On a consolidated balance sheet of a major company, you will likely see non-controlling interest come up so it is important for investors to understand this common item and ensure to back it out for valuation purposes. This article will teach investors all about non-controlling interest as we walk through Coca-Cola’s 2022 financial statements and our own simplified example with journal entries to really make it clear.

What is Non-Controlling Interest?

Non-controlling interest occurs when a company is owned by more than one entity/person and certain owners do not have enough individual voting power to influence decisions. Typically, the threshold for control is 50% ownership but corporations can have different classes of shares with different voting power so “control” does not necessarily follow the percentage split of net income in more complex situations. It is about control of the board of directors through voting rights and the ability to make unilateral decisions.

For example, imagine a company is going to start a new joint venture with an external third party. The parent company will own 75% of the new entity and the external party will own the remaining 25%. For consolidation purposes in accounting, the parent company will include 100% of the assets and income of this entity, but then also break out the 25% portion that does not belong to them through “non-controlling interest” accounts in the financial statements so that investors can see it.

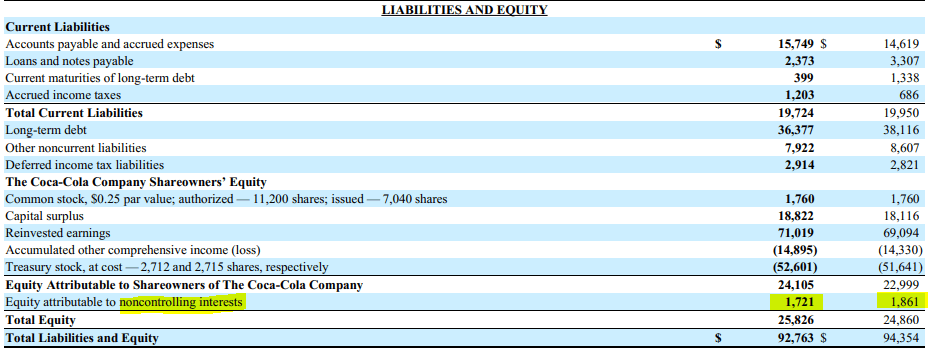

Non-Controlling Interest on the Balance Sheet

On the balance sheet, non-controlling interest is shown as part of the shareholder’s equity section on the liability side of the balance sheet. As the parent company has control of the new entity through their 75% ownership, 100% of the assets and liabilities are consolidated on the balance sheet.

The assets and liabilities of the subsidiary are held at fair value (or other relevant accounting method) and the remainder is equity. As the parent company only owns 75% of this equity, the remaining 25% equity owned by the external third party is shown separately and labeled “non-controlling interest” in the equity section of the balance sheet. We can see this below with $1,721 million of non-controlling interest being backed out of equity attributable to Coca-Cola’s shareholders.

For our simplified example, let’s say that the business has $100 million in assets, $50 million in debt, and $50 million in equity. Under the consolidation method, 100% of assets and liabilities will be recorded on the parent company’s balance sheet who effectively controls the business. This means that all $100 million of assets and $50 million of debt will be reported at the parent company level even though they only own $$37.5 million of the business’s equity (75% ownership x $50 million equity).

The balance sheet will remain in balance because the 3rd party’s non-controlling interest of $12.5 million (25% ownership x $50 million equity) will also be included on the parent company’s balance sheet as a separate line item. Below are the journal entries that would establish this initial setup.

