Edited for clarity: 9/21/22

As a company creates income, this changes its shareholder’s equity. Add investment securities and it can get hairy.

The Statement of Comprehensive Income attempts to capture the effect of unrealized gains on investment securities. It reports these changes to shareholder’s equity through the balance sheet, through OCI and AOCI.

OCI stands for Other Comprehensive Income, and AOCI stands for Accumulated Other Comprehensive Income. One refers to the income statement; the other, to the balance sheet.

But it’s not just unrealized gains (or losses) on investment securities that OCI attempts to capture.

The following are also reported on Other Comprehensive Income or AOCI:

- Foreign currency adjustments

- Unrealized gains for retirement obligations

- Other special adjustments…

Unfortunately, the accounting around Comprehensive Income, OCI, and AOCI can not only be confusing, but also changed in 2016 with a new GAAP accounting rule (ASU 2016-01).

This change had a big impact on financial companies with large investment securities. Companies like Warren Buffett’s Berkshire Hathaway now report a GAAP Net Income that is a practically worthless measure.

The impact of this new accounting rule affects Net Income, Invested Capital, and ROIC calculations.

To truly master all of the complications surrounding Other Comprehensive Income, we’ll unpack the following [Click to Skip Ahead]:

- The Relationship Between Retained Earnings and (Other) Comprehensive Income

- The Basics of Comprehensive Income, OCI, and AOCI (very important)

- The Big Accounting Rule Change in 2016 and its Impact on OCI

- When OCI is Essential For Understanding a Company’s Actual Growth and Profitability

Alright, buckle in, and read carefully.

The Relationship Between Retained Earnings and (Other) Comprehensive Income

First we need to understand the way that Net Income flows from the Income Statement to the Balance Sheet. (Part 1)…

- Say a business earns $200 million in Net Income for a year.

- Let’s say further that they decide to sit on the cash.

So, on the income statement, Net Income = $200 million. In the balance sheet, Cash and Cash Equivalents also grows by $200 million, which pushes Total Assets and Shareholder’s Equity up by $200 million.

We can intuitively understand that relationship, and it can also be traced through the cash flow statement.

However, that’s not the only way that this (retained) Net Income is recorded (Part 2).

Any Net Income that is not distributed through dividends (or share buybacks) to shareholders is reported as Retained Earnings. These are tracked in a place called the Statement of Retained Earnings.

Unlike the calculations in Part 1, these figures don’t contribute to the Income Statement, Balance Sheet, or Cash Flow Statement. Rather, the tracking of Retained Earnings is done in parallel with the other GAAP figures.

Retained earnings simply tracks the changes of shareholder’s equity for the company for year to year as it receives Net Income and pays capital back to shareholders. Other Comprehensive Income tracks the impact of unrealized gains and other effects to Shareholder’s Equity from year to year which isn’t accurately captured solely by Net Income + Retained Earnings.

The Basics of Comprehensive Income, OCI, and AOCI

The differences between comprehensive income, OCI, and AOCI are subtle, yet critically important!

In its most basic form:

Comprehensive Income = Net Income + Other Comprehensive Income (OCI)

A reminder (from above) that depending on the financial statement, OCI could contain any of the following:

