income as their main source of income. These banks derive revenues from interest-bearing assets. Let’s take a moment and look at those assets.

Most banks offer the following financial products or different versions:

- Credit cards

- Mortgages

- Personal loans

- Auto loans

These above assets all earn interest. When we take out a car loan for 6%, for example, the 6% interest we pay to borrow $20,000 for a car goes to the bank. The interest is the fee they earn for loaning us the money for the car.

The higher the rates, the more potential revenue a bank earns. But these loans or credit cards come with risks associated with the bank, primarily in the form of defaults.

If they make poor decisions on who they loan to and the borrower defaults, the bank loses money.

Conversely, deposits at the same bank pay interest, for example, 4%. Then the difference between 6% and 4% equals the revenue the bank generates.

An easy way to think about this idea: banks act as a middleman between creditors and depositors. They take on the risk of lending money at a higher rate than they pay.

One measure of the success of a quality bank remains the quality of its loan portfolio. A bank’s net interest income will depend on its assets and the mix of its loan portfolio.

Each loan portfolio will carry a mix of fixed and variable-rate loans, depending on the credit quality of the customers. Mortgages represent this idea the best.

Riskier loans carry higher risk and higher interest rates, and personal loans typically carry higher rates than a mortgage, for example.

The different mix of loans, rates charged, and types of loan rates will greatly impact the bank’s interest income.

As we mentioned earlier, interest rates tremendously impact a bank. For example, a bank like Wells Fargo, which relies heavily on mortgages for income, will suffer more when rates rise. If the mortgage rates rise faster than the bank can adjust its deposit rates, Wells will take a hit to revenue.

This idea is a little more inside baseball for us, but remember, as rates rise, both income and expenses will feel an impact.

Two factors to always consider when investing in banks:

- What is the interest rate environment?

- What is the overall macro situation?

We also need to understand this because if the bank earns more from its interest income than its interest expense, it will operate profitably. Like any other business, they have other costs to consider, such as rent, labor, management salaries, and utilities.

How Do We Calculate Net Interest Income?

To recap, net interest income helps measure a bank’s profitability. To calculate net interest income, we subtract the bank’s interest expense from the interest income.

Interest income equals revenue the bank earns from its loan portfolio. And interest expense equals interest paid to depositors of the bank.

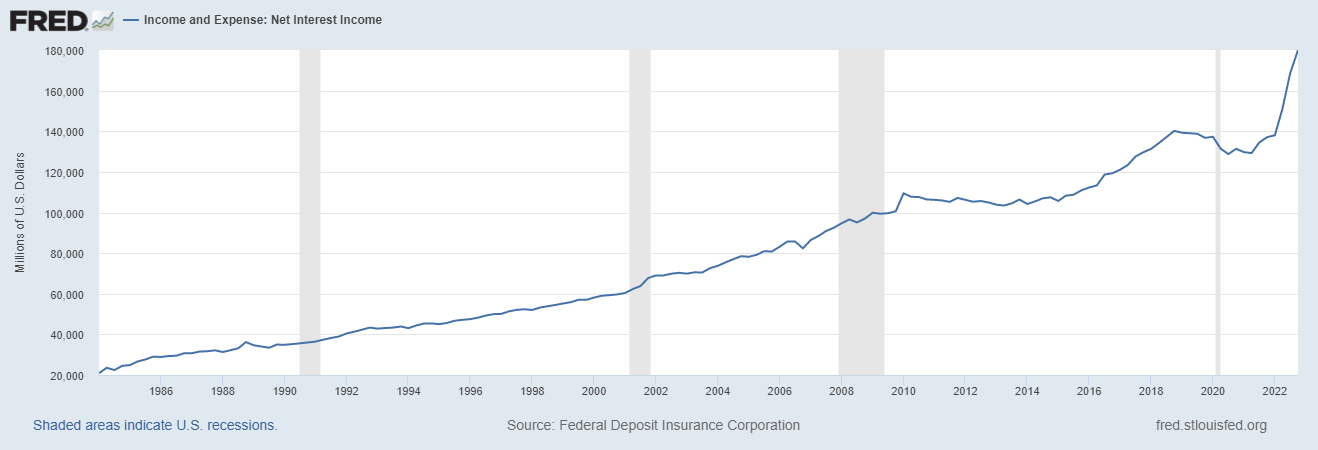

The bank’s net interest income has grown steadily since 1984, as we can see from the chart below from the St. Louis Fed.

Over the years, banks have increased net interest income at a 5.68% CAGR clip, with the last ten years seeing a slower rate of 5.54%.

The FDIC reported that the net interest margin had grown 35 basis points (0.35%) over the past quarter and 58 basis points (0.58%) over the past year to 3.14%. Net interest margin compares net interest income to the bank’s loan portfolio balance—a topic we will cover next.

