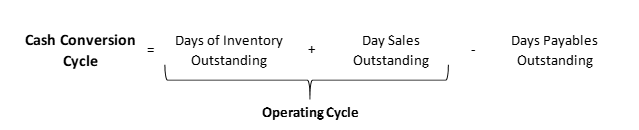

A company’s Operating Cycle and Cash Conversion Cycle are quite similar with only one additional item added on to the Operating Cycle formula in order to get the Cash Conversion Cycle formula.

Both formulas are liquidity measures and can also be used as a gauge for the operational and financial effectiveness of a company.

The Operating Cycle measures the time it takes a company to convert inventory into cash and the Cash Conversion Cycle takes into account the fact that the company does not have to pay the suppliers of its inventory or raw materials right away.

As will be shown later in an example using Walmart, both ratios can be calculated using readily available figures from a company’s financial statements.

The period most often used is a full year’s 365 days but the ratios can also be calculated for a quarter, half-year, or any combination thereof. Within an industry, the Operating Cycle and Cash Conversion Cycle can be used to make meaningful comparisons between companies.

Looking across industries however, the comparisons will start to lose their usefulness as one might imagine some noticeable differences in the operating cycle of say a discount retailer and heavy manufacturer.

How to Calculate Operating Cycle

The formula for a company’s Operating Cycle is contained within the larger Cash Conversion Cycle formula.

As mentioned earlier, the Operating Cycle is a measure of how long it takes the company, through its business operations, to convert inventory that has been purchased (including everything from finished goods to raw materials) into cash.

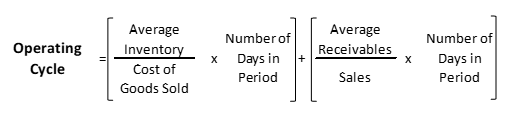

As can be seen below, the first part of the Operating Cycle formula is Days Sales of Inventory and the second part is Days Sales Outstanding. By adding these two metrics together, we get the sum of the total average number of days inventory is on hand before it is sold together with the total average number of days it takes customers to pay the company cash.

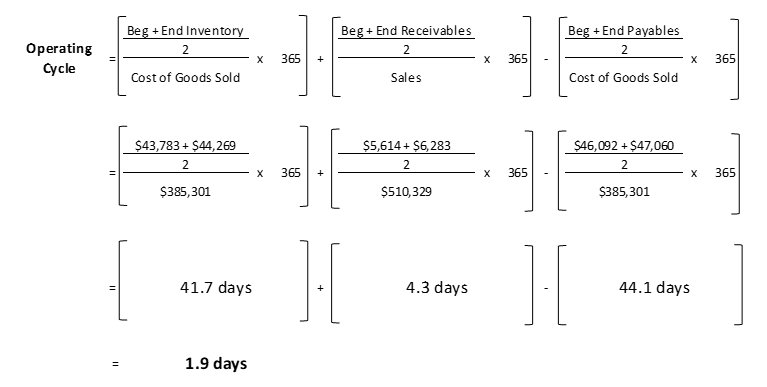

The formula for Operating Cycle with the detailed breakdown of Days of Inventory Outstanding and Days Sales Outstanding can be seen below.

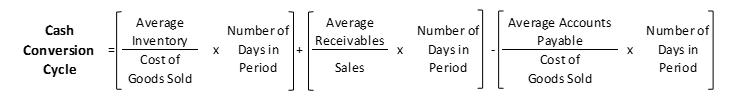

Cash Conversion Cycle

As mentioned previously, the Cash Conversion Cycle takes into account the fact that the company’s investments made in inventory are not necessarily paid for upfront at the time of purchase as the company’s suppliers can allow them to buy on “credit”.

Essentially, the Days Payables Outstanding represents the funding of inventory that suppliers are contributing to the business. As such, the Cash Conversion Cycle is the more precise measure of the funding needs of a business.

The fact that suppliers do not have to be paid right away is significant because it means that the business needs less financing upfront in order to grow their sales.

The implication here is that with less funds needed to be provided by the business’s equity investors and lenders, this means more cash is available for shareholders and that the business can achieve a higher Return on Invested Capital.

Looking at Walmart

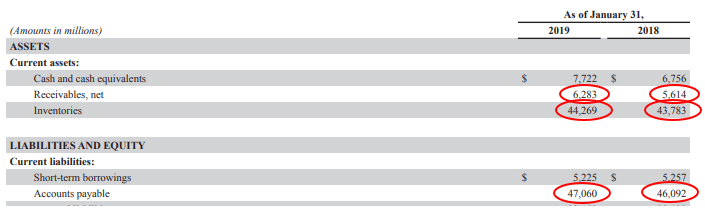

To help visualize the formula and put some a real life example behind it, we will take a look at calculating both the Operating Cycle and Cash Conversion Cycle for Walmart.

Below is a snip of Walmart’s balance sheet where we can find the inventories, receivables, and accounts payable amounts.

As we are concerned with the average of these items over the period and since we will be looking at a full year, we will use January 31, 2018 as the beginning plus the ending value as of January 31, 2019, dividend by two.

Sourced from Walmart’s 2019 Annual Report

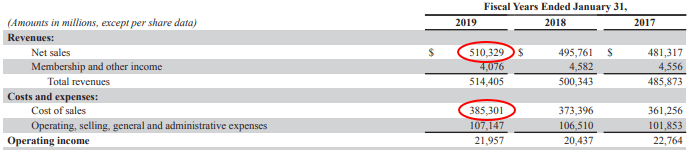

Next, from the income statement, we can find the net sales and cost of goods sold items.

Do note that we have taken the Net Sales figure as not to include Membership revenues which would not be of our concern with inventory and its conversion to cash. However, this was a judgement call and as always if we are not including an item for one company we should be sure to compare apples to apples and make the same adjustment for any other companies we are analyzing.

Sourced from Walmart’s 2019 Annual Report

Putting it all together in the formula below, we can see that Walmart had an Operating Cycle of 46.0 days in 2019 with it taking on average 41.7 days to sell their inventory and another 4.3 days to collect cash from customers. With Walmart taking on average 44.1 days to pay their suppliers, this decreases their Cash Conversion Cycle to only 1.9 days.

Related posts:

- Accounts Receivable Vs. Accounts Payable and the Working Capital Cycle In today’s business world, intangibles have grown in importance, but “old school assets and liabilities” such as accounts receivable and payable have grown in relevance....

- Free Cash Flow Yield – Finding Gushing Cash Flow for Future Growth Cash is king, and free cash flow acts as the engine’s oil. Determining free cash flow and its different uses remains a fantastic way to...

- Degree of Operating Leverage (DOL) – CFA Level 1 The term degree of operating leverage (DOL) does not get as much attention as its more forthright cousin, financial leverage, but is just as important...

- Cash Flow Analysis Example Using Cash Flow Ratios Everyone Should Know Updated 4/4/2024 “There is a huge difference between the business that grows and requires lots of capital to do so and the business that grows...