- Unrealized or realized gains/losses

- Foreign exchange adjustments

- Changes in pension benefits, and more

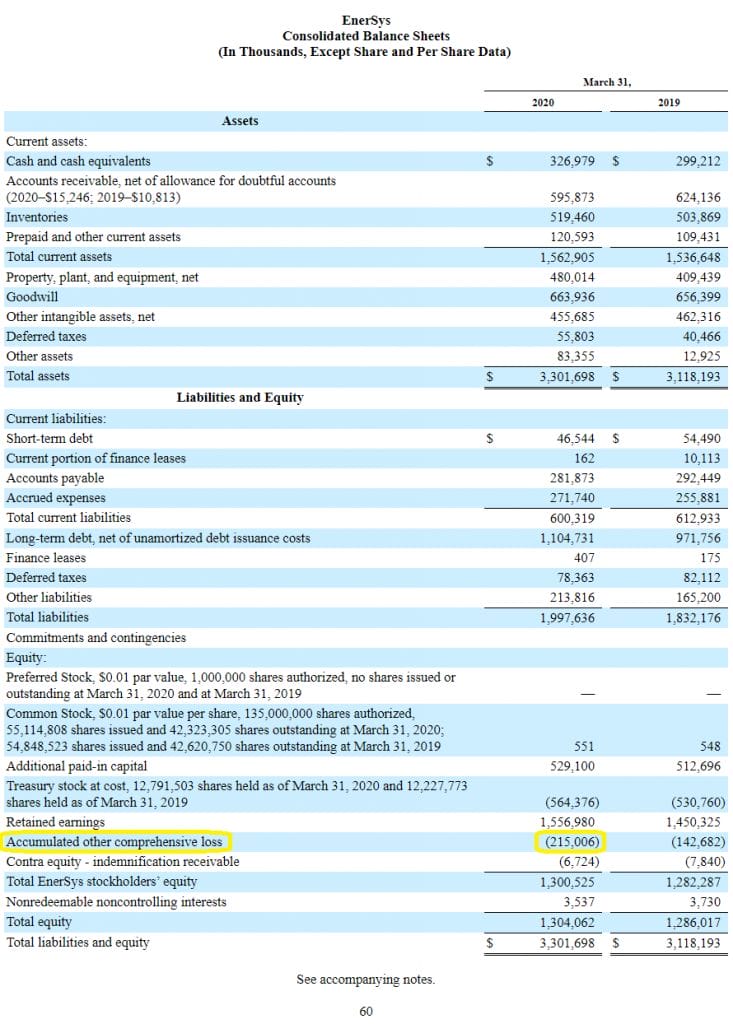

And so, Accumulated Other Comprehensive Income (AOCI) records this OCI as a Balance Sheet item (as a component of Retained Earnings). Example of AOCI in a company’s 10-K ($ENS):

Note that AOCI is an accumulating metric like Retained Earnings. Meaning, it is a total balance accumulated over many years, like Cash and Cash Equivalents as another example while OCI—displayed in the Statement of Comprehensive Income—is an annual figure, like Net Income.

The Statement of Consolidated Income and OCI

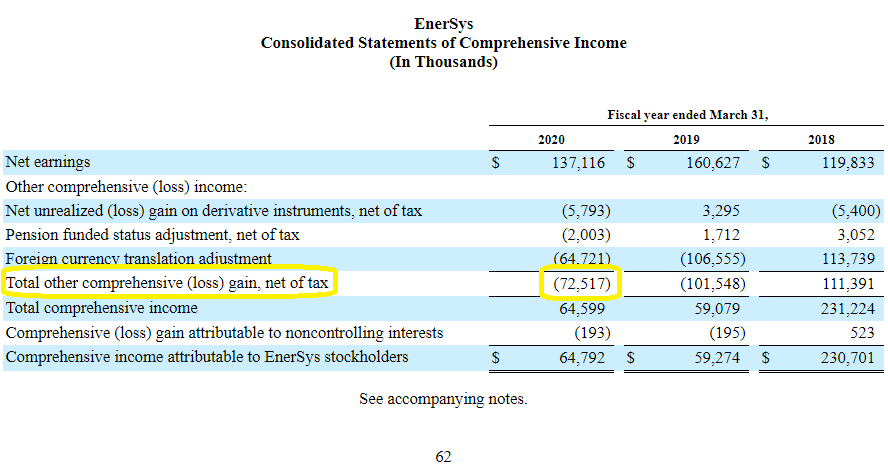

Let’s use $ENS again to tie in the entire picture of the financials. Once we found AOCI in the Retained Earnings part of the Balance Sheet, we can also see how OCI’s annual figure plays into that.

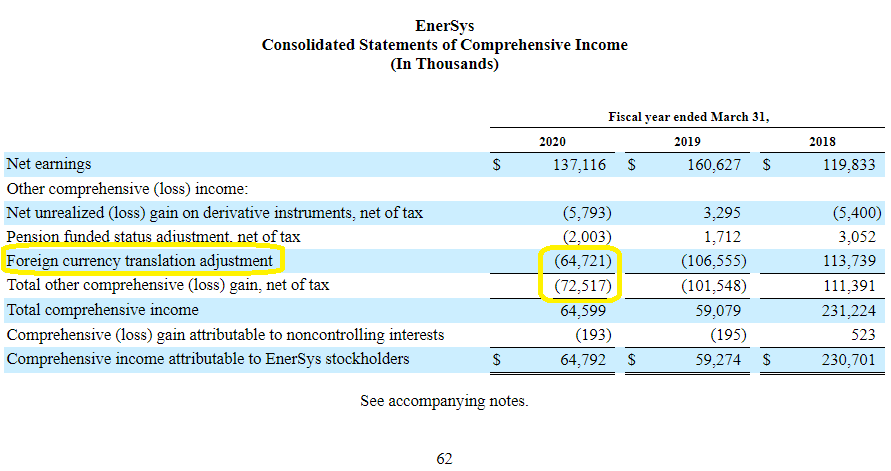

From the Consolidated Statements of Comprehensive Income for $ENS:

For 2020, the Total OCI was -$72,517 (in thousands). That 2020 figure should add to AOCI in the Retained Earnings statement from 2019 –> 2020 (in our case, subtract from AOCI balance).

