Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

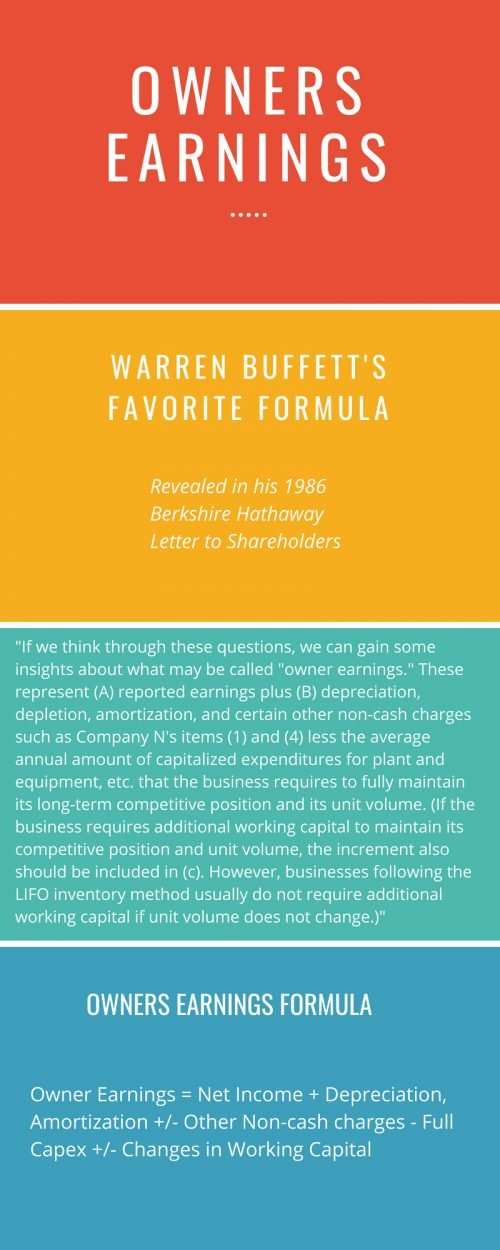

Welcome to Investing for Beginners podcast, this is episode 66. Today we’re going to talk about several different topics, we’re going to talk a little bit about owners earnings. Which is one of Warren Buffett’s favorite formulas, if you will, or thoughts and ideas on how he looks at a business. And we’re also going to talk a little bit about options and before we start talking about those I’d like to tell you about a book I just read recently.

Just a quick note, there are several affiliate links sprinkled throughout the transcript.

It’s called F Wall Street and it was a fantastic book it was very easy to read and it is not full of jargon if you will. There’s not lots of technical terms in there.

He’s very good at explaining and breaking down different ideas like owners earnings. For example, he also talks a little bit about intrinsic value. He also talks about certain types of cash flows.

But again it’s not super jargon there’s not a lot of math and even the math that’s in there is super simple and the other thing that’s kind of cool about it is he comes from it as an angle he’s a quote unquote insider he’s somebody that works in the business he buys and sells stocks for people that want to invest.

But he comes at it as an angle of everybody in Wall Street’s out to get something from you and he’s not and it’s very his language is very it’s not rough but he’s very sarcastic is probably the best way of putting it.

Especially attitude yeah thank you that’s the better way of putting it yeah there’s a lot of attitude and he’s definitely coming in at have added advantage of looking at Wall Street as sort of the enemy and when I say Wall Street he’s really talking more about the big funds and people that are out there trying to hustle as opposed to somebody’s they’re trying to help you invest your money and it’s a great book I really enjoyed it it’s not very long it’s about 250 pages give or take and it’s very fascinating.

I would highly recommend it it’s something that something new that I came across. I know Andrew would read it recently and he never you never sale yours that I didn’t read a little bit of it uh and uh he had recommended it to me based on his partial reading of it and I really enjoyed you didn’t really recommends that book for Jae Jun he does and I think he gets you can tell by some of his writing that he gets some of his ideas from that book so it was pretty cool so Andrew why don’t you start us off talk a little bit about owners earnings and we’ll have a little roundtable on that and we’ll talk about options.

