In contrast to deferred tax liabilities, a net operating loss (NOL) carryforward is a number that can be used to offset future Net Income, which creates a deferred tax asset on a balance sheet that represents a future tax deduction.

The deferred tax asset created from a net operating loss carryforward is a metric now required to appear in a company’s Consolidated Balance Sheets, and is added to the Consolidated Income Statement as it used to increase future earnings. You should also find an explanation of the various NOLs and other carryforwards in the footnotes of the 10-k.

Famous investor Warren Buffett took advantage of loss carryforwards with his purchase of Berkshire Hathaway in 1965, and today investors can use knowledge of NOLs deductions to identify companies that are poised to unlock higher free cash flows in upcoming years.

This post will explain the net operating loss carryforward in these sections:

- How Warren Buffett used NOLs to increase Berkshire’s EPS

- Example of how to find NOLs in the financials ($WHR 10-k)

- How Deferred Tax Assets are Calculated from NOLs

- Explanation and example of Valuation Allowances ($AMZN 10-k)

- Explanation and example of varying tax rates for NOLs ($FB 10-k)

Warren Buffett’s Cash Windfall from NOLs After Buying Berkshire

The funny thing about Warren Buffett’s original purchase of Berkshire Hathaway—which is now his holding company vehicle through which he owns whole businesses (See’s Candies, GEICO, etc) and the stocks of many great companies (Coca Cola, Apple, etc)—was that Buffett admits that the purchase was one of his big mistakes.

And yet, one of the greatest investors in the world now has made the name of Berkshire synonymous with great wealth and success, and it all started with some shrewd investment and “extraction” of early cash flows partly through net operating loss carryforwards.

As reported by Shawn Allen, CFA, Buffett’s average purchase cost for share in Berkshire was $14.86, at a time when the company had net working capital around $19 per share. To get this great deal, he had to invest in a business with a long history of losing money in a shrinking industry with a bleak outlook.

But that wasn’t the entire picture.

Back then, net operating losses where not required to be disclosed in the company’s financials, and yet there was a “hidden asset” for Berkshire in the form of the NOL carryforward:

“And it turns out that the 1964 balance sheet was in effect missing an important hidden financial asset in terms of available past losses that could be used to eliminate substantial future income taxes. Subsequently, Berkshire did make substantial profits in 1965 and 1966 that benefited greatly from a lack of income taxes.”

Not only was this great find a huge win for Buffett, but his timing was impeccable.

In the years to follow, Berkshire posted great earnings. In 1965, the first year since purchase, Berkshire posted around a $4.00 EPS with zero income tax paid!

Berkshire continued with $4.89 in EPS for 1966, and though the long term financials of the business ended poorly and the core business was eventually shut down, Buffett took this explosion of fresh capital and continued his great streak of making money multiply many times over.

Application to Net Operating Loss Carryforwards in Today’s Environment

In general, investors won’t be able to find such hidden sources of value like Buffett did, since deferred tax assets that are calculated from NOLs are required to be disclosed in balance sheets today.

But, investors can take advantage of the benefits from larger future cash flows from a company’s use of NOLs, which can lead to great price appreciation as that capital is reallocated—similar to the way that companies with large piles of cash can provide a quick catalyst to share prices with the announcement of a great acquisition or stock buyback.

And if an investor is keen on the subtle differences between operating ROIC and the more widely used ROIC, one could astutely recognize large deferred tax assets from substantial NOLs potentially suppressing ROIC calculations, masking core businesses that actually have much higher ROICs than they appear.

Finally, an operating loss carryforward could also be hidden due to the rules around valuation allowance, in which case a sudden, unexpected increase in earnings can unlock greater tax deductions than the company initially expected—which would not appear on a balance sheet. I’ll talk about that, along with dubious tricks regarding valuation allowance to watch out for.

But first, an examination of a pretty plain example of operating loss carryforwards in a 10-k.

Net Operating Loss Carryforwards in $WHR’s 10-k

As I mentioned at the top, a Net Operating Loss Carryforward is a number that gets converted into a long term deferred tax asset that will show up on a company’s balance sheet.

