I talk a lot about the power of compound interest and how time in the market is better than timing the market, and I feel like I’ve shown some good examples, I really outline a great example in this post that shows the value of investing early and why you should start as early as you can. I even touch upon the fact that you should Open an Investment Account for a Child if you can, but you should be sure not to do this at the detriment of your own retirement.

If you want to pay for your kids’ education, you should start as early as you can – and the data shows that!

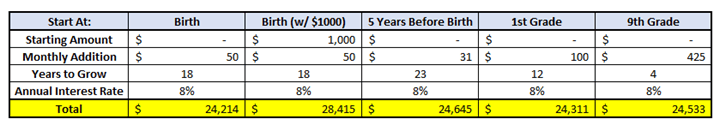

Below I’ve shown the impact of starting early with five different scenarios that show you should start as early as you can.

- The first scenario is simply a base scenario where you put in $50/month from birth and receive an 8% Compound Annual Growth Rate (CAGR), which is fairly conservative as the average CAGR since 1950 is 11%. Try to view this as a “control” like you might think of from a science experiment.

- The next situation is the exact same, except you’re starting with $1000. So, starting with $1000 in your account will give you more than $4000 in 18 years when that child goes to college. That’s some pretty serious motivation to start early.

- Next shows that if you start 5 years before the child is born, you only have to put in $31/month to have the about the same amount of money when that child goes to school. And, you actually put in $2,244 less than you would in the first example as $31*12 months*23 years = $8,556 total saved vs. $50*12 months*18 years = $10,800 total saved.

- The fourth example shows that you would have to save $100/month if you started when the child entered first grade. This would cause you to have to save a total of $14,400 ($100*12 months*12 years).

- The last example is if you were a procrastinator and waited until they entered high school, and this would require you to save $425/month, which would result in you needing to save a total of $20,400 ($425*12months*4 years).

I mean, I think the data is pretty obvious, save as much as early as you can and invest that money and you’re going to be much, much more prepared for your future.

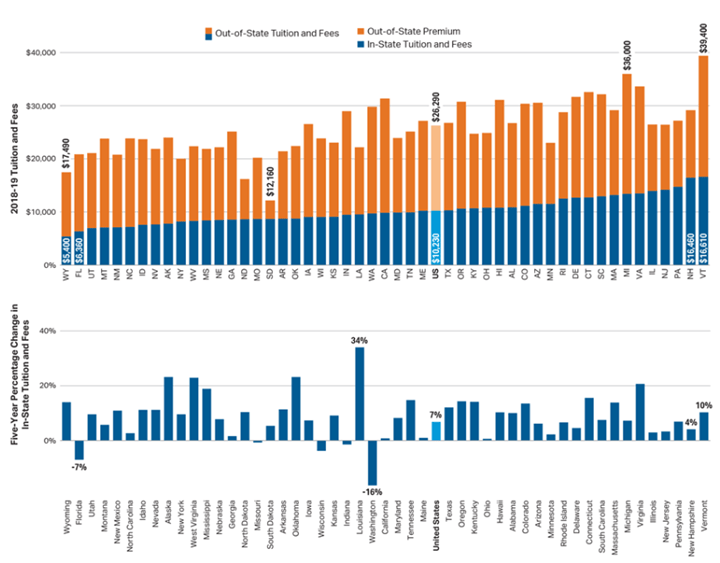

You might be wondering how much college really costs nowadays, and it’s going to blow your mind, so I’ve included an amazing chart below that shows the average cost of tuition for both in and out-of-state students by state, as well as how that tuition has changed, provided by the CollegeBoard website.

Something that’s important to note is that this is the average and it’s for tuition only.

There is a really good chance that tuition will go up from now until when your child is in college, and when I say a really good chance, I mean over 100%!

Not really, but you get what I’m saying!

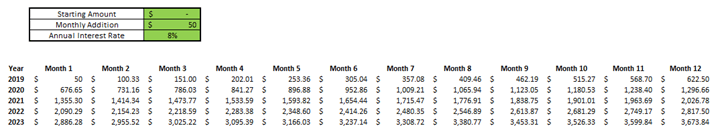

So, how much do you actually need to save? Well, that really comes down to your own personal preference, so I’ve included a calculator that you can download here. Take a look at how it works, below:

All that you have to do is enter three key pieces of information:

- Starting Amount – the amount that you will input into your College Investment Account to begin with

- Monthly Addition – this is simply the amount that you intend to contribute each month

- Annual Interest Rate – this is how much you think your money will grow by each year. I use 8% because I think that’s a conservative assumption. If you want to be even more conservative, you can bump it down to maybe 6%, or even lower, and you can go more aggressive as well if you think the market will be a better performer than the 8% that I assume.

Below is a screenshot of what the calculator looks like:

As you can see, it really is pretty simple to use. The numbers will auto calculate so you can see what an expected account balance will be for each month.

Along with simply opening an investment account to save for your children, there are a lot of other ways that you can potentially maximize your investments/savings for your children.

The #1 option, in my eyes, is opening a 529 account.

A 529 account is an account where you input post-tax dollars into an account and then they will grow tax-free for years.

A 529 does have a few limitations, however, like the money has to essentially be used to further education of yourself or your beneficiary. That can mean many things, however, such as college, trade schools, private grade schools, textbooks, and many other things.

One benefit, though, is that you can change the beneficiary, so if your children don’t use it, it can be passed along to grandchildren, or you can even use it on yourself for your own further education. If worst comes to worst, you can always simply take the cash, but you have to pay taxes on it and a 10% penalty as well, which obviously isn’t ideal but it’s not like the money is completely wasted.

If you want to see what the best option is based on where you live, I recommend checking out the Saving for College website that allows you to take a look at all of the options that are available for each state.

This website really is awesome because you can drill down even further after you have clicked on your state to learn more about all of the different options that you have at your disposal.

Hopefully you now are motivated not only to save for the benefit of your children, but you’re also ready to find what sort of plan will be the most effective way to accomplish that.

The Personal Finance community often talks about optimizing your money, so you can be financially independent, but doing something like this is a way to help out your children with becoming financially independent.

I highly encourage you to act on this motivation and start saving as early as you can – your children will thank you for it, I guarantee it!

Related posts:

- How the College Investor Has a HUGE Compounding Advantage!! When it comes to money, sometimes young adults don’t realize just how lucky they have it. By becoming a college investor rather than a “young...

- Why It’s Important to Continue Investing in You Sometimes the first person everyone forgets is themself. Make sure that doesn’t become you and you continue to invest in yourself. In the events of...

- Investing Tools for Parents: Family HSA, 529, and more… Andrew and Dave recently went in depth on a Family HSA in their recent podcast episode so I thought it was no better time to...

- “I Don’t Get It – Why is Investing Important?” So many people will ask me “why is investing important” and at the end of the day, it really boils down to one thing –...