Options time decay can be one of the most insidious forces to lose you money as you buy call and put options. As I mentioned in my options for beginners guide, time decay (known as theta) erodes the price of an option over time and is the primary reason why an investor would take the other side of your options trade (selling to open an options contract).

Options time decay attacks both sides of the options chain, both the calls and the puts. Whether you are just starting out or have traded options for a while, knowing about the time decay factor of options is critical, and I hope to prove just how insidious it is with this post.

Instead of digging into hard core calculus, let’s take a couple simple examples ($INTC, $AAPL, and $GRUB). I’ll show you exact examples of how options time decay took its toll on my returns.

I’ll cover something groundbreaking… well, it’s more of an observation… but I think it’s a huge part of time decay that isn’t talked about HARDLY ANYWHERE (and especially with all of the algebraic greeks flying around)…

And finally, I’ll show you a comparison of my results trading with options time decay and against options time decay, and I hope someone will find that helpful.

Options Market Difficulties

Alright so here’s the thing about the options market.

It’s hard as I write this in 2020 to find any sort of historical data. Unlike the stock market, where you could find the high price of an obscure $2B stock on a Tuesday in January back in 1987 relatively easily– I struggle to find any historical data that isn’t behind a paywall.

And not only that, but even if I could find a good source of this, I highly doubt I’d get any sort of good intraday options trading data.

In fact I still long for good source of free options intraday data, showing each price at where a contract exchanged hands– so if you have one, please kindly share.

So we have this data problem with options.

How this affects our education on time decay is that it can be hard to conceptualize this time decay easily.

Add to the mix that stock prices are volatile, and that options prices move with these stock prices, and so time decay on options can be masked as the prices move with the stock.

Someone who is too lazy or uninterested to, God forbid, refuse to dissect the first order derivatives of the Black Scholes model and solve for theta; that someone can lose a lot of money if buying options without considering options time decay.

Simple Time Decay Example: Intel ($INTC)

I made a spreadsheet to show you time decay, and you can do this with any stock right now.

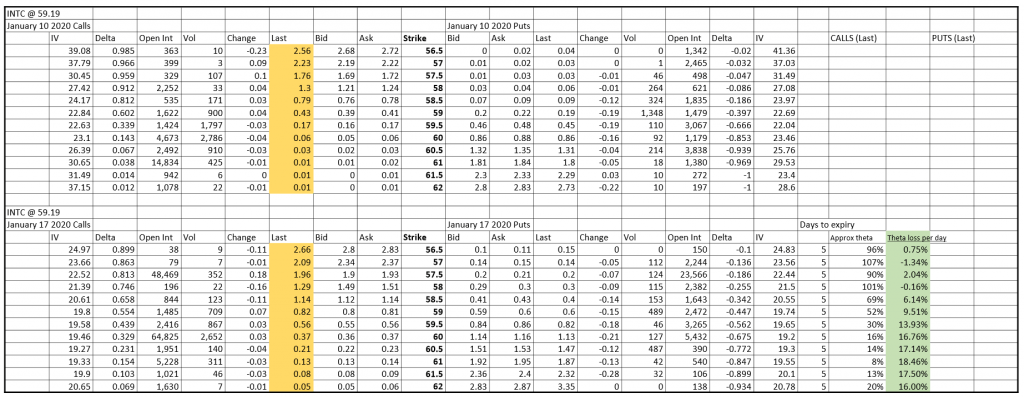

Here’s a snapshot of an options chain (this one is $INTC), at a random point of time in the trading day. I took this as a copy and paste from my brokerage Ally Invest.

I want you to notice a couple of columns I added here. Days to expiration is a rough estimate of when each contract would expire (this was a quick and dirty spreadsheet).

To find the time decay, I simply compared the Last Price of a contract to the Last Price of a contract with the same strike price at a different expiry. For example: the 58.5 call expiring 1/10 compared to the 58.5 call expiring 1/17. Finally, I divided that time decay number by the days to expiration column to get a quick and dirty estimate of about how much value your option would lose with each day that you hold it.

