Updated 9/27/2023

“Mobile devices, high-speed data communication, and online commerce are creating expectations that convenient, secure, real-time payment and banking capabilities should be available whenever and wherever they are needed.”

Credit cards, debit cards, and mobile payments are helping make the use of cash transactions between customers and businesses less and less common. As the common chant goes, “Cash is dead.”

Peer-to-peer payments do the same for informal transfers between friends and family to pay IOUs, split the bill at dinner, and much more.

According to the St.Louis Fed, users of P2P apps have grown from 64.4 million users in 2017 to 96 million by 2019, with expectations of growing beyond 126 million by 2021. Over 40.4% of all people have used a P2P payment app in the last year.

Many big fintech players promote peer-to-peer payments as an easy and safe way to transfer money; companies such as PayPal and Square with their Cash App are popular, and other services such as Zelle help enable quick, easy money transfers.

In today’s post, we will learn:

- What Is A Peer to Peer Payment Network?

- How Does a Peer-to-Peer Payment Work?

- How Peer-to-Peer Payments Make Money

- Leaders in the Peer-to-Peer Payment Space

Okay, let’s dive in and learn more about peer-to-peer payments.

What is A Peer to Peer Payment Network?

Peer-to-peer payment systems, such as Cash App, Venmo, and PayPal, or P2P payments or money transfer apps, allow users to send money to each other via their mobile devices linked through a debit card or bank account.

The peer-to-peer payments are available to be sent either through your mobile phone app or online through a computer. The transactions can take moments or days, depending on the service and amount you send.

Through the P2P payment app, your account links to one or more of your bank accounts, typically through your debit card. When the transaction occurs, the account balance will show the money either pushed or pulled from the account to the person you were trying to send it to via the Venmo app.

Here’s a bit of history about P2P payments.

P2P payments began with the rise of PayPal, which specializes in electronic money transfers. PayPal’s payment system initially assisted both eCommerce businesses and individuals and reached a massive scale following the acquisition by eBay in 2002.

That acquisition marked the explosion of P2P payments.

eBay’s business model of online auctions needed a transaction intermediary like PayPal to facilitate the payments between sellers and customers, whether individuals or businesses. Buyers on eBay needed PayPal’s service because they wanted protection from providing random strangers with their credit card information. And sellers needed the service because many didn’t have the money to set up a merchant acceptance account to accept online payments.

Thus, peer-to-peer payments were born to fill that void.

The next leap forward was the rise of smartphone technology, which affects many aspects of daily life, including how we handle our money. Many peer-to-peer space innovators began as apps before branching into other services; companies such as Venmo, PayPal, and Square are the market leaders, as are Apple Pay and Google Pay.

These companies’ apps easily allow users to send and receive payments quickly, with no fees involved.

With the prevalence of smartphones in everyone’s pocket, the rise of eWallets is growing, with Apple leading the way, allowing users to pay bills, split checks, or send their portion of rent. Apple recently announced they are working with numerous states to facilitate uploading our state driver’s licenses to their Apple Wallet. While not making Apple money directly, these kinds of services create more reasons to use the Apple Wallet and drive retention and user interactions, making the device even stickier.

How Does a Peer-to-Peer Payment Work?

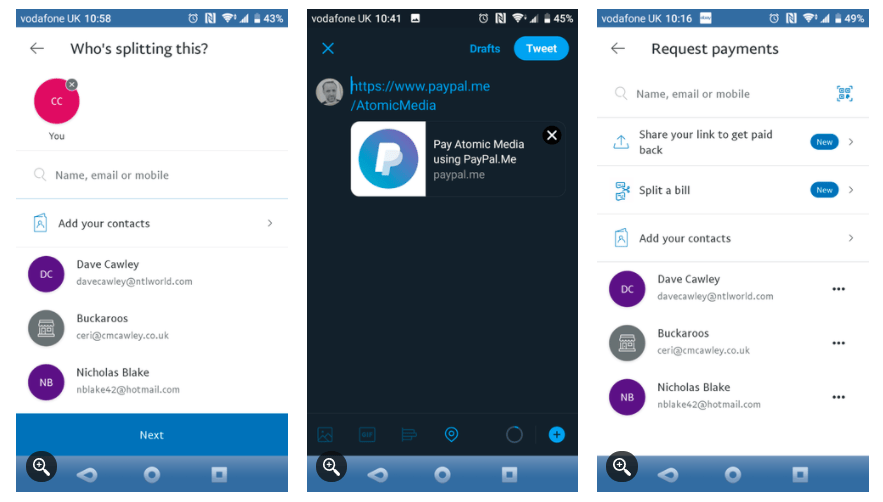

Here is the process for setting up a peer-to-peer payment network. Each company setup will vary, but generally:

- First, we download the PayPal app

- Next, we create contacts and send payments using another’s email address, phone number, or account nickname.

- Finally, we transfer money from the user’s account with the PayPal app, which transfers it to the receiver’s account.

