Do you know what your net worth is? If not, don’t worry! I am here to show you exactly how to create your own personal net worth statement.

Bankrate defines it as “Net worth is the value of all assets, minus the total of all liabilities.” In other words, it’s essentially your own person balance sheet, or a Profit and Loss (P&L) statement.

Honestly, I never really was a big fan of tracking my net worth, or even knowing what my net worth was, but I honestly just think that it’s because I was too scared to really know. I knew it was negative. The question for me was never if it was negative, it was how far negative is it?

Once I really got into budgeting, investing, and creating ways for me to become financially independent as quickly as I possible could, I then finally got into tracking my net worth statement.

Like I said before, a net worth is basically a personal P&L. Essentially, all that you’re doing with a net worth statement is calculating all of your assets that you have, all of your outstanding debts that you still owe money on, and then taking the difference between the two. I think the hard part of this is really trying to come up with exactly what all you own and what all you owe on.

What are some common assets that you might have?

- Cash – this is likely the most common one that hopefully all of us have! This could be actual cash, money in a checking account, savings account, maybe a different savings account like a high-yield savings account, etc.

- 401k – all that hard work that you’ve been putting in at your job to max out your company match? Yeah, that’s definitely an asset!

- IRA – this can either be a traditional or a Roth, but make sure to get the total amount!

- Brokerage Account – you may have multiple brokerage accounts and if so, make sure to include all of them!

- 529 Account – I go back and forth about including this as an asset because anything in this account is going to go to my children, but if I didn’t have this account, then I’d be paying for their education without any tax savings and that would then register as a liability/debt, so that’s why I include it.

- HSA – I also debate about including this but anything that goes unused by the age of 65 can be withdrawn, penalty free, for any purpose. So, for that reason, I definitely consider an HSA an asset. PS – HSAs are like my favorite thing ever. I am a huge fanboy!

- Land/Property/Real Estate – I ONLY count the value of real estate or property if it’s not my primary residence. Your primary residence is NOT an asset. This is something that I struggle with but the thing is, if you still owe on the home then it’s not an asset. You will always need to have a home so money is always going to be tied up in it. I still struggle, like I said, but I do not count ANY asset value for my primary home, and I recommend that you don’t either.

- CDs – these are very safe, cash-like investments that you can absolutely count as an asset

And what about those pesky liabilities/debts?

- Credit Cards – credit card debt is the WOAT. Are you familiar with GOAT, meaning the Greatest of All Time? Well, the WOAT is the Worst of All Time. Credit card debt is oftentimes 20%+. And sometimes welllll above that 20% threshold. So yes, I think we all agree that this would classify as being the WOAT

- Student Loans – while this might not necessarily be “bad debt”, it is absolutely debt that you need to pay off. You took the money out to get an education and now that you’re graduated (hopefully), you have to pay those loans back! Depending on the interest rate, they will likely be lower on the priority list to pay off, but they need to be accounted for!

- Car Loans – ah, car loans. Cars are one of the worst investments that you can make and it’s why I will never own a new car. I’m a used man only for the rest of my life. That sounded really bad.

- Mortgage– this seems obvious. You have to pay for your shelter! This is also most likely the highest expense that you might have on a month-to-month basis, so please do not forget it. Rent isn’t included though as you technically don’t owe any money on it. You could move out when your lease ends and be totally off the hook!

- Personal Loan – this might be to cover a debt, pay for a repair, or anything else! Maybe just so you could get Christmas presents. Personal loans need to be thought of and are likely a higher interest rate as well!

- 401k loan – if you took out a 401k loan to pay for something, you obviously have to pay that back. This might be an easy one to overlook as oftentimes the payment is taken directly out of your paycheck but it’s imperative to not forget about this debt

- Cell phone – cell phones are monthly bills, but also many people will owe money on their phones too. They’ll but that $800 phone and pay for it over the course of their 2-year contract. If you’re paying off a phone, you guessed it – it’s a debt!

There are many, many other things that you might have in your life that are assets and liabilities. If you want to run anything by me, I’m more than happy to help, so just shoot me an email at [email protected].

A rule of thumb that I follow is if you’re not sure if something should count as an asset, don’t count it. If you’re wondering the same about a liability, count it. That way you’re assuming the worst case and you’ll be much better off in the long run!

So, now that you’ve created that list, the fun is about to begin! I have included a Net Worth Statement calculator that you can download below to get you to your number.

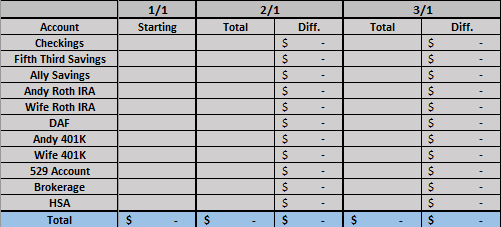

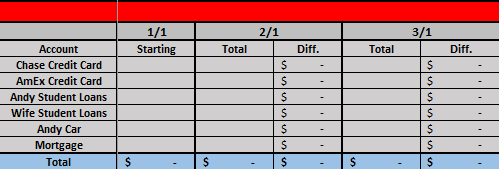

Once you download the spreadsheet, you’ll see that it’s broken up into three sections – Assets, Debt/Liabilities and Net Worth. All that you have to do is fill it out! Let me show you how.

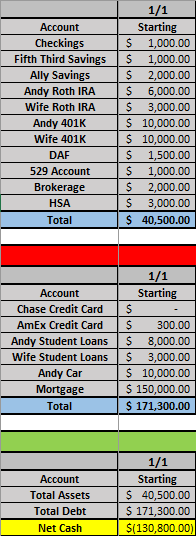

As you can see above, I have included all of my assets. We have two savings accounts, one at Fifth Third just for immediate cash access and then another at Ally to make sure that I’m getting a high yield on my emergency fund and short-term purchases.