Andrew: yeah sounds good so what’s the purpose of owners earnings Warren Buffett was the first one to really kind of popularize this idea and so I guess to kind of explain owners earnings we need to explain what earnings are and at the risk of getting too technical need to explain how earnings is kind of tabulated.

Obviously earnings drives Wall Street right so when you see earnings growth that’s what the analysts are all focused on they’re looking at revenue growth earnings growth and that tends to make the stock either pop up or dive down and sometimes it can happen even though it’s not logical right so a company could do better than their expectations with earnings growth and still have the stock pop up or up or down.

That’s kind of a discussion for another day however the basic idea of earnings growth makes a business grow once you have more earnings you have more profit you can reinvest in the business you can grow the business and over the long term stock prices tend to grow because earnings grow.

Now it’s not as simple as just taking your for me like I I have my own business right for me because it’s a one-man show revenue and expenses are pretty straightforward finding earnings for me is pretty straightforward.

But once you get to like the public corporation size with thousands ten thousands hundreds of thousands of employees expenses for this that and the other thing you have the possibility of expenses. You could expense it from one year to the other all these sorts of things can kind of make earnings a little bit more complicated.

And so because it can be complicated it can also uncover value for you and so that’s where kind of owners earnings come in if earnings are being misrepresented I did not pronounce that right but as it goes I mispronounced a lot of things.

Basically you can find pockets of value you can find stocks that are better maybe having the potential of having greater earnings in the future by using something like owners earnings and it does require having kind of a more advanced knowledge of financial statements.

Buffett’s in particular isn’t too complex it is one of those things where you don’t want to cover each individual aspect in the podcast but I will talk about some of the general theory behind it.

Like I said how earnings can get complex with corporations I believe that’s something that’s important to understand and it’s a big reason why you can’t just rely strictly on p/e ratio because there can be discrepancies there can be manipulations we have seen that in the past.

So you want to look at multiple factors so obviously one way to mitigate against bad earnings our presentation is owners earnings other methods are some of the things that we teach like looking at also your sales your book value lots of different ways to go about it.

But when you think about how earnings is calculated basically there are other things that a corporation needs to consider. So they would need to consider like interest and taxes. Those are those tend to be big ones.

Obviously corporations need to pay taxes you saw kind of earnings boost with the latest tax cuts for corporations that kind of flowed through and led to more stock buybacks in the market.

You also have interest payments so a company with more debt they might purchase bonds or other debt instruments. They will have to take that out of the earnings before really posting because that’s true profit right.

I mean you have earnings that you get from the business and then you also have these other expenses that come along with running a business so that’s another thing another big one is like depreciation and amortization. I believe we’ve covered the basics of that before just kind of as a recap say you are buying you have to buy a huge factory to create widgets or whatever.

If you don’t have depreciation then it’s going to make whatever year you buy the factory look like earnings are really bad when essentially you did fine as a business so for example let’s say the let’s say you make three million dollars a year and the factory costs you six million dollars right.

It looks like the first year you bought the factory that you had negative earnings or you didn’t pull a profit when in reality you did pull a profit you just have this if anything with the new factory you have a higher earnings potential in the future and what happened in the core business as far as however much it costs you to pay employees versus what you brought in might still be the same or even better than the year before.

Then businesses use depreciation to kind of they’ll take that expense and they’ll average it out over let’s say ten years and so earnings more accurately reflects what’s going on with the health of a business and what they really own earned excuse me and so that’s really the whole purpose of earnings is to give you the health of the business.

Give you an idea of how the business is doing how it’s turning a profit and owners earnings tries to give you a more accurate representation of that. so because earnings does take depreciation into account it can also have some flaws because if a company is let’s say over aggressive on buying factories right if they’re trying too hard too fast to expand then that can be a problem for investors because I can actually instead of help cash flow in the future can hurt cash flow.