What’s a little confusing in this case is that you have a component of OCI which is attributable to noncontrolling interests = -$193. Because our retained earnings and AOCI pertains only to $ENS shareholders (and not noncontrolling interests), we need to ignore this -$193 component of OCI.

Since we need to adjust this figure, the relationship between these financial statements can be calculated like:

-$72,517 + $193 = -$72,324

Looking at the difference between 2019 and 2020 AOCI,

-$215,006 + $142,682 = -$72,324

Our statements reconcile.

Note: Remember that Total comprehensive income is simply the summation of Net Income and OCI, which is why that figure doesn’t have much to do about AOCI, and thus doesn’t have a simple flow back into the balance sheet/retained earnings.

The Big Accounting Rule Change in 2016 and its Impact on OCI

As mentioned several times in the bullets above, the OCI captures the impact of unrealized gains or losses to shareholders’ equity.

If a company holds a financial instrument like a marketable (equity) security, its real value is changing every year with the market. But, its value on the balance sheet remains at cost. In this respect, the equity security grew in value “silently,” until it was sold for a profit, at which time a large jump in GAAP Net Income would appear.

However, this changed in 2016 with ASU 2016-01.

Now, unrealized gains and losses are included in a company’s Net Income instead of the OCI. This means the changes in values now flow through to Retained Earnings

As you can imagine, this creates huge implications to companies with large amounts of equity securities, especially if those securities are held for long periods of time as part of their business models (like insurance companies).

With ASU 2016-01, the changes in unrealized gains and losses in these equity securities are reflected directly in the income statement, and thus makes those Net Income figures jump up and down with the market.

Note: Keep in mind that this is another example of a difference in GAAP vs IRS accounting, and so the company doesn’t have to pay income tax just because of this special treatment of unrealized gains/losses.

We now have a situation that used to be defined inside OCI and instead flows through the Income Statement, which could unlock lots of opportunities of hidden value for those investors who are paying attention.