The NOL itself won’t show up on any line item in the financials, but instead can be found in the footnotes, in the section discussing income taxes and deferred tax assets and liabilities.

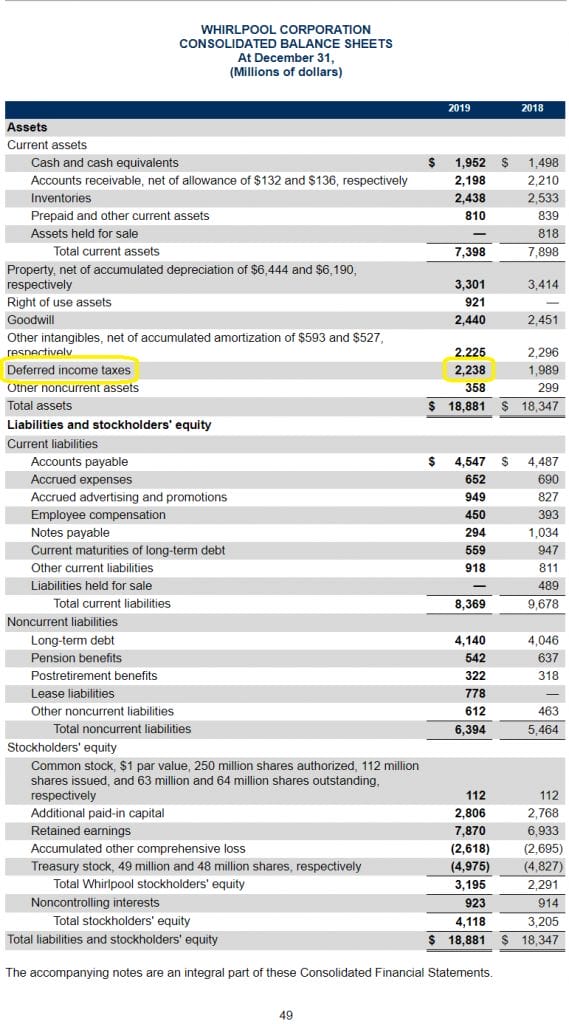

To find deferred tax assets in the consolidated financial statements, you should be able to see a line item listed as a deferred tax asset on the balance sheet. It can also just fall under “Other assets”, in which case further explanation should also appear in Notes to the Financials.

It’s also possible that a company doesn’t have any loss carryforwards to speak of, in which case you likely won’t see a line item or explanation in the footnotes.

Here’s where the deferred tax assets live on Whirlpool’s balance sheet:

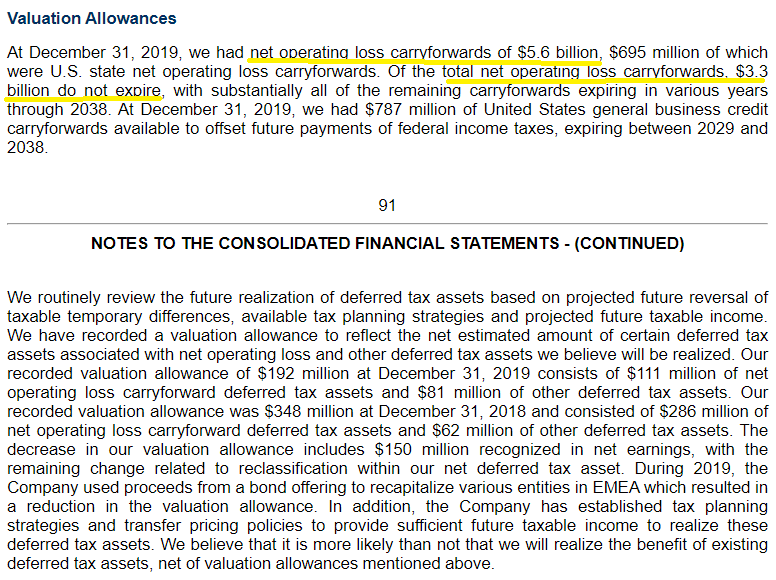

Next you’ll want to look in the footnotes to the 10-k to find information on NOLs. Depending on how the company wants to disclose these deferred tax assets, the breakdown of either Other Assets or Deferred Tax Assets could live in the section of management’s discretion—in this case Whirlpool put it inside Note 15: Income Taxes. I like to quickly identify it by searching (Ctrl + f) the word “carryforward”.