And so like I know Buffett takes capital expenditures into account when he calculates owners earnings and so he penalizes companies for having too much capex and it’s for that same logical reason is if a company’s spending too much to reinvest in the business buying too many factories that’s capex.

Then the real earning power actually isn’t as high as it might appear in in the regular earnings statement and so hopefully it’s not too complex hopefully it kind of gives you an idea of how earnings owners earnings is kind of calculated kind of why it is right and if it’s something you want to pursue I know a lot of value investors.

If they don’t have if they don’t follow Buffett’s owners earnings calculation they might kind of have their own or they might you might have heard of things like EBITDA and that’s funny it’s kind of a thing that’s becoming a trend in the investment bank banking world and the more typical kind of Wall Street route that maybe Joe Ponzio is kind of trying to push against in his F Wall Street book.

But like the guys are working like Deutchse Bank or Goldman Sachs there’s a couple Instagram accounts I follow though they’re really funny and they make a lot of jokes about eBay dock and what that is it’s another form of our earnings calculation.

And so what they’re doing is they’re looking at they’re trying to look at what the core business is doing and they’re ignoring things like depreciation amortization interest in taxes and so again there’s going to be plus and minuses to calculating earnings and calculating the variations of earnings and it’s going to be different for situations so it can get really muddy and messy which is why I tend to prefer to look at bigger scale things I just want to see like total sales I want to see total earnings and make sure there’s just enough in there.

But if you really want to get down to the nitty-gritty and really attempt to understand and try to find undervaluation through kind of like a mastery of accounting. Then it’s definitely something you can try to pursue and earners earnings could be a fantastic way to do it. and I know Ponzio covered it in a F Wall Street as well and another book recommendation if you’re really interested in owners earnings and particularly the way Buffett calculated it is called the Warren Buffett Way and they show some of his previous successes some of his best stock picks and they show kind of how he calculated that owners earnings then and how he created valuations off of those and so that can be again just another useful tool another great piece of information and maybe a jumping board to get you into learning more about financial statements.

So that’s kind of all I have to say about it.

Dave: well that was quite a lot that was good a lot of great stuff that you unloaded on us there the thing that I really liked about the owners earnings Buffett created it back in 1986 he shared his exact thoughts and one of his shareholder letters and it was fantastic I’m not going to read it to you on the air because there’s a lot of gobble goop in there that would really confuse people.

But if you’re really interested in it there is a I wrote a blog post about owners earnings a while back and I can put a link to it in the show notes and it has Buffett’s quote in there about his thoughts on owners earnings so you can kind of get an idea of what he was thinking about it.

And I liked all the things Andrew was talking about it it’s definitely a deep dive into the company for sure if you’re interested in learning more about the accounting aspects of digging into financial statements and really learning the ins and outs of how a company thinks about different things.

It’s a great way to look at it one of the things that I like about owners earnings is it gives you an idea of kind of what the company is doing with their money.

And kind of the reason why I say that is because the whole point of a company growing is to create assets which is going to create cash flow and it gives you an idea of using this formula it gives you a really good idea of what the company is doing with their money.

Whether they’re going to use it to pay more assets or whether they’re going to use it to pay out a dividend you can just use this this formula helps you see where that money should be going or could be going and it gives you an idea behind the what management really thinks of the business and how they want to use it.

And that’s really kind of what it breaks down to there’s a lot of deep dive accounting terms like capex and maintenance capex and averaging those out there’s a lot of different things you need to go into to really get into the nitty-gritty of it and again that’s really more for somebody like me who’s kind of a geek and I really like to dig into this stuff.

The F Wall Street version of owners earnings is far more simple than what Andrew and I are talking about and it’s a lot more a lot less involved I like it as just kind of an overview tool to kind of give you a quick back-of-the-envelope kind of idea of how the company is doing.

And I think it’s a good way to kind of help you screen for companies a little bit and that’s kind of what the angle he comes at it from the book the owners earnings that I’m talking about and the one Andrew is talking about is a far more deep dive into the company and getting a little more in depth into what’s really going on with a company.