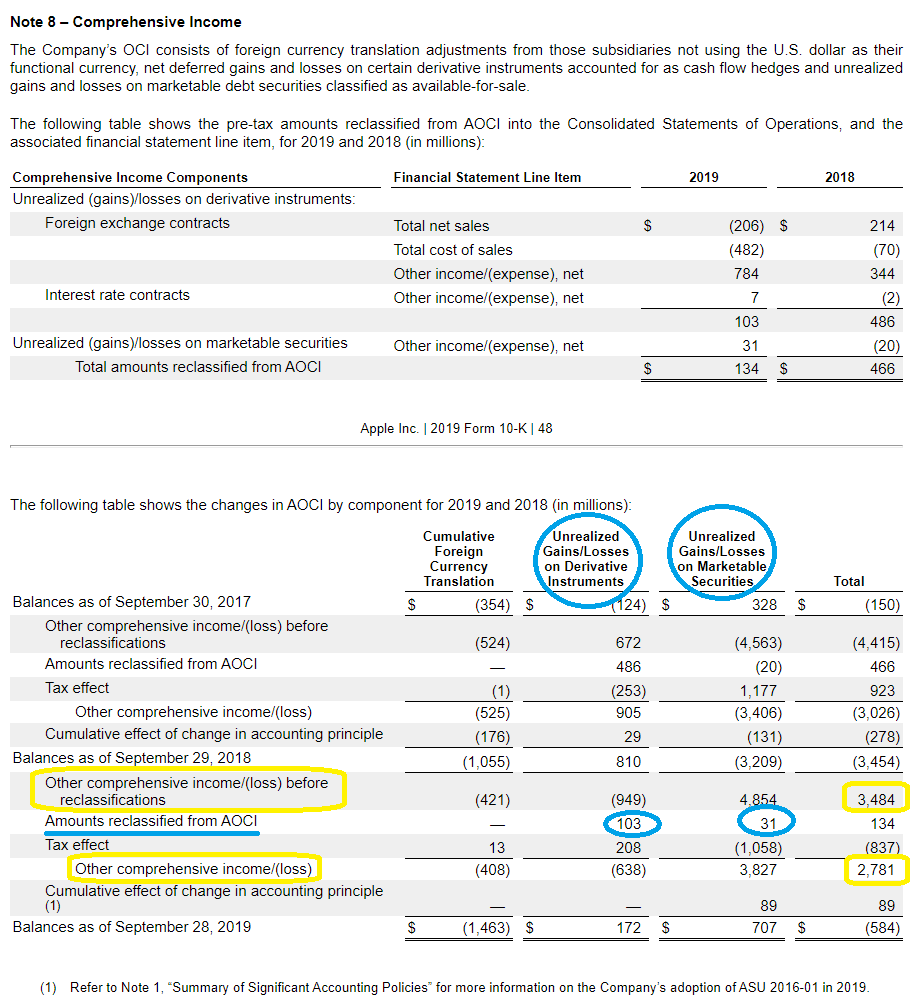

A company like Apple really broke it out nicely on their 2020 10-K, so we can see how the new ASU 2016-01 accounting rule and OCI and AOCI all fit in now:

Note how the company chose to put Unrealized Gains and Losses inside their AOCI calculation, and then adjusted it out of OCI (subtracted $134 as a reclassification away OCI towards Net Income). Also notice the table at the top of the notes. It defines where those new Unrealized Gains and Losses contribute to the Income Statement, leaving a potential gray area.

Keep in mind that this new ASU 2016-01 rule only applies to OCI related to financial instruments like equity securities, and not others like foreign currency effects.

This is big with insurance companies, who take premiums and invest those to make income for their holding company.

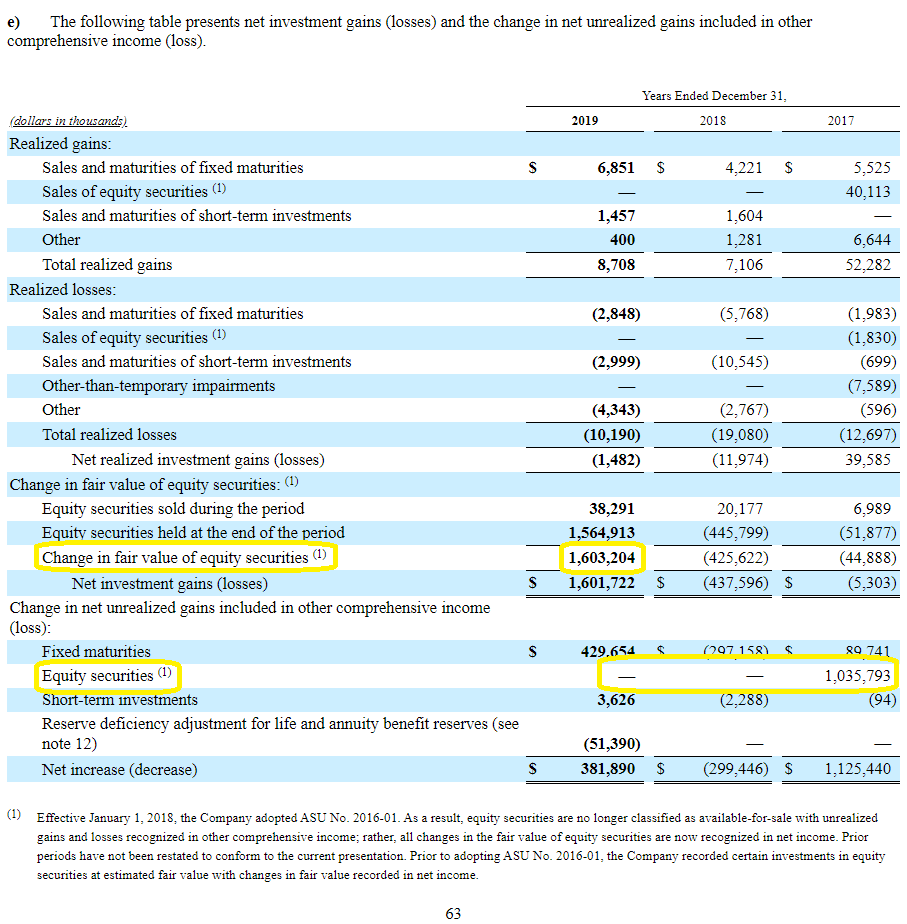

For example, Markel shows the difference between Net Income (through Net Investment gains) before the OCI Accounting change and after it was in effect (2018, 2019):

You can see how unrealized gains no longer fall under Other comprehensive income as the change in value of equity securities in 2018 and 2019 is zero, with a large change in fair value instead for the Net Investment gains portion of Net Income.

When OCI is Essential For Understanding a Company’s Actual Growth and Profitability

Let’s go back to $ENS, as it shows a perfect example of when Other Comprehensive Income (OCI) is important.

- Compare Comprehensive Income to Net Income!!

When these two metrics vary widely, we have a situation where Net Income probably isn’t accurately recording the actual growth reality of a business, making metrics such as P/E mostly useless.