A couple of takeaways here that confirm what all of the crazy calculous and equations behind options and theta already tell us (I’m helping you skip a lot of pain here, you’re welcome):

- Options time decay does in fact exponentially increase, especially between 1-2 weeks before expiration

- Options that are far in-the-money both on the puts and calls side tend to experience a much lower degree of time decay than at-the-money options

- The farther out of the money an option is, the exponentially greater the effect of time decay on its price over time

If you didn’t understand the statements behind #2 or #3, and need a simple explanation to ATM, ITM, and OTM, then head over to my options guide for beginners and revisit this post later.

Now, that’s one great visualization of time decay that’s easily duplicated…

However.

That doesn’t really show how time decay slowly eats away at options contracts because we’re just looking at a one time snapshot.

Options Time Decay in My Trading (examples)

Let’s take a painful look (for me) into my way-back time machine (yesterday), so I can show you some examples of time decay in action and show you what NOT to do. [Charts from Yahoo Finance]

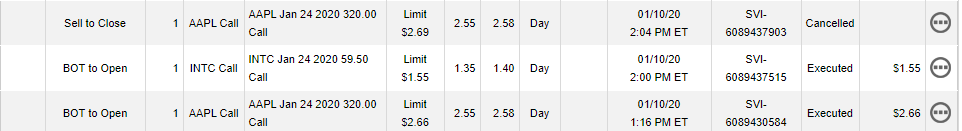

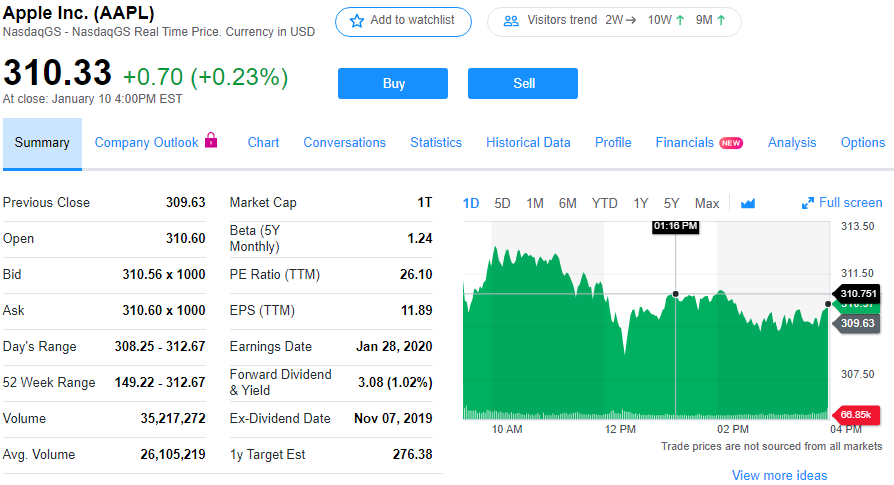

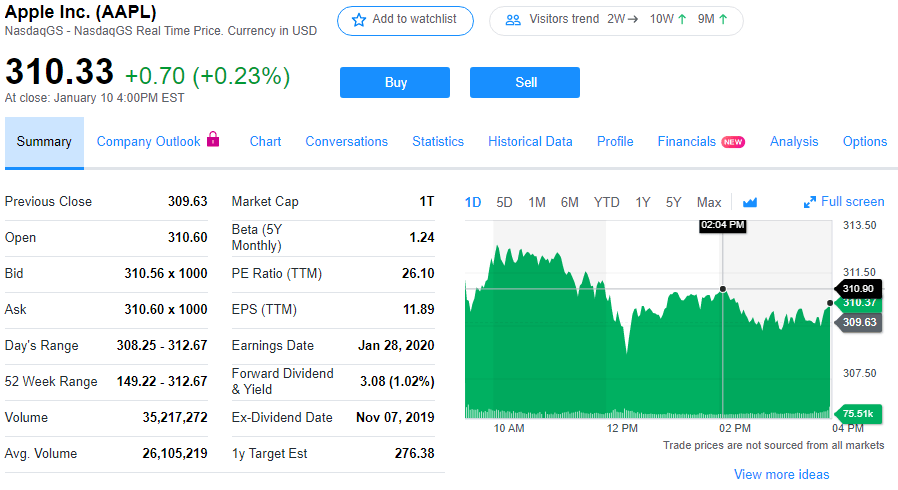

You can see that I bought the AAPL call at 1:16pm for $2.66. I tried exiting the position at 2:04pm, putting in an order to sell at $2.69. It didn’t get filled as the Bid/Ask stayed below that.

In fact, even though the price rose from $310.751 at 1:16pm to $310.90 at 2:04pm, I remember the call option trading mostly below my $2.66 purchase price, and my $2.69 order Hail Mary was a desperate attempt to break even on the trade in case of an upwards surge. My order never got filled.

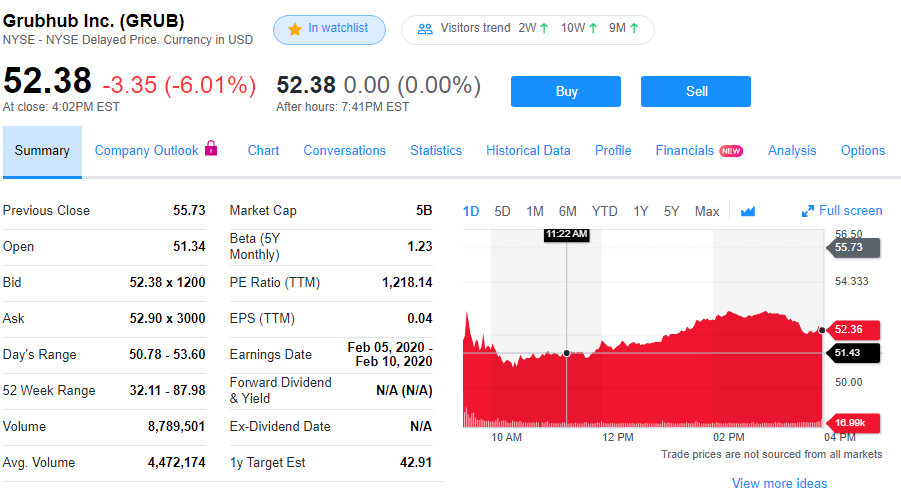

Here’s a REALLY bad one where I missed the closing price by about a percent (I bought a put around -7%, the stock closed -6% for the day).

I foolishly tried to catch some afternoon action and catch what I thought would be a continuing downwards trend, only to see the stock move against my put option and never come back. .

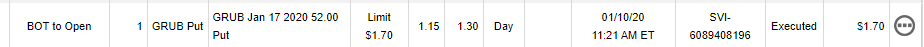

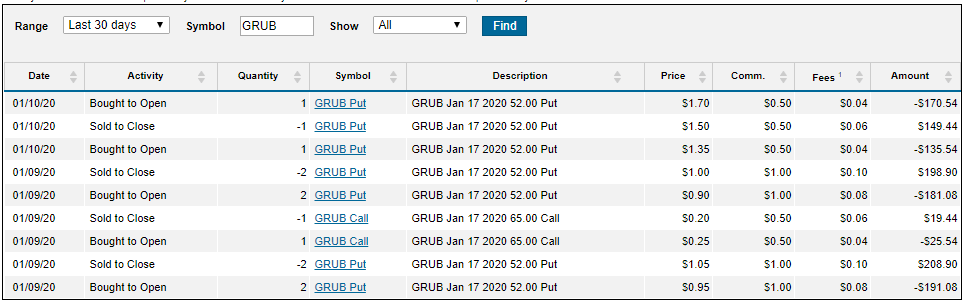

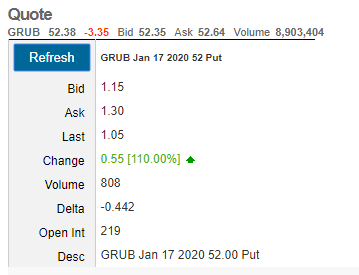

I bought this 52.00 put at $1.70. Here’s where the option ended for the day:

Even though there was still 7 days left to expiratoin on this contract (5 actual trading days), the time decay that this option had experienced in addition to just overall cooled off demand for the option rendered it much less valuable than before, when the “action” was still hot.

My option lost -38.2% in a few hours, on a stock that only moved about -1% against me. That’s a lot that can be attributed to time decay on top of being plain wrong.

Both of these (non) trades happened on a Friday, which may have an amplification of the time decay effect due to all of the weekly contracts expiring that day…

But anyways.

How I’ll Counter Mid-day/ Afternoon Time Decay

Because of all of this horrible time decay nonsense, I’ve made a new resolution for my fun money daytrading scheme:

STOP BUYING OPTIONS BETWEEN 10AM – 3PM.

Because this options trading journey is becoming as much of a love-hate relationship as my golf game (“I’m never playing golf again”, “I love golf”, “I’m never playing again”), I’m not going to promise to follow this resolution forever… I’m only going to say that this is the plan for me, for now, moving forward.

I’ve noticed that options prices really spike in the first 30 minutes of trading, with some of that aura and trend sticking around until 10:30 or 11am sometimes.

But after that, volume in the stock market really tends to drop off. And as it does, those options prices sink lower– tick, tick tick, tick tick…

Buying Options vs Selling (Writing) Options

Now, you might be thinking, what’s the point of all of this if YOU- the author– can’t even profitably and successfully buy and sell options with any sort of regularity? Why talk about buying options if you aren’t even good?

And that’s where I say, you’re absolutely right.

And is why I can’t describe why I continue to try new things (and lose money) in my buying and selling of options with some “fun money” set aside.

But what I can tell you is this.

There’s a tale of two stories with this options “trader”. I believe that both stories do tell the moral of the story behind options and their inherent time decay characteristics– in that one story shows the power of taking advantage of time decay by selling options and the other story shows that the odds are stacked against you, including time decay, as you try and flip options.