First you can see the paragraphs that explain the NOL carryforwards themselves, as shown. Notice that $WHR has $5.6 billion of net operating loss carryforwards.

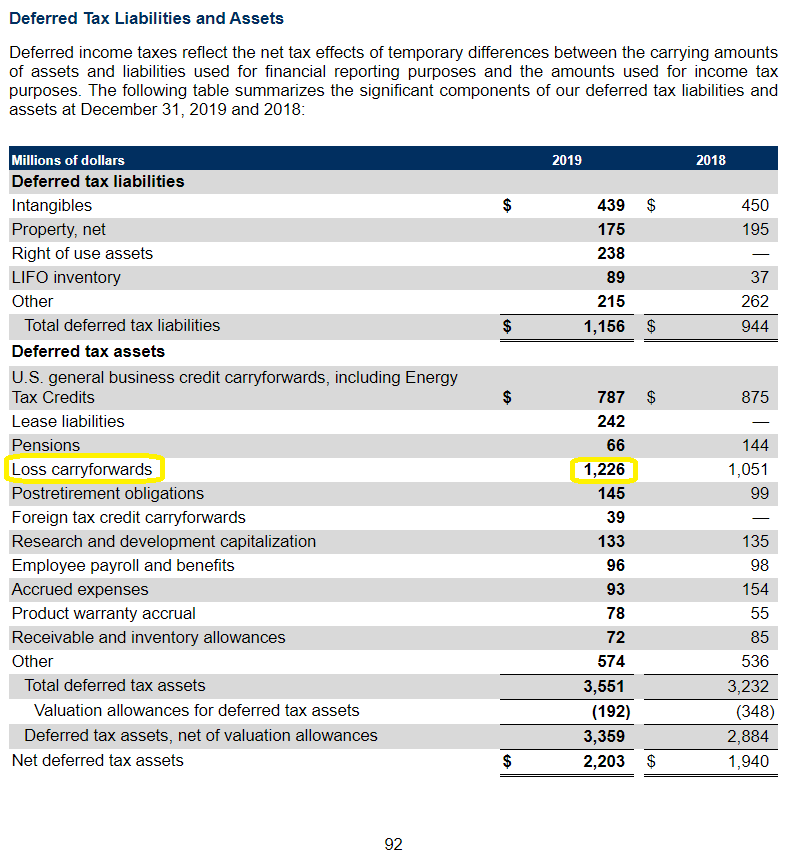

And then, you can see a table that shows what deferred tax assets were calculated from the NOL carryforwards:

What’s IMPORTANT to realize about the relationship between the deferred tax assets carryforwards and the NOL carryforwards is that the asset carryforwards are calculated from the NOL carryforwards.

As outside observers, we don’t get to see this calculation for ourselves, but we can see how the company came to the calculation through the NOL carryforwards figure above ($5.6 billion) and the carryforwards which are now deferred tax assets ($1,226 million).

If we divide the asset by the NOL, we get 1,226 / 5,600 = 22%, which is close to the U.S. corporate tax rate since the Tax Cuts and Jobs Act (TCJA) from 2017.

The reason for this difference between the deferred tax asset (on financial statements) and the NOL carryforward (disclosed in the notes) is that the NOLs deduct the company’s future income, after which that tax savings goes directly to earnings.

In other words, using $10 billion in NOLs would save $2 billion in income taxes if the tax rate was 20%.

Other observations about NOLs/ Deferred Tax Assets

You can see that there’s also a breakdown for U.S. loss carryforwards and “foreign” loss carryforwards, which seems to be a common feature for companies with substantial revenues abroad.