Recall that the Comprehensive Income for $ENS was $64,792 (in thousands) while its Net Income was $137,116.

Pulling up that picture from above again, we see that a large component of the Statement of Comprehensive Income is Foreign currency translation adjustment.

We can see that for 3 years in a row, the Comprehensive Income was wildly variant from Net Income. So understanding OCI for this business is essential.

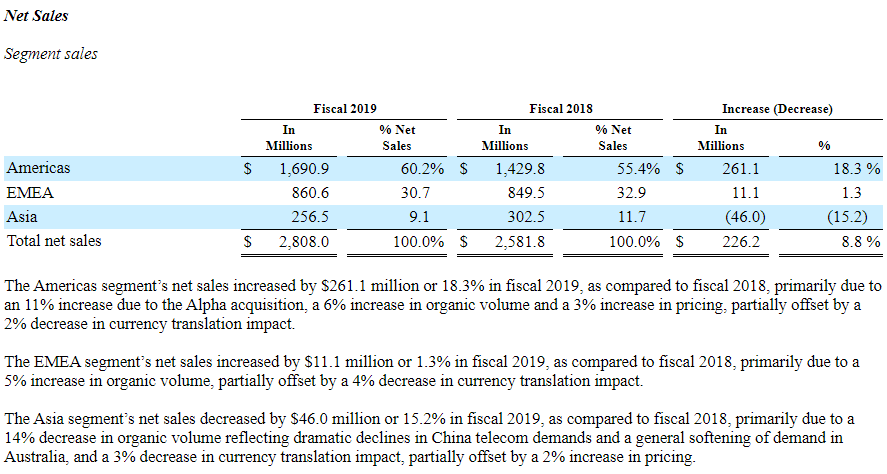

If we can recognize that foreign currency is playing a big part, we can do more digging to understand why.

The geographical breakdown of revenues for $ENS explains that nicely:

We should’ve known that already based on analyzing the company. However, what’s not clear until we examined OCI is that discussion of the results of operations doesn’t fully disclose the impacts of currency for this business.

In other words, various parts of the MD&A will mention how changes in currency have affected revenues. But the impacts to the company’s ability to reinvest for future growth can only be sussed out in the OCI, in this case.

Because OCI has so significantly decreased Comprehensive Income, Shareholder’s Equity doesn’t increase much. This is why, even after a great year of earnings, the balance sheet hasn’t grown nearly as much.

The impacts are spread throughout the balance sheet, from Goodwill adjustments to Retirement obligations to the value of Cash and Cash Equivalents. It explains why Shareholder’s Equity didn’t increase related to traditional Retained Earnings.

OCI Accounting: Depends on Context

Now, we need to understand that not all OCI is created equally.

In the case of marketable securities, I probably won’t care about the extreme changes in OCI. These are really unrealized gains or losses. Just because its market value is fluctuating doesn’t mean the company will necessarily have less retained earnings down the road.

However, in the case of foreign currency fluctuations, those are real effects.

In other words, those currency fluctuations are probably more long term. Forex speculators tend to be familiar with long term currency trends, which tend to last a long time. This is because currency trends usually have to do with long lasting fundamental changes in macroeconomics. Examples include imports/exports, demand for government debt, fiscal and monetary policy, etc.

That means that any company with a significant portion of some sort of OCI needs to be evaluated for the probable long term impact to future growth, and either disqualify Net Income or not.

In the case of $ENS, an analyst knowing about the presence of high components of Other Comprehensive Income could also observe the cash flow statement. There, you can see the foreign exchange effects on its cash and cash equivalents, which have reduced the value of that cash all by itself.

Investor Takeaway

Whether you’re looking at an insurance stock with large equity positions in their investment portfolio… or a company with significant foreign exchange exposure…

Taking a glance at Other comprehensive income (OCI) and its relation to Net Income is worth the effort.

As you follow the path down through OCI and AOCI, take note of anything suspicious that could signal a potential for hindered growth in the future.

As it relates to completely digesting all parts of a 10-K, this important section is one to watch, when the context calls for it.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large balance of marketable...

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Updated 12/19/2023 Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large mix...

- Held for Trading HFT/AFS Securities – Company Investment Portfolios [Guide] Updated 3/30/2023 Ever wonder why Warren Buffett buys all those stocks and what the goal is behind them? Also, why does he mention valuing Berkshire...

- Marketable Securities In-Depth Guide: What They Are, Valuation, and Impact Updated 3/30/2023 Have you ever seen that line item on the balance sheet listed as marketable securities and wondered what they were? I know I...