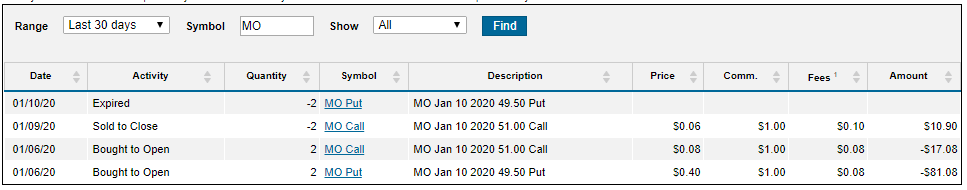

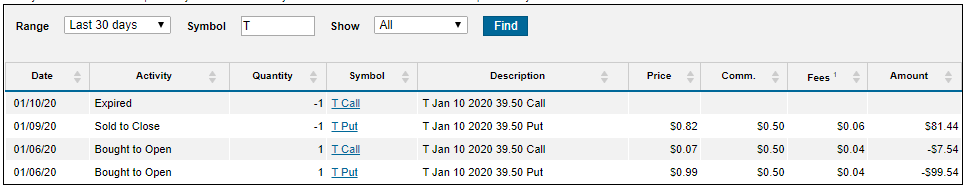

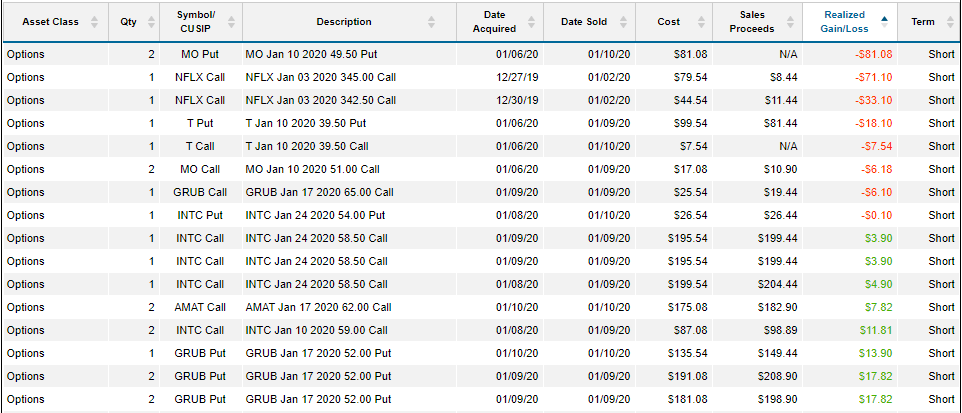

Here’s the activity on my brokerage account highlighting some of my great failures and successes trying to “hop out of the way” of the options time decay steam roller headed my way with each trade:

I set that $100 on fire. Here I at least cut my -25% loss “short”:

This includes the GRUB play I wrote about at the top that I’m holding in the desperate hope for a rebound on Monday:

Little bitty profits, massive risk.

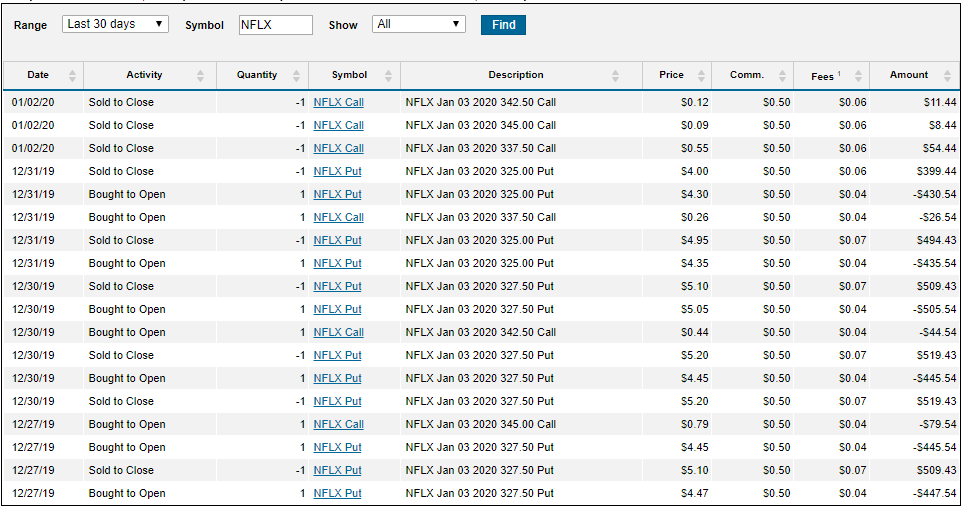

Here’s the only sequence where I can say I did well, but also after taking massive risks (I got lucky and guessed its direction perfectly):

I’d like to give you a taste of how some of my total profits and losses have played out the past few days (spoiler alert, I’ve lost money on a net basis on all of my buying calls/puts trades except for NFLX above):

Through this limited lens so far, I’m concluding that all of my worst trades have happened because I’ve held these options for several days, or bought them during the mid-day/afternoon just to see the money go up in flames.

But that’s not the whole story with options time decay.