I’ve also seen line item breakdowns within U.S. segments, such as Federal and State, and there’s also other types of carryforwards that could be applicable—such as a capital loss carryforward.

But for the purposes of net operating loss carryforwards, a company should have had a net operating loss in the past, and these will either expire within a specified number of years, or are indefinite. The setting of this standard can vary based on the tax or accounting laws of the time, or due to any changes in tax laws.

Note: Examples of recent tax laws that had substantial impacts to carryforwards and their applications as tax deferred assets include TCJA in 2017 and the CARES Act in 2020. This could limit the applicability of previous net operating loss carryforwards, as the TCJA did, or could allow previously un-utilized net operating losses to be deducted from future income, like the CARES Act did.

The TCJA also reduced the maximum deduction taken from NOLs in any given year to 80%, which you can read the full implications of TCJA here. It’s a riveting read, and explains the differences in many company’s financials today, such as removing tax loss carrybacks and the large reductions to deferred tax liabilities or deferred tax assets that resulted from lower corporate tax rates, the one-time tax established on accumulated foreign earnings, and more.

The specificity around these loss carryforwards can cause potential “hidden assets” in the right circumstances, which is why it’s important to read the footnotes closely as the company discloses the conditions around net operating or capital loss carryforwards.

Valuation Allowance and Other Deferred Tax Specifications ($AMZN 10-k)

I found a good description of Valuation Allowance in Amazon’s 10-k, as they explained their net operating loss carryforwards directly below their line items disclosing deferred tax assets, quoted here as:

“Our valuation allowances primarily relate to foreign deferred tax assets, including substantially all of our foreign net operating loss carryforwards as of December 31, 2019. Our foreign net operating loss carryforwards for income tax purposes as of December 31, 2019 were approximately $8.6 billion before tax effects and certain of these amounts are subject to annual limitations under applicable tax law. If not utilized, a portion of these losses will begin to expire in 2020. As of December 31, 2019, our federal tax credit carryforwards for income tax purposes were approximately $1.7 billion. If not utilized, a portion of the tax credit carryforwards will begin to expire in 2027.”

You’ll notice other terms describing the carryforward situation such as “valuation allowance”, which refers to how much of the company’s allowed loss carryforwards they expect to take against future income.

Sometimes a company’s NOLs may expire before they can use them, as a company needs to earn enough in Net Income to absorb a loss carryforward as a tax deduction.

So, the loss carryforwards that the company expects they will not be able to utilize is called valuation allowance, and is subtracted from actual loss carryforward assets to get a “net” deferred tax asset (or net deferred tax liabilities, if deferred liabilities are greater than deferred assets).

Watch for Dubious Accounting With Valuation Allowances

As mentioned in a fantastic book about financial accounting called What’s Behind the Numbers, a company’s management can manipulate the valuation allowance to prop up short term earnings.

Because valuation allowance acts as a reserve, company can lower it from year to year in order to decrease income tax expense, even the actual future tax deductions aren’t likely to happen. In effect, doing this is essentially stealing from future profits in order to prop current ones—when tax valuation allowances are calculated or changed improperly.

John Del Vecchio, co-author of the book, recommends watching for any changes of valuation allowance from year to year, and also recommends reading footnotes to compare expected tax rates and realized tax rates.

It takes a bit of sleuthing and some intelligent interpretation, but can be very worth it particularly if these allowances and/or charges are making up a large portion of earnings or cash flows.

