Nike (NKE) announced results for the fourth quarter of 2020 on May 31, 2020. The following report is a summary of those results for Nike and will not attempt to offer any opinions on those results. Only the numbers and facts from the quarterly 10Q report are presented; if you would like more detail, please follow the link below.

Nike 10Q Quarterly Report May 31, 2020

Financial Highlights

- Fourth-quarter reported revenues of $6.3 billion

- Digital sales for Nike increased by 75 percent

- Greater China revenues increased in the fourth quarter by 8 percent.

Selected Financial Data

- Quarter end Market Cap – $149.144 Billion

- Quarter end Market Price – $95.87

- Enterprise Value – $154.11 Billion

- Earnings per share – $(0.51)

- Return on Equity – (35.96)

- Return on Assets – (10.98)

- Return on Invested Capital – (19.50)

- Debt to Equity – 1.62

- Dividends per share – $0.25

- Dividend payout ratio – 0.60

All information presented below will be in comparison to the previous fourth quarter results from 2019 unless otherwise stated.

Fourth Quarter Income Statement Review

Revenues for Nike declined 38 percent for a total of $6.3 billion as a direct result of store closures across the company because of the Covid-19 pandemic. All of this was offset by growth in Greater China, which was shut down earlier in the fiscal year.

The only brand in the Nike universe that saw a revenue increase was the Jordan brand, which was up 15 percent for the quarter, likely a result of the Michael Jordan documentary shown on ESPN during the height of the pandemic shutdowns in the US.

Nike’s gross margin declined 37.3 percent or 820 basis points as higher production costs offset higher full-price average selling prices, increased inventories, and rate impacts on the supply chain, all of which were impacted by Covid-19.

Expenses for selling and administrative declined six percent to $3.2 billion, which included a bad debt expense of $187 million. The demand creation expense was $823 million, which was down 19 percent compared to the prior year. The expense as a result of the shift of retail and brand marketing away from sporting events were canceled or delayed because of Covid-19.

The overhead operating expense declined one percent for a total of $2.4 billion, which was a result of lower wages and reduced travel and related expenses.

Nike reported an effective tax rate of 1.7 percent, compared to the previous year of 20.4 percent. The lower tax rate is a result of the mix of earnings taxed in the US, and the utilization of foreign tax credits.

Net loss for the quarter was $790 million for earnings per share of $(0.51), all a result of lower revenues and gross margins due to the impacts of Covid-19 on operations.

Fourth-Quarter Balance Sheet Review

Nike’s inventories for the quarter-end were $7.4 billion, up 31 percent compared to the previous year’s quarter. The increase in inventories reflects the store closures across the company around the world, along with lower wholesale shipments all a result of Covid-19 on operations.

Total liquidity for Nike at quarter’s end included $12.5 billion in cash and cash equivalents, plus short-term investments of $8.8 billion. All of which was $4.1 billion higher than last year as a result of the proceeds from a $6 billion corporate bond issue in March.

Total current assets rose 24 percent during the quarter, directly as a result of the increase in cash and cash equivalents. Also, the total assets for the quarter increased by 32 percent compared to the previous year.

Long-term debt rose in the quarter by 172 percent as Nike issued a bond offering to raise capital during the quarter as a result of Covid-19’s impact on operations.

Shareholder’s equity declined in the fourth-quarter of 2020 by 11 percent for a total of $8.055 billion.

Nike also secured a new $2 billion credit facility, which added to the already in place credit facility of $2 billion. All of which helps add liquidity to Nike as the pandemic continues.

Shareholder Returns

Nike repurchased 1.9 million shares during the fourth quarter for about $159 million before the share repurchase programs were suspended in March as a result of Covid-19.

Nike also declared a dividend during the quarter of $0.245, which was an increase from $0.22 in the previous year’s quarter.

Valuation

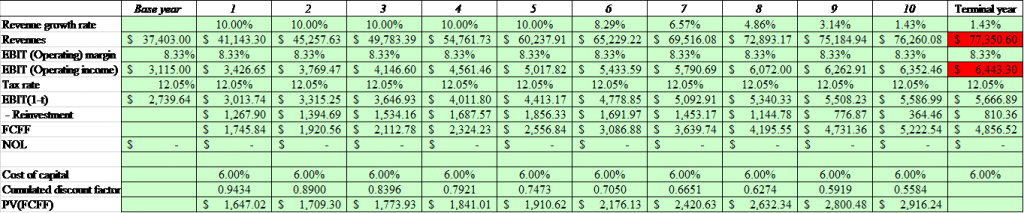

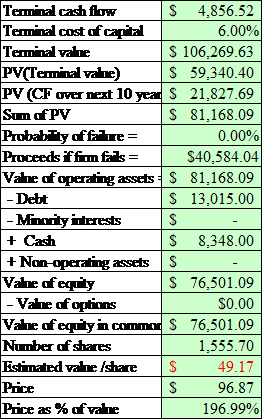

Below is a discounted cash flow valuation of Nike based on the trailing twelve-month numbers, which include the fourth-quarter financials reported above. The valuation is an attempt to calculate a possible price target based on the financial results of the company. I will include my estimates so you can follow along with the thinking.

The valuation is not meant as investment advice, rather an exercise in valuing a company.

Free Cash Flow growth – 10%

Discount Rate – 6%

Terminal Rate – 1.43

Result of valuation equals $49.17

Showing a range of discount rates, all other numbers remaining the same:

- 5.75% – $49.98

- 6.25% – $48.38

Compare those results to the current market price of $96.87 as of June 30, 2020.

Final Thoughts

That wraps up our summary of the financial results of Nike for the fourth-quarter of 2020. The company was impacted greatly by the Covid-19 pandemic, as were most during the pandemic.

No opinions were offered, and the valuation above is not meant as any investing guidance, for either a buy or sell of the company. Rather as an educational exercise to learn more about the company and see a possible buy price based on the latest financials.

As always, thank you for taking the time to read this report, and I hope you learned something that can help you with your investing journey.

Until next time, take care and be safe out there,

Dave

Related posts:

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...

- Wells Fargo (WFC) 10Q Summary First Quarter 2020 Wells Fargo 1Q20 Summary Wells Fargo reported its first-quarter earnings on April 14, 2020. What follows is a summary of the bank’s results for the...

- Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential (PRU) 1st Quarter 2020 10Q Summary Prudential Financial Inc announced its first-quarter 2020 results on May 5, 2020. The quarter was as expected, given...