Then we both have IRA and a 401k for our retirement savings. I also have ‘DAF’ which is my Dividend Aristocrats of the Future brokerage account that I like to invest in. Then we have a 529 for our son, another brokerage account for some more short-term, speculative investing, and our HSA.

Ok, breathe. A lot of stuff! But it’s really a very minimal amount of time that I spend updating this each month and the high that I get is overwhelming. It’s so motivating. You’ll see.

But let’s keep going! Off to the debts/liabilities!

I’m not going to lie – I actually did lie on these (lol). I didn’t want to really disclose our debts so I just made up some examples of very common debts that will help get the point across!

Chances are, you likely might have all of these debts. Even if you don’t have a credit card debt, but you do have a credit card, include it on your statement. Even if I have $20 owed on my account, I will still put that on as a debt even if it’s not past due or anything like that.

It’s money that I owe, and if I were to pay $500 on my credit card then I’d have $500 less in my checking account, so not counting the credit card debt but counting my checking account is inflating my net worth. And lying to myself is the las thing that I want to do – I want a reality check!

The last section then is the Net Worth section, which is essentially a summary of the data that you have been inputting:

Ok, now that you have your assets and liabilities inputted, it’s time to start tracking!

All that you have to do is simply logon to your various apps or websites that hold this information and list your most current balance. I’ve put in some theoretical numbers below:

As you can see, at this point in my life, if the numbers above were totally accurate, then my net worth would be -$130,800…ouch! Of course, a large amount of that is my house, which you likely do own a small percentage that you could be perceived as an asset, but I am telling you that you will be much better off if you never consider your primary residence to be an asset.

It would be awful to be using that home as an asset to make money decisions with and then when crap hits the fan, you’d have to move your family to generate cash to pay for other expenses that arose. Just don’t ever assume it’s an asset and you’ll be way better off.

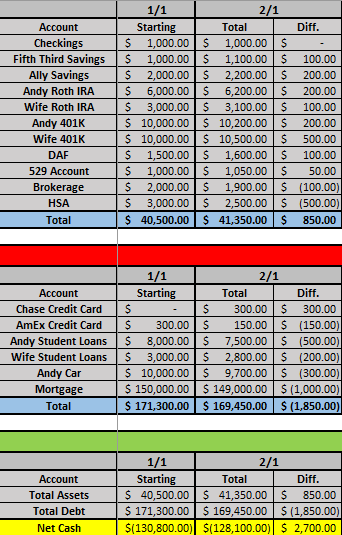

Now that you have listed all of your starting amounts, the next step is simply to logon to those same apps or websites each month and input your new totals. Then, the ‘Diff’ column will automatically populate so you can see how you fared from month to month:

So, after inputting that ‘Total’ Column you can see that the Net Worth is showing a total of -$128,100, so while we still don’t want that to be negative, that is a big improvement of $2700 from month-to-month!

Then, just continue to update this sheet month after month and let the numbers continue to show you your track record. You can see that in the example above, my brokerage account actually dropped in value due to some risky speculative stock picks (don’t do that!), the HSA dropped due to a medical expense and the Chase Credit Card balance increased, but what does this all mean?

Crap happens!

These are three things that are small setbacks but when you look at all of the good that you did in the month, it easily outweighs the bad. Look at that little yellow highlighted $2700 to keep getting motivated and pushing along!

If you’re in the middle o the year, like we are currently as it’s June, then simply just delete the previous columns, or just changed the dates across the top titles, and START NOW! Don’t even wait until July 1. Start today.

The most important thing with this is simply the motivation factor that you get. Just like it is with budgeting, dieting, anything else that isn’t “fun”, once you get started the motivation is so strong that it’s hard to stop.

It legitimately will take about 5-10 minutes each month to login to your apps or websites and see what your balances are and record them. The thing that will take the most part is simply thinking of all of the assets and debt/liabilities that you might have. Take your time on this step though because if you miss things then your net worth statement will be flawed from the start!

Do yourself a favor and checkout the download and calculate your own net worth! Of course, if you’re an active member of the Doctor Budget community then you will receive the Net Worth Statement calculator on your Doctor Budget file, and if you’re not a member of the Doctor Budget family, then maybe you should be!

All it takes is $29 for you to gain access to the best budget planner on the market and one that will continue to get more and more updates and added accessories. Sure, I make some of them free to the public, but not all of them, so if you like this net worth calculator then the Doctor Budget might be the best way to make sure that you get all of the additions in the future!

Do yourself a favor and bring awareness to your financial situation. Download the file, input your numbers and track your performance. Tracking performance is the BEST way to get motivated to make changes in your life.

Are you ready? Are you motivated? LET’S GO!

It might seem overwhelming, but if you continued to improve by $2700 every month then you would have a positive net worth in just 4 years! That is a monstrous improvement!

Related posts:

- Don’t Think You Can’t Save Money Quickly With a Low Income? Updated 1/15/2024 Have you been told that you can’t save money quickly with a low income? Are you tired of living paycheck to paycheck? Are...

- 7 Ways to Prioritize Saving with a Budget Calendar Have you ever heard of a budget calendar? Personally, I use one nearly every single day of the week and it saves me a ton...

- Useful Tricks to Form Good Money Habits into Natural Decisions One thing is for certain, there are good money habits and there are bad. It seems like everyone has at least one bad habit (me...

- Helpful Tips and Habits for When You Are Broke Every single person has a different philosophy when it comes to saving or spending money. Some people are penny pinchers and can save a ton...