Deferred Tax Assets Derived from NOLs Carryforwards at Varying Tax Rates

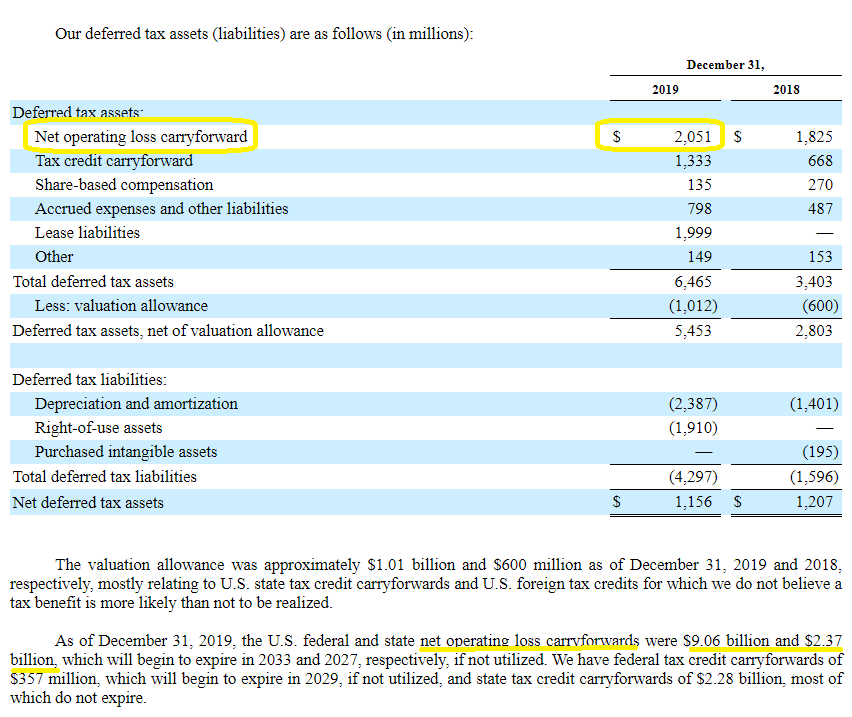

Sometimes you’ll compare NOL carryforward disclosures and the actual loss carryforward deferred assets, and see what seems to be a strange relationship between the two.

Take Facebook and their latest 10-k, for example.

In this example, the NOL carryforward deferred tax asset only made up around 18% of the company’s total NOL carryforwards, which is noticeably lower than the 21% U.S. Corporate Tax Rate.

But, if you’ll notice, $2.37 billion of these NOL carryforwards were on state tax, which is significantly lower than federal tax. Thus, the overall deferred tax asset makes up a lower percentage of original NOL due to the contribution from state NOLs.

Note also that adding foreign taxes into the mix distorts calculations considerably, doubly more so with the repatriation taxes from the TCJA. If you have calculations that seem way off, check the footnotes for the possibility of complex foreign tax implications, charges, and/or reserves.

Investor Takeaway

As deferred tax assets from net operating loss carryforwards are used from year to year, you’ll see them on the income statement as they adjust income tax expense. As a loss carryforward is used, it will lower tax expense on the income statement, and will subsequently lower deferred tax assets on the balance sheet to the same extent.

So, in this regard, a long term asset such as a deferred tax liability may not be as valuable as a long term asset such as Plant, Property, and Equipment, which can create multiple years of cash flows rather than just one.

But, net operating loss carryforwards can unlock value to investors who are aware of their implications, and can adjust their calculations and models accordingly.

It’s just another step to fully mastering financial statements (the 10-k and its footnotes), and can make the difference between investing and analysis that can properly interpret and forecast changes, vs reactionary investing and analysis that doesn’t understand fluctuations in financial results.

Related posts:

- Analyzing Intangible Assets and Their Impact To Assets and Operating Income The change in how companies invest their capital has grown exponentially, and accounting rules have not kept up. Intangible assets comprise a larger portion of...

- Deferred Income Tax Liabilities Explained (Real-Life Example in a 10-k) Deferred income taxes in a company’s consolidated balance sheet and cash flow statement is an easy concept in principle, but when deferred income tax liabilities...

- Accounting for Operating Leases in the Balance Sheet – Simply Explained Updated 9/25/2023 Operating lease accounting can be confusing. Especially when you have to sift through multiple financial statements to quantify its impact. The latest FASB...

- Where to Find Operating Income in the 10-k and What it Says About a Business A company’s operating income is the profit associated with regular business operations before considering the financial leverage of the business, and its associated interest expense,...