| Dr. Assets – $100 million | |

| Cr. Debt – $50 million | |

| Cr. Shareholders’ Equity – $37.5 million | |

| Cr. Non-Controlling Interest – $12.5 million |

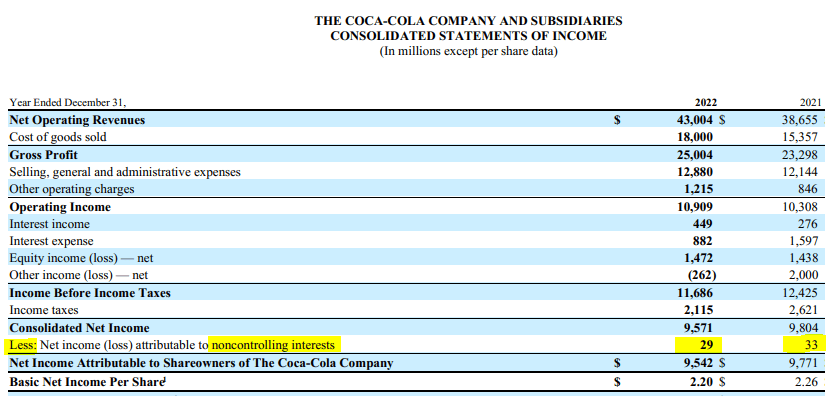

Non-Controlling Interest on the Income Statement

On the income statement, the parent company is consolidating activity of all joint ventures they are in control of (i.e. +50% ownership). This means that 100% of the revenue and expenses for consolidated subsidiaries will see their financial figures reported directly in the appropriate categories on the income statement. The non-controlling interest share of profits is then backed out at the bottom of the income statement before net income available to common shareholders is arrived at. This can be seen below in the 2022 income statement for Coca-Cola where they had to back out $29 million of income attributable to non-controlling interests before arriving at the income available to shareholders of Coca-Cola.

In our example, let’s assume this business with $100 million of assets mentioned earlier, earns $10 million of net income per year. 75% of this is attributable to the parent company and 25% is attributable to the other external 3rd party. In their consolidated financials, the parent company would record all the revenue and expenses it took to achieve the $10 million in profit before backing out the $2.5 million attributable to this “non-controlling interest” to arrive at the net profits available to owners of the parent company.

Let’s look at a summary of the annual journal entries below to see how the subsidiary affected the parent company’s consolidated income statement. As the subsidiary earns revenue and/or pays expenses, they could have paid cash or have an associate accounts receivable and/or payable. The end result is that the net income arrived at from the yearly transactions will be rolled into retained earnings at the company which are the last line items in our journal entry summary below.

| Cr. Revenue – $40 million | |

| Dr. Cost of Goods Sold – $20 million | |

| Dr. Operating Expenses – $10 million | |

| Dr. Net Income – $7.5 million | |

| Dr. Income Attributable to Non-Controlling Interest – $2.5 million |

How do Non-Controlling Interests Perform?

Partnerships and investments with 3rd parties can make up a substantial part of some businesses. It is important to get a general understanding of the profits being shared with non-controlling interests to understand what the parent company is giving up or getting in return by making these partnerships.

You can get a quick idea of the return on equity (ROE) the parent company is getting on their joint ventures and subsidiaries by looking at the ROE of the non-controlling interest. High quality financial reporting will also see the non-controlling interest described in further detail in the notes to the financial statements or within the management discussion and analysis write up.

In our example, the non-controlling interest is earnings $2.5 million on the equity of $12.5 million. This would mean the non-controlling interest is getting a 20% ROE ($2.5 million earnings ÷ $12.5 million equity).

Looking at the non-controlling interests at Coke, we see they earned $29 million and $33 million in 2022 and 2021, respectively. At year-end, the equity of these non-controlling interests were $1,721 and $1,861, respectively for 2022 and 2021. This would imply the non-controlling interests in business relationships with Coke are earning ROE of 1.7% and 1.8% respectively for 2022 and 2021. Given the low ROE from Coca-Cola’s subsidiaries, its might signify that these are early stage new ventures that are not in the mature and profitable part of their business lifecycle yet.

Takeaway for Investors

Understanding non-controlling interests allows investors to understand how reliant the business is on third party relationships (even if the parent company is in control) and how profitable these relationships are. Non-controlling interests should be backed out of any valuation analysis whether done by cash flows or book value as these profits do not belong to the parent company.

Investors interested in continuing to build their investing, finance, and accounting knowledge should check out IFB’s product page for access to full courses and newsletters to assist them along their investment journey!

When you’re ready, there are 2 ways we can help you:

Little Package of Valuation: Learn how to value companies using various methods, from discounted cash flow models, multiples, and much more. We have put in the reps to help you simplify a complicated process. The models included are customizable to allow you to adapt to your needs.

Value Spotlight: Stock market investors can save time and find success by discovering the right tools and resources. If you don’t know where to start, or are simply tired of wading through the endless sea of financial information, Value Spotlight was created for you.

Related posts:

- Public Holding Company Benefits: Lowered Risks, More Autonomy, more… A holding company, simply, is a company that holds (or owns) other companies. Some popular public holding companies include Warren Buffett’s Berkshire Hathaway, banks like...

- Simple Balance Sheet Structure Breakdown (by Each Component) “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.” Peter Lynch The ability...

- Interpreting the Statement of Cash Flows: Operating, Investing, and Financing A lot of critical information can be learned from the statement of cash flows. As cash flows to shareholders are what investing is all about,...

- Balance Sheet Item: Book Value of Equity and Its Individual Components Updated 6/24/2023 “Price is what you pay; value is what you get.” A company’s evaluation involves determining the value of its assets, liabilities, and equity....