The FDIC-reported increase to 3.14% marks the first time the number has exceeded 3.0% since 2020, but the metric remains below the pre-pandemic number (3.25%).

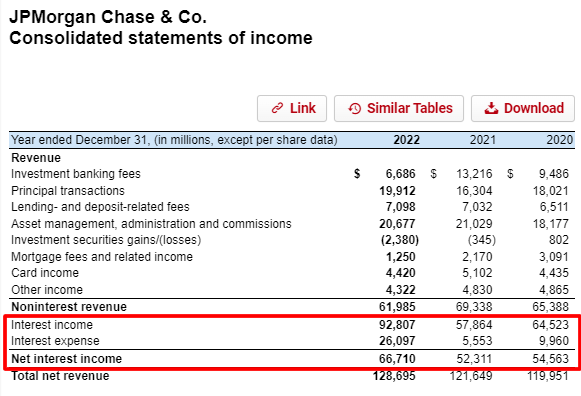

The current rising interest rate environment has helped banks grow their profits. Wells Fargo and JP Morgan reported 8% and 15% growth over the past quarters. JP Morgan has also had growth in the loan portfolio of 3%, and 2022 saw a total of $66.7 billion in net interest income, compared to $52.3 billion in 2021.

The formula for calculating net interest income is as follows:

Net Interest Income = Interest Income – Interest Expense

Banks operate on a model of loaning money to individuals and businesses while receiving monthly interest payments. And to attract depositors, the bank offers interest on any balances held within the bank.

To explain a bit deeper, when a bank loans money to borrowers, they take on the risk of collecting the money lent while receiving regular payments for accepting the risk.

To attract depositors, banks offer attractive interest rates to entice customers to park their money in the bank.

But the tradeoff for the bank entails taking in deposits, which they need to lend out while paying an attractive interest rate. For banks to have funds to lend out, they must attract depositors. The more depositors they can attract, the better.

For example, one of the leading auto lenders, Ally Bank, has a history of growing depositors at a rapid pace. The rising depositor base allows them to lend more aggressively to borrowers, which helps their net interest income growth.

The borrower/depositor flywheel allows Ally to grow quicker than competitors, making it a more attractive investment.

The calculation of net interest income is a simple formula, with most banks including the necessary inputs on their income statement. In most cases, you can find interest and interest expenses on the income statement.

Let’s say, for example, that Bank A has:

- $100 million in interest income

- $78 million in interest expense

Then, Bank A would have:

Net Interest Income = $100 million – $78 million = $22 million

Simple, huh? Let’s try it out on a few real banks.

Examples of Net Interest Income with Real Companies

For our first guinea pig, we will use JP Morgan (JPM), and their latest 10-K, dated 2-21-23. I will use a screenshot from the 10-K with the inputs for the formula highlighted so you can see where to gather the inputs.

Now, we can build a chart to see how JP Morgan generated net interest income over the past three years; all numbers will be in millions.

Millions | 2022 | 2021 | 2020 |

Interest Income | $92,807 | $57,864 | $64,523 |

Interest Expense | $26,097 | $5,553 | $9,960 |

Net Interest Income | $66,710 | $52,311 | $54,563 |

Notice JP Morgan already calculated the net interest income for us, but it’s always a good idea to understand the components and see patterns.

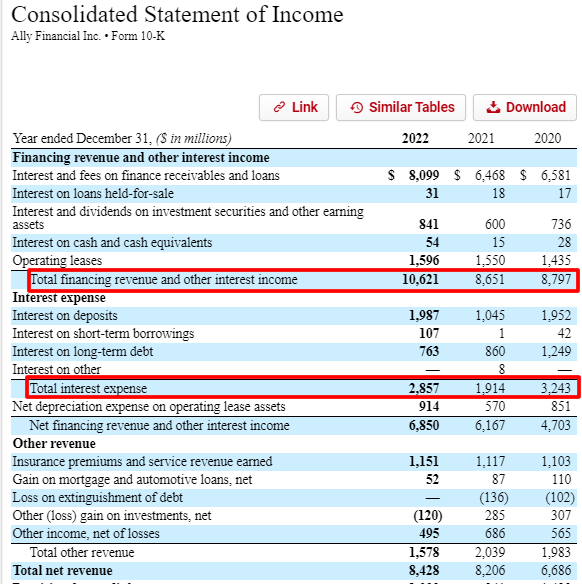

Next, look at the net interest income for Ally Bank (Ally). We will use their 10-K dated 2-24-23; unless otherwise stated, all numbers will be in millions.

Using the screenshot below from Ally’s latest 10-K, we can pull the inputs and calculate the net interest income.

Ally doesn’t calculate the net interest income like JP Morgan, but we got this here.