But basically again it kind of all boils down to what the company is doing with their with their assets what they’re doing with our liabilities and how they treat do those things and the thing that I like about it too is it does take into account things like depreciation amortization and those are very can be very critical things to think about when you’re thinking about the earnings of the company because the one thing I don’t like about just looking at the net earnings of a company is that there can be some manipulation in there and I am certainly not an expert in determining all that.

But I’m trying to learn more about it and it can be it can be a little bit misleading and I just feel like sometimes it was just a little too much wiggle room in there for me to not know and I’m one of those people just has to know so I’m yes I’m a nerd I get it I’m okay with that I’ve accepted it I’m 51 years old it’s not going to change so I’m just going with it.

The point of what I’m saying is that this is a great formula to use if you really want to dive deep into the company and you really want to find out what they’re doing with their money and where it’s going. I think that’s kind of the basic point of the whole formula.

Andrew: in a nutshell it can be a good way to also evaluate management because they’re making like you said decisions on what to do with their capital. And oh no you can get really intense from there but yes um there’s going to be situations it’s not black and white but there’s going to be times where it’s better to give money back to shareholders rather than grow the business.

depending on what kind of efficiency or what-what their growth picture kind of looks like so you can kind of use as another way to evaluate management without having to speak to them and so I guess it could be useful in that way too.

Dave: yep totally yep very much so all right so moving on let’s talk a little bit about options so Andrew why don’t you give me your thoughts on options.

Andrew: options stay away. If you yeah I mean if so if you think about and there are some good things about options and we should cover that too.

But if you think about really what you’re trying to do with an investment an investment is something where you put money at risk you’re supposed to be paid an income for that risk and the idea is once you receive income from the investment then you buy more investments with that income and then it can grow exponentially.

We talk about that all the time compounding interest dividend reinvestment yeah the other.

With options you have there are so many different types of options and it can be really easy to get tangled up in it and then trying to really follow it if you’re a beginner but if you if you really understand that when you’re buying stocks the reasoning behind it is to because I’m not like some crazy expert right. Like huh, I don’t I don’t try to go into the stock market or the investing world thinking that I have some edge that makes me better than everybody else like I could figure it out better than everybody else.

There’s and I don’t argue that the average investor can be that way either what we’re really doing and what our truth is that we understand something that’s so basic and so fundamental that’s so lost once you again kind of get tangled up into the world of investing.

That simply by being a part owner of a business simply by buying stocks that are kind of beaten down by the market. Yet still, have good business fundamentals still have strong balance sheets and simply by holding it for the long term and letting the interest work for you rather than trying to work for the interest work for the gains work to try to do all these sorts of complex and second third fourth level thinking and strategy and skills.

Instead of trying to do all that just simply put your money to work let the businesses do the work let them grow earnings let that get funneled back to you reinvest some money and then do that consistently and hold for the long-term and understand how the stock market works understand that there are going to be bear markets it’s it’s inevitable there are going to be recessions it’s inevitable.

And that most of your gains will be made on the recovery because you stood your ground because you did not cater to the common emotion that’s felt in the market when people think stocks are just the worst thing ever.

But so I guess saying all that right there are options that you can buy that provide you with income there are options that you can buy that can hedge you right like the idea of a hedge is to give you kind of like a backup plan because with anything that has to do with trading investing obviously there’s so much uncertainty nobody can predict the future.

And so you can have things like hedges too if you act against something that you don’t expect to happen you buy stocks expecting them to go up but that’s not always a case and so that’s where your hedge kind of comes in to rescue you.

That’s all fine and good and there’s other strategies I know like you can buy and again I’m not an expert and I haven’t gotten super deep into the reeds with this but I know you can buy like I think it’s you, buyer, you sell do you buy puts or do you sell there you sell puts I think you sell calls and you buy puts right.

Dave: I believe so yes.

Andrew: yeah so you can like buy and they can put on the stock for example and so again don’t quote me if I’m wrong but the essential idea is the doing that will still give you an income and then it lets you buy.