Depending on our service, this can take mere moments or days. For example, sending money with Zelle outside your contacts can take several days, while transferring among PayPal users takes moments. Square’s Cash App can pull money from your checking into your Cash App to make payments in incredible moments.

According to Fidelity National Information (FIS), people love P2P payments mainly because of ease and convenience; in fact, over 57% of consumers surveyed said that is the main reason they use the service.

Think about how easy this is to use for consumers.

For example, if you are out to eat with friends, Andrew pulls out his credit card to pay the bill. We can take out our phone, pull up our PayPal app, pick Andrew’s name from our contacts, type our cut of the bill, and send the money to Andrew. How easy is that?

If we have a PIN set up to make the payment a little more secure, we enter the PIN, and voila! Once Andrew receives the payment, he can leave it in his PayPal account, pay his credit card from the app, or transfer it to his bank account.

Each P2P payment app is slightly different, but they all operate on the same design for ease and convenience.

Now, speaking of security, there are some concerns regarding P2P payments.

Though all the peer-to-peer payment systems encrypt or shield your private financial information, some have experienced financial scams or hacks. Many of the apps have dedicated fraud support, along with fraud monitoring, to help consumers maintain safe, secure accounts.

Many P2P players use different precautions to help lower security risks, from using PINS, passwords, and transaction notifications to help confirm whether we did send the money or not. For example, Cash App sends you a text message whenever money goes in or out of the account, helping communicate all the transactions.

Recently, there has been a rise in P2P fraud; unfortunately, as a service gains popularity, it increases bad people’s interest in trying to profit from unsuspecting individuals.

Some common fraud scenarios:

- Consumers use their PayPal app to buy something, pay for the product or service, and never receive the items.

- Fraudsters call customers, impersonating fraud departments while asking for personal and financial information to create P2P accounts to steal money from users’ contacts.

- Scammers ask to use a victim’s phone, claiming it’s an emergency. At the same time, they pretend to use the phone, open a P2P account, and transfer money.

- Some better hackers will gain access to the victim’s phone and steal username and password information for later use.

As mentioned above, all the P2P apps have their fraud departments to help consumers, but the best way to prevent fraud is to be alert.

Many consumers avoid P2P payments because of the fear of fraud, and recently, the New York Times reported that the number of customer reviews, including the words “fraud” or “scam,” rose almost 80% last year.

How Peer-to-Peer Payment Apps Make Money

The best way to illustrate how peer-to-peer apps make money for their companies is to highlight one company’s app and its uses. I want to use Square’s Cash App for our guinea pig.

Cash App is a P2P payments service owned by Square, with Cash App being part of a suite of services that Square offers its customers. Since going public in 2015, Square has risen quickly to become one of the leaders in the payment processing space.

Square launched the Cash App in 2013 to compete with PayPal, Venmo, Apple Pay, and Google Pay. P2P services such as the listed allow users to make payments or transfer money through their smartphone apps.

Cash App expanded its functionality beyond P2P payments, allowing users to deposit their paychecks, purchase bitcoin, and invest in stocks through the platform, all for free.

Despite all the intense competition from other P2P payment services, Cash App has been a bonus for Square, generating revenues of $3.33 billion in the second quarter of 2021, increasing 177% year over year. Square currently carries a market cap of $110 billion, making it one of the largest fintech players on the market and one of the larger financials in the world, larger than Citibank, for example.

So how does Cash App make Square money if its services are free?

While the Cash App is free to download, and its core services, such as peer-to-peer payments and bank transfers, are free, Cash App makes money by charging businesses to use their app and charging personal users fees for additional services.

For example, Cash App charges businesses 2.75% for accepting Cash App payments per transaction. The payments happen in two ways:

- An individual makes a P2P payment with the App to a business, for example, paying for tickets online from the Cash App to the vendor.

- An individual uses the Cash Card, a Visa card that the user can order, which links to their Cash App, to pay a business.

For a 1.5% industry standard, individual standards can speed up transfers from the Cash App account to their linked bank account. Users can transfer their funds into the bank account immediately instead of waiting for the standard deposit time, two to three days, with an additional fee.

For a 3% fee, users can make a personal payment using their credit card instead of the Cash App balance.

Additional services, such as Bitcoin, allow users to buy and sell Bitcoin for a fee of 1.76%. These additional services allow Square to make money from their Cash App.

The different P2P payment apps that offer free services are a sort of honey pot. Companies designed them to entice users into the ecosystem and get them hooked on the services. The longer the consumer uses the free services, the more entrenched they become, and the more others embrace the system, the bigger the network grows.

That network growth is part of the design; by offering free services, these companies entice consumers into their web and then expand those use cases by offering other services, which help Square monetize its Cash App and grow its revenues.

PayPal, Apple, Square, and Google are all following this playbook. Consider how entrenched we are in the Apple ecosystem or Google ecosystem. Once you are in, it is that much harder to leave. It’s like Hotel California; you can check out but never leave.