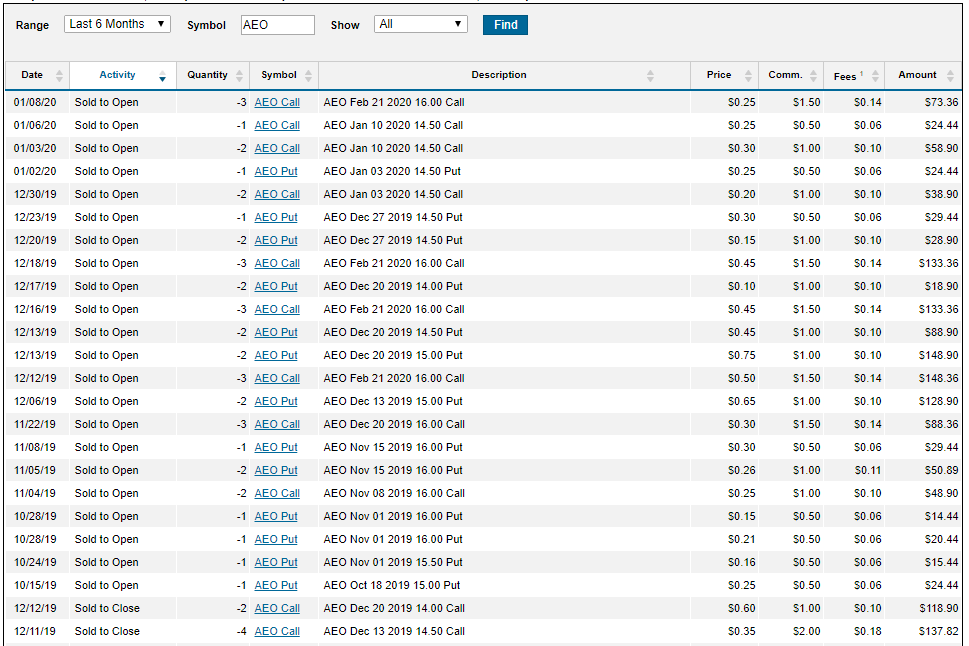

Here’s my brokerage account with the “boring” theta gang strategy of selling cash covered puts and covered calls, and putting time decay on your side:

Each time I Sold to Open an option contract, I was exposing myself to around $1400 – $1600 of downside risk depending on where $AEO was trading.

I did do some in-and-out of those that I opened, for nice gains. My only downside risk for all of this option writing was being long $AEO, which is a stock I’m happy to own for the long term anyways.

Even though my 600 shares are down -$609.67 as of writing this, the profits from my option writing on it equal a total net +$73.20, even as the stock has decreased -5.4% since I started.

I’m calculating about a return of 3.5% CAGR on that money, again… even as I was wrong on the stock and it’s decreased -5.4% over the last 3 months.

The reason for that kind of success is because all of the option time decay is working on my side, and over time and over many trades I’m winning even as my stock is losing. And, I don’t have to guess on timing… I can just let time go by and rest easy.

So dear reader, which strategy do you like better?

The fast, furious, and infuriating? Or the other one?

By the way, looking for some cool merch?

I managed to score a 10% from the founder of Thetagang Merch, use offer code EINVEST10 for 10% off all orders! (Store link)

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- How to Trade Options: A Beginner’s Guide to the Risks (and Rewards) Table of Contents [Click to Skip Ahead] Intro to Options The Two Most Basic Options Contracts The Options Killer: Time (Theta) How to Create a...

- 4 Popular “Theta Gang” Strategies to Collect Premium from Options What is theta gang? Simply put, these are options trading strategies that capitalize on the fact that the prices of options decay over time. Instead...

- My Bag Holder Experience in Tesla — Seeing -55% Disappear in 25 Minutes A bag holder is a stock market sucker. This is an investor who buys a stock, hoping it goes higher, but then gets caught “holding the...

- Selling Covered Puts for Great Premiums: It Doesn’t Have to Be Risky Getting down to the basics of selling covered puts really helps the options trader conceptualize the risks and reward profile behind the trade. The big...