Basically if the stock goes down so you do this on the stock you really want to buy right you’ve calculated its intrinsic value to be let’s say twenty-five dollars you buy there there’s some aspect of the naked put that puts you in if the stock trades to fifteen and so if the stocks at twenty and you have this put that you can exercise at fifteen then if the stock continues to fall then then you then you win right you’re happy because then you got to buy the same stock that was at twenty now you get to buy it at fifteen and you’re essentially by another greater discount then if you just bought at twenty.

It also provides you upside because you collect income along the way because you hold it and so it’s like well if the stock continues to rise then that’s fine because I’m collecting income as if I were still holding it and having it that to pay me a dividend right.

So you have this a lot of these type of options trades that either work as hedges or they seem to work as a win-win situation so whether the stock goes up down or sideways it seems like you will be happy with the result.

But something to understand I think about Wall Street is that there’s no such thing as a free lunch there’s no such thing as completely eliminating risk if we go back to the definition of investments you’re putting money at risk.

There’s no way to you can you can try the three different things to kind of mitigate the risk but it’s always going to bring another risk along with it and so a risk with the naked put option for example for value investing would be an opportunity cost risk. sure you win on the upside or you win on the downside but what about if you were right on the stock and and you bought it at twenty it goes up to thirty sure you might still get the upside of the put.

But you won’t you won’t have as much upside as if you if you would have just bought and so you even though you receive income you would not get that same stock price appreciation.

So you’re always going to be trading off something and so in order to give yourself kind of like a win quote-unquote on a trade that goes against you have to give up upside to do that.

I say why even try to kind of out think it right if we’ve already talked about we very determined one of our first episodes we talked about trying the time in the market and how it doesn’t really matter if you can time the market correctly as long as you’re in there long enough that will actually beat trying to time the market. and so that’s why I kind of urge investors to stay away from options is especially if your average especially if for your beginner is because even though it can really give you kind of those win-win situations it’s not a true win-win and you can really cap your upside by doing that.

And can keep you out of a stock that you would have liked to be in and then you still get the same kind of fear missing out so why not instead really be okay with the idea that I’m not trying to figure out which stocks are going to go down which ones are going to go up I’m not trying to mix portfolio of like long’s and shorts I’m not trying to capture like a big movement with an option thing where you can really hit a jackpot if if a stock moves a certain way.

I’m not trying to do any of that that’s all trying to predict things all I’m trying to do is understand that most investors don’t really understand what a good business looks like all you have to do is look at some of the most expensive stocks right now look at their balance sheets and their income statements and realize that these investors are nuts.

We can do that we can use that same knowledge to generally figure out what the stocks really worth and buy the ones that are trading much lower than it avoiding the ones like Tesla that are trading much higher than what they’re really worth. And again we can really hold for the long term which is a huge advantage compared to a lot of the mutual funds who are in and out of trades by the year and then they’re not really true buy and hold.

And we’ve talked about the implications of the whole financial industry one of our first five or six episodes was also about that maybe episode 7 I don’t know.

Just keeping those things in mind I think it really makes sense to avoid options it really makes sense to just kind of stick to what what’s simple stick to what works and instead of wasting brainpower on trying to figure out what options are. even though it’s something yeah maybe get a general understanding but really is it a rabbit hole you don’t want to go down I think if you want to go down a rabbit hole I much rather say you go down the owners earnings rabbit hole then like a rabbit hole about options or puts or shorting or hedging or any of those sorts of things.

And I think one last reason why options are bad not last reason may be one of many reasons is that you really have to leverage you have to invest with margin so you have to essentially borrow money from a broker and with that comes all sorts of complications we’re probably one of the most anti debt people out there I know that’s kind of few and far between maybe I won’t speak for Dave but at least for myself I’m like super anti debt and the constant stocks and personal finances.

Dave: I’m right there with you.

Andrew: okay so maybe we’re conservative to a fault but just investing with debt leads all sorts of problems it can make you exit a trade you’ll be forced to exit a trade when you don’t want to when you invest on margin and that’s just one of the many things that can go wrong.

Again you have to buy options with margin and so I don’t want to buy with any debt at all anyways even though maybe the risk of losing a lot of money is really small it’s still not something I want to pursue and it’s not something I really want to recommend for most people.

Dave: yeah I agree and I I think one of the things that I like about what you were saying was the margin and using the risk and it really options really comes down to what your risk tolerance is. and whether you’re comfortable using all those tools as a way to invest and I’m not and it’s that’s just not something I really want to go down that rabbit hole at all and so frankly I really have not learned more than just the cursory amount of it.

I started reading a little bit about it when I first got into investing and it just sounded scary risky a great way for me to lose any sort of money that I had and I just did not find it appealing in any way shape or form. And again this doesn’t mean that it is bad or that it’s all bad if your risk tolerance can handle the ups and downs of this or the fluidity of everything that goes on and using leverage and debt to help finance your financial dreams then by all means weren’t as much about it as you can and hope for the best.

But I think the way that Andrew and I look at in investing and our ideas of how to grow your wealth are far more conservative but they’re also a lot less risk-free. like I can go to bed at night not stew and stew and fret about what’s going to happen in the stock market tomorrow because I don’t have to worry about that I’m not leveraged to the gills don’t have a huge trade that may get for stew like Andrew said it may get forced to sell tomorrow and I could lose my shirt on it just because of the way I’ve set up my options.

Again if it’s something that you’re comfortable with doing go for it if you’re not like Andrew and I it’s why even go down that rabbit hole I think an owners earnings rabbit hole would be far more beneficial to you in the long run than running in options game. That’s just again my thought on that.

Andrew: I need to be sure you can make a lot of money with options there’s plenty of stories online about it and it could be fun for some fun money too because of a leverage it tends to magnify your results so you could turn like a thousand dollars into a hundred thousand.

But at the same time for all the reasons we already mentioned I don’t think it’s a good route to take and it’s I see him more as gambling than investing for most people.

Dave: yeah I would I would agree unless you really got the time to really educate yourself and really learn how works in and out yeah I would agree with that.

Andrew: and you almost have to play it as if you’re more you’re better playing the game itself rather than like actually analyzing companies because you can be right on the trade or you could be right on your investment thesis and still lose money on the trade so you kind of have two more so have a little bit of a crystal ball and or just have a superior strategy that really focuses on the options part of it rather than the stock market part of it.

Dave: exactly yeah I would agree.

All right folks will that is going to wrap up our discussion today on owners earnings and options I hope you found some value in it and you learnt a thing or two so without any further ado we’re going to go ahead and sign off you guys have a great week go out there and invest with the margin of safety emphasis on the safety and we’ll talk together next week.

We hope you enjoyed this content Seven Steps to Understanding the Stock Market shows you precisely how to break down the numbers in an engaging and readable way with real life examples.

Get access today at stockmarketpdf.com until next time have a prosperous day the information contained is for general information and educational purposes only it is not intended for a substitute for legal commercial and/or financial advice from a licensed professional review our full disclaimer at einvestingforbeginners.com.

Related posts:

- IFB53: Dave and Andrew Debate Negative Net Income (Earnings) Welcome to Investing for Beginners podcast this is episode 53, Andrew and I are going to take a stab at talking about negative earnings....

- IFB56: New 2018 GAAP for Marketable Securities Will Inflate Earnings Welcome to episode 56 of the Investing for Beginners podcast. In this week’s episode we’re going to talk about something that Warren Buffett dropped...

- IFB26: Combining Earnings Yield and the Return on Capital Formula Welcome to episode 26 of the Investing for Beginners podcast. In today’s show, we will discuss the return on capital formula by Joel Greenblatt. The...

- IFB67: Are These Record Share Buybacks Good or Bad? Welcome to Investing for Beginners podcast this is episode 67. tonight Andrew and I are going to talk about share buybacks, this has been a...