According to FIS, no one is willing to pay for P2P services, and most said they wouldn’t use it if there were a fee, which is now industry standard. But companies like PayPal use it to get consumers into their ecosystem. Then, they create more practical benefits that increase consumer engagement, keep them on the platform longer, and deepen the network. All of which allows them to offer different paid services.

Leaders in the Peer-to-Peer Payment Space

Here is a listing of some of the bigger players in the P2P space, with some benefits and drawbacks. Remember that this list is not exhaustive and is subject to change as there is a ton of disruption in the fintech space.

Venmo(PayPal)

The Venmo app, owned by PayPal, allows users to send money to each other via a linked bank account, Venmo account, or credit card. The Venmo account is slightly different from PayPal’s service in that it offers a free debit card that allows consumers to spend their Venmo account balance on purchases.

Pluses:

- Many people use Venmo, making it a convenient way to go cashless—many network effects with many users.

- The free, optional debit card for purchases, with the bonus of cashback options for select purchases.

Drawbacks:

- There is a fee to transfer money via a credit card. Venmo charges 3% to use your credit card.

- Venmo charges 1% to transfer your balance to the linked bank account instantly.

Venmo generated over $450 million in revenue for PayPal in 2020, making it one of the leaders in the space, with expectations for $900 million in 2021.

PayPal

The OG of P2P payments now helps consumers transfer money and make payments via e-commerce or online. The service started with eBay and expanded to encompass much of the payments industry. PayPal’s business generated $21.4 billion in revenues in 2020, an increase of 20%.

Pluses:

- Like Venmo, many users and payment functions beyond P2P money transfers.

- PayPal has high transfer limits, with limits of up to $60,000 in a single transaction.

- Allows multiple options to transfer money, such as debit card, credit card, bank account, PayPal balance, and PayPal credit card.

Drawbacks:

- The only free money transfer options are linked bank account and PayPal balance. All the other options charge 2.9% in transaction fees.

- The transfers are not timely, with the typical transfer time of one day, but others can take up to three to five business days, considering your bank’s clearing process.

- PayPal charges 1% of the amount transferred to cash out your bank account or a $10 minimum.

Apple Pay Cash

The Apple Pay Cash app allows users to send and receive money via the Messages app. Users can sign up for Apple Pay and, after linking a debit card, can use the services.

2019 Apple Pay generated $988 million in revenue, projecting over $4 billion in revenue by 2023.

Pluses:

- Users have the option of using Apple Pay with lots of retailers. The Apple Pay Wallet is compatible with tons of retailers, from McDonald’s, Walmart, Shell gas stations, and many more.

- Apple Pay is very convenient for Apple users; with Apple devices leading cell phones, almost everyone has access to the network, making it a comprehensive option for P2P payments.

Drawbacks:

- It is only available on Apple devices, and it is unavailable if you are not part of the ecosystem.

There are many other options that I didn’t highlight, such as:

- Google Pay

- Zelle – which is part of the real-time payments network

- Social media transfers such as Facebook Messenger

Also, there is Square’s Cash App, which we discussed above.

If you are looking to send money internationally, there are other services available, such as:

- MoneyGram

- Western Union

- Xoom (owned by PayPal)

- Wise

The bottom line is that there are many options in the peer-to-peer payments space, and the list continues to grow.

Investor Takeaway

In an era dominated by smartphones and consumers willing to pay for convenience, people increasingly rely on digital wallets. Picking up on the trend accelerated by the Covid pandemic, companies like Apple, PayPal, and Square are upping the anty on creating simple apps that are easy to use.

Peer-to-peer payments are on the rise, and the competition is fierce to see who can gain control of people’s wallets.

The race to create the first “super app” is on, with the leaders PayPal stating their desire to become the leading app to make all payments, from bills, personal payments, buying online, and merchant transactions. Square is right there, with PayPal and others like Apple, Google, and Amazon looking to dip their toes in this growing space.

We are still in the early innings of this game, and who will be the winner in the payments space is far too early to call. Others, such as Stripe, Flipkart, and Adyen, offer similar services but differ. I sense there will be several “winners” along the way, with many companies taking different payment niches.

And with that, we will wrap up our discussion on peer-to-peer payments.

As always, thank you for taking the time to read today’s post, and I hope you find something of value in it. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there.

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Real-Time Payments: A Guide to the Next Big Thing Updated 9/27/2023 When most think of payment systems or rails, we think of Visa, Mastercard, or American Express. The real-time payment system gets lost in...

- Fintech 101: Intro to Financial Technology Updated 12/19/2023 Fintech or financial technology describes new tech that seeks to enable and improve financial services. Despite the uptick in fintech and how we...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- Embedded Finance: The Services Revolutionizing the Financial Industry Updated 9/27/2023 The coronavirus pandemic accelerated businesses’ decisions about payments and how they would accept payments easily for both consumers and the business. These decisions...