2022 | 2021 | 2020 | |

Financing revenue | $10,621 | $8,651 | $8,797 |

Interest expense | $2,857 | $1,914 | $3,243 |

Net Interest Income | $7,764 | $6,737 | $5,554 |

As we can see, Ally has grown their net interest income over the last three years.

Another cool takeaway is to compare the net interest income to the bank’s overall revenue. Using this analysis can give you insight into what drives revenue for the bank and how reliant it is on interest rates.

For example, over the past three years, Ally has a percentage of revenue balance of:

- 2022 – Net interest income equals 92%

- 2021 – Net interest income equals 82%

- 2020 – Net interest income equals 83%

Now compare those numbers to JP Morgan:

- 2022 – 51.8%

- 2021 – 43%

- 2020 – 45.4%

As we can see, JP Morgan operates with a much more balanced revenue stream than Ally Bank, allowing them to pursue other opportunities and not be as tied to deposits and interest rates.

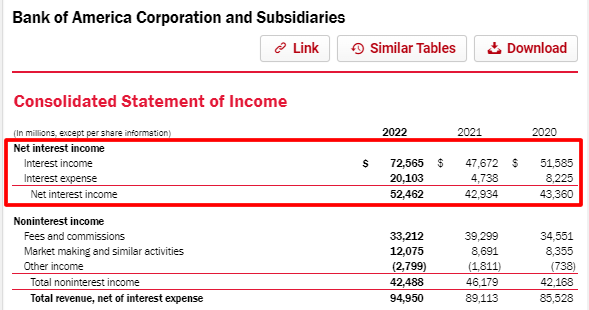

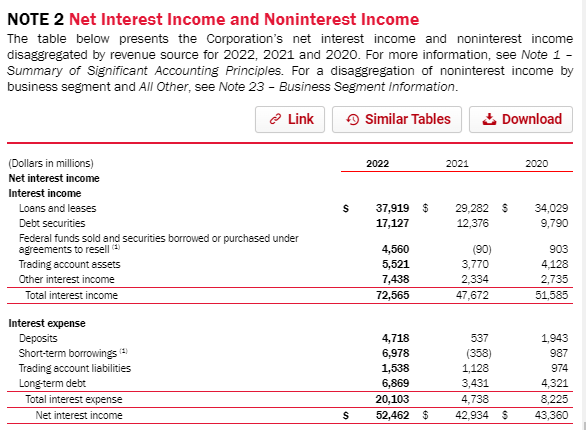

Let’s take a quick look at one more: Bank of America mimics JP Morgan by calculating our net interest income in their latest 10-K dated 2-22-23.

Pulling the numbers from above, we see:

2022 | 2021 | 2020 | |

Interest income | $72,565 | $47,672 | $51,585 |

Interest expense | $20,103 | $4,738 | $8,225 |

Net Interest Income | $52,462 | $42,934 | $43,360 |

Again, we can see that Bank of America continues to grow their net interest income. Looking deeper into the income statement, we see the bank generates 55% of its net interest income.

Bank of America also provides further detail in its notes section regarding net interest income, as seen below:

Investor Takeaway

Investing in banks or any financials is part of the challenge around understanding financials. Financial institutions have different account terms and methods of generating revenue. Once we understand those terms and methods, we can analyze them based on those factors.

I liken it to learning a new language, like Portuguese. Once you understand the grammar, verbs, nouns, and sentence structures, you can start speaking comfortably.

Investing in financials offers the same idea and methods. Today’s post attempts to help you learn one part of the language of banks, net interest income.

Net interest income is the difference between interest earned and paid to lenders. It is a ratio used specifically in the financial industry, and banks particularly, to measure profitability.

But as interest rates declined over the years, the way institutions organized themselves has changed due to declining interest rate margins for banks. Trading, services, and other financial activities have allowed banks to expand their non-interest income.

In other words, banks have diversified their revenue streams to have less reliance on net interest income over the years.

And with that, we will wrap up our discussion for today. Thank you for taking the time to read today’s post, and I hope you find something of value.

Until next time, take care and be safe out there,

Dave

Related posts:

- Ally Bank Stock Analysis This in-depth analysis on the Ally Bank stock will hopefully serve as a good example of how investors can look at a company’s qualitative factors...

- How to Calculate the Loan to Deposit Ratio; Average LDR of the Big Banks Deposits are the lifeblood of banks, and loans are the means to generating income for the bank. The more deposits, the more loans, which leads...

- How to Calculate the Loan to Deposit Ratio; Average LDR of the Big Banks Updated 3/30/2023 Deposits continue as the lifeblood of banks, and loans help generate income for the bank. The more deposits, the more loans, leading to...

- Understanding the Commercial Banking Industry – A Simple Guide Updated 1/5/2024 “Banking is a very good business if you don’t do anything dumb.” Warren Buffett The banking industry is